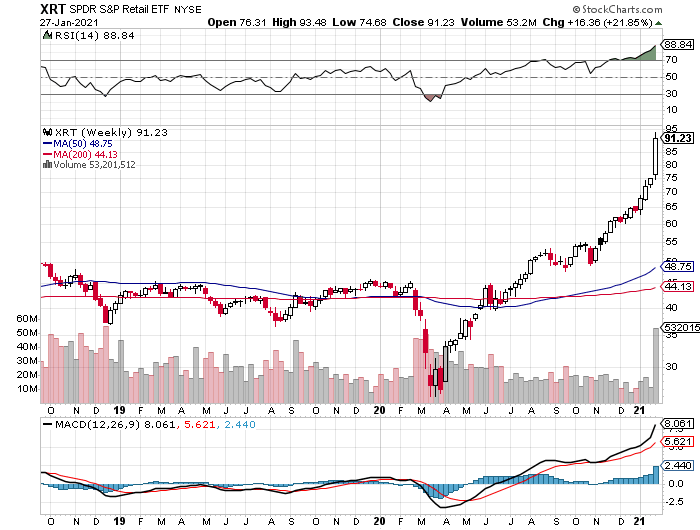

1. GME Got to 9.5% of XRT Retail ETF

XRT Retail stocks ETF….This will concern regulators

©1999-2021 StockCharts.com All Rights Reserved

2. Two lists of heavily shorted stocks

In the S&P Composite 1500, here are the 20 companies with the highest amount of dollars’ worth of shares sold short:

FactSet

Starting with the S&P Composite 1500 Index (made up of the S&P 500 SPX, -0.15%, the S&P 400 Mid Cap Index MID, -1.95% and the S&P Small-Cap 600 Index SML, +0.03% ), here are the 20 stocks with the highest percentages of shares sold short against the total number of shares available for trading:

How you could lose everything by short-selling stocks, whether it’s betting against GameStop or Tesla

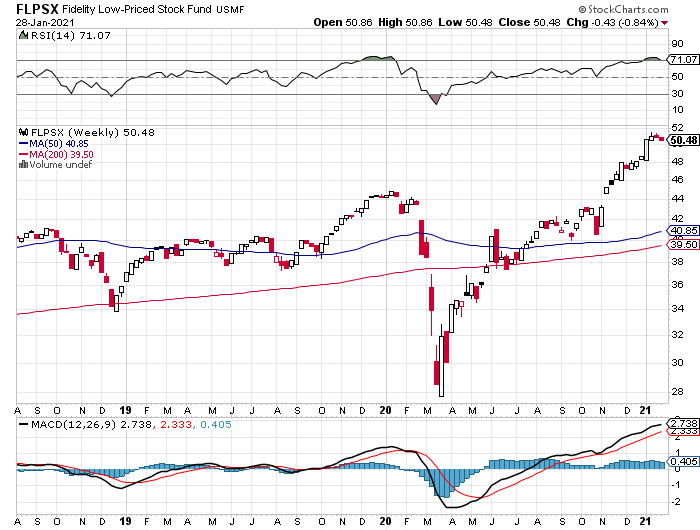

3. Accidental $1B in Gains…Fidelity Low Priced Stock Fund

Fidelity Low Prices Stock Fund Owned 2m shares of GME worth $1B at its peak price

©1999-2021 StockCharts.com All Rights Reserved

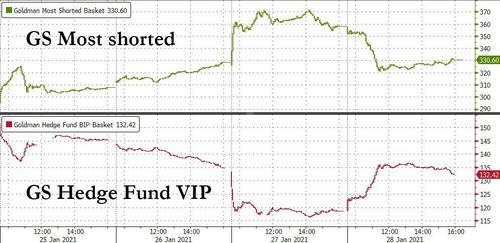

4. Goldman Hedge Fund Most Shorted Basket is Mirror Image of Goldman VIP Basket

Zerohedge

And since any victory for the WallStreetBets crowd means the short squeeze is back, it also means that a defeat for hedge funds, as can be seen in the chart below which shows that the Goldman most shorted basket is a mirror image of the Goldman hedge fund VIP basket.

In other words, any expectation that the WSB crowd would be finally crushed today and the hedge fund world would return to normalcy was crushed.

But what happens next, and how does it all end?

Last night we speculated that if indeed there are more shorts – both synthetically or otherwise – than available shares, then the only place bearish hedge funds will be get shares to cover their shorts is from the company itself. Which means that Gamestop can theoretically ask for any price (somewhat reasonable) and hedge funds will have to agree. After all, it’s not GME’s fault that hedge funds were so greedy they overshorted the company, which really is what all this boils down to.

https://www.zerohedge.com/markets/jpmorgan-has-some-bad-news-hedge-funds-hoping-nightmare-ends-soon

5. Weed Stocks Post Biden Win

CGC Canopy Growth

©1999-2021 StockCharts.com All Rights Reserved

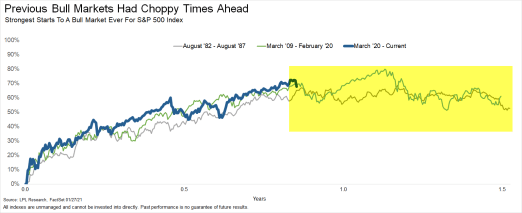

6. Market Tracking 1982 and 2009 Bull Cycles

LPL BLOG

Lastly, as shown in the LPL Chart of the Day, after a 72% rally in the S&P 500 Index (and more in small caps and the Nasdaq), maybe it is simply time for a break. After all, the current bull market has tracked almost perfectly the start of the 1982 and 2009 bull markets thus far, and both of those took a break for a few months starting around this point in the cycle.

https://lplresearch.com/2021/01/28/will-gamestop-stop-the-bull-market/#more-20122

7. America’s top-tier malls were resilient, but values are now crumbling, down 45% from 2016 levels, Green Street says

KEY POINTS

· Real estate analytics firm Green Street estimates the values of so-called A-rated malls have tumbled about 45% from 2016 levels.

· A-rated malls are an important bellwether to monitor in the retail real estate industry because they account for the majority of mall value in the U.S. There are about 250, representing a quarter of America’s roughly 1,000 shopping malls.

· The biggest U.S. mall owner, Simon Property Group, holds a substantial portion of the A-rated malls and outlet centers in the U.S. And its shares are down more than 32% over the past 12 months.

When Macy’s Chief Executive Jeff Gennette explained at an investor meeting in early 2020 that he saw a “bifurcation of malls” shaping up, with the state of lower-tier shopping centers continuing to “decline rapidly,” he didn’t have anything bad to say about so-called A-rated malls.

Instead, Gennette said the department store retailer would continue to invest in its locations in A-rated malls, as it closed at other underperforming properties.

But the values of even some of the best shopping malls in the U.S. have declined at a staggering rate in recent years, according to a report published this week by the real estate analytics firm Green Street. Green Street now estimates the values of A-rated malls have tumbled about 45% from 2016 levels, which peaked following a runup after the Great Recession.

A-rated malls are an important bellwether to monitor in the retail real estate industry because they account for the majority of mall value in the U.S. There are about 250 of them, representing a quarter of America’s roughly 1,000 shopping malls, by Green Street’s count. They bring in $750 in sales per square foot, on average, compared with an A++ mall, at $1,100; a B mall, at $425, and a C mall, at $250.

“Mall values had a very strong recovery out of the global financial crisis,” Green Street senior retail analyst Vince Tibone said in an interview.

“The overall retail environment was much healthier,” he said. “At the time, the sentiment was that e-commerce was a big deal, but ‘A’ malls were more immune. And the sentiment on ‘A’ malls was totally different. We had a lot of transaction evidence that strongly suggested that — for the best malls in the country — net operating income was growing at a healthy clip, cap rates were low and financing was available.”

But, he said, that story has changed over time. Even for A-rated malls, fundamentals have started to weaken, driven down in large part due to weaknesses at department store chains, which historically have been the anchor tenants pulling in shoppers and encouraging other retailers and restaurants to move in. Asset values have been pressured even more in the past 12 months as the Covid pandemic brought new challenges, Tibone said.

8. G.M. Will Sell Only Zero-Emission Vehicles by 2035

The move, one of the most ambitious in the auto industry, is a piece of a broader plan by the company to become carbon neutral by 2040.

\

General Motors plans an electric Hummer pickup, with a high-end version due in showrooms this fall.Credit…General Motors Company, via Associated Press

By Neal E. Boudette and Coral Davenport

The days of the internal combustion engine are numbered.

General Motors said Thursday that it would phase out petroleum-powered cars and trucks and sell only vehicles that have zero tailpipe emissions by 2035, a seismic shift by one of the world’s largest automakers that makes billions of dollars today from gas-guzzling pickup trucks and sport utility vehicles.

The announcement is likely to put pressure on automakers around the world to make similar commitments. It could also embolden President Biden and other elected officials to push for even more aggressive policies to fight climate change. Leaders could point to G.M.’s decision as evidence that even big businesses have decided that it is time for the world to begin to transition away from fossil fuels that have powered the global economy for more than a century.

G.M.’s move is sure to roil the auto industry, which, between car and parts makers, employed about one million people in the United States in 2019, more than any other manufacturing sector by far. It will also have huge ramifications for the oil and gas sector, whose fortunes are closely tied to the internal combustion engine.

A rapid shift by the auto industry could lead to job losses and business failures in related areas. Electric cars don’t have transmissions or need oil changes, meaning conventional service stations will have to retool what they do. Electric vehicles also require fewer workers to make, putting traditional manufacturing jobs at risk. At the same time, the move to electric cars will spark a boom in areas like battery manufacturing, mining and charging stations.

9. 5 Types of Investors

Paul Merriman-Marketwatch

I interact with lots of investors, and they tend to fall into five broad groups.

Group 1: The majority of people I regularly speak with believe they are longtime buy-and-hold investors. My advice to them is usually some variation of “Keep doing what you’re doing.” (Of course that assumes they are holding investments that make sense for them.)

John Bogle famously stated this advice: “Don’t do something, just stand there.”

Group 2: Many investors want higher long-term returns and are questioning whether they own the best stocks, asset classes or funds. My advice here is to own 10 asset classes that have favorable long-term records.

On my website you can find this list along with our newly updated best-in-class ETF recommendations.

If the threat of a bubble is a good incentive to “clean house” and upgrade your lifetime portfolio — and if you understand the tax implications of making the necessary trades — then have at it!

Group 3: Young investors and those just getting started. These people are typically setting money aside in their 401(k) or similar retirement programs or in IRA accounts. I think they should ignore bubble warnings and keep adding money — especially when prices decline and each dollar invested buys more assets worth holding for the long-term future.

Group 4: Market timers. I really have no good advice for investors who follow the “I can’t stand it anymore” approach I described above. Fear and greed are awful guides for long-term investors.

But if you are determined to use timing, consider investments that are clearly not in bubble territory. Ben Carlson recently identified a handful of asset classes that fit that description and therefore are presumably priced for buyers:

• Emerging markets.

• European stocks.

• Energy stocks.

• Japanese stocks.

• Value stocks.

• Financial stocks.

If you believe the overall stock market is a bubble in danger of bursting, these could be good alternatives.

Group 5: People who already have enough to meet their needs. This is an excellent position to be in, and logically it should not present a problem.

However, lots of people in this category still want more, more, more. And they’re willing to risk what they already have in order to get that elusive “more.”

I usually argue that this is the time to play defense.

The most effective strategies to defend what you already have are diversifying your equity portfolio and increasing your proportional investments in bond funds.

Recently I spoke with an investor I have known well for some time. A very big part of her portfolio is in a single stock she acquired when she worked for a technology company. If she sold that stock, she would have enough to take care of her needs for the rest of her life.

When I asked her what she wanted most, her first answer was making as much money as she could. I told her she could sell that one stock and buy an equity index fund and still have the same expected return — with much less risk.

After we talked awhile, she came around to the idea of unloading the stock to lock in her gains, knowing she would be set for life. In her case, this seemed like a very sensible approach.

Every personality and every set of circumstances is different. If you struggle with this situation, a good adviser who doesn’t sell products may be a big help.

It’s impossible to know the future, but a good understanding of the past can help you find the best course.

To that end, here’s a podcast and a video that I’ve put together discussing our updated best-in-class recommendations.

Opinion: How to invest in a market bubble

Paul A. Merriman

https://www.marketwatch.com/story/how-to-invest-in-a-market-bubble-2021-01-27?mod=home-page

10. 12 Lifestyle Choices That Can Save Your Brain, Starting Now

At any age, you can lower dementia risk by controlling these 12 risk factors.

Source: Image by Tumisu, pixabay.

Dementia: A Disease of the Elderly?

People think of Alzheimer’s disease and other types of dementia as diseases of the elderly. While the incidence of dementia does increase with age, the seeds of dementia can be sown long before that. In fact, harm to the brain can begin in infancy, for example, when babies are exposed to high levels of air pollution. That and other risk factors continue into middle age and beyond. Fortunately, research evidence is building that there is much we can do at any age—from childhood to elderhood—to protect our brains from the ravages of mental decline.

In this blog post, I’ll describe recent science-based discoveries about significant causes of dementia plus recommendations to prevent or delay mental decline. After all, “We all want our cognitive lifespan to match our life span—we can’t wait until signs of cognitive decline appear. We must be proactive now.” These words from Dr. Lisa Mosconi, associate director of the Alzheimer’s Prevention Clinic at Weill Cornell Medical College, can serve as a rallying cry.

The “Dangerous Dozen:” 12 Risk Factors for Dementia

“Dementia” is defined as a group of symptoms that affect memory, normal thinking, communicating and reasoning ability, sometimes making it difficult for sufferers to perform even simple self-care tasks such as bathing and eating. Alzheimer’s disease causes most cases of dementia.

Recently, an analysis of large-scale studies has provided solid evidence that 12 modifiable risk factors account for 40% of dementia, according to reports from 2020 by the Lancet Commission, a group of 28 experts who made a thorough study of the available research. While the “Dangerous Dozen” are not the only risk factors for dementia, they are responsible for a large chunk of the problem.

The “Dangerous Dozen,” as I’ve dubbed them, are these:

1. Excessive alcohol use

2. Head injury

3. Air pollution

4. Poor early-childhood education

5. Mid-life hearing loss

6. High blood pressure (hypertension)

7. Obesity

8. Smoking

9. Depression

10. Social isolation

11. Physical inactivity

12. Diabetes

Other factors also play into the risk for dementia, including chronic stress, chronic lack of sleep, certain medications, and harmful chemicals in household products and cosmetics. Genes and family history also play a role. Surprisingly, even certain types of genetic risk can be lowered by the lifestyle changes discussed below.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.