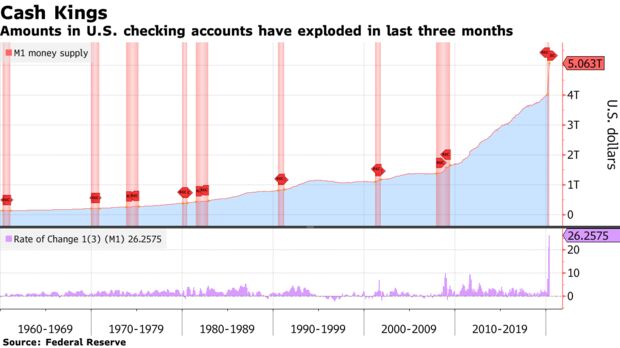

1. American Saved $1.4 Trillion in First Three Quarters of 2020…The Most Ever.

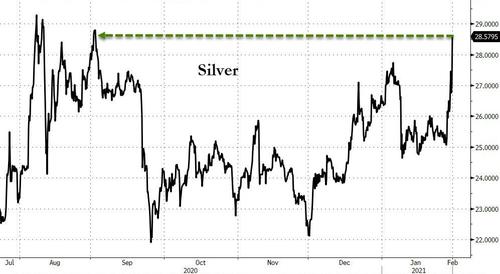

2. Silver Futures Soar 8%, Rise Above $29 As Reddit Hordes Pile In

BY TYLER DURDEN–ZEROHEDGE

Update (1800ET): It was the one print everyone was waiting for, and here it is: silver futures opened up 7%, surging from $27/oz to a high of $29.095 following a weekend of speculation that the next big squeeze on WSB’s radar is silver. And whether that’s true or not, may no longer matter in a world where – as described below – there is virtually no physical silver to be purchased.

Spot Silver is back to its highest since the August/Sept cycle highs…

https://www.zerohedge.com/markets/reddit-preparing-unleash-worlds-biggest-short-squeeze-silver

3. 4,000,000,000 Cash Held in SPACS

When SPACs Attack! A New Force Is Invading Wall Street.

From Barry Ritholtz Big Picture Blog https://ritholtz.com/2021/02/10-monday-am-reads-296/

4. Gamestop Insider Activity will be Interesting to Watch Going Forward.

Nasdaq-GME Insider Activity

Number of Insider Trades

| INSIDER TRADE | 3 MONTHS | 12 MONTHS |

| Number of Open Market Buys | 2 | 17 |

| Number of Sells | 8 | 18 |

| Total Insider Trades | 10 | 35 |

Number of Insider Shares Traded

| INSIDER TRADE | 3 MONTHS | 12 MONTHS |

| Number of Shares Bought | 1,226,400 | 3,567,333 |

| Number of Shares Sold | 1,038,619 | 1,289,047 |

| Total Shares Traded | 2,265,019 | 4,856,380 |

| Net Activity | 187,781 | 2,278,286 |

https://www.nasdaq.com/market-activity/stocks/gme/insider-activity

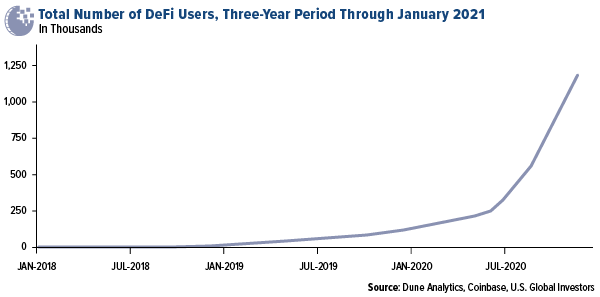

5. The Rise of DeFi, a Competitor to Traditional Financial Services

Decentralized finance (DeFi) also continued to grow in 2020. In short, DeFi has the potential to completely upend the traditional financial services industry by providing “global, programmatic, decentralized, 24/7/365 markets” for services as various as taking out loans, investing in derivatives, trading assets and buying insurance contracts. For the first time, financial product development has been put “directly in the hands of engineers, who no longer need to work at a bank and ‘ask permission’ to create products.”

According to Coinbase, there were 1.2 million DeFi users around the world taking advantage of these open-source systems. The number will only continue to grow.

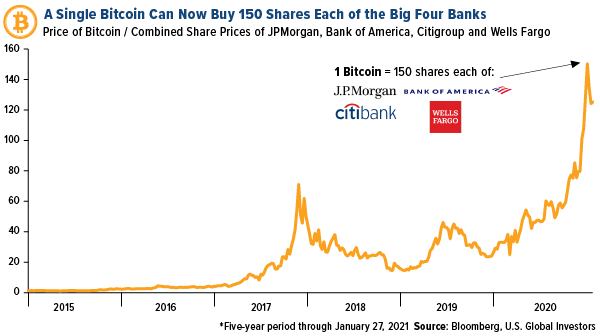

I think one of the biggest signs that open-source technology is giving traditional finance a run for its money is that, today, a single Bitcoin is enough to purchase between 100 and 150 shares each of the big four U.S. banks. Compare that to five years ago, when one could only buy you about one share each.

Power to the Players: Reddit, Robinhood and Bitcoin-by Frank Holmes of U.S. Global Investors, 1/29/21

6. Harvard, Yale, Brown Endowments Buying Bitcoin for At Least a Year

Yale University(Shutterstock)

Ian Allison

Jan 25, 2021 at 4:34 p.m. ESTUpdated Jan 25, 2021 at 4:59 p.m. EST

Some of the largest university endowment funds in the U.S. have been quietly buying cryptocurrency for the past year or so through accounts held at Coinbase and other exchanges, CoinDesk has learned.

According to two sources familiar with the situation, Harvard, Yale, Brown and the University of Michigan as well as several other colleges have been buying crypto directly on exchanges. (Several Ivy League endowments took an interest in blockchain technology via crypto-focused venture capital funds back in 2018.)

“There are quite a few,” said a source who asked to remain unnamed. “A lot of endowments are allocating a little bit to crypto at the moment.”

Yale and Brown did not respond to requests for comment by press time. When reached by CoinDesk, the Harvard and University of Michigan endowments declined to comment. Coinbase also declined to comment. University endowments got a single mention in Coinbase’s annual report for 2020, but without naming any names.

Some of the university endowment funds in question may have held accounts with Coinbase for as long as 18 months, according to one source.

“It could be since mid-2019,” the source said. “Most have been in at least a year. I would think they will probably discuss it publicly at some point this year. I suspect they would be sitting on some pretty nice chunks of return.”

University endowments are pools of capital accumulated by academic institutions, often in the form of charitable donations. These funds, which support teaching and research, can be allocated into various assets for investment purposes.

Harvard’s is the largest university endowment with over $40 billion in assets. Yale has over $30 billion, Michigan has about $12.5 billion, while Brown holds $4.7 billion. It is unknown how much each fund has allocated in crypto but it is likely a fraction of percent of their total assets.

Long road

Back in 2018, Yale University Chief Investment Officer David Swensen made headlines by backing two crypto-focused venture funds, one run by Andreessen Horowitz and another launched by Coinbase co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang.

Several other universities followed Yale in backing crypto VCs, including Harvard, Stanford, Dartmouth College, MIT, University of North Carolina and Michigan. Clearly, some of those schools appear to be taking the next step by investing directly in crypto assets.

The second source, who is involved in the crypto hedge fund world, pointed to “a big change” over the past few months. “We are seeing defined benefit pension plans getting close to making allocations. We are seeing public pension plans getting close to making allocations,” the person said.

“If I had heard that three years ago, I would have said it was wrong,” said Ari Paul, co-founder of BlockTower Capital and previously an investment manager for the University of Chicago. “But a lot of institutions are now comfortable with bitcoin. They understand it and can just buy it directly, as long as it’s from a regulated entity like Coinbase, Fidelity or Anchorage.”

7. Bill Miller On Bitcoin Doubters

Bitcoin is not without its doubters, and any serious investor must consider the opposite perspective and weigh its merits. We have thought through some of the common objections, which follow:

- “It’s a Ponzi Scheme.” This is easiest to address, because it demonstrates a lack of understanding of both Bitcoin and Ponzi schemes. Bitcoin is quite the opposite of a Ponzi scheme, which involves a central criminal extracting value from current investors using new investors’ money to fund redemptions while falsifying stated returns. There is no middleman in Bitcoin – only a network of users governed by an established protocol. Indeed, the value of the network grows with its aggregate usage, but users share in the value growth as new users adopt the technology. The market’s deep liquidity and supporting infrastructure leave no doubt that the price and stated returns of Bitcoin are as real as it gets.

- “It Produces Nothing and Therefore Has No Intrinsic Value.” What it “produces” is the ability to store and transmit value according to a logical, predetermined algorithm and decentralized governance. The value of any asset that pays no dividends, like Berkshire Hathaway stock or the US dollar, is what buyers and sellers collectively believe it is worth. At Bitcoin’s current market capitalization of $700 billion, buyers and owners believe it is more valuable than all but six companies in the S&P 500 (all of which are tech companies).

- “Some Other Coin or Technology Will Replace It.” Unlikely at this point. A look at the history of new technological standards would show many instances in which the winner is not always the most robust technology but the one that is early and robust enough. Bitcoin’s market cap is over 5x Ethereum’s, and while Ethereum may be a survivor, there are ways to mimic its functional benefits with Bitcoin.

- “It’s Too Volatile to Be a Store of Value or Medium of Exchange.” Indeed, as we flagged earlier, it has done much better than simply “store” value. When Bitcoin’s volatility approaches that of Treasuries, its market cap and price per bitcoin will be immensely higher and leave little room for excess return. At that point, one could imagine Bitcoin transitioning to become a more commonly used medium of exchange.

- “If It Actually Works, Regulators Will Ban It.” It has worked for twelve years with little regulatory interference under multiple administrations. In fact, the regulatory outlook for Bitcoin in the US has never been brighter, which may explain why so many institutions are now getting involved. In 2014, a senior member of the Federal Reserve Bank of Saint Louis studied Bitcoin and concluded that, “enforcing an outright ban is close to impossible…well-run central banks should welcome the emerging competition.” The Office of the Comptroller of the Currency, which is a branch of the United States Treasury Department, has said that chartered banks can now custody cryptocurrency and use blockchain technology to settle transactions. The US government collects capital gains taxes on Bitcoin and has auctioned over $6.5 billion dollars at current market value to the public. It would be an abuse of power to sell property of that much value to a government’s constituents, collect taxes on it and then ban it. The new head of the SEC, Gary Gensler, is a Bitcoin fan. While we believe the next decade will see adoption grow at a much faster rate than it did during Bitcoin’s first decade, it is unlikely that Bitcoin will work so quickly that it becomes disruptive to long-standing reserve currencies, and to the extent it does, it will be worth a lot more

MicroStrategy and Bitcoin: the Mother of All Fat Tails?

Bill Miller IV, CFA, CMT and Tyler Grason, CFA

https://millervalue.com/4q20-income-strategy-letter/

8. Popular 20 Year Short Seller Stops Short Reports.

Citron Research says it will stop publishing short-seller research after the GameStop squeeze

- Andrew Left of Citron Research is discontinuing short-seller research after the GameStop squeeze.

- In a tweet on Friday, Left said, “After 20 years of publishing Citron will no longer publish ‘short reports”.

- Instead, Left will focus his efforts on long-only investment opportunities for individual investors.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Famed short-seller Andrew Left of Citron Research is throwing in the towel when it comes to publishing short-seller research, according to a tweet on Friday.

The move comes after an epic short-squeeze in GameStop fueled by traders who frequent Reddit’s WallStreetBets propelled shares higher by more than 2,000% this year.

Left had been bearish on the video-game retailer prior to the epic surge, calling for the stock to fall 50% when it was trading near the $40 level. On Friday, shares of GameStop briefly traded above $400.

Ultimately, Left closed out his short position in the stock and alleged that an “angry mob” of GameStop investors harassed him and targeted his family.

“After 20 years of publishing Citron will no longer publish ‘short reports’.” Left tweeted.

Instead, Left will solely focus on publishing long-only research on individual stocks for investors, the tweet said. Left has headed Citron Research since the dot-com bubble era and predominantly published short-reports. In recent years, he has been publishing long-sided research as well.

In a video posted to YouTube, Left expanded upon his decision to solely focus on long reports going forward.

“After 20 years, we noticed something. Where we started Citron was supposed to be against the establishment. We’ve actually become the establishment,” Left said, adding that “its completely now lost its focus.”

Left said Citron will publish a long report this Monday.

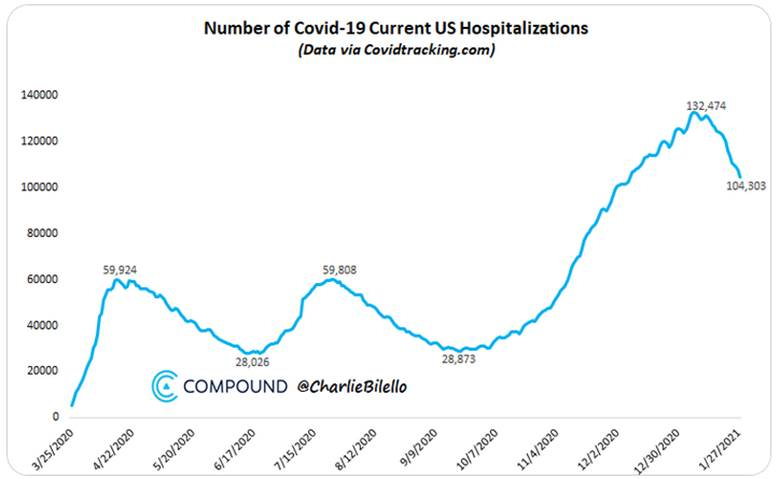

9. Covid Hospitalizations Update

New Covid-19 cases in the US averaged 156k/day over the last week, down from a peak of 244k on Jan 11 and fewest since Nov 16 (note: 7-day average), while Covid-19 hospitalizations in the US have declined by 28k from their peak on Jan 6, lowest level since Dec 7.

From Dave Lutz at Jones Trading

10. 3 Ways to Lie with Statistics

Psychology Today –Glenn Geher Ph.D.

Based on the concepts presented above, there are three that a researcher might misrepresent things in presenting statistics:

1. Amplifying the Importance of Statistical Significance. As you can see by the above reasoning, statistical significance is limited in its importance. While statistical significance can tell you that some finding is likely to represent how things are in terms of patterns at the broader population level, based on how statistical significance is determined, you can, in fact, never be fully certain that you are correct. So amplifying the importance of statistical significance without providing sufficient detail about the process by which statistical significance was determined is one way that a researcher might (even if unwittingly) misrepresent things with statistics. In short, just because a finding is statistically significant does not make it true.

2. Capitalizing on Type-I Error. Without getting too bogged down in the details, Type-I Error exists when a researcher finds that one result is statistically significant but, in fact, the reality is that the findings do NOT generalize to the broader population of interest. This kind of outcome is actually more common than one might think. It often results from a scenario in which a researcher conducted a plethora of significance tests as part of the analytical process. In short, the more significance tests someone conducts during the analytical stage, the more likely he or she is to find a spurious result. That simply means a result erroneously comes out as statistically significant. If you conduct 1,000 significance tests, you are likely to find a few of them as significant simply by chance alone. Sometimes a researcher might (again, unwittingly) present a statistically significant finding as a big deal, even if it is, in fact, simply spurious and the result of the researcher conducting too many analytical tests.

3. Failing to Report on Effect Size Information. Sometimes, for various reasons connected with the hypothesis-testing process, a finding might come out as statistically significant but it might correspond to a small, and perhaps irrelevant, effect. When presenting statistical findings, then, it is important to present information on both statistical significance and effect size. If a finding is statistically significant AND the effect size is relatively large, that is when you can really start to feel confident that the effect being discussed is actually meaningful and worth talking about. When a researcher omits information on effect size when presenting statistics, he or she may be over-amplifying the importance of the result.

Bottom Line

People talk about lying with statistics all the time. Yet without having a basic understanding of how statistical processes operate, it is not really possible to understand what this actually means. To truly understand what it means to “lie with statistics,” people need a basic understanding of statistical significance and effect size. To develop a truly full understanding, sign up for a statistics course today. This stuff is really important and understanding statistics truly provides intellectual skills that can be applied to a broad array of situations.

* Note: Several additional methodological issues, beyond the purview of this post, would also be relevant to our consideration of these findings. For instance, we would probably want to know if participants were randomly assigned to the different conditions as in a true experimental design. And we would ideally need to know more about additional descriptive statistics such as the standard deviation for the variable.

https://www.psychologytoday.com/us/blog/darwins-subterranean-world/202101/3-ways-lie-statistics

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.