1.Low Volatility Stocks vs. MSCI USA Index is at Widest Level Since 1999.

The return differential between the MSCI USA Minimum Volatility Index, which owns a portfolio of low-volatility stocks, and the MSCI USA Index is now at its widest level since 1999, says John Kolovos, chief technical strategist at Macro Risk Advisors. Owning some of these left-behind companies could be the way to add some ballast to a portfolio in case of a drop, Kolovos says.

Big Tech Stocks Are Back. What’s Behind the Nasdaq’s 4% Rally. By Ben Levisohn https://www.barrons.com/articles/big-tech-stocks-are-back-whats-behind-the-nasdaqs-4-rally-51611364722?mod=past_editions

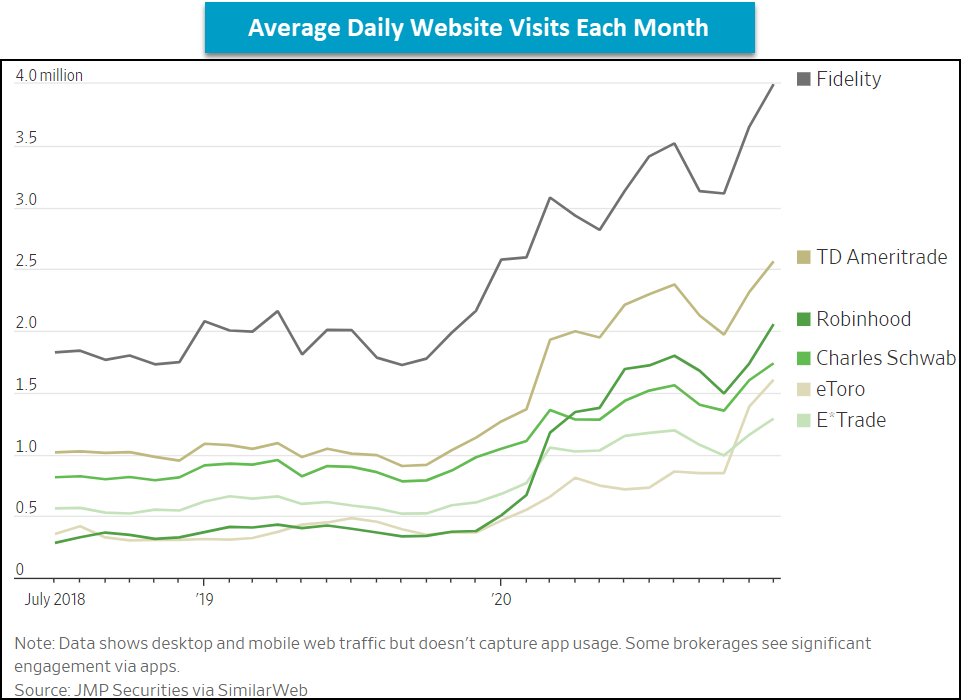

2.Average Daily Website Visits Each Month Fidelity and TD Well Ahead

Nasdaq Dorsey Wright www.dorseywright.com

3.Companies Trading at 10x Revenue Approaching 1999 Levels.

Dave Lutz Jones Trading—Can the SEC take action against some of the mob on /wsb? Welp, back when I was youngster on the Alex Brown, then UBS Desk – I watched these “Yahoo Message Boards” – Enter 15 yr old Jonathan Lebed. SEC said the postings Lebed made to Internet website message boards in connection with the eleven transactions referred to above included baseless price predictions and other false and/or misleading statements, and always caused an increase in the volume and price of the stock. These messages were generally devoid of substantive content and, in addition to false price predictions, touted the stock by claiming, among other things, that the stock was about to “take off,” would be the “next stock to gain 1,000%,” and was “the most undervalued stock ever.”

4.Penny Stock Volume Over Trillion Shares in December.

One trillion (sic) shares of penny stocks traded in December! Penny stocks have always been the most speculative corner of stock markets, so the unprecedented (that word again) enthusiasm for penny stocks provide yet another indication of the “irrational exuberance” that have gripped markets.

John Baird

https://www.linkedin.com/in/jonathanbaird88/

5.GME Small Cap Stock to Large Cap Stock in One Week. $10B Market Cap.

Eric Balchunas, @EricBalchunas

·$GME‘s market cap is now over $10 which means it is classified as a large cap stock. Small to large in two weeks flat.

https://twitter.com/EricBalchunas

6. Massive New Issuance of Stock…60% Above Prior Record.

Abnormal Returns Blog from Sentiment Trader

Among the most opportunistic groups on Wall Street are investment bankers. If they see an appetite for something, they will work tirelessly to fulfill it. They’ve been busy over the past year, and there’s no letup so far.

We noted the rise in IPOs, and their performance, in December. We’ve neared or exceeded the prior bubble peak in most metrics that count. It’s not just IPOs, but additional offerings like secondaries that are enjoying open arms among investors.

Over the past year, there has been nearly $400 billion in issuance according to Bloomberg data.

https://sentimentrader.com/blog/when-the-ducks-are-quacking/

7.Insider Selling at Record Levels.

Sentiment Trader https://sentimentrader.com/blog/when-the-ducks-are-quacking/

8.Another SPAC ETF hits the market. CEO behind the launch says the fund has ‘edge’ over its rivals

The ETF industry is embracing SPACs with open arms.

The third exchange-traded fund based on special purpose acquisition vehicles launches Tuesday.

Created by Morgan Creek Capital Management and Exos Financial, the Morgan Creek-Exos SPAC Originated ETF will trade under the ticker SPXZ.

It joins the ranks of Defiance’s Next Gen SPAC Derived ETF (SPAK), the first of its kind that debuted in October, and Tuttle Tactical Management’s SPAC and New Issue ETF (SPCX), which launched in December. They are up about 16% and 19% respectively since their launch dates.

SPXZ’s “real edge” will come from how its portfolio is constructed, Mark Yusko, CEO, chief investment officer and founder of Morgan Creek Capital Management, told CNBC’s “ETF Edge” on Monday.

“The SPAC structure is great and it’s optimal for these high-growth, innovative companies, but they’re not all going to be winners,” Yusko said. “The real edge here is all about active management.”

SPACs are essentially publicly traded shells that raise capital to buy out other companies. Roughly two-thirds of SPXZ’s holdings will be SPACs that have chosen a company to take public, while one-third will be blank-check entities still seeking start-ups.

For comparison, SPAK’s portfolio is composed mainly of established companies that have gone public via SPAC such as DraftKings and Virgin Galactic. SPCX, the first actively managed SPAC ETF, generally holds shares of SPACs looking for companies to bankroll.

Morgan Creek and Exos plan to apply their five decades of collective experience managing investments to the newly popular structure by identifying the highest-quality management teams, Yusko said.

“We’re excited to bring this active approach to a market that I think is really in its infancy,” he said, predicting that 2020 will go down “as the year of the SPAC.”

Though investors will have to be “very careful” not to get involved in lower-quality investments as the space grows, the idea that SPACs are dangerous on the whole “is simply not true,” he said.

“There will be people and management teams and sponsors drawn to this structure that shouldn’t and those will have bad outcomes. But is every IPO a good outcome? Not even close, despite the rigorous vetting,” Yusko said. “At the end of the day, Wall Street gets paid to take companies public, so they’re going to take companies public. It’s like the old Doritos commercial: Go ahead and eat them, we’ll make more.”

And while individual investors don’t typically get a chance to participate in standard IPOs at the outset, SPAC IPOs tend to be more accessible and ultimately less speculative, Yusko said.

“A SPAC IPO, because it goes public at a $10 price, is available to everybody, and since you don’t know what the deal’s going to be, you don’t have the speculative frenzy on day one of trading, so you can actually acquire a position,” he said.

With “robust companies of the future” such as Virgin Galactic employing this structure, finding opportunity will hinge on diligence and quality control, Yusko said, pushing back on critics such as former Goldman Sachs CEO Lloyd Blankfein.

“The people that criticize SPACs today are the same ones that criticized hedge funds 10 years ago or criticized mutual funds 30 years ago,” Yusko said. “When lots of people like a structure and people have success utilizing it, other people may not like that.”

“By focusing on quality, focusing on the best teams and the best ideas and the best companies, I think you can get great returns,” he said. “I don’t think we’re going to see a slamming on the breaks, but I do think we’ll see a slowdown in the number of opportunities that are fantastic.”

https://www.cnbc.com/2021/01/25/third-spac-etf-hits-market-and-its-ceo-claims-edge-over-rivals.html

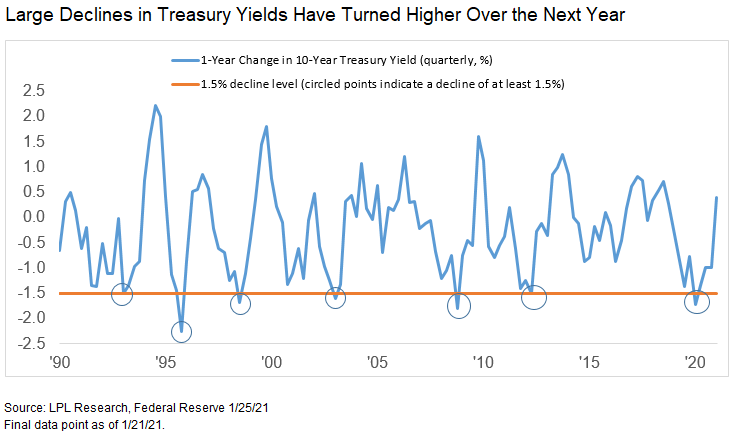

9.Interest Rate Reversals Revisited

Posted by lplresearch

Economic Blog

1/26/2021

In LPL Research Outlook 2021: Powering Forward, we noted that large interest rate declines historically have been followed by reversals. With the 10-year Treasury yield continuing to climb, now’s a good time for an update. As shown in the LPL Chart of the Day, since 1990, the 10-year Treasury yield had declined at least 1.5% in a year seven times, based on quarterly data. The most recent decline was as of the end of March 2020. Will history hold true this time around?

“The previous six times the 10-year Treasury yield was down at least 1.5% in a year as of the end of the quarter, it was higher a year later every time, by an average of 0.92%,” said LPL Research Chief Market Strategist Ryan Detrick. “Well, we saw a new large decline at the end of March 2020, and while the final number won’t be in until the end of March 2021, as of last week, the 10-year yield was up again.”

https://lplresearch.com/2021/01/26/interest-rate-reversals-revisited/

10. 3 of the Most Important Life Lessons You Can Learn From Sports

By Pat Sullivan

Among the many values of sports, there are three special lessons that transition flawlessly into life. Every successful person I have ever worked with has developed these three concepts.

FQ is more important than IQ

I was directing a basketball clinic in Salt Lake City, Utah when Dale Brown, the former Louisiana State University coach, spoke these words, “Your FQ is more important than your IQ.” He then explained that your FQ is your Failure Quotient. How often can you fail at something and have the resiliency to get right back up?

Pat Riley, the president of the NBA’s Miami Heat, wrote, “Success is getting up one more time than you’ve been knocked down.” If there is one constant in the athletic world, it is that athletes will meet failure.

Baseball players must develop strong FQ’s because failure is a huge part of their game. Great hitters fail 7 out of 10 at bats. They experience failure 70% of the time. Basketball players have a similar experience. A player is an outstanding 3 point shooter if he fails 6 out of every 10 shot attempts.

The University of St. Francis basketball team I coached for 34 years played in a tournament in New York against the number 2 ranked team in the country. They were a great team and they beat us on a shot at the final buzzer.

Our best shooter, who was averaging 17 points per game, took 10 shots in the game and failed to make one basket. We had to play another game the next day. Before the game I told him, “If I see you open and you don’t shoot, I am taking you out of the game. You are our best shooter and you will shoot us into the national tournament at the end of the season.”…And that is exactly what he did because he had developed a resilient FQ.

Life can often be a struggle. Most of us will meet failure personally and/or professionally. There is a lot of adversity out there and none of us are exempt. We have to beat failure in life just like our player did in the athletic arena. We have to get back up. How? Two ways: Learn from it and put it behind you.

“I’ve failed over and over again in my life and that is why I succeed.” – Michael Jordan

Team ego

Bill Russell played for the Boston Celtics for 13 years. In 11 of those 13 years, the Celtics won the NBA championship. Russell said whenever the Celtic players entered a building for a practice or a game, they left their individual egos at the door. But what they brought in was their Team Ego.

They knew they were a talented team and they also knew they played together. Their Team Ego was telling their opponent that they better bring an outstanding game if they were to beat the Celtics, because the Celtics knew they would bring a great game every night.

The essence of athletics is teamwork. John Wooden, the legendary UCLA basketball coach, taught, “The main ingredient of a star is the rest of the team.” He was fortunate to coach numerous stars and he got them to believe in his team first philosophy.

Michael Jordan was a star. I saw him play in person at the Chicago Stadium and the United Center at least 40 times during the most important time of the season – the NBA playoffs. He is the best player I have ever seen play the game.

When you think of Jordan, you think of his great scoring ability, but you seldom hear what a great teammate he was. He practiced harder than anyone on the Bulls; he was their best defensive player, arguably the best defender in the entire NBA; and he is the leading assist man in Bulls history. Jordan set the tone for the Bulls Team Ego!

I have worked with some outstanding leaders – principals at the high school level and presidents at the collegiate level. They knew they could not lead alone; they needed to develop a strong team and they did two things toward this goal: They surrounded themselves with good people and they gave all the credit away. They created a strong Team Ego by taking the blame but passing the credit on.

Listening

Sport is a great arena to develop the skill of listening. Every sport begins with the teaching of the fundamentals. Every sport teaches a system of play. Every athlete wants playing time and that begins and ends with listening. It is only by listening intently that a player can successfully understand and implement the fundamentals and the system.

One player not listening to game planning and game coaching can destroy team play. One player not in the right spot at the right time leads to broken plays.

Classroom teaching and the teaching of sport are the same, with one exception. Teachers and coaches teach their subject matter in the classroom and their systems on the athletic fields and courts. When the classroom exam comes, the students must know the subject matter to perform well. The exam in athletics is the game.

The players must execute the system the coach has taught them during the game. However, the opponent will do all he can to not allow the team to run their system. It would be like a student taking an exam with someone’s hand waving over his eyes during the entire exam! Players must develop the skill of listening if they are to beat the opponents who are waving their hands at them throughout the game.

Every great leader I’ve worked with was a great listener. They listened with their ears and their eyes. Their eyes were riveted on the person speaking as they gave that person their full attention.

The bottom line to listening in life is simple: LISTENING IS RESPECT.

The development of a strong FQ, concentrating on team ego, and listening – great lessons that can be learned in athletics – do lead to a successful life.

If these lessons of sport and life lead to success, you may want to remember John Wooden’s maxim:Talent is God given, so be humble, Fame is man given, so be thankful, But conceit is self-given, and you better be careful.

https://addicted2success.com/life/3-of-the-most-important-life-lessons-you-can-learn-from-sports/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.