1. Low Quality Leading Rally

Crossing Wall Street

Eddy Elfenbein on February 8th, 2021 at 11:53 am

One of the factors that is used to dissect the market is “quality.” Analysts like to see if high-quality stocks are leading the charge, or if they’re being left behind. That’s assumed to be a good indicator of what investors are thinking.

At the outbreak of the coronavirus, investors flocked to high quality names. That makes sense. But since May, high quality has lagged. Actually, it’s lagged pretty badly.

Here’s a chart of Fidelity’s Quality ETF divided by the S&P 500.

http://www.crossingwallstreet.com/

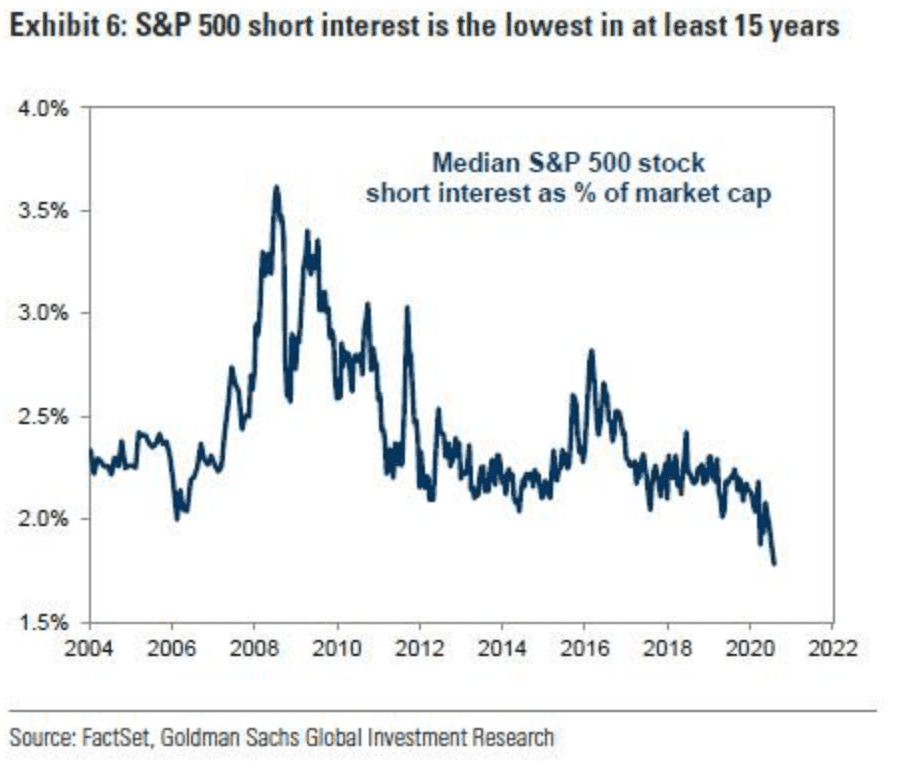

2. $10B in Shorts Unwound Last Week..Remember Short Interest was at 15 Year Low to Start 2021

Short squeeze seen lifting S&P 500 further – Citi

A squeeze of short positions looks set to drive a further rally in the S&P 500 index, Citi said, as hopes for big fiscal stimulus drove the U.S. equity benchmark to new record highs.

Nearly $10 billion worth of shorts were unwound last week on the S&P 500, the largest rate since April, and $21 billion shorts still remain and are in loss, analysts at Citi said.

“There is potential for further short squeezes supporting market gains for another week or two given the size of the remaining short base,” they wrote in a report late on Monday, based on data on the exchange traded futures.They also said that at 4,000 points holders of long positions on the index could be tempted to take profit, potentially holding back the market in the short term.

The S&P 500 is up more than 5% so far in February and on Monday it closed at a new all time peak of 3,915 points.

The surge comes after a social media-driven retail trading frenzy targeted heavily shorted stocks, forcing big hedge funds to close their bearish bets globally. (Reporting by Danilo Masoni in MILAN; editing by Thyagaraju Adinarayan)

https://financialpost.com/pmn/business-pmn/short-squeeze-seen-lifting-sp-500-further-citi

Source: Goldman Sachs.

3. Social media sentiment ETF to launch in wake of Reddit rebellion

VanEck’s decision to license the Buzz index breathes new life into an old idea that failed

The Reddit rebellion might have died down for the moment, but New York asset manager VanEck is betting that there is long term value in listening to social media chat and is launching a social sentiment exchange traded fund. The fund will invest in the stocks being most talked up on social media and appropriately enough, the company most likely to be sent “to the moon” by the new ETF is Virgin Galactic, Richard Branson’s space tourism company, currently the largest stock in the underlying index. Despite the recent hype around social media, the VanEck Vectors Social Sentiment ETF is actually a revival of a previous fund that barely got off the ground.

https://www.ft.com/content/5655b6ae-89e6-4a03-9b4c-faa73d87e66f

4. Citi Global Risk Aversion Index Hits New Lows

From Dave Lutz at Jones Trading

Citi’s Global Risk Aversion Index, a combination of indicators across asset classes and geographies, has fallen to its lowest since the pandemic first roiled markets last year

5. U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever

Carolina Gonzalez

U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever(Bloomberg) — The average yield on U.S. junk bonds dropped below 4% for the first time ever as investors seeking a haven from ultra-low interest rates keep piling into an asset class historically known for its high yields.

The measure for the Bloomberg Barclays U.S. Corporate High-Yield index dipped to 3.96% on Monday evening, making it six straight sessions of declines.

Yield-hungry investors have been gobbling up junk bonds as an alternative to the meager income offered in less-risky bond markets. Demand for the debt has outweighed supply by so much that some money managers are even calling companies to press them to borrow instead of waiting for deals to come their way. A majority of new issues, even those rated in the riskiest CCC tier of junk, have been hugely oversubscribed.

The lower yields should encourage more speculative-grade companies to tap the market after raising more than $7 billion last week. January was a record month for sales with $52 billion priced, and year-to-date volume stands at about $60 billion.

Buyers have been snapping up CCC graded issues as yields for that slice of high yield also decline. They dropped to 6.21% on Monday, also a record low, and have outperformed the rest of the market for three consecutive months, according to data compiled by Bloomberg. Notes rates in the single-B tier yield an average 4.30%, while those in the BB range yield 3.05%, the data show.

https://finance.yahoo.com/news/u-junk-bond-yields-drop-231257469.html

HYG High Yield Bond ETF

©1999-2021 StockCharts.com All Rights Reserved

6. U.S. Dollar Stays Weak but Holds Early 2021 Lows

©1999-2021 StockCharts.com All Rights Reserved

7. Commodities Rally

COMT-Commodities ETF approaching 200day moving average on upside for first time since Jan.2020

©1999-2021 StockCharts.com All Rights Reserved

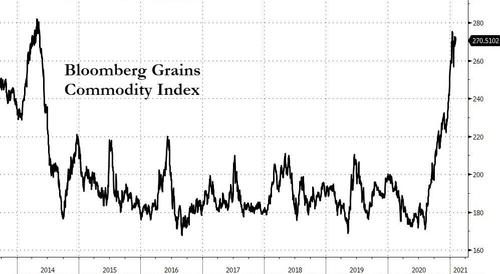

8. Commodities Grain Index Trading to 2014 Levels

Zerohedge

9. Global 10 Year Break-Even Inflation Rates Highest Since 2014

And the expectations for inflation are just as global, with US breakevens at their highest since 2014…

Source: Bloomberg

Flashing Red? Global Inflation Breakevens Are Breaking Out-BY TYLER DURDEN

https://www.zerohedge.com/markets/flashing-red-global-inflation-breakevens-are-breaking-out

10. Adam Grant: Why the Best Leaders Love Being Wrong

Popular organizational psychologist Adam Grant has a new book for our increasingly polarized times.

BY LINDSAY BLAKELY@LINDSAYBLAKELY

Adam Grant. Photo: Courtesy subject. Illustration: Chloe Krammel

Many first-time entrepreneurs share a similar narrative: They stumbled upon a problem in need of solving and, against all kinds of odds, worked like crazy to come up with the best solution to it. “I just had to figure it out!” they often say. “I felt like such an imposter!”

That early period can be one of the most fruitful and special times in the life of an entrepreneur: You’re eager to learn and act on that new knowledge. You have confidence in your ability to achieve a future goal but also the humility to question whether you have the right tools, says Adam Grant, an organizational psychologist at the Wharton School of the University of Pennsylvania and author of the new book Think Again: The Power of Knowing What You Don’t Know(Viking, 2021). It’s when you move from complete novice to somewhat successful amateur that you are likely to run into trouble. Fast growth can promote a false sense of mastery.

“That jump-starts an overconfidence cycle, preventing us from doubting what we know and being curious about what we don’t,” Grant writes. “We get trapped in a beginner’s bubble of flawed assumptions, where we’re ignorant of our own ignorance.”

In Think Again, Grant explores why entrepreneurs and executives–and really everybody–get caught in the trap of closed-mindedness, unwilling to change their assumptions and beliefs even when the evidence is right in front of them. In a turbulent world, he argues, your ability to rethink and unlearn matters far more than raw intelligence.

Technology Tips, Hacks, and Solutions for the Remote Workforce

So how do you second-guess yourself in the smartest way possible? Read on for the biggest takeaways from the book and from Grant, who discussed his work recently with Inc.

1. Beware of “founder syndrome.”

It can happen to even the most innovative founders: They bet (correctly) against the consensus and proved all the naysayers wrong. “And then they overgeneralize the wrong lesson: that every time they bet against consensus they will have better judgment,” Grant says. “That’s when arrogance and narcissism rear their ugly head.”

The better approach is to analyze why you were right and others were wrong in this situation. You need to attribute your success to something specific. Did you have different knowledge? A better approach to analyzing the problem? Were you lucky you lacked experience and came in with a fresh view? “Don’t follow your intuition; test your intuition,” he says. This is particularly important when you’ve done well in one realm and now want to launch in another. What worked at a consumer-facing startup may be irrelevant to a B2B venture.

2. Come up with at least one reason you might be wrong.

One of the easiest ways to try to curb overconfidence is to come up with even one viable reason why you might be wrong, Grant writes. “When you form an opinion, ask yourself what would have to happen to prove it false.”

Consider the fate of BlackBerry, a company that in 2009 accounted for nearly half of the smartphone market. The BlackBerry, its creator Mike Lazaridis believed steadfastly, was a device for sending and receiving email; people were never going to want to carry around the equivalent of a computer in their pocket. Many of his engineers believed otherwise. By 2014, of course, BlackBerry’s market share had fallen to less than 1 percent. What might have happened if he had questioned his assumptions?

3. Develop a trusted “challenge network.”

You are unlikely to be able to see all of your own blind spots, no matter how self-aware you become. To ensure you know what you don’t know, you need a team of employees willing to challenge you. Grant calls these employees “disagreeable givers.” “They dish out the tough love and critique you because they care and want to make your thinking better,” he says. Grant’s favorite way of identifying these types of people in a job interview is to ask some version of this question at the end of the interview: If you were going to reinvent our hiring process, what would you do differently?

Disagreeable people often will give you the most honest feedback without fearing repercussions. That last part is key: For disagreeable givers to be most effective, they must operate in a psychologically safe culture that treats mistakes as learning opportunities.

4. Find joy in being wrong.

This is perhaps the most challenging bit of advice in Grant’s book–particularly for entrepreneurs who are often rewarded for managing the expectations of others and projecting success–but it may be the most crucial. When Daniel Kahneman, the Nobel Prize-winning psychologist, discovers an aspect of his research or thinking that is wrong, Grant says, his reaction is more like joy: It means he’s now less wrong than before.

Think more like a scientist performing an experiment and less like a preacher or politician defending your ideas. If you consider your own conclusions and theories as provisional, Grant says, you’re less likely to escalate your commitment to a losing strategy.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

https://www.inc.com/lindsay-blakely/adam-grant-book-think-again.html

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.