1. Shares of Money Losing U.S. Tech Companies…Wow! 5x Increase in 10 Months.

Source: Dave Wilson’s Chart of the Day

From Barry Ritholtz blog https://ritholtz.com/2021/02/10-wednesday-am-reads-226/

2. Low Volatility Stocks Massive Underperformance 50% behind S&P 2 Years.

2 year numbers S&P +41.5% vs. SPLV (low volatility ETF) -11%

https://www.etf.com/SPLV#overview

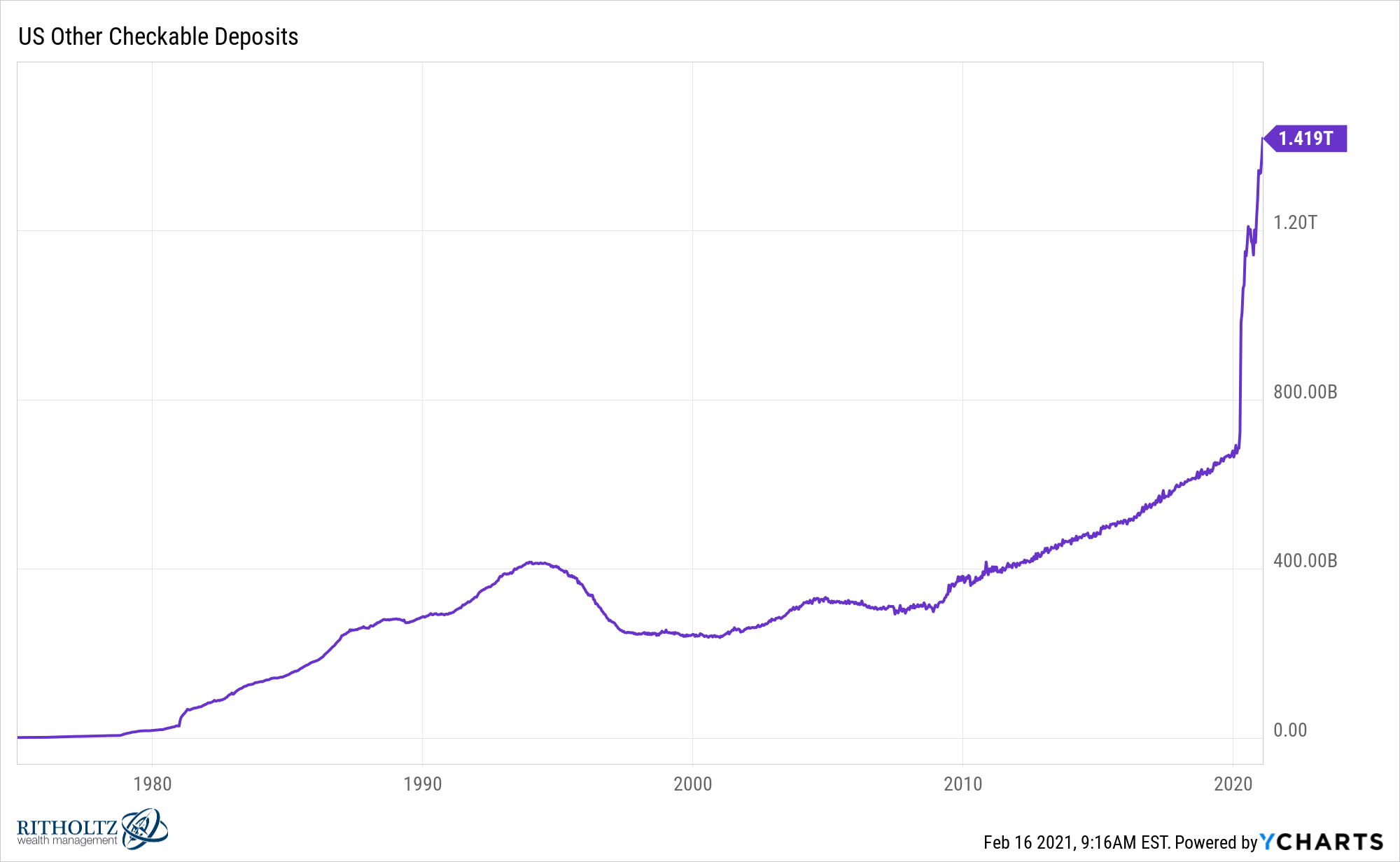

3. Nasdaq 1999 Chart…..No Growth in American Checking Deposits.

Look at the growth in things like checkable deposits (bank accounts, savings accounts, cash equivalents, etc.):

Consumers are flush with cash and many will see even more in the coming weeks or months once a stimulus deal is passed.

https://awealthofcommonsense.com/2021/02/why-valuations-probably-wont-matter-for-a-while/

Why Valuations Probably Won’t Matter For a While–1 by Ben Carlson Found at Crossing Wall Street Blog http://www.crossingwallstreet.com/

4. Interesting Read…This Is Where the Real Stock Market Bubble Is

Marketwatch

By Mark Hulbert

Bubbles typically manifest in certain pockets of the market even as other sectors remain undervalued.

It is likely that the S&P 500 Technology Hardware, Storage & Peripherals index is in a bubble at risk of bursting.

That’s the conclusion I draw from a study by three Harvard University researchers: Robin Greenwood, a finance and banking professor who chairs the institution’s Behavioral Finance and Financial Stability project; Andrei Shleifer, an economics professor; and Yang You, a Ph.D. candidate. In their study, “Bubbles for Fama,” published in the January 2019 issue of the Journal of Financial Economics, they analyzed U.S. stock market history back to 1926 in search of ways to forecast a bubble that was about to burst.

Applying the formula the researchers derive, I calculate there is an 80% chance that the Technology Hardware, Storage & Peripherals index will be 40% lower than today at some point in the next two years. Among some of the better-known firms in this industry are Apple (ticker: AAPL), Seagate Technology (STX), and Western Digital (WDC).

Though no other industries satisfy the researchers’ definition of a bubble, two others come close. They are also in the technology arena: Semiconductors and Semiconductor Equipment, and Software.

Why focus on an industry that may be in a bubble, rather than the market as a whole? Prof. Greenwood told Barron’s that he and his fellow researchers learned from their study of the history of bubbles that they “rarely are marketwide” events. Far more common, he said, is for a bubble to manifest in certain pockets of the market even as other sectors remain undervalued.

This was certainly the case at the top of the dot-com bubble, the mother of all bubbles. Greenwood reminds us that, even as dot-com stocks soared to outrageous valuations in the late 1990s and early 2000, other sectors of the market—notably value stocks—were either fairly valued or even undervalued. Some of those other sectors actually gained ground during the bear market that accompanied the bursting of the dot-com bubble stocks.

The researchers define a bubble to be any industry whose two-year return is at least 100 percentage points greater than the overall market’s. This is a high standard indeed—among all industries for which they had performance data between 1926 and 2016, just 40 satisfied the definition at any point over this 90-year period.

Read more:The Stock Market Bubble Is Just Getting Started

Not all bubbles burst, of course, and those that do don’t always burst right away. The researchers imposed a strict precondition here as well: Once an industry satisfied their definition of a bubble, they considered it to have burst if, within the subsequent two years, it lost at least 40% of its value. Of the 40 industries that satisfied the researchers’ definition of a bubble, 21—or 53%—burst.

What this means, assuming the future is like the past: There’s a slightly better than one out of two chance that any industry that outperforms the market by 100 percentage points in any two-year period will lose 40% or more over the subsequent two years.

The researchers also studied how the probabilities of a crash changed when they tightened or loosened their definition of a bubble. When they set the criterion to be just 50 percentage points ahead of the market, instead of 100, the odds of a crash fell to just 20%. When they tightened the criterion to 150 percentage points, the probabilities of a crash rose to 80%.

This latter probability is what applies to the Technology Hardware, Storage & Peripherals index. Over the past two years, according to FactSet, it has outperformed the S&P 500 by 151 percentage points.

One is tempted to apply the professors’ formula to individual securities, as I myself have done in the past. In November 2017, for example, I used the formula to argue that the odds of Bitcoin crashing were greater than 80%. It lost 67% over the next 12 months. I used the professors’ formula once again in February 2020 to argue that the odds of Tesla (TSLA) crashing were 80%. The stock lost 59% over the next six weeks.

Since then, of course, Tesla and Bitcoin have skyrocketed, as have any of a number of other highflying assets. Should I once again forecast that there is a high probability of their crashing, I asked Greenwood? He demurred, stressing that further research is needed into the various factors that affect the odds of an individual stock crashing.

Yet he added he believes that not only is the broad stock market overvalued, there are individual pockets of the market that are “incredibly frothy and bubbly.”

Mark Hulbert is a regular contributor to Barron’s. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

5. ARK Space Exploration ETF (ARKX)—Next Up for ARK Funds is Space Innovation ETF

UFO-Current Space ETF Picked up $80m in Flows Since ARKK Filing

Halo Effect-ETF.com

What is clear is that the ARK halo effect is a real thing. Since ARK detailed its plans to enter this segment on Jan. 13, other space-linked ETFs have been both rising and gathering assets relatively quickly.

The Procure Space ETF (UFO), launched in April 2019, has now picked up almost $80 million in net creations since Jan. 13. That’s roughly 3x its asset haul in the entire 2020 calendar year.

In fact, UFO hasn’t seen a single day of outflows since ARKX’s filing, growing to a $140 million ETF. And, to boot, it’s rallied 19% since that day. In 2020, the fund’s performance struggled, and UFO ended the calendar year down about 2%.

UFO was the first global-in-scope fund in this aerospace, and it’s an index-based strategy that’s built around two segments in an 80/20 split: 80% of the portfolio invests in companies that generate at least 50% of their revenues from space-linked businesses; 20% invest in diversified companies that support space exploration through technology, equipment and services.

Some of the fund’s best-performing names so far in 2021, each delivering triple-digit gains, include Gilat Satellite Networks (GILT), Loral Space & Communications (LORL) and Virgin Galactic Holdings (SPCE), all names sitting among UFO’s top holdings.

(Use our stock finder tool to find an ETF’s allocation to a certain stock.)

Only Virgin Galactic (SPCE), however, is found in the competing SPDR S&P Kensho Final Frontiers ETF (ROKT). This much smaller ETF that splits its focus between space exploration and deep sea exploration has also gained assets since ARK’s move, picking up about $9 million since Jan. 13. At face value, that’s not all that much, but ROKT is already outpacing its entire asset creations for calendar 2020.

ARK hasn’t disclosed fees for ARKX, but the firm’s other ETFs cost 0.75% in expense ratio, or $75 per $10,000 invested. Assuming they stick with that same price tag, ARKX will cost as much as index-based UFO, and notably higher than ROKT, which has a 0.45% price tag.

Contact Cinthia Murphy at cmurphy@etf.com

https://www.etf.com/sections/blog/arks-next-etf-nears-landing

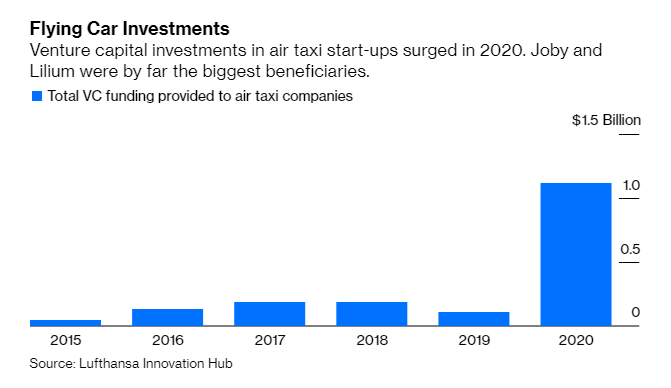

6. Venture Capital Investors Deploy $1B to Flying Taxis.

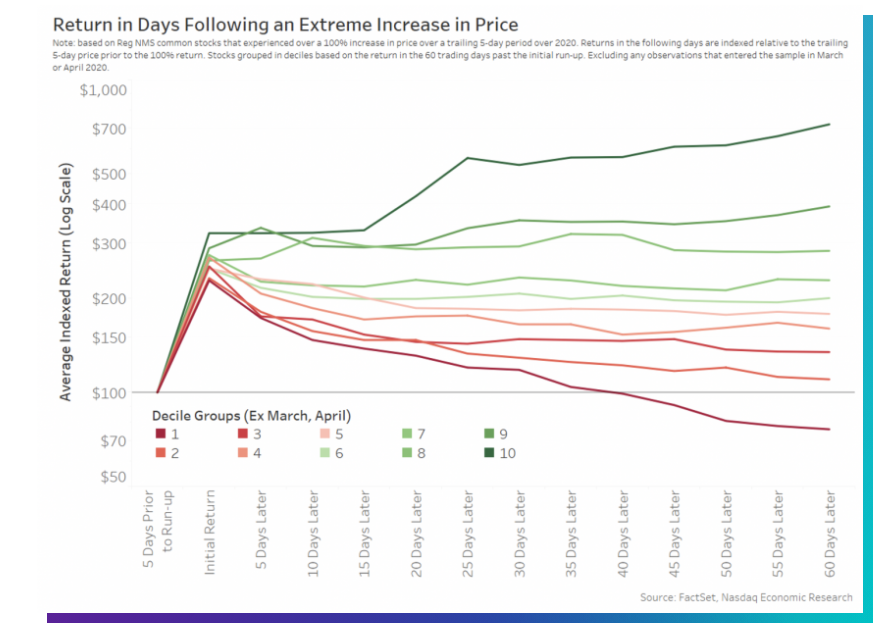

7. What happens to stocks that double in a week?

Nasdaq Phil Mackintosh

We looked at all the times in 2020 where stocks doubled in the space of a rolling five-day window.

After limiting our sample to common stocks that had at least a full 60 days of trading after the initial 100% increase, there were 371 unique observations. However, 40% of all instances occurred during the initial market-wide v-shaped rebound in markets following the Covid-19 selloff, as stimulus was added to the system.

In this analysis, we took those “COVID recovery” stocks out. What was left were 225 different NMS stocks that doubled (or more) in price over a rolling five-day window in 2020.

We all recently watched the Reddit-fueled rally in GME, which pushed the stock price from around $40 per share to over $400 per share, only to fall quickly back to almost $40 per share again. That has left some asking: Why wasn’t trading halted to protect investors?

The answer, it turns out, is more complicated. It also poses a warning to those who want to implement volatility halts for single stocks without disrupting markets unnecessarily.

When we looked at the subsequent performance of all the stocks with rapid rallies, we actually see that the majority held most of the gains, even months later.

We group the stocks into deciles based on their returns roughly two months later (Chart 1). This shows that:

- In almost all decile groups, the following week sees average prices pullback.

- But over the next two months, many deciles hold (most of) the remaining gains.

- While the stocks with the strongest rallies tend to resume their outperformance (decile nine and 10), this vertical axis is on a log scale, so the best (tenth) decile of stocks triple in a week and then roughly triple again.

- Only the worst (first) decile portfolio fell back below their prices at the starting of their five-day doubling window.

One thing that is reasonably consistent when you look at these fast-rising tickers is that there is usually a corresponding material news event. A handful of these cases were biotech companies that had positive news on drug tests; however, that wasn’t always the main catalyst. For example, three stocks in the top decile (10) were:

- Seres Therapeutics (Nasdaq: MCRB), which announced positive trial data on a new drug.

- Workhorse Group (Nasdaq: WKHS), whose initial rally was further boosted by its inclusion to the Russell 3000 index and an announcement of new company financing.

- SPI Energy Co. (Nasdaq: SPI), which rallied on the announcement of plans to build electric vehicles (EVs).

There are plenty of valid reasons for a stock to double in short time. Knowing that, ensuring that volatility halts designed to protect investors don’t incorrectly (and unfairly) slow trading in other companies whose valuations have also increased becomes much more complicated.

https://www.nasdaq.com/articles/the-lowdown-on-high-flying-stocks-2021-02-18

8. A common way to look at the minimum wage is to compare it to the median wage.

The median wage is the wage at which half of workers are paid more, and half are paid less. Comparing the minimum wage to the median wage can help identify how states will benefit from a boost to the minimum wage.

The ratio of the minimum wage to the median wage is called the Kaitz index. The higher the ratio — meaning the more people making close to the minimum wage — the more people will benefit from a minimum wage raise, since those near-minimum wage workers are likely to see their pay increase.

To estimate this ratio, we used current minimum wages and the median wages in 2019 from the Bureau of Labor Statistics’ Occupational Employment Statistics program.

For example, New York’s median wage per the Bureau of Labor Statistics in 2019 was $22.44, and the current minimum wage is $12.50, meaning the minimum wage in New York is 55.7% of its median wage.

Meanwhile, Texas’ minimum wage is much smaller than its median wage compared to New York. Texas’ minimum wage of $7.25 is 39.7% of its median wage of $18.28.

Read Insider’s full story on the Kaitz index here.

5 maps and charts show what a $15 minimum wage would really mean for workers across AmericaJuliana Kaplan and Madison Hoffhttps://www.businessinsider.com/minimum-wage-current-15-dollars-maps-charts-2021-2

9. Cutting out the middleman on electric car sales

Joann Muller, author of Navigate

Illustration: Annelise Capossela/Axios

The auto industry is in the midst of the biggest transformation in a century, with cars one day running on electrons, not gasoline.

Why it matters: But it’s not just the cars that are changing. How we buy and service them is being disrupted, too. Instead of selling cars through franchised dealers, emerging auto manufacturers want to sell electric vehicles direct to consumers, either online or in their own stores.

- But that’s illegal in more than half the states in America, which environmentalists and consumer groups argue is holding back EV adoption and keeping the U.S. from achieving emissions reduction goals.

What’s happening: A coalition of EV companies and advocates is working state-by-state to overturn decades-old laws that prohibit car manufacturers from opening their own stores or service centers.

- Tesla started the fight in 2014; now newcomers like Rivian, Lucid and Lordstown Motors are joining the effort, too.

- “What did the global pandemic teach us? It’s that people want a better way to buy a car,” Rivian’s vice president of public policy, James Chen, tells Axios.

Where it stands: At least 20 states allow EV manufacturers to sell directly to consumers, including California, Illinois and Florida. The latest was Colorado, which passed a law last March.

- In eight other states, including New York, Tesla fought for an exemption from the franchise laws, but it doesn’t apply to other EV manufacturers.

- One of those states, Washington, took up a bill this week that would remove the restriction for all EV makers.

- In Michigan, where Rivian is based, the rules are exceptionally twisted: EV makers can conduct “sales-like” activities at branded stores, but the actual sale — transfer of title — must take place in another state.

- The remaining states, including Texas — where Tesla is building a new gigafactory — prohibit EV manufacturers from direct sales.

The big picture: The dealer franchise laws were passed in the 1950s to protect car dealers from having to compete with factory-owned stores.

- As a result, carmakers like GM and Ford wholesale vehicles to independent dealers, who turn around and sell those cars to consumers at a markup.

What they’re saying: EV startups don’t want a middleman selling or servicing their high-tech products.

- “We have a desire to have direct touch with our customers,” says Rivian’s Chen.

- Neither does Lucid, which plans to sell its luxury EVs at company-owned “studios” or online. Cars would be picked up for service, or maintained by mobile service fleets.

The other side: “The direct-sales model wasn’t built to sell EVs,” says Jared Allen, a spokesman for the National Automobile Dealers Association.”

- “It was built to limit competition for both sales and service by creating a vertical channel for manufacturing, sales and service that allows a single entity to control everything, including prices.”

The intrigue: GM and Ford initially backed the dealers in their fight against Tesla, but now they have skin in the EV game, too.

- GM says it aims to phase out gasoline vehicles by 2035 and Ford has a $500 million stake in Rivian.

- Both companies are investing heavily in EV development and asking dealers to do the same to get their showrooms EV-ready.

What’s needed: Daniel Crane, a University of Michigan professor tracking the issue suggests a legislative compromise.

- Traditional cars could continue to be sold and serviced only by franchised dealers.

- But EVs and future technologies could be sold directly by both legacy carmakers and startups.

10. 3 Practices to Improve the Quality of Your Life

Dan Mager MSW–Realistic resolutions to make your year better and more manageable.

Accomplish the great task by a series of small acts. —Tao Te Ching, Verse 63

So many of us are worn-down and worn-out from a disorienting, isolating, and loss-soaked 2020. As a result, it’s understandable to want to dismiss 2020 as “the worst year ever.” It’s natural to be glad to be rid of the last year, along with its extraordinary and even surreal slate of challenges.

It’s also important to appreciate that 2021 (like all other years) will be far from a panacea. That notion was blown away in early January in the form of the riotous insurrection at the US Capitol. Like all new years, this one will invariably come with its own struggles. Appreciating that 2021 will inevitably yield both positive and negative outcomes provides the psychological flexibility that allows for the year to hold space for some good while increasing resiliency for whatever bad may come, while also helping us manage expectations.

Each new year invites opportunities to reflect on where we’ve been recently, where we are currently, and where we’d like to go. These are occasions to consider the kinds of life adjustments that will best serve our growth, health, and healing—the sorts of course corrections that help us move into greater alignment with our values and make progress toward become the person we wish to be.

Most of us start out with the best of intentions, knowing what we want, and understanding what we need to do. Taking action that shifts our behavior and engaging in those actions consistently is the challenge.

You can improve and even maximize your chances of success by focusing on things that you can actually influence or change. Often these may often feel small or seem insignificant, but a critical mass of small changes can create a tipping point that makes a big difference. Such seemingly small but powerful changes include the following practices.

1. Prioritize more consciously. We all have limited time and energy available to us – we only have so much of both. In fact, time may be the only thing that is truly irreplaceable. Therefore, it’s critical to be mindful about what (and who) we spend it on. Identify the activities that are most important to you and strive to make more space for them during the course of your day/week.

Allow yourself to let go of less meaningful activities, including those that have been a regular part of your life. Letting go of things we’ve been accustomed to—even when we know that they no longer serve us well—is a loss that requires mourning and adjustment. Consciously acknowledging this loss creates the space to grow beyond it and frees up precious time and energy that can then be allocated for higher priority activities.

2. Accept that “done” is better than “perfect.” So often, we struggle with a combination of procrastination and perfectionism. There is frequent overlap between the two. How often do you find yourself putting things off until you have the time and availability to make them just right/perfect? It isn’t the wish for high quality that is problematic, but rather the delay in starting and finishing tasks because we have a self-created idealized expectation of the final product. This creates (or more commonly exacerbates) feelings of inadequacy and self-criticism—not because we haven’t done whatever it is well enough, but because we just haven’t done it!

article continues after advertisement

Develop the skill of learning and practicing not allowing the perfect to be the avowed enemy of the perfectly good enough. The sense of accomplishment, satisfaction, and relief that results from completing even relatively small things in a timely matter is not to be underestimated—in terms of how it feels, as well as the mental-emotional effects on well-being.

3. Pay attention with intention to pacing. It’s valuable to remind yourself that everyone goes at their own pace. Trying to do more than what may be realistically possible for you or simply too much is a primary contributor to mental-emotional-physical fatigue. The experience of fatigue is maintained by patterns of activity in which people are highly active when they feel good but often overdo it, leading to higher levels of exhaustion, distress, or pain. This is especially true for people challenged with chronic pain or illness but is relevant for everyone.

Pacing refers to spacing out activities during the course of a day (or other time period) so as to stay within the limits of what you’re realistically capable of doing without overdoing it and leaving yourself depleted. Another way to think of it is that pacing is an approach to utilizing your limited and precious energy strategically and mindfully, based on what is manageable for you given your current capacity. Since everyone’s current capacity is different—and a moving target—it’s essential to learn how to tune in to your own energy levels as they shift with time and activity.

Pacing involves alternating activity—be it physical or mental—with even brief periods of rest to give yourself the opportunity to recharge. Do what you can when you can and give yourself a break, bringing self-compassion and self-forgiveness to bear if you fall short of your self-created expectations for production. Many people consistently overschedule themselves based on internal and external pressure to get things done. The reality is that very rarely will any real problems result if you can only finish 3 or the 5 tasks you set for yourself on any given day.

Applying and integrating these 3 practices into your life on a day-to-day, hour-to-hour, and moment-to-moment basis can become a vital part of an ongoing strategy of being kinder, more forgiving, more compassionate, and ultimately, more caring to yourself. And the quality of your life will be much the better for it.

Copyright 2020 Dan Mager, MSW

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.