1.Market Now Betting on 7 Rate Hikes.

2.Another Chart that Quietly had -20% Correction…Dow Transports

Transports 18,200 to 14,600 before recent bounce

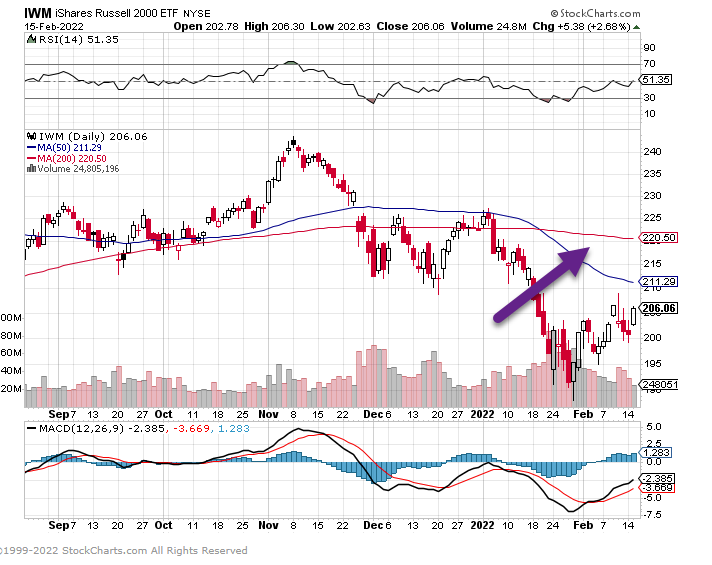

3.Small Cap Bounce After -20% Correction

Small Caps bounce 9% off lows but still well below 200 day moving average and 13% from highs

4.History of U.S. Energy Balance Sheet

The United States now produces so much of its own energy from all sources (oil, gas, wind, nuclear, hydro, solar) that it increasingly reduces the net call on imports, and frees up surpluses for export.

Gregor Macdonald https://twitter.com/

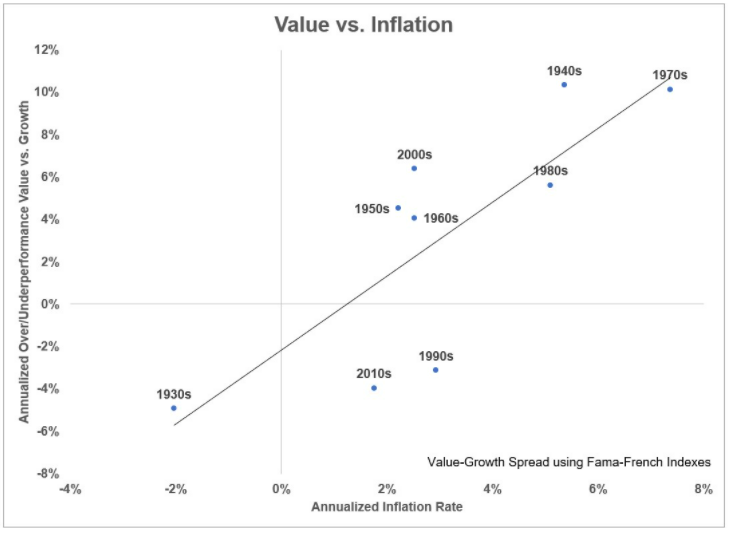

5.Value Stocks Perform Better During Decades of High Inflation

Value Stocks Like Higher Inflation by Ben Carlson

I’m not taking a victory lap here because I certainly didn’t expect to see inflation rise to nearly 8%. I wasn’t expecting so many supply chain issues stemming from massive consumer demand.

And that piece wasn’t a macro call as much as it was trying to understand why value stocks had lagged growth stocks so badly in the years leading up to the pandemic.

My takeaway was value stocks needed higher inflation to outperform once again. While not a perfect relationship, value has tended to perform better during decades with above average inflation and perform worse during decades with lower inflation.

Here’s the visual:

https://awealthofcommonsense.com/2022/02/value-stocks-like-higher-inflation/

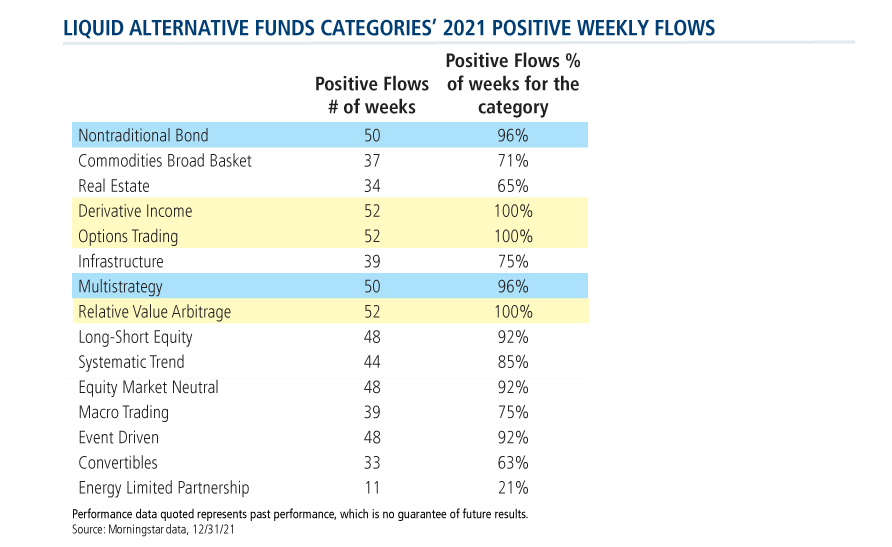

6.Liquid Alternatives $102.7B Positive Flows 2021

Advisor Perspectives Blog….AUM Jumps in Liquid Alts

All categories increased their Total Net Assets from last year with an overall 33% increase in assets totaling $707.4 billion on December 31, 2021. Real Estate, the largest category, ended the year with $239 billion in assets, up almost 50%.

Weekly flow-gathering was equally impressive. Options Trading, Relative Value Arbitrage, and Derivative Income categories enjoyed positive flows each week in 2021. Flows into Nontraditional Bond and Multistrategy categories were positive for 50 weeks with Event Driven, Equity Market Neutral, and Long-Short Equity Categories positive for 48 weeks. These flows confirm investors’ need for products providing portfolio diversification, performance consistency, alternative sources of income, and an equity hedge.

In aggregate, estimated net flows totaled $102.7 billion in 2021. A positive year after three consecutive years of negative net flows and the strongest positive year since 2013.

Elise Pondel, CFA, AVP, Director of Product Analytics

7.Top 1% Households by Wealth vs. Bottom 50%

Food for Thought: Portfolio allocations of the top 1% vs. the bottom 50%:

Source: Goldman Sachs; @MikeZaccardi

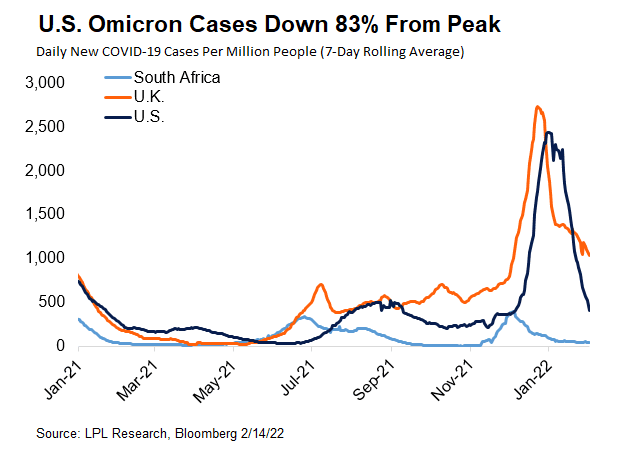

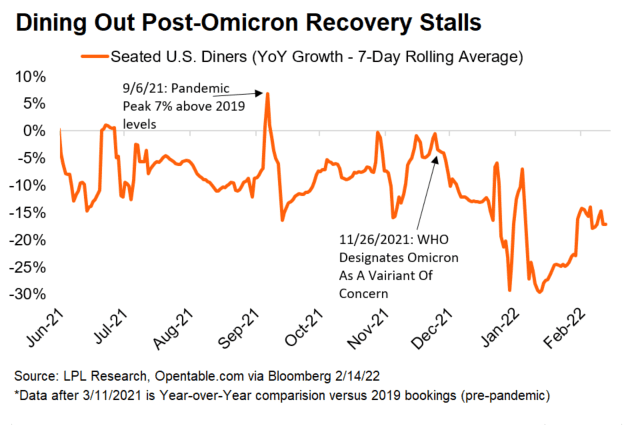

8.Omnicron Cases -83% vs. Restaurants Recovery Stall

LPL Research

https://lplresearch.com/2022/02/15/what-could-the-end-of-the-omicron-surge-mean-for-inflation/

9.Post Crypto Superbowl…BlockFi $100m Fine

Peter Thiel-backed crypto start-up BlockFi to pay $100 million in settlement with SEC, 32 states

PUBLISHED MON, FEB 14 202212:52 PM ESTUPDATED MON, FEB 14 20227:41 PM EST

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

· BlockFi has agreed to pay $100 million to the SEC and 32 states to settle charges related to its retail crypto lending product.

· The service, BlockFi Interest Accounts, let users accrue interest on holdings of bitcoin and other cryptocurrencies.

· BlockFi says it is now applying to register with the SEC to offer a new crypto savings product called BlockFi Yield.

Cryptocurrency firm BlockFi said Monday it has agreed to pay $100 million to the U.S. Securities and Exchange Commission and several states to settle charges related to its popular crypto lending product.

BlockFi, which is backed by Silicon Valley investor Peter Thiel, touts itself as a banklike platform for crypto users. The company offers a popular savings product that lets clients accrue interest on their digital currency holdings.

BlockFi advertises annual percentage yields as high as 9.25% on its website, much higher than the average savings rates on offer from incumbent financial institutions. The firm says it is able to offer such rates as large institutional investors are willing to pay more to borrow the deposits.

Bitcoin and other digital assets are not regulated, however, and authorities have grown concerned by a lack of oversight for crypto-related services that more closely resemble traditional financial products that are regulated.

The SEC said Monday it had charged BlockFi with failing to register its retail crypto lending product, BlockFi Interest Accounts, and with violating the registration provisions of the Investment Company Act of 1940.

BlockFi agreed to pay the SEC $50 million to settle the charges, without admitting or denying wrongdoing or liability. It will also pay a further $50 million to 32 states over similar charges.

Following the settlement, BlockFi said U.S. customers will no longer be able to open new interest accounts with the firm. Clients can continue receiving interest on their existing holdings, but cannot add new assets to their accounts, the company said.

BlockFi says it is now applying to register with the SEC to offer a new crypto savings product called BlockFi Yield. The company added it intends to eventually move existing U.S. users over to the new service, unless they decide against it. BlockFi said the move provides “regulatory clarity” for the industry.

“From the day we started BlockFi, we have always known that strong engagement with regulators would be critical for the adoption of financial services powered by cryptocurrencies,” BlockFi CEO and founder Zac Prince said in a statement.

“Today’s milestone is yet another example of our pioneering efforts in securing regulatory clarity for the broader industry and our clients, just as we did for our first product — the crypto-backed loan,” he added.

The SEC also issued a warning to other crypto lenders that offer services like BlockFi’s, with Gurbir S. Grewal, director of the agency’s enforcement division, saying they “should take immediate notice of today’s resolution and come into compliance with the federal securities laws.”

The watchdog is reportedly scrutinizing Celsius, Gemini and Voyager Digital as part of an inquiry into crypto lending practices, according to Bloomberg. All three firms said they are cooperating with regulators.

Last year, Coinbase shelved plans to launch its own interest-earning crypto product after the SEC threatened to sue the company. The crypto exchange’s CEO, Brian Armstrong, got into a public spat with the watchdog, accusing it on Twitter of “sketchy behavior.”

Founded in 2017, BlockFi has raised a total of over $500 million in venture funding to date, according to CB Insights data, and was last privately valued at $3 billion.

10.Warren Buffett: 3 Daily Habits That Separate the Doers From the Dreamers

Don’t just dream about success–act on it with focus and intent.

.

BY MARCEL SCHWANTES, FOUNDER AND CHIEF HUMAN OFFICER, LEADERSHIP FROM THE CORE@MARCELSCHWANTES

Outside of Warren Buffett‘s mastery of investing, you have to agree that his simple life and business lessons are not only the stuff of legends, but also have a profound effect on people.

Some of it is pure common sense, like this slice of wisdom from the Oracle of Omaha:

You only have to do a very few things right in your life so long as you don’t do too many things wrong.

So, if you keep your failures to a minimum (with the full understanding that you must fail in order to succeed) you can achieve a level of success you’ve never imagined by doing a few things right over and over again0002:43

The next question should naturally be: What are some of those things? Well, we should probably consult Buffett on the matter. We may think that we need to devise grandiose strategies from complex ideas, but Buffett himself famously said, “It is not necessary to do extraordinary things to get extraordinary results.”

3 Buffett habits to practice

Some of life’s greatest successes come from the daily habits we practice with commitment and belief. An obstacle on the way to your success may be focusing too much on the results and not enough on the habits that will get you there.

Here are three that Buffett preaches by. They have worked for him. Will they work for you?

1. Surround yourself with the right people

A Buffett put it a few years ago when he spoke with some college students, “You will move in the direction of the people that you associate with. So it’s important to associate with people that are better than yourself.”

As the famous saying goes, we are the average of the five people we spend the most time with. And depending on whom you associate with at work, that can potentially disrupt your thinking, belief system, and how you make decisions.

2. Act swiftly on a decision

Did you ever sit on a decision too long and do nothing when you should’ve acted on it? Buffett calls that “thumb-sucking.” It’s stalling, procrastinating, and avoiding something that may have been your best bet to begin with to reach your goals. We’re all guilty of it.

As with most important decisions in life, do your research thoroughly, get all the information, and then act swiftly on your decision.

3. Invest in yourself

According to Buffett, one of the keys to your success is to go to bed a little smarter each day. By investing in yourself, especially honing your communication skills, Buffett says you will “become worth 50 percent more than you are now.”

If you can’t communicate well in business, Buffett warns, “it’s like winking at a girl in the dark–nothing happens. You can have all the brainpower in the world, but you have to be able to transmit it. And the transmission is communication.”