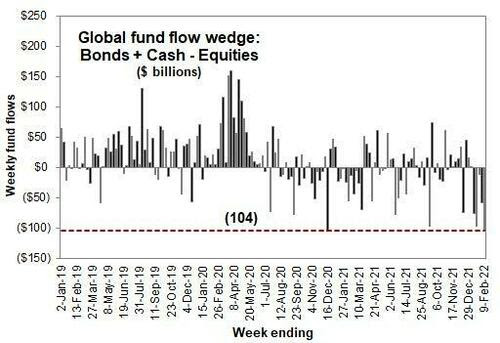

1. 2021 More Equity Inflows than Prior 25 Years Combined.

Zerohedge-2021 logged more equity inflows, $913 Billion, than the prior 25 years combined. 2022 is on pace to exceed this number by 45%.

Rubner writes that “in 2009, I officially retired the term “Great Rotation” or the movement of capital out of fixed income into equities, from my weekly emails and IB chat rooms. I switched this portfolio shift into the “Wedge”, which was the movement of capital into bonds and cash, and out of equities.”

https://www.zerohedge.com/markets/money-flowing-stocks-record-pace-goldman-does-not-see-larger-correction-taking-place

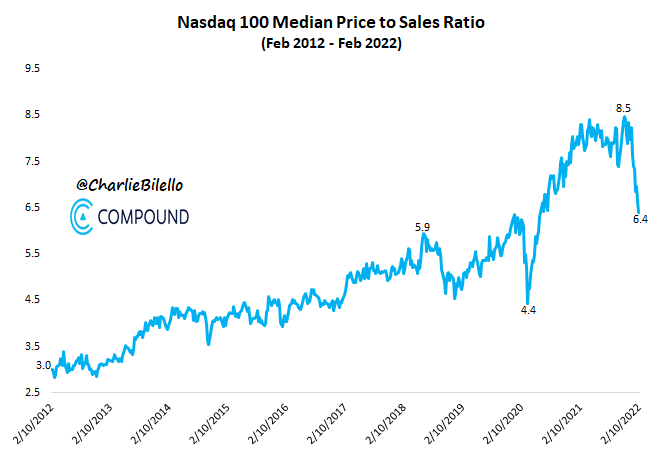

2. Nasdaq Price to Sales Ratio…Lower but Still Double 10 Years Ago

@Charlie Bilello The question many are asking is how much lower can valuations go?

If we look at the Nasdaq 100 over the last 10 years, we find that even after the recent correction, the median Price to Sales ratio remains elevated at 6.4x. Ten years ago (in 2012) this multiple stood at 3x. Powered by YCharts

What was the 10-Year Treasury yield and Fed Funds Rate back in 2012?

Exactly the same as they are today: 2.0% and 0-0.25% respectively.

Which means that a) multiples can certainly go lower and b) sentiment, much more than interest rates, are the primary driver of valuations.

3. Negative Returns Very Uncommon in Diversified Bond Portfolio

SCHWAB

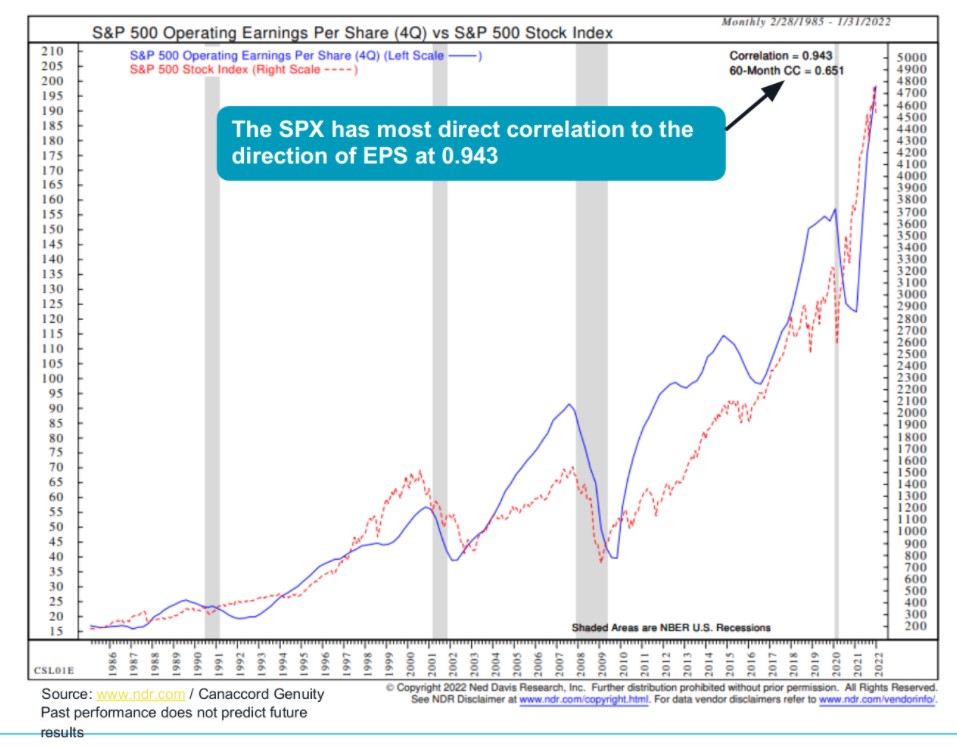

4. S&P …What Matters is the Direction of Earnings Per Share….0.94 Correlation.

From Irrelevant Investor Michael Batnick

https://theirrelevantinvestor.com/2022/02/12/time-to-buy-defense-stocks/

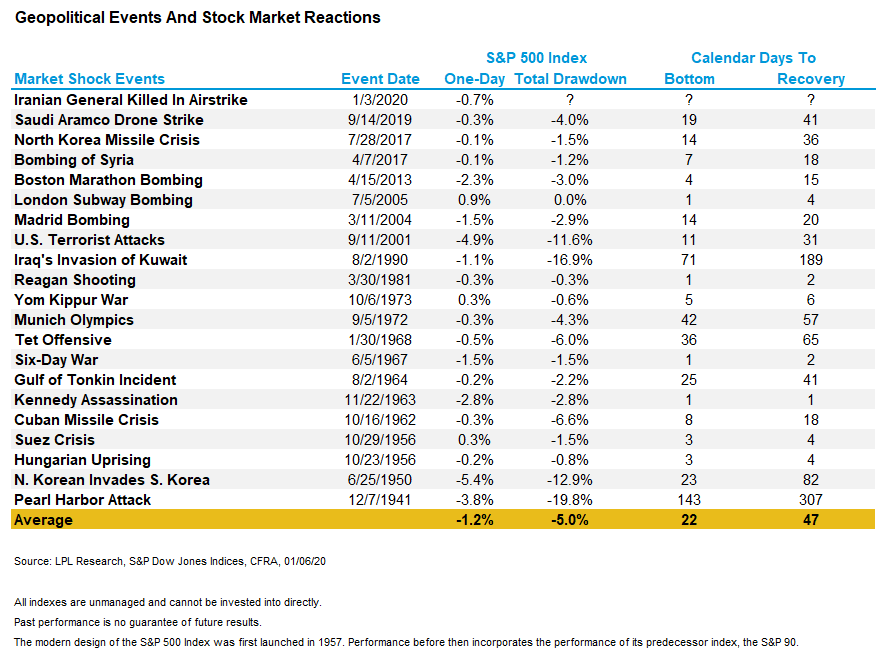

5. Geopolitical Events and Stock Market Reactions

LPL Research

https://www.marketwatch.com/story/what-a-russian-invasion-of-ukraine-would-mean-for-markets-as-white-house-warns-attack-could-come-any-day-now-11644624056?mod=home-page

6. 85% of Russian Natural Gas Goes to Europe.

WSJ-For now, the most likely energy disruption would be to Russia’s exports of natural gas, say analysts. Russia exports around 23 billion cubic feet of gas a day, about 25% of global trade, and 85% of that gas goes to Europe, according to Cowen. In particular, Russia’s flow of natural gas to Europe through a pipeline network in Ukraine could be disrupted during a conflict. The network transports about 4 billion cubic feet a day at full capacity to Europe but is currently flowing at about 50%, according to Cowen. Approximately half of Russia’s federal budget is tied to oil and gas, according to investment bank Raymond James.

By

Christopher M. Matthews Follow and Collin Eaton Follow https://www.wsj.com/articles/

Science Direct

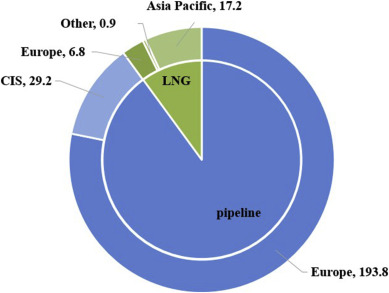

Fig. 1. Russia’s natural gas production, consumption, and export [analysis based on 1].

Natural gas export occurs via pipeline systems and in the form of LNG. The Russian natural gas export geography for LNG includes Asia Pacific (Japan, South Korea, and Taiwan), Europe, and other countries (including the Middle East and Canada, with minor volumes), and for pipeline gas includes Europe and CIS countries, predominantly Belarus. Besides, Russia imports natural gas from Kazakhstan and Uzbekistan for further re-export [1]. Fig. 2 shows the main destinations of Russian natural gas export in 2018.

https://www.sciencedirect.com/science/article/pii/S2211467X2030064X

7. 30 Year Treasury Yield 2.29% Last….3.5% Level is High Going Back to 2014

30 year treasury yield…50day about to cross above 200day to upside (bullish)

30 Year Yield has been Below 3.5% Level Since 2014

8. Gold Sideways for 2021…Watch for Breakout

9. Sun Belt Rents Rise as Population Migrates

Bloomberg-Among the 50 largest metropolitan areas, Tampa ranked No. 1 with a 27% surge in rent in the 12 months through January, according to the Zillow Observed Rent Index. Rents also rose 27% in the Miami area, while they were up 26% in No. 3 Phoenix, the data show. According to LinkedIn data, Sun Belt cities such as Nashville, Tennessee; Austin and Tampa are among the largest per-capita recipients of net job migration. Miami didn’t make LinkedIn’s top 10 overall, but it has proved a popular destination for the emerging crypto economy, and has attracted some high-profile new finance and tech firms. By Jonathan Levin

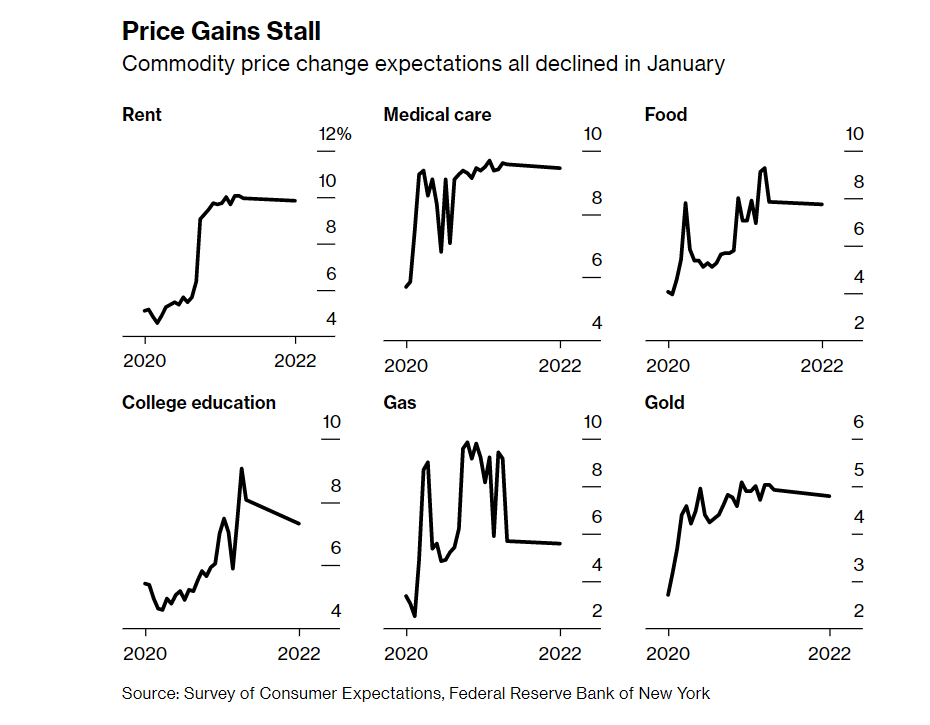

However…Inflation including rents is starting to flat Line

10. Why your high-performing employees may be slowly disengaging from work

BY WHITNEY JOHNSON5 MINUTE READ

We are experiencing an extraordinary socioeconomic upheaval the media calls the Great Resignation. Half the American workforce is looking for a new job. (I dislike this label and prefer to call the phenomenon the “Great Aspiration.”) Most people aren’t giving up, despite the significant workplace headwinds of the pandemic. Workers are looking for better work, higher compensation, greater purpose, more flexibility. Individuals want opportunities to grow. They are emboldened to make their own change.

To model human growth and help people see their progress and proactively direct their own growth, I use the so-called S curve to describe learning. Here’s the framework in summary: The base of the curve is the launch point. Growth is slow as competence is gradually acquired. It can be painful and discouraging and requires appropriate management.

As competence increases, we tip into the sweet spot up the steep back of the “S.” Growth is rapid, engagement and productivity are high. Again, well-informed management strategies can extend this valuable phase. The subject of this article is the final stage: mastery at the high end of the “S.” It’s a plateau that becomes a precipice; we’ve exhausted the growth experience available on a curve, and we’re getting bored. This is where an employee who is very, very good at what they do begins to feel they can’t do it anymore. They need a new S curve to climb.

Why is this so?

ADVERTISEMENT

Our enjoyment and engagement in any activity is driven by neuroscientific processes. Our brains are learning machines, with a default setting for growth. When we are learning, our brains are changing. This is called neural plasticity. Brain cells, the neurons, develop cell-to-cell connections called synapses. As we learn, new synapses form between cells not previously connected. Our synapses grow at a rate commensurate with the challenge level in our brains. Mental effort translates into faster growth of the neural network.

Additionally, our brains are continually running predictive models. When something is new to us, our predictions can be uninformed. When we get it wrong, dopamine in the brain drops. It feels bad. When we get what we expect dopamine levels are steady. When our expectations are exceeded, dopamine is released in high doses. Dopamine is a feel-good chemical; it makes us feel delight. We are naturally drawn to seek the dopamine reward of exceeding expectations.

Consider this analogy: In actual mountaineering, the summit is the goal. It’s the high end of that S curve. But stopping for very long at high altitude can be deadly. Elevation above 26,000 feet is considered the death zone. We consume oxygen faster than it can be replaced–a condition called anoxia. In a short time, bodies and brains start to die from oxygen deprivation. Even if supplemental oxygen is available, physical exhaustion and cognitive impairment can lead to serious accidents and death.

Learning—or rather, the brain activity and chemicals associated with learning—is the oxygen of human growth. At the high end of the S curve, where we are in mastery, our actions are automatic, our competence is high, but our brain rewards are low. We’re not getting dopamine doses delivered sufficiently to make us feel the involvement and delight that we once had. Our interest is dying. This results in stagnation, lower productivity, and disengagement. It becomes difficult to force ourselves to do things we do easily and well.

In his book Behavioral and Neural Plasticity, Michael M. Nikoletseas writes that habituation is an organism’s decremented response to environmental stimuli that it experiences repeatedly over time. Habituation leads to a behavioral plateau, where the organism responds minimally, if at all, to events that it has found to be predictable. “If we present a stimulus many times, the organism will either stop responding, or respond minimally at a lower level. Eventually, no matter how many more times we present the stimulus, we do not see any further change. The curve plateaus.” Nikoletseas adds that humans exhibit decremented responses to events that have become too familiar. We produce nothing but a reflexive response—no new learning—which is neural rigidity.

This is why top performing employees are often the biggest flight risk. It’s why the quality of their work may decline. They don’t just want a new job; they need one. Hopefully, informed leaders have the early, open, and regular conversations with their reports that help both manager and employee map this process. The S curve of the learning model provides a common language to facilitate this critical communication. Leaders can have their finger on the pulse of an employee’s perception of their progress, the most important indicator of when retention is going to become a challenge if a new in-house opportunity is not available. Proactive preparation can ensure that valuable human resources know that their growth is a high organizational priority.

The fascinating 2019 study titled The CEO Life Cycle illustrates this process at the highest level of organizations. It describes the pattern of growth, stagnation, and possible regrowth over time. Tracking the year-by-year financial performance of more than 700 S&P chief executives, the study reveals distinct phases of job performance, starting with the “honeymoon” and concluding with the “golden years.”

Those who last to year 11, when the golden years typically begin, must first survive the death zone of success. The peak of a CEO’s S curve is around year six. It is “often followed by a time of prolonged stagnation and mediocre results,” according to the report. The plateau is a precipice: Many CEOs quit or are fired. CEOs only reach the golden years if they deliberately and repeatedly reinvent themselves on new curves of learning: “CEOs who survive the complacency trap typically go on to experience some of their best value-creating years.”

Once valuable employees who are in decline can be valuable again. They may just need a new version of the curve to climb.

Whitney Johnson is CEO of the tech-enabled talent development company Disruption Advisors, an Inc. 5000 fastest-growing private company in America and one of the 50 leading business thinkers in the world as named by Thinkers50. She is a frequent lecturer for Harvard Business School’s Corporate Learning and she is the author of Smart Growth: How to Grow Your People to Grow Your Company.