1.One Year…..XLE Energy ETF +50% vs. XBI Biotech -43%

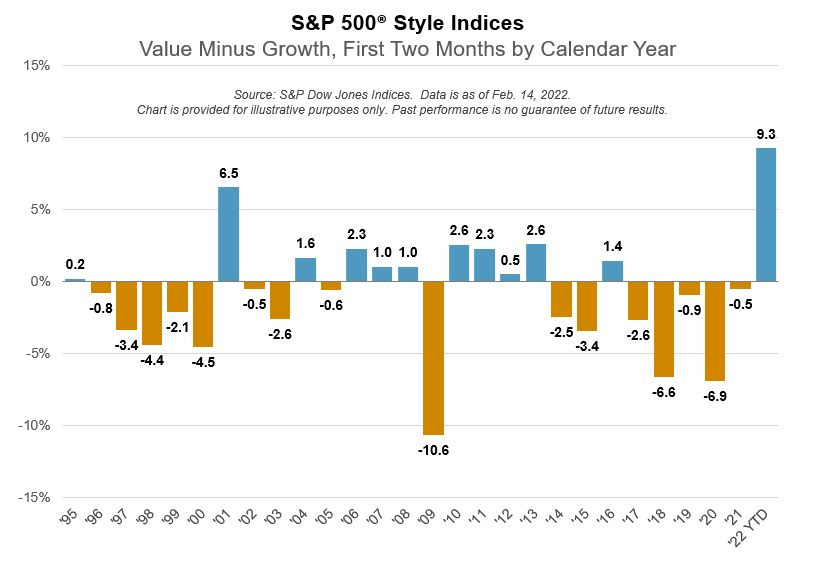

2. After underperforming Growth for 11 of the last 15 calendar years, Value leads Growth by 9% in 2022, its best relative start to a year on record.

Joseph Carr Dow Jones

https://www.linkedin.com/in/

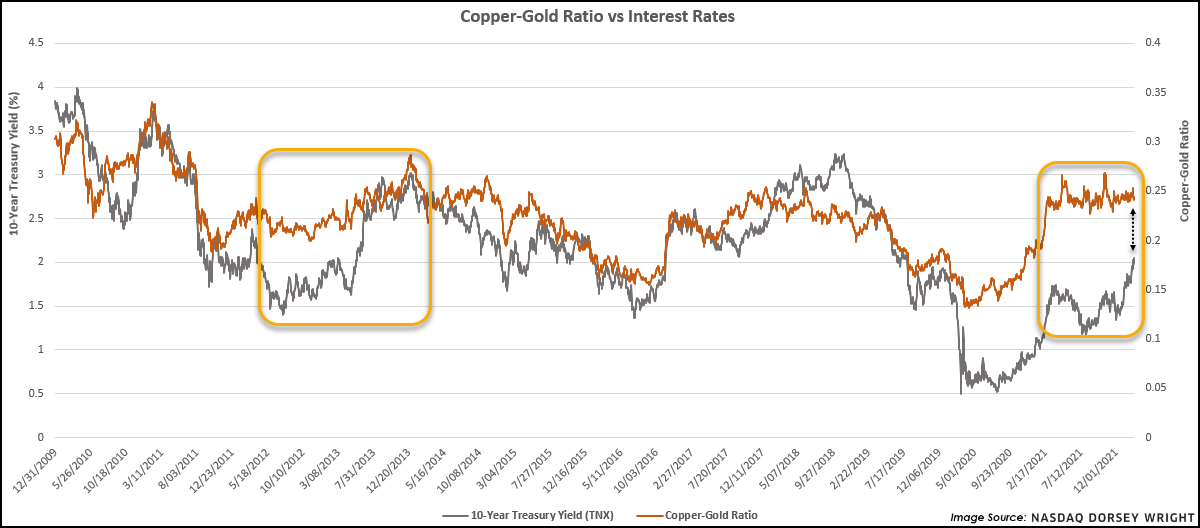

3. Copper-Gold Ratio vs. Interest Rates.

Nasdaq Dorsey Wright–Gold’s repeated failures to breakout could likely be stemming, at least in part, to the likelihood of rising real yields given a fading base effect and hawkish stance from the U.S. Federal Reserve. Rising real yields (nominal yield less inflation) typically act as a headwind for precious metals, a topic further detailed in this article.

A tangent technical trend to this conversation is the tightening spread in the copper-gold ratio. Like gold over the past year, copper (HG/) prices have traded between about $4 and $4.80, which has led to a stall out in the copper-gold ratio and an opportunity for interest rates to close the gap. We saw similar behavior in 2012 when the copper-gold ratio flatlined, rates diverged, and then subsequently rebounded. Note that the rebound in rates eventually coincided with an uptick in the copper-gold ratio, so if history rhymes, this could also add skepticism to a sizeable precious metals rally.

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

4. ”Low Volatility” ETF is Down 2% More than S&P YTD

SPLV Low Volatility ETF vs S&P

5. Banks vs. Tech YTD

KRE Regional Bank ETF vs QQQ Tech

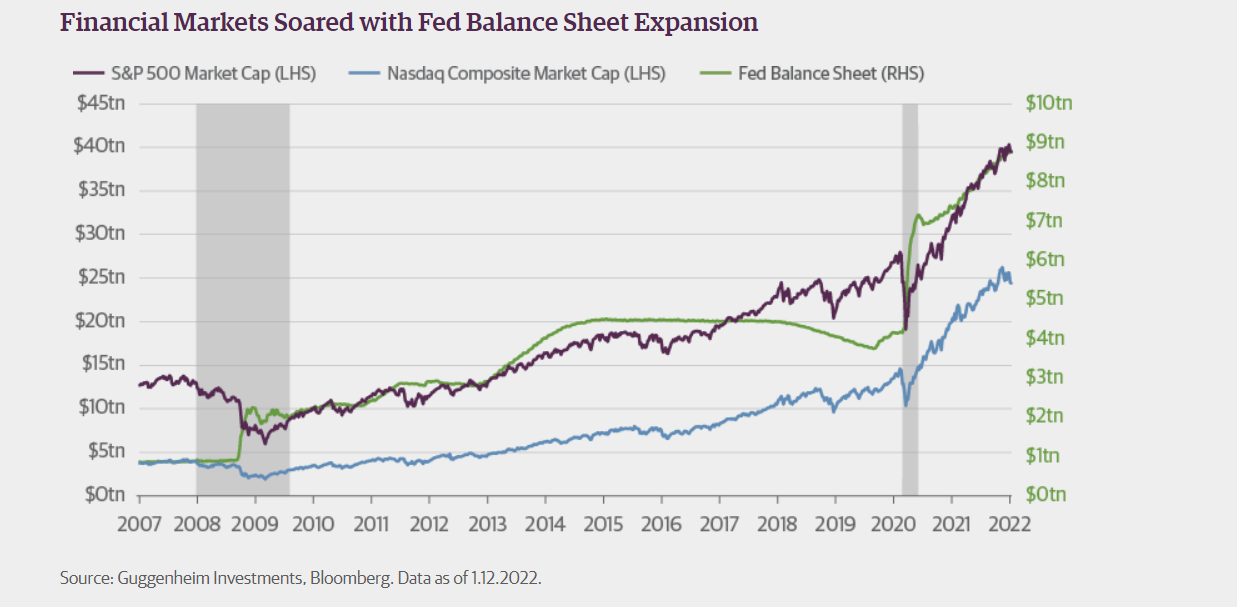

6. Fed Balance Sheet Overly with Nasdaq and S&P

Guggenheim

https://www.guggenheiminvestments.com/perspectives/global-cio-outlook/forget-raising-rates-shrink-the-balance-sheet

7. Bond mutual funds have now experienced two consecutive weeks of outflows totaling $30 billion

Advisor Perspectives Bond Funds Lurk as a Challenge to Fed’s Inflation Fight-by Eric Balchunas, 2/16/22

Bond funds are in a bad spot, and it will probably get worse.

A crash to Earth for growth stocks and cryptocurrencies is one thing, but a sharp decline in mainstream bond mutual funds could spell enormous trouble. Signs are emerging of the beginnings of a potential downward spiral in these funds, which could ultimately lead to redemption halts and subsequent panic by retail investors. That could pose the biggest challenge to the Federal Reserve’s plans to tame inflation through rate increases and quantitative tightening.

Bond mutual funds have now experienced two consecutive weeks of outflows totaling $30 billion, with exchange-traded funds adding an additional $10 billion. It may not seem like a big deal — and it isn’t yet — but these funds almost always take in cash, and it doesn’t take long for a little outflow to become a lot. Moreover, the last two times these funds experienced periods of significant outflows, the Fed did or said something dovish to turn it around. Now these outflows may not have been the cause of the central bank’s actions — although they were most likely at least a factor given how these funds manage more than $5 trillion of aging baby boomers’ retirement investments — but they are correlated. At least as of late.

The problem for these funds is they own a bunch of bonds that are going to be worth less if all the new bonds coming out offer higher yields. That’s why the prices of bonds are down and their returns are diminishing. And there’s really nowhere to hide. Corporates, Treasuries, mortgages, long term, short term, international, you name it, they are all red this year. And when bond funds start posting negative returns, money tends to start flowing out.

When they experience outflows, they usually start by dipping into their cash or selling any bond ETFs that they own as liquidity reserves. This is already taking place; the most liquid bond ETFs — HYG, LQD and TLT, for example — are experiencing billions of dollars in outflows already this year. Mom-and-pop investors aren’t selling these ETFs; they are professional money managers. Once they sell all their ETFs and the outflows continue, they will have to sell actual bonds, which will lower prices and result in negative returns, which will spark more outflows which will force them to sell more bonds which will lower prices and their returns. You get the idea. This downward spiral would start to dry up liquidity in the bond market and could ultimately lead to the fund having to halt redemptions. Panic would ensue.

The prospect of halting redemptions — and their much larger size — is why bond mutual funds are arguably a bigger risk to market stability, and the Fed’s hawkish plans, than bond ETFs, which many have pegged as the most serious threat. While ETFs won’t escape misery, they have only a fifth of the assets, and they have the release valve of trading on an exchange. Their shares may trade at a discount to net asset value, but they will trade.

I’m not the only one pointing out this potential problem. Janet Yellen said the same thing a year after the March 2020 crisis in response to questions from Senator Elizabeth Warren:

“I believe it is important to look very carefully at the risks posed by the asset-management industry, including BlackRock and other firms. FSOC began to do that, I believe, in 2016 and 2017, but the risks it focused on were ones having to do with open-end mutual funds that can experience massive withdrawals and be forced to sell off assets that could create fire sales. That is actually a risk we saw materialize last spring in March.”

Had the Fed not stepped in and thrown the kitchen sink at the bond market at that time, it’s entirely likely that some of the country’s biggest mutual funds would have halted their redemptions. They experienced two consecutive weeks of $90 billion outflows. One example is the $143 billion Pimco Income Fund, which declined 13% in the 30 days before the Fed acted. This triggered outflows of about $14 billion. All in all, the fund shrank 18% in a few weeks. How much more of this could the Pimco fund have withstood before it would have needed to halt redemptions? In India, where the central bank didn’t act as aggressively as the Fed did in the U.S., Franklin Templeton halted redemptions on about half a dozen of its active bond funds.

Of course, it’s possible that outflows from bond mutual funds are much more orderly — or even reverse and turn to inflows — and that these funds are able to adapt to the rising rate environment without the downward spiral kicking in. But as the Fed embarks on tightening monetary policy, investors and policy makers need to keep a close eye on which way the money flows and how funds are able to respond.

Bloomberg News provided this article. For more articles like this please visit bloomberg.com.

8. Tesla Falls in Consumer Reports Ranking After Design Changes

Bloomberg-Tesla Inc. sank toward the bottom of Consumer Reports’ newest annual auto brand rankings, weighed down by poorly received design changes and reliability problems.

The electric-car maker placed No. 23 out of 32 brands on the 2021 list, down seven spots from the year before, Consumer Reports said Thursday. Tesla’s Model 3 was also beaten out as the “top pick” for 2022 in the electric-vehicle category by Ford Motor Co.’s Mustang Mach-E.

By Sean O’Kane https://www.bloomberg.com/

9. Miami becomes least affordable housing market in the US

From Morning Brew https://www.morningbrew.com/

Home prices are rising at a faster clip than wages By Katherine Kallergis

(iStock/Illustration by Shea Monahan for The Real Deal)

Miami is the most expensive housing market in the country, surpassing New York, according to a RealtyHop report.

Home prices in Miami have soared during the pandemic, propelled by the migration of out-of-state buyers and renters, many of whom have moved from the Northeast. Wages, meanwhile, have not risen at the same pace.

A household in the city of Miami would have to contribute 78.7 percent of its income toward homeownership costs, according to RealtyHop’s February affordability index. That’s based on a median home price of $589,000 and a projected median household income of $43,401.

Miami has moved higher in the ranking of least affordable cities for housing in recent months, eclipsing Los Angeles in October to take the No. 2 spot.

New York became the second least affordable city in February. A household in New York City would have to spend close to 78 percent of its income on homeownership costs, including mortgage payments and property taxes. That’s based on a median annual household income of $68,259 and median home price of $970,000.

In third-ranking Los Angeles, households can expect to spend 74.2 percent of their annual incomes on housing, based on a median income of $68,733 and a median home price of $925,000.

RealtyHop analyzes homeownership affordability across the country’s 100 most populous cities.

To remain below the threshold for cost-burdened housing, homeowners and renters should spend no more than 30 percent of their income on housing.

“What we’ve been seeing since the pandemic is Miami is the destination for a lot of out-of-state residents,” said RealtyHop data scientist Shane Lee. “These people often bring in more money than [locals].”

Rents have also jumped exponentially. One report found that rents in Miami rose 38 percent, the highest gains nationwide, in 2021.

Much of the local workforce, including those in healthcare, education and first responders, are priced out of homeownership. A Florida Realtors report found that home health care and personal care aides, earning the least out of 17 occupations studied, would need to earn more than three times their median annual salary to purchase a home, and nearly double their salary to rent a one-bedroom unit.

Last year, Miami ranked 16th in the country for cities with the biggest increases in median home asking prices, according to RealtyHop. The median price rose 17 percent in 2021 to $580,000. Austin experienced the biggest increase, up nearly 28 percent to $535,000.

“Miami has become increasingly unaffordable especially for those local residents. They’re the ones who increasingly struggle with homeownership,” Lee said. “It’s the same reason why Austin was the hottest market [in 2021].”

Lee and other experts predict price growth will slow as interest rates rise, but sales will continue to increase.

Miami Most Expensive US Housing Market (therealdeal.com)

10. How One Person Can Change the Conscience of an Organization

by Nicholas W. Eyrich,and Robert E. Quinn,

Summary. While corporate transformations are almost universally assumed to be top-down processes, in reality, middle managers, and first-line supervisors can make significant change when they have the right mindset. Dr. Tadataka Yamada was one of dozens of executives…more

In December 2000, when Dr. Tadataka Yamada became the new chairman of research and development at Glaxo SmithKline, he was horrified to learn that his company was a complainant in a lawsuit over access to drug therapies for HIV/AIDS patients. GSK was one of 39 pharmaceutical companies charging Nelson Mandela and the government of South Africa with violating price protections and intellectual property rights in their efforts to access lower priced antiretroviral drugs. Close to 25 percent of black South Africans were living with HIV/AIDS and at the time, antiretroviral therapies cost approximately $1000 per month—more than a third of the average South African’s annual salary, putting treatment out of reach for most patients.

Yamada held discussions with his research staff and quickly learned that he was not alone in his opposition to the lawsuit. The team wanted to be a part of the solution to global health issues, not party to a lawsuit preventing such drugs from reaching those in dire need, but they felt they lacked the power to change the company’s direction. Yamada felt differently. In one-on-one meetings with individual board members of GSK, he stressed the company’s moral responsibility to alleviate human suffering and tied it to the long-term success of the company. He stated that GSK can’t make medicines that save lives and then not allow people access to them. He noted the public relations disaster associated with the lawsuit, and set forth a vision, co-created by his team, for how GSK could also become a leader in the fight against TB and malaria, diseases that also were disproportionately impacting third-world populations. The external pressure did not abate, with protests against many drug companies around the world.

In April, 2001, all 39 companies dropped the lawsuit against Nelson Mandela; GSK and others reduced the prices of antiretroviral drugs by 90% or more. Furthermore, under Yamada’s direction, one of GSK’s major laboratories in Tres Cantos, Spain, was converted into a profit-exempt laboratory that focused only on diseases in the developing world, including malaria and tuberculosis. Using his influence, Dr. Yamada also spurred GSK into allocating resources for affordable access to medications and development of future therapies. Subsequently top executives at GSK became leaders in global health issues. Andrew Witty assumed the CEO position at GlaxoSmithKline in 2008 and became one of the leading spokespersons for global health in the pharmaceutical industry. Chris Viehbacher, corporate executive team member at GSK, subsequently became the CEO of Sanofi, and a champion of global health. Both have since partnered with the Gates Foundation on global health initiatives.

Most people would love to be a part of such an amazing turn of events, yet this kind of transformation doesn’t happen very often. While many helped with these efforts, what made it possible for Dr. Yamada to step forward with a steady voice and a sound vision? In several interviews with Dr. Yamada we identified four key mindsets that helped him catalyze this transformation.

The power of one.

A single person with a clarity of conscience and a willingness to speak up can make a difference. Contributing to the greater good is a deep and fundamental human need. When a leader, even a mid-level or lower level leader, skillfully brings a voice and a vision, others will follow and surprising things can happen—even culture change on a large scale. While Yamada did not set out to change a culture, his actions were catalytic and galvanized the organization. As news of the new “not for profit” focus of Tres Cantos spread, many of GSK’s top scientists volunteered to work there. Yamada’s voice spoke for many others, offering a clear path and a vision for a more positive future for all.

The power of sequential skill building.

Prior to GSK, Yamada had a lot of practice with smaller challenges, from caring for the most complex patients in the intensive care unit, to becoming a department head and national leader in his field. Along the way he also led other efforts to change the status quo by actively helping more African Americans and women to join the gastroenterology faculty at the University of Michigan. The lesson is not to underestimate any chance you have, even if small, to hone your skills of challenging the status quo for the greater good. Train your “courage for challenging convention” muscle consistently, so that it’s ready when needed. At GSK, he first invited the input of his team, ultimately resulting in the plan to convert the Tres Cantos laboratory to a “not for profit” disease focus. He did not wait for someone else to speak out first, or for a committee to be formed to study the issue. He had built the skills to quickly recognize the problem, and also to advocate for a better way—a way GSK could become a leader in the fight against diseases that might not be profitable but would help countless individuals in dire need.

The power of sustained focus and determination.

It’s easy to say, “This will take some doing; I’ll think about it later.” Combined with an unconscious “This could be dangerous for my career,” it can be easy for tough challenges to gradually slip from focus. Over time the unacceptable can become the norm, and the energy for change dissipates. But Yamada didn’t accept the unacceptable; his focus and determination were well honed. He emigrated from Japan as a teenager and entered the demanding field of medicine. Along the way he took up marathon running and edited a seminal 3440-page textbook of Gastroenterology, among many other achievements. Attacking challenges was not just an occasional adventure—it’s been a way of being, as well as a highly successful career path. Assuring success of the Tres Cantos lab was not accomplished with a simple signature on a document. The laboratory was initially funded by GSK with the expectation that the researchers would soon obtain external grants so the output from the lab would not have expectations of making a profit for GSK. Partnerships with many organizations and universities were also initiated and sustained to help support this work.

The power of using privilege to support people with less privilege.

While such a mindset is not required for transformation to occur, most would agree that it’s even better, and more rewarding, when transformation also helps those with less privilege. Dr. Yamada, trained over many years in the “patient first” culture of medicine, had a well-honed awareness of the larger change he could bring because of his voice, and a vision for the positive impact GSK could bring to South Africa—and other countries in dire need of low cost, life-saving drugs to treat HIV, TB, and malaria. His team, and ultimately many others at GSK, shared a desire to help those less fortunate. The work done by the Tres Cantos lab continues to impact countless people in poverty suffering from TB, malaria, and many other diseases.

Speaking of the lawsuit that sparked his transformational leadership, Yamada said: “It was obvious we could reduce the price, but beyond that I felt it was really important for the company to make a commitment to making medicines for people where we might not make profit, but where we could have huge medical impact.”

With the support and efforts of many at GSK, this positive vision and pathway for action reverberated across the organization and helped energize a culture shift. The changes catalyzed by Yamada continued after he left GSK in 2006 to become President of the Global Health Program at the Bill and Melinda Gates Foundation. Today GSK is one of the top pharmaceutical companies for global drug access and global health initiatives. In just the past 3 years Tres Cantos researchers have co-authored over 100 scholarly research publications. The laboratory continues to provide independent researchers access to GSK facilities, expertise and resources to advance the understanding of diseases of the developing world.

Yamada was one of dozens of executives we spoke to over the last several years to learn how one can succeed in making positive change in large organizations. In these interviews, we heard accounts that reflect the mindsets Yamada described. In nearly every case we saw the power of one. In one example, a woman in a Fortune 50 company shared her experience in transforming her unit in Brazil. After being promoted to a senior position at headquarters, she saw the need for change, but the politics were more intense, and her previous experience seemed irrelevant. With unwavering focus, she pressed forward and succeeded. In reflecting on her success, she noted that challenging the status quo is a skill that one can develop, and it applies at every level. In another case, a woman in a Fortune 500 company was promoted to oversee a large but failing business line. The eight people who preceded her were all fired. She spent months examining the organization and formulated a strategic plan. It required serious work at the top. Her boss said no. Using all her acquired skills and courage, she led her boss until he was ready to change. The organization turned around.

These stories remind us that while corporate transformations are almost universally assumed to be top-down processes, in reality, middle managers, and first-line supervisors can make significant change when they have the right mindset.