1. SuperBowl Bets +78% Year Over Year…4 Years Since Legalization…Gambling Companies Revs +1,000%

Barrons-Bookmakers have always been busy on Super Bowl Sunday, but this year will be a bonanza like never before. Bettors are on track to wager $7.6 billion on the game, up 78% from last year, and it’s not because the office pool is getting bigger.

Legal sports gambling has now spread to 30 states and Washington, D.C.—home to more than 130 million. In the four years that it has been legal, both the amount of money bet on sports and the amount counted as revenue by gambling companies have risen nearly 1,000%, to $57 billion and $4.3 billion, respectively, according to the American Gaming Association, or AGA.

In New Jersey, which led the way in allowing sports betting, $10.9 billion was wagered in 2021. That’s $1,200 for every man, woman, and child in the state.

The $22 Billion Wager: DraftKings and Others Are Reaching for a Piece of the Sports-Gambling Prize By

Avi Salzman Follow

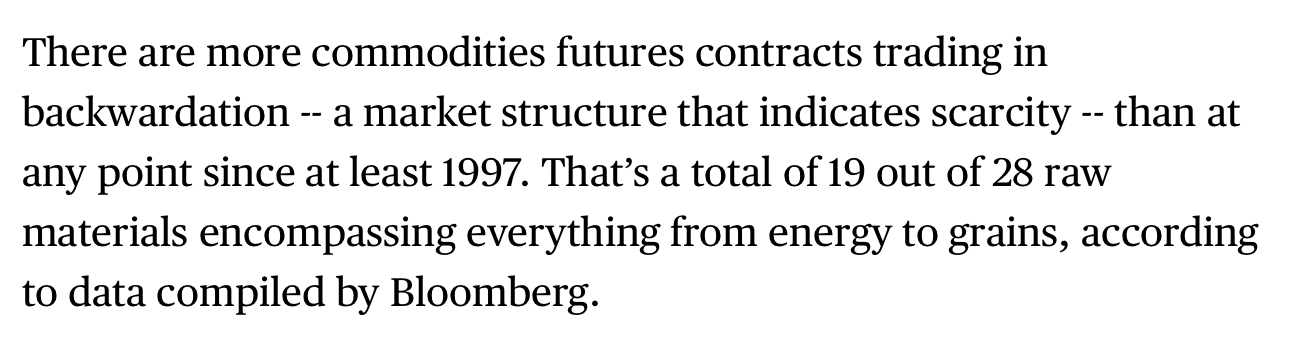

2. The Most Commodities in Backwardation Since 1997

Commodities: Many commodities are in backwardation amid tight supplies.

Source: Bloomberg Read full article

From The Daily Shot https://dailyshotbrief.com/

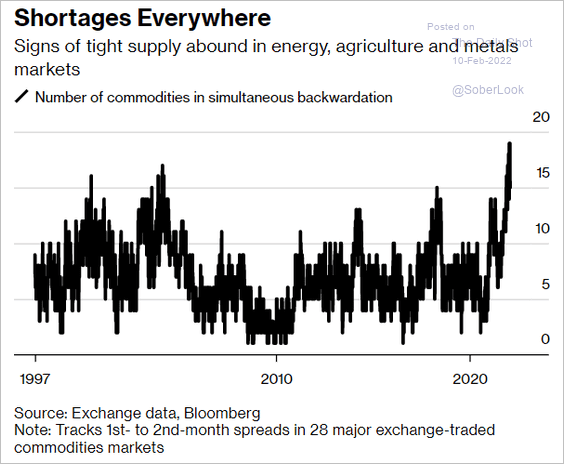

3. Timber eyed as a hedge against rising prices as inflation surges to 40-year highs

“Timber, historically, has been positively correlated with inflation fairly directly,” Joe Sanderson of Domain Timber Advisors told Insider, adding that this makes it a good hedge against the rising prices of goods and services.

https://markets.businessinsider.com/news/commodities/inflation-hedge-asset-timber-wood-lumber-hike-rates-fed-cpi-2022-2

4. TBF Short Bonds ETF….Rally but Still Well Below 2021 Levels

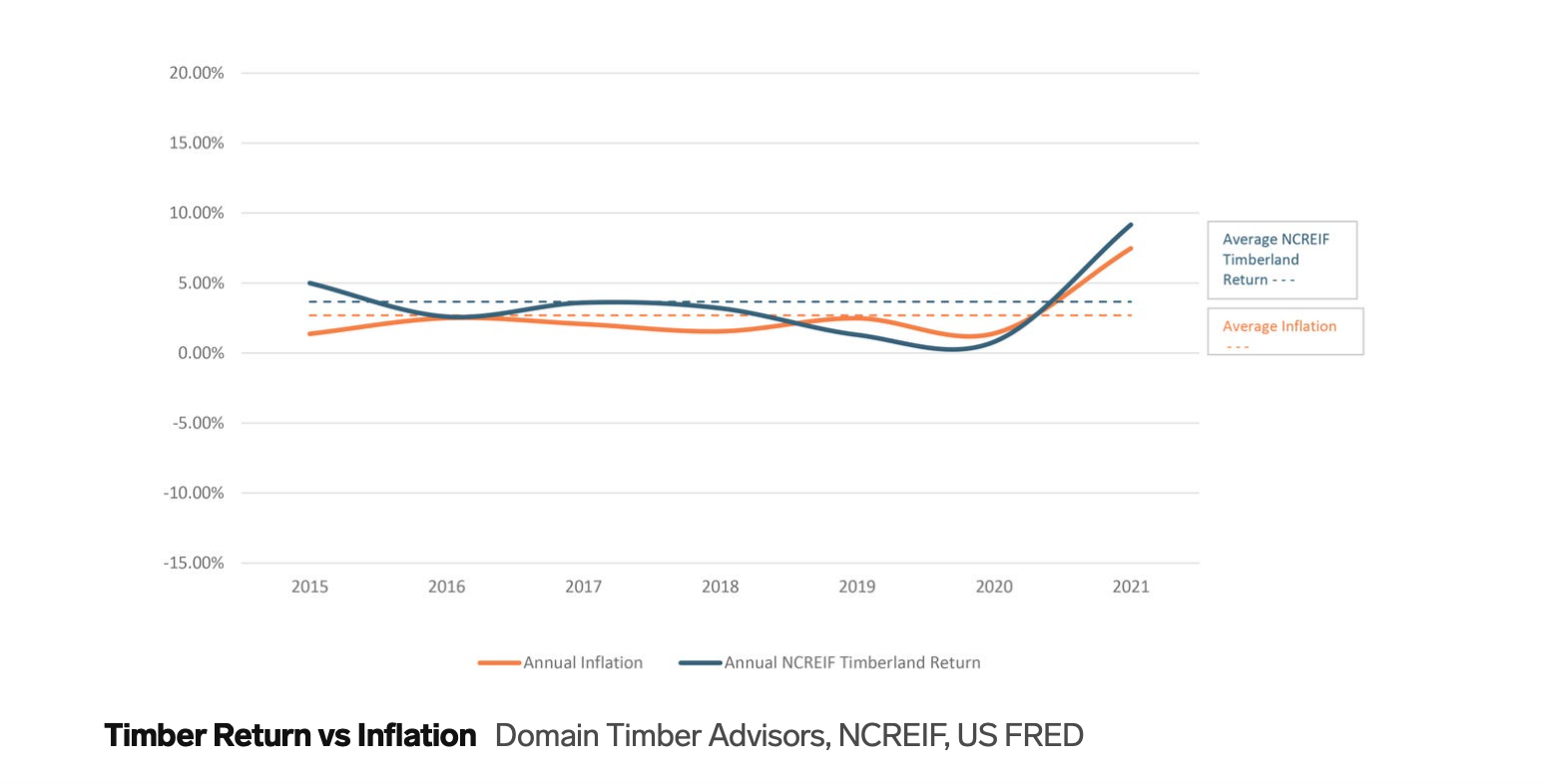

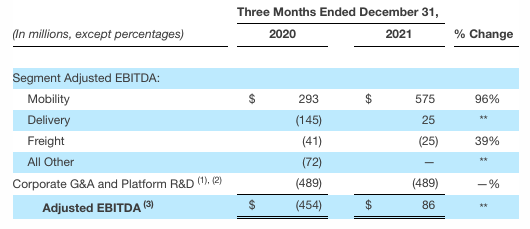

5. UBER Made More Money Delivering Food than People

Uber wrapped 2021 with strong revenue growth and greater adjusted profitability

Alex Wilhelm@alex /. Today after the bell, Uber reported its fourth-quarter financial performance. The company saw $25.9 billion in gross platform spend, up 51% compared to its year-ago result, and revenues of $5.78 billion, up 83% compared to Q4 2020. The company also reported GAAP net income of $0.44 per share, though that number did include non-operating items relating to investments.

Analysts had expected the company to report a per-share loss of $0.35 against revenues of $5.34 billion, according to estimates shared by Yahoo Finance. Shares of the American company are up just under 6% in the immediate aftermath of its earnings disclosure.

On a per-segment basis, here’s how Uber’s key business units performed in revenue terms:

Image Credits: Uber

The company’s diversification is in full-force in the above numbers, with ride-hailing posting the slowest growth of Uber’s core unit results, even losing the revenue crown to delivery. However, when it comes to generating heavily adjusted EBITDA, things are rather different:

Image Credits: Uber

Here we can see that Uber’s ride-hailing business remains utterly supreme when it comes to the creation of margin for the company’s corporate operations to charge against. In contrast, delivery and freight-focused operations effectively canceled out one another in the quarter. Still, for Uber, posting positive adjusted EBITDA is a useful indication that its business has matured into something less awash in red ink than it once was, helped in no small part by the company’s delivery work shifting its results into the green.

Found at Chartr www.chartr.com

6. 285 ETFs Hold TSLA….62.6m Shares

What’s one factor about our current markets that doesn’t get enough attention?

One factor about our current markets that doesn’t get enough attention, in my opinion, is the explosion in the number or ETFs over the past ten years and the huge volume traded there.

Tesla is a holding in over 200 different ETFs – when TSLA stock goes higher all these ETFs need to buy TSLA stock to match its weighting and performance. The same is true when TSLA stock goes lower; all the ETFs need to sell.

This is true of any major ETF held stock: when it goes higher, more funds need to buy it (and need to sell it when its going lower). All this is fine when the markets are functioning normally, but in moments of inefficiency, when liquidity dries up, this can lead to huge volatile moves.

So, blame the algos, blame the ETFs, blame the Fed, but this is how fear and selling in a few of the markets’ mega-caps can quickly cascade into a waterfall.

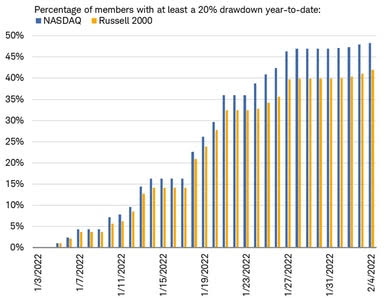

7. 50% of Nasdaq and 45% of Small Cap Russell 2000 -20% from Highs.

Schwab-Liz Ann Sonders–Deteriorating breadth was an issue in 2021 but has become more acute in 2022. For example, more than 40% of the stocks on the Russell 2000 index have experienced a drawdown of a least 20% from a recent peak so far this year. For the Nasdaq index, the total is closer to half. These stealth bear markets are having an effect at the index level, with the Nasdaq recently experiencing a maximum drawdown of 17% from its November 2021 peak and the Russell 2000 down (at its worst point) 21% this year from its November 2021 peak.

Bear markets are getting less stealthy

Source: Charles Schwab, Bloomberg, as of 2/4/2022. Past performance is no guarantee of future results.

https://www.schwab.com/

8. BlackRock Planning to Offer Crypto Trading, Sources Say

Clients would be able to trade crypto through the firm’s Aladdin investment platform, said one of the sources.

By Ian Allison

BlackRock headquarters in New York (Jeenah Moon/Bloomberg via Getty Images)

BlackRock, the world’s largest asset manager, is preparing to offer a cryptocurrency trading service to its investor clients, according to three people with knowledge of the plans.

The New York-based company, which manages over $10 trillion in assets for institutions, plans to enter the cryptocurrency space with “client support trading and then with their own credit facility,” one of the people said. In other words, clients would be able to borrow from BlackRock by pledging crypto assets as collateral.

One of the people said BlackRock will allow its clients – which include public pension schemes, endowments and sovereign wealth funds – to trade cryptocurrency through Aladdin (short for “Asset, Liability, Debt and Derivative Investment Network”), the asset manager’s integrated investment management platform. The timetable for unveiling the service is unclear.

BlackRock declined to comment.

The asset manager may have been telegraphing its intentions as early as June when it began hiring for an Aladdin blockchain strategy lead. These days it’s taken as known that Wall Street banks and large financial institutions are edging into crypto, with the likes of Goldman Sachs, Morgan Stanley and Citi carefully choosing strategies.

Read more: BlackRock Wants a Blockchain Strategy for Aladdin, Its Investments Engine

BlackRock has already sent some positive signals to the market regarding crypto, including trading CME bitcoin futures, as per a filing with the U.S. Securities and Exchange Commission. The company also has plans to launch the iShares Blockchain and Tech ETF, an exchange-traded fund tracking an index composed of companies involved in crypto technologies in the U.S. and abroad.

BlackRock also owns 16.3% of MicroStrategy, whose CEO, Michael Saylor, regularly trumpets news about his firm’s bitcoin holdings.

A second person with knowledge of the plans said BlackRock was “looking to get hands-on with outright crypto” and was “looking at providers in the space.”

A third person referred to a working group of “approximately 20 or so” inside BlackRock that is evaluating crypto, adding, “They see all the flow that everyone else is getting and want to start making some money from this.”

https://www.coindesk.com/

9. New FDA-approved eye drops could replace reading glasses for millions: “It’s definitely a life changer”

A newly approved eye drop hitting the market on Thursday could change the lives of millions of Americans with age-related blurred near vision, a condition affecting mostly people 40 and older.

Vuity, which was approved by the Food and Drug Administration in October, would potentially replace reading glasses for some of the 128 million Americans who have trouble seeing close-up. The new medicine takes effect in about 15 minutes, with one drop on each eye providing sharper vision for six to 10 hours, according to the company.

Toni Wright, one of the 750 participants in a clinical trial to test the drug, said she liked what she saw.

“It’s definitely a life changer,” Wright told CBS News national correspondent Jericka Duncan.

Before the trial, the only way Wright could see things clearly was by keeping reading glasses everywhere — in her office, bathroom, kitchen and car.

“I was in denial because to me that was a sign of growing older, you know, needing to wear glasses,” she said.

It was in 2019 that her doctor told her about a new eye drop with the potential to correct her vision problems, temporarily. The 54-year-old online retail consultant, who works from her farm in western Pennsylvania, instantly noticed a difference.

“I would not need my readers as much, especially on the computer, where I would always need to have them on,” she said.

Vuity is the first FDA-approved eye drop to treat age-related blurry near vision, also known as presbyopia. The prescription drug utilizes the eye’s natural ability to reduce its pupil size, said Dr. George Waring, the principal investigator for the trial.

“Reducing the pupil size expands the depth of field or the depth of focus, and that allows you to focus at different ranges naturally,” he said.

A 30-day supply of the drug will cost about $80 and works best in people 40 to 55 years old, a Vuity spokesperson said. Side effects detected in the three-month trial included headaches and red eyes, the company said.

“This is something that we anticipate will be well tolerated long term, but this will be evaluated and studied in a formal capacity,” Waring said.

Vuity is by no means a cure-all, and the maker does caution against using the drops when driving at night or performing activities in low-light conditions. The drops are for mild to intermediate cases and are less effective after age 65, as eyes age. Users may also have temporary difficulty in adjusting focus between objects near and far.

As of now, the drug is not covered by insurance. Doctors who spoke with CBS News said it’s unlikely that insurance will ever cover it because it’s not “medically necessary,” as glasses are still a less expensive alternative.

For Wright and millions just like her, the new drug is an easy backup solution — with a clear advantage.

“Just a convenience to have that option of putting the drops in and being able to go,” she said.

https://www.cbsnews.com/news/

10. The Power of Regret Found at Abnormal Returns Blog

Daniel Pink is the author seven books about business, work, creativity, and behavior, including the #1 New York Times bestsellers Drive and To Sell Is Human. He is also one of our curators here at the Next Big Idea Club.

Below, Daniel shares 5 key insights from his new book, The Power of Regret: How Looking Backward Moves Us Forward. Listen to the audio version—read by Daniel himself—in the Next Big Idea App.

1. Regret is universal.

“No regrets.” We hear it everywhere—in hit songs, on tattoos, in celebrity interviews. The message booms from every corner of the culture. Forget the past, seize the future, bypass the bitter, savor the sweet. A good life has a singular focus (forward) and an unwavering valence (positive).

This philosophy makes intuitive sense, but there’s just one problem: It’s dead wrong. Regret is not dangerous or abnormal, a deviation from the steady path to happiness; it is healthy and universal, an integral part of being human. Everyone has regrets. In one study from the 1980s, regret was the second most-common emotion expressed in interviews, trailing only love. In 2008, social scientists found that among negative emotions, regret was both the most experienced and the most valued. And in my own survey of nearly 4,500 Americans, 99 percent of people admitted that they do at least occasionally experience this emotion.

Regret is a universal human experience. The only people who don’t have regrets are five-year-olds, people with brain damage and neurodegenerative disorders, and sociopaths.

In other words, the inability to feel regret—in some ways the apotheosis of what the “no regrets” philosophy encourages—isn’t a sign of psychological health. It’s the sign of a grave disorder.

2. Done right, regret makes us better.

Why is regret hard to take and harder to avoid? Why is it so prevalent? Are we all masochists? No. Well, at least not all of us. Instead, we are wired for survival. Regret makes us feelworse, but it can make us do better. Indeed, the way it makes us do better is by making us feel worse. A half-century of research shows that dealing with our regrets properly—not ignoring them, but not wallowing in them either—delivers at least three benefits.

“Regret makes us feel worse, but it can make us dobetter.”

First, it can sharpen our decision-making. In one study, negotiators fared better on subsequent interactions if they considered previous negotiation regrets. Reflecting on prior regrets can help us avoid cognitive biases, like escalation of commitment to a failing course of action.

Second, regret can elevate our performance on a range of tasks. People who regret their performance on problem-solving tasks do better on their next attempts to solve problems. Even hearing about other people’s regrets can change our thinking for the better. People who heard a story about a woman who narrowly missed out on winning a trip to Hawaii because she switched seats scored 10 points higher on the LSAT, the law school admission test.

Third, regret can strengthen our sense of meaning and connectedness. People who think counterfactually about pivotal moments in their lives experience greater meaning than those who think explicitly about the meaning of those events. Likewise, when people consider counterfactual alternatives to life events, they experience higher levels of religious feeling and a deeper sense of purpose than when they simply recount the facts of those events.

This way of thinking can even increase feelings of patriotism and commitment to one’s organization.

In short, regret can make us better by improving our decisions, boosting our performance on problem-solving tasks, and deepening our sense of meaning.

3. To understand what people regret, look beneath the surface.

Beginning with George Gallup in 1949, pollsters and professors have tried to determine what people regret. Do they have career regrets, education regrets, romance regrets, health regrets, family regrets, financial regrets? And since the mid-20th century, their answer has been unsatisfying.

“People seem to express the same four core regrets, irrespective of the domain of their life.”

People regret a lot of stuff. No domain predominates. But I think I figured out the riddle. What’s visible and easy to discover—the realms of life, such as family, school, and work—is far less significant than a hidden architecture of motivation and aspiration that lies beneath it. In analyzing 15,000 regrets from people in 105 countries, I’ve found that people seem to express the same four core regrets, irrespective of the domain of their life.

One is foundation regrets. Many of our education, financial, and health regrets are actually different outward expressions of the same core regret: our failure to be responsible, conscientious, or prudent. Our lives need some basic level of stability.

The second category: boldness regrets. A stable platform for our lives is necessary, but not sufficient. One of the sturdiest findings in academic research and my own is that over time, we are much more likely to regret the chances we didn’t take than the chances we did.

Third: moral regrets. Most of us want to be good people, yet we often face choices that tempt us to take the low road. When we behave poorly or compromise our belief in our own goodness, regret can build and then persist.

Finally, connection regrets. Our actions give our lives direction, but other people give those lives purpose. Many human regrets stem from our failure to recognize and honor this principle. Connection regrets arise anytime we neglect the people who help establish our sense of wholeness. When those relationships fray, disappear, or never develop, we feel an abiding loss.

Foundation regrets, boldness regrets, moral regrets, connection regrets—these are the four core regrets that people express.

“We are much more likely to regret the chances we didn’t take than the chances we did.”

4. Science offers a systematic way to deal with our regrets.

So, what can we do to turn our existing regrets into engines of progress? Science suggests a three-step process.

First, look inward through self-compassion. Self-compassion, pioneered by Kristin Neff at the University of Texas, begins by replacing searing judgment with basic kindness. It doesn’t ignore our screw-ups or neglect our weaknesses; it simply recognizes that being imperfect, making mistakes, and encountering life difficulties is part of the shared human experience. By normalizing negative experiences, we neutralize them. Self-compassion encourages us to treat ourselves with kindness rather than contempt so that we can move on.

Second, express outward through self-disclosure. We’re often skittish about revealing negative information about ourselves to others. But an enormous body of literature makes clear that disclosing our thoughts, feelings, and actions by telling others—or simply writing about them—brings an array of physical, mental, and professional benefits. Disclosing regret lifts the burden, and by converting the blobby, amorphous negative emotion into concrete words, we make the threat less menacing and can begin making sense of what happened.

Third, move forward through self-distancing. When we’re beset by negative emotions, including regret, one response is to immerse ourselves in them, but immersion can catch us in the undertow of rumination. A better, more effective, and longer-lasting approach is to move in the opposite direction—not to plunge in, but to zoom out and gaze upon our situation as a detached observer. Self-distancing helps you analyze and strategize, examine the regret dispassionately, and then extract a lesson from it that can guide your future behavior.

“Self-compassion encourages us to treat ourselves with kindness rather than contempt so that we can move on.”

5. Anticipating our regrets is useful, but this medicine should come with a warning label.

We often think about regret through the rearview mirror, but it’s also well worth our time to consider it through the front windshield.

Anticipating regrets can often work to our advantage. It slows our thinking. It taps our cerebral breaks, allowing us time to gather additional information and to reflect before we decide what to do. Anticipated regret is especially useful in overcoming regrets of inaction. For example, one well-regarded British study showed that people prompted to agree with the simple statement “if I do not exercise at least six times in the next two weeks, I will feel regret” ended up exercising significantly more than people who did not have regret on their minds.

Anticipating our regrets is often useful, but it should come with a warning label. One problem with using anticipated regrets as a decision-making tool is that we’re pretty bad at predicting the intensity and duration of our emotions, and we’re especially inept at predicting regret. Anticipating regret can sometimes steer us away from the best decision and toward the decision that most shields us from regret.

The best advice, then, is not to avoid all regrets, but rather to optimize them. We know that people tend to regret the same four things, so anticipate those regrets. Do everything you can to build your foundation. Take a sensible risk. Do the right thing. Reach out. But for other possible regrets, chill out. Good enough is often good enough.

Our everyday lives consist of hundreds of decisions, some crucial to our well-being, many inconsequential. Understanding that difference can make all the difference. If we know what we truly regret, we know what we truly value. Regret—that maddening, perplexing, and undeniably real emotion—points the way to a life well-lived.

To listen to the audio version read by author Daniel Pink, download the Next Big Idea App today:

https://nextbigideaclub.com/