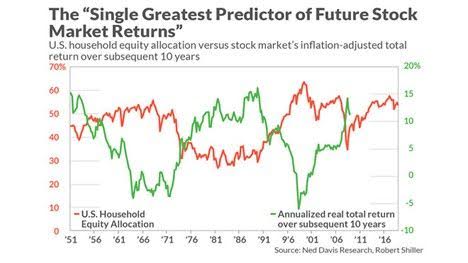

1.Future Stock Investment Returns Tend to be Inversely Correlated to the Popularity of Stock Ownership

Jonathan Baird THE SINGLE GREATEST PREDICTOR OF FUTURE STOCK MARKET RETURNS?Is there a single greatest predictor of stock market returns? No, markets are much too complicated for one calculation to be reliably relied on. However, the chart below draws inferences that are worth consideration.

The obvious conclusion to draw from the chart is that future investment returns tend to be inversely correlated to the popularity of stock ownership. Periods of declining enthusiasm for the ownership of stocks by households, such as the late 1970s-early 80s, create attractively priced markets that subsequently produce strong returns for extended periods. Conversely, times of extreme bullishness for the ownership of stocks by households, such as the late 1920s, late 1960s, and today, have been followed by less than compelling market returns.

https://www.linkedin.com/in/jonathanbaird88/

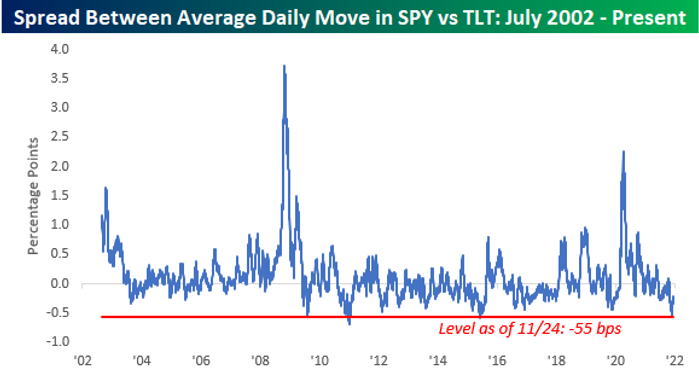

2.Bond Volatility Reaching Extreme Negative Levels.

Marketwatch By Mark DeCambre–No TLC for TLT

It is no secret that Treasurys, similar to stocks these past few weeks, have had a turbulent ride. However, the folks at Bespoke Investment Group make the case that plain-vanilla bonds are experiencing volatility that one would normally associate with equities, not bonds that promise stability due to their steady cash flows.

Gauged by the popular iShares 20+ Year Treasury Bond ETF TLT, 0.63% against the SPDR S&P 500 ETF Trust SPY, -0.44% bond volatility is reaching extreme negative levels. The folks at Bespoke put it this way. “Since 2002, in fact, there have only been three other periods where the spread was at similar or more extreme levels,” referring to a measure of the spread between daily moves for the SPY versus TLT going back to 2002.

“When the readings are positive, it indicates that SPY has been more volatile than TLT, while negative readings indicate that TLT has been more volatile than SPY,” Bespoke writes (see attached chart).

BESPOKE INVESTMENT GROUP

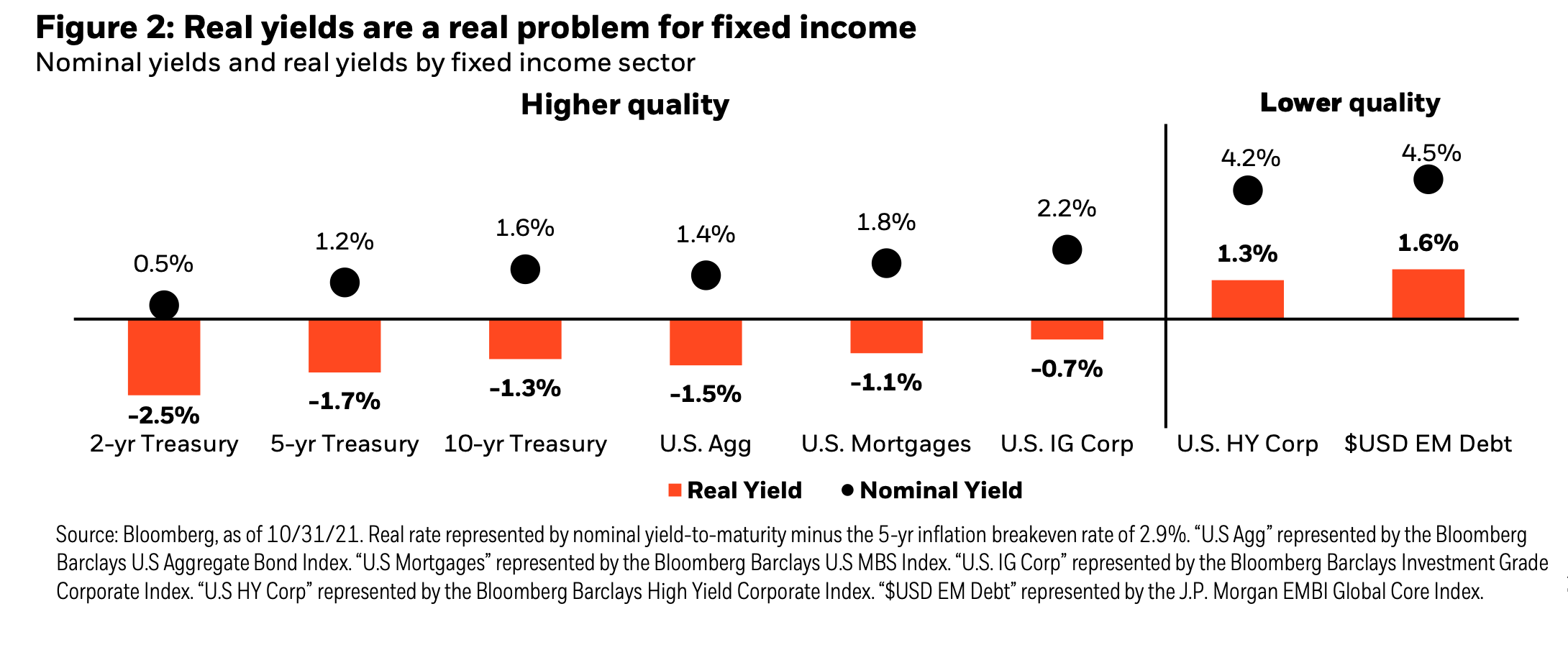

3.Inflation Adjusted (Real) Yields a Real Problem.

Blackrock

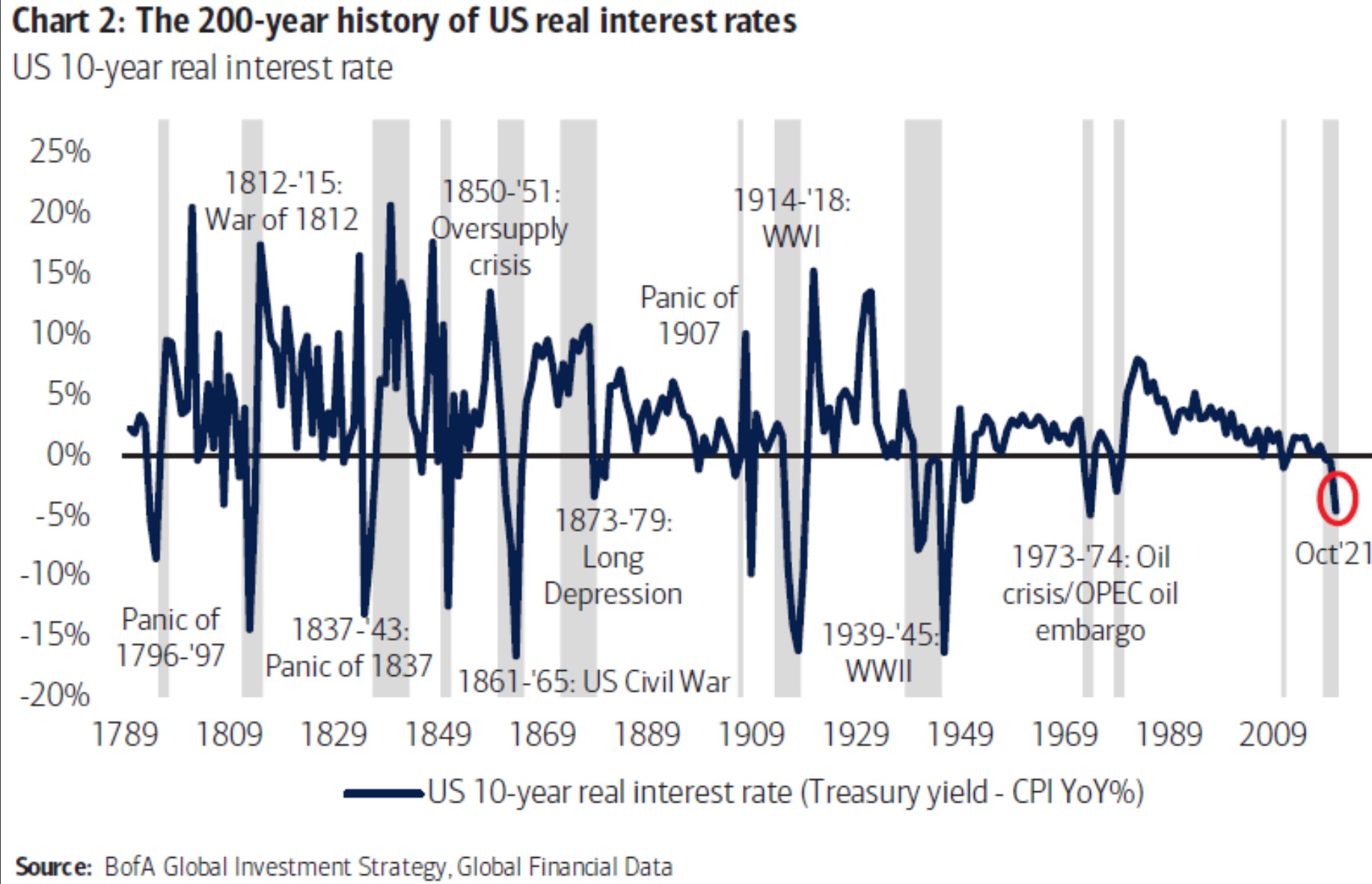

4.200 Year History of Interest Rates Matched with Historical Events

https://twitter.com/tracyalloway

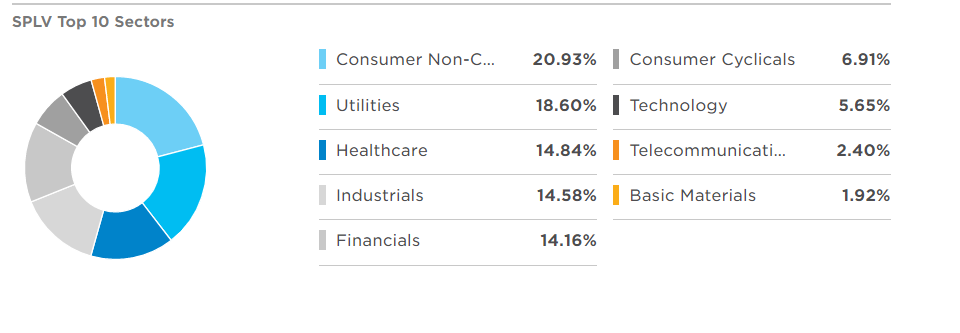

5.SPLC Low Volatility ETF Hits New All-Time High

Low Vol ETF +16% YTD Trailing S&P but hits new highs

Sector Breakdown—5% Technology Stocks

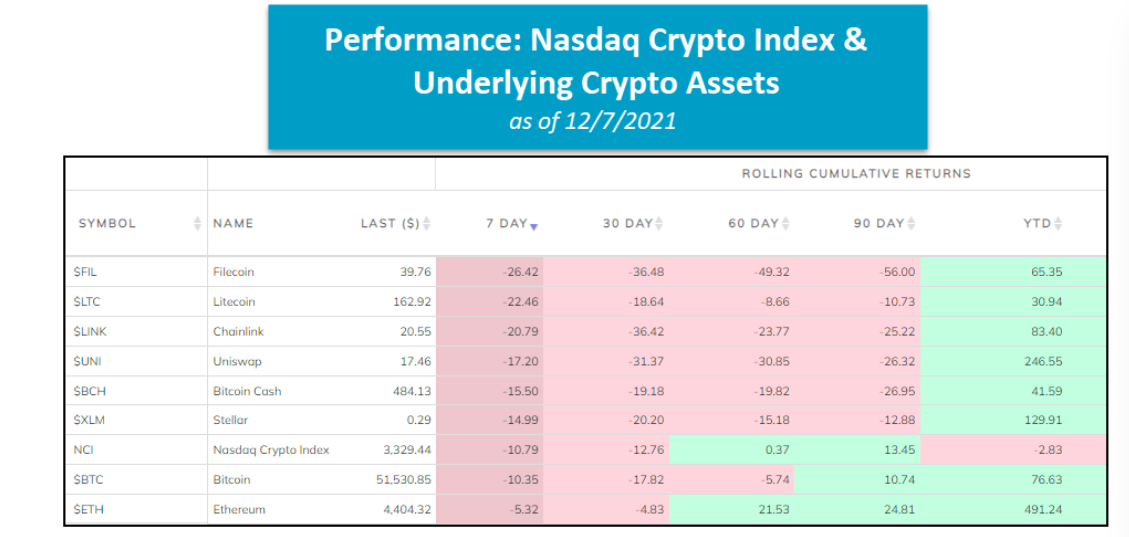

6.Nasdaq Bitcoin Crypto Index Underlying Performance

Nasdaq Dorsey Wright

https://oxlive.dorseywright.com/research/bigwire

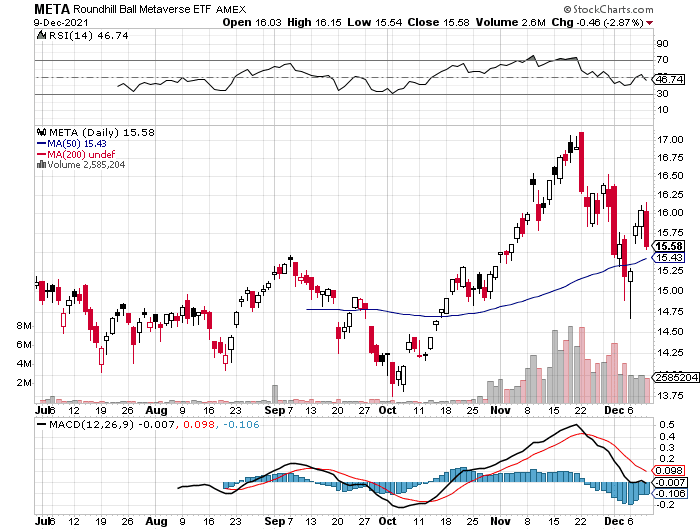

7.Metaverse ETF Closing in on $1B in AUM

Denitsa Tsekova–. Metaverse Race Heats Up in Markets as Latest ETF Unveiled

(Bloomberg) — The rush to capitalize on the virtual-reality boom is intensifying in the world of exchange-traded funds, as First Trust Advisors LP announces the latest offering.

The Indxx Metaverse ETF plans to track tech-powered firms across emerging and developed markets, according to a Tuesday filing with the Securities and Exchange Commission. It will be passively managed.

ETF providers are rushing to stake a claim on what Mark Zuckerberg called “the next frontier” in human communication and interaction when he rebranded Facebook Inc. as Meta Platforms Inc.

New funds tracking the trend are popping up in South Korea and Canada, and analysts estimate the market will reach nearly $800 billion by 2024 — an annual growth of about 13%.

Read more: What the Metaverse Is, Who’s In It and Why It Matters: QuickTake

First Trust is one of the largest sellers of thematic funds, with almost $150 billion in ETFs under management.

“I think it shows lots of validation for the theme when a large issuer jumps on,” said Athanasios Psarofagis, ETF analyst for Bloomberg Intelligence.

The firm follows Roundhill Ball Metaverse ETF, which goes by the ticker META and came to market in June. META drew $664 million of cash in November, the most since its inception, and now manages $866 million, according to data compiled by Bloomberg.

First Trust didn’t disclose the management fee for its new ETF. META charges 0.75%.

https://finance.yahoo.com/news/metaverse-race-heats-markets-latest-145653541.html

Meta Roundhill Meta ETF

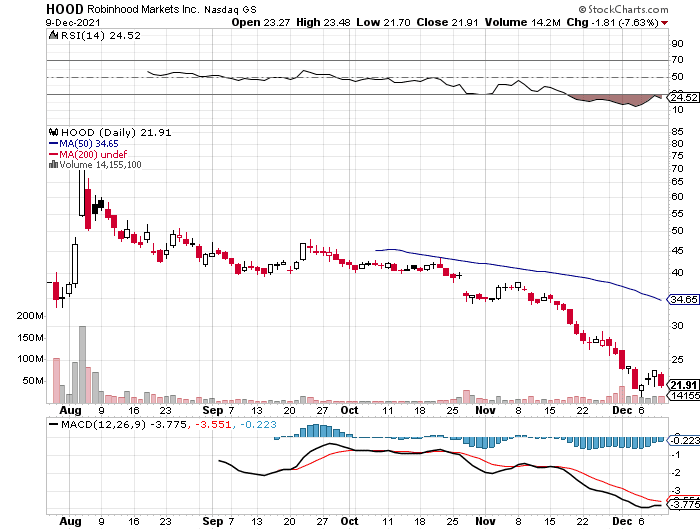

8.Robinhood -70% From Highs.

9.Last Time the S&P had Negative Earnings Yield was 2000

NY Times Dealbook…What Goes Up …

Market watchers see warning signs in the relentless rise of stocks.

By Andrew Ross Sorkin, Jason Karaian, Sarah Kessler, Stephen Gandel, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

Warning signs

U.S. stocks have been on a run, with the S&P 500 up nearly 4 percent so far this week, and more than 25 percent for the year. Fears about the Omicron variant of the coronavirus quickly faded, with stocks regaining all their lost ground. This makes some market watchers nervous.

In a note to clients, Bank of America equity strategists led by Savita Subramanian said that the S&P 500 now has a real earnings yield, the inflation-adjusted ratio of earnings per share to the stock price, approaching negative 3 percent, the lowest since 1947.

A low earnings yield means that corporate profits are not keeping up with stock prices. Since real yields factor in inflation as well as earnings, a negative yield means that a company, based on its stock price, is not earning enough to keep up with inflation. (Using last month’s inflation number, Tesla’s real earnings yield is negative 5.2 percent.)

Negative real earnings yields are rare and often precede a stock market slump. The last time the S&P 500 had a negative real earnings yield, the Bank of America analysts said, was in 2000, before the tech bubble burst. It also happened twice during the stagflation of the 1970s and ’80s. This year, the S&P 500’s real earnings yield turned negative in June, but it really sunk in the past few months as inflation has marched higher.

Besides a bear market, there are two ways a negative earnings yield can turn positive.

- Inflation would have to drop significantly, which some economists think is possible.

- Corporate profits, at a time when wages are rising and supply issues are interfering with plans, would have to accelerate faster than expected.

After the initial shock of the pandemic, stocks have shrugged off negative news and set records. (S&P 500 futures are down modestly this morning.) But the more that analysts consider the numbers, the more they worry that the gravity-defying rise may not last much longer. That said, “we live in a world where real negative rates are almost acceptable as a norm,” Subramanian noted.

https://www.nytimes.com/2021/12/09/business/dealbook/stock-markets-warnings.html

10.A Psychologist Who Helps West Point Cadets Develop Mental Strength Shares 3 of His Best Tips

Nate Zinsser runs the performance psychology department at the military academy.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

Getty Images

Entrepreneurship is legendarily hard on your mental health, but you know what’s even tougher than getting a business off the ground? Fighting a war. Which is why, when founders are in the market for advice on dealing with stress and adversity, they often turn to the armed services for advice.

I’ve rounded up plenty of tips of resilience, endurance, and strategy from the likes of Navy SEALs in the past. But if you’re a fan of this sort of wisdom, a new resource sounds unmissable.

Nate Zinsser runs the performance psychology department at the U.S. Military Academy at West Point. Basically, it’s his job to teach cadets how to weather the worst the battlefield might throw at them. And now he’s sharing his secrets in a new book entitled The Confident Mind: A Battle-Tested Guide to Unshakable Performance.

Bloomberg recently offered a sneak preview of the type of advice on offer (subscription required). If you want to decide whether to pick up a copy, here are a few of the techniques covered in the article — and the book — in brief:

1. Train yourself to relax on cue.

Being able to shut off the chatter in your brain at will so you can actually relax can feel like a mysterious gift some people simply have and some people don’t. But it’s actually a skill you can learn. The Army has long taught soldiers how to sleep on cue, and psychology offers several tips on how to calm your noisy brain and relax even in stressful situations.

Zinsser suggests you teach yourself these simple but powerful techniques and get used to employing them in whatever short windows you have. Even two minutes of deep breathing and relaxation can be useful.

“You essentially rest your brain, with physiological changes in blood pressure, heart rate, oxygen uptake, and blood lactate accumulation,” he explains to Bloomberg.

2. Don’t waste your energy on negativity.

People with addictions are taught the serenity prayer in recovery — “Grant me the serenity to accept the things I cannot change, courage to change the things I can, and wisdom to know the difference” — and apparently West Point cadets are taught something similar in training.

Zinsser stresses that negative emotions like anger and fear sap your energy. To help them conserve their reserves of mental strength, he teaches cadets to recognize when negative emotions are unlikely to do any good, and to avoid moaning or complaining at all costs.

3. Fill up your fuel tank.

Even the toughest warriors can’t summon mental strength (or even physical strength) out of thin air. Zinsser instead teaches them to be mindful of what they need to do to “fill their tanks” and make sure they prioritize doing those things.

“Do the things you need to give yourself success and energy in a suboptimal environment,” he instructs, whether that’s extra sleep or extra time to prepare for a tough assignment. Zinsser stresses that often means saying no to other things (like a fun night out or another task) that would stand in your way of that essential preparation.

Interested in more of Zinsser’s wisdom? Check out the Bloomberg article or the book.

Get Inc.’s top posts straight to your inbox. Sign up here and you’ll receive Today’s Must Reads before each day is done.

DEC 6, 2021

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/jessica-stillman/mental-strength-military-army-west-point.html?cid=sf01003