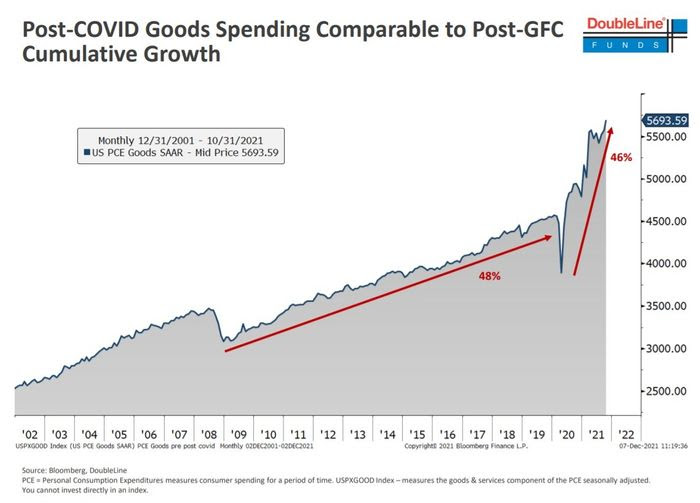

1.Growth in Spending on Goods Since the Pandemic Nearly Equals Growth of Last 12 Years Combined.

This chart from Gundlach shows just how hot the U.S. economy is running

Marketwatch By Steve Goldstein

Just how hot is the U.S. economy? This striking chart from the so-called bond king, DoubleLine CEO Jeffrey Gundlach, shows it’s sizzling.

In a presentation to investors, the manager of the DoubleLine Total Return Bond Fund presented this chart, showing that the growth in spending on goods since the pandemic nearly equals the growth in total spending since the 2008 global financial crisis, up until the coronavirus struck the global economy.

https://www.marketwatch.com/story/this-chart-from-gundlach-shows-just-how-hot-the-u-s-economy-is-running-11638957979?mod=home-page

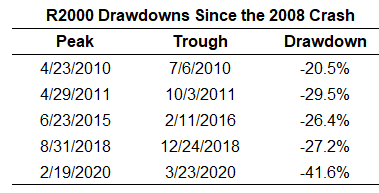

2.Small Cap Stocks Experienced 5 Bear Markets Since 2009

Ben Carlson-The Russell 2000 has experienced 5 bear markets since 2009 The avg loss is nearly 30%

https://twitter.com/awealthofcs

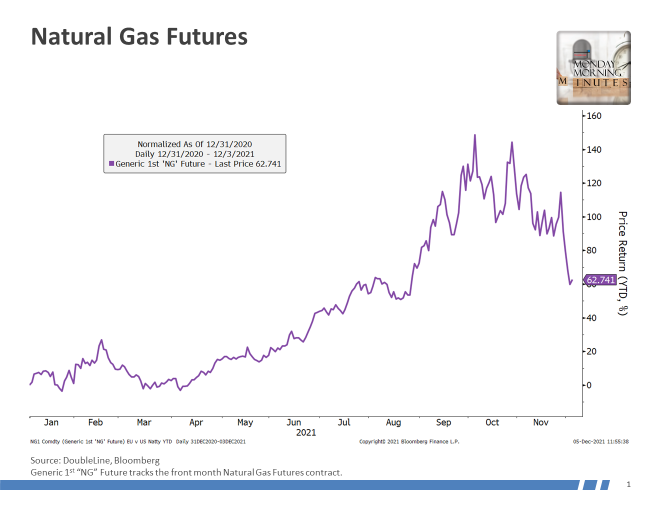

3.Natural Gas Futures Chart ….$140 to $62 on Warm Weather

https://twitter.com/DlinerMinutes

4.Biotech ETF XBI -37% Correction from Highs.

XBI approaching 200day on long-term weekly chart.

5.Rise in Bond Yields-Check out the rise in the 1-, 2- and 3-year bond yields.

Crossing Wall Street Blog

Posted by Eddy Elfenbein on December 8th, 2021 at 3:24 pm https://www.

6.Money Continues to Flow Out of Mutual Funds into ETFs

Ed Yardeni

https://www.linkedin.com/in/edward-yardeni/?miniProfileUrn=urn%3Ali%3Afs_miniProfile%3AACoAAALrHVMBHlwPSSowUQnQXNc-S2CZ5LYInwI

7.The ‘MEME’ ETF Arrives

This story has been edited to reflect holding weightings made before launch.

Roundhill Investments’ latest ETF aims to capture exposure to stocks that have become darlings in the eyes of retail investors, but does so without the animal spirits of early 2021 that drove GameStop and AMC to steep stock prices.

The Roundhill MEME ETF (MEME) debuted on the NYSE Arca Wednesday with an expense ratio of 0.69%.ore from ETF.com

MEME follows a custom index from Solactive that follows stocks with elevated social media mentions and high short interest, including SPACs and ADRs. The index’s selectable universe is set at the end of each month, and reconstitutes and rebalances every two weeks based on social media and shorting activity. Companies with less than $1 billion in market capitalization are disqualified from inclusion.

The most similar fund to MEME that is trading today would be the VanEck Social Sentiment ETF (BUZZ), which uses a similar online sentiment strategy. However, that fund rebalances monthly and carries an additional 6 basis points in fees.

Roundhill CEO Will Hershey said MEME is a middle-ground option for investors who want access to the high-beta world of meme stocks, but without taking on the risk of holding a single stock that may or may not go to the moon.

“It’s a way for people to potentially put on the trade to get access to or to be exposed to one of those pops, if and when they happen again, without having to be right on a single day,” he said.

On debut, the largest holdings in the company are ContextLogic, Digital World Acquisition Corp., Upstart Holdings, DraftKings and SoFi, with weights ranging from 4.39% to 4.21%.

The two equities that brought the concept of meme stocks to mainstream attention are lower on the index. The first major meme stock, GameStop, holds a 3.96% weight, while AMC holds 4.11% weighting.

GameStop reached as high as $347 per share in late January after individual investors on Reddit’s r/wallstreetbets and similar forums bought up shares to squeeze hedge funds that had sold short more of the company’s stock than all of GameStop’s shares outstanding at the time.

AMC had its own moment in the spotlight in early June, jumping almost 400% in a matter of days with a combination of another short-squeeze call and the euphoria of widespread vaccinations against COVID-19 available to the public in the U.S.

While the animal spirits from earlier this year have largely calmed down due to inflation, COVID’s resurgence and a less accommodative Fed, Hershey said there’s still the potential for the crowd to send a new stock soaring.

“If you asked me, I would have told you that GameStop would be back at $30 by now, and I would be wrong,” he said. “So I’ve learned better than to try and predict how or when things will start or stop.”

Contact Dan Mika at dan.mika@etf.com, and follow him on Twitter

https://www.etf.com/sections/

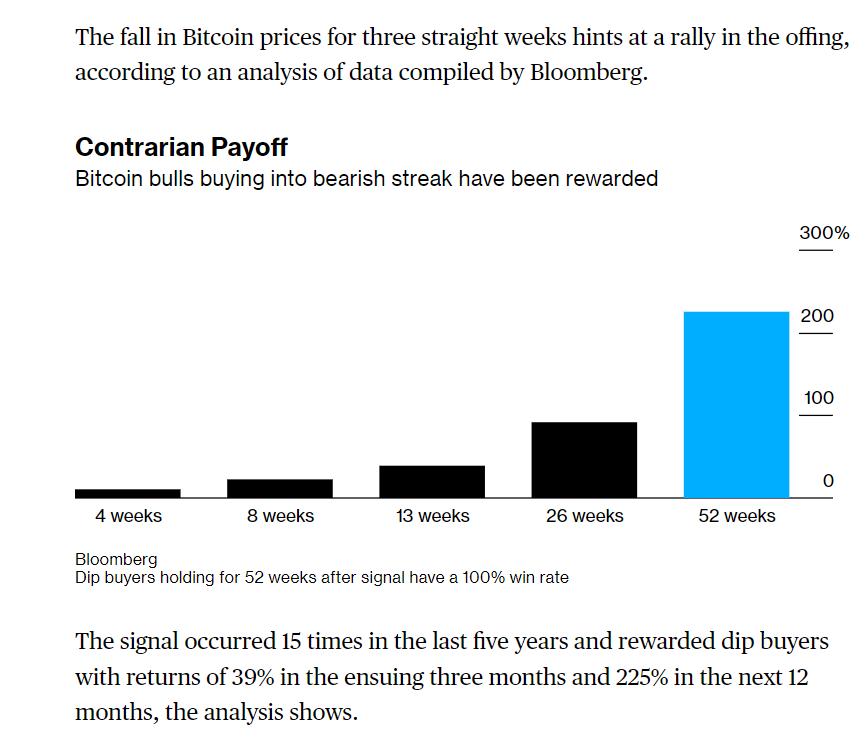

8.History of 3 Straight Weeks Down for Bitcoin

Bitcoin Fluctuates Around $50,000 in Year-End Tug-of-War–By Emily Graffeo

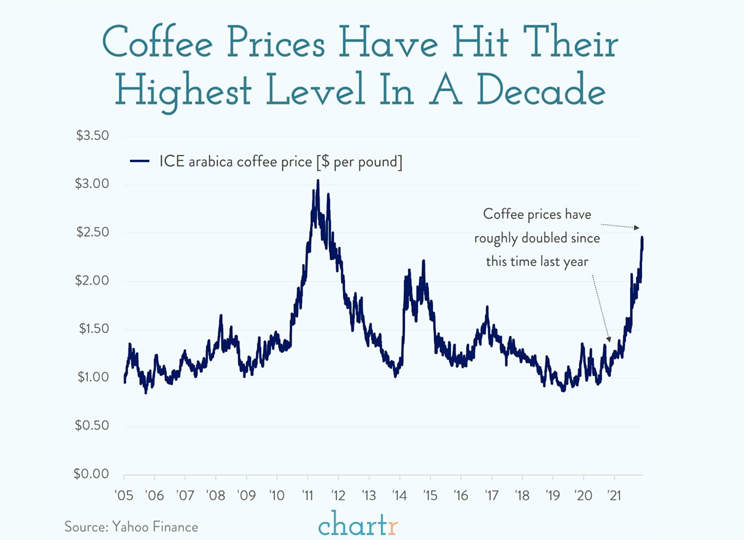

9.Coffee Prices Highest Level in 10 Years

10.Avoid these 5 phrases when asking for a raise—and what to say instead, according to a salary negotiations expert

Published Wed, Dec 8 202111:47 AM ESTUpdated 4 Hours Ago

Fotini Iconomopoulos, Contributor@FOTINIICON

your salary is often an uncomfortable process to navigate. The fear of rejection and disappointment can make it easy to get tongue-tied and use language that might hurt your chances of getting what you want.

All successful negotiations begin with being aware of the words you use. I’ve spent more than a decade coaching Fortune 500 executives and their teams on how to achieve their objectives through effective communication.

When it comes to compensation negotiations, here are the five phrases that set people back the most:

1. ‘More money’

What to say instead: An exact salary range.

Too often, negotiators freeze up when naming their request. They shy away from specifics and make open-ended statements like “I want more money.”

But the best way to get what you want is to say what you want. I’ve seen people hesitate because they’re worried they’ll either aim too high or undersell themselves by aiming too low.

No great negotiator goes in unprepared. Do some digging on your team and in your market to find out what people of your caliber are making. Use that data to determine the lowest amount you’ll accept, and state it clearly in your range.

2. ‘I think I deserve this because…’

What to say instead: “I deserve this because…”

Great negotiators don’t think, they know. They are confident about how much value they bring to the organization, and they aren’t afraid to articulate it.

If you’ve gotten praise from co-workers, managers or other supervisors, bring those emails or performance review notes to the negotiation conversation. Adding outside, objective opinions will make your case even more compelling.

And wherever possible, quantify. Speak about your contributions in specific terms like revenue increases or successful projects you worked on.

3. ‘I was hoping for…’

What to say instead: “Based on how my experience is valued in the market and in this organization, I would expect…”

Using aspirational words like “hope” makes it sound like you were never actually expecting to receive the salary bump you’re asking for. If you’ve prepared appropriately, you know that your number is reasonable, so act like it.

Use the research you’ve done and the value you’ve proven to frame your ask. When you frame your expectation as an objective fact, it’s going to come across as more rational and more difficult to reject.

4. ‘I’m going to have to go to the competition…’

What to say instead: “I’ve received other offers, but I’m more interested in making this position sustainable.”

Threatening to quit is a dangerous game. Your boss may ask you to pack up your things and leave.

Outside job offers can be used as leverage, but they have to be managed carefully. Instead, mention that you’ve been getting calls from the competition, but you’re more interested in making your current position work.

This is a more effective and collaborative way to use your leverage; it keeps the situation positive while adding subtext that they’re going to have to be competitive in order to keep you.

5. ‘Thanks, anyway…’

What to say instead: “When can we pick up this conversation again?”

Not every negotiation will get resolved quickly. Occasionally, you’ll get a no. But that’s not the end of the negotiation — it’s just the start.

If you’re interested in staying at the company, it may just take a little longer to get what you want. The key is to ask questions: If they say “Not now,” ask “When?” If they say “You need some more experience,” ask “What does that experience look like to you?”

Agree on specific milestones so you’re not guessing when you’ll pick up the conversation again. If your boss is avoiding answers, you might want to consider looking for a new job where you’ll be valued.

Above all, remember that you’re having this conversation is because your organization needs you. Arming yourself with that confidence can make all the difference.

Fotini Iconomopoulos advises executives around the world to get better deals and trains their teams to negotiate more effectively. She is also the author of “Say Less, Get More: Unconventional Negotiation Techniques to Get What You Want” and an MBA instructor at York University’s Schulich School of Business.