1. Percentage of Stocks in S&P That Have Printed a New Rally High.

The pie chart below shows the percent of stocks in the S&P 500 that have printed a new rally high since the market bottom on March 23, broken down by month.

2. History of Falling Dollar and Equity Sectors.

A falling U.S. dollar is getting a lot of attention from stock-market investors, and according to the chart below from Wells Fargo Investment Institute, the focus isn’t misplaced.

The chart sums up how the stock market and a variety of sectors have performed during past episodes of dollar weakness stretching back to 1988. As noted previously, the dollar’s long-term correlation with the S&P 500 SPX is somewhat negative, meaning that equities tend to rise as the dollar falls — though there are exceptions.

What stock-market history says about a falling dollar By William Watts

International stocks unlikely to outperform during this bout of dollar weakness, analyst forecasts

3. U.S. Oil Production Saw Biggest Decline Since 1980 in May

Data: EIA; Chart: Axios Visuals

U.S. oil production’s nearly 2 million barrel per day decline in May was the steepest monthly drop since at least 1980, the federal Energy Information Administration said in a short report.

Why it matters: The agency’s monthly production data, which is more robust than weekly snapshots but arrives with a lag, starkly shows the toll the pandemic took on U.S. output after the price collapse caused a major pullback. Some of the lost output has recently returned as prices improved, but production is expected to remain depressed.

4.Power Outages Cost U.S. $150B Annually

A Day Without Power: Outage Costs for Businesses

Asim Hussain, Vice President, Commercial Strategy and Customer Experience, Bloom Energy

Frequent power outages are becoming an unfortunate norm for U.S. businesses. A 2018 survey found that one in four companies experience a power outage at least once a month. These outages are not mild inconveniences – the costs are quickly rising to be board room-level issues.

For large companies, the cost of an outage can escalate into the millions of dollars per hour of downtime. In fact, the DoE recently estimated that outages are costing the U.S. economy $150 billion annually.

As extreme weather events integrate into the nation’s DNA, energy challenges and power supply disruptions are becoming more and more common. Hurricanes, heatwaves, wildfires, and storms are impacting the bottom line for companies across the U.S.

https://www.bloomenergy.com/blog/a-day-without-power-outage-costs-businesses

5. Real Rates vs. Gold…Inverse Relationship

Hedgeye.

CHART OF THE DAY: Get Real Rates Right → Get Gold Right Keith McCullough@keithmccullough

6.Gold and Bitcoin Trading Insync.

Older investors go for #Gold, Younger ones #Bitcoin

JPMorgan says. Strategists say retail-investing jump masks generational split. Older people prefer bonds, millennials snap up tech stocks. https://bloomberg.com/news/articles/

7. Why Housing Could Be One of the Best-Performing Asset Classes of the 2020s

Posted August 3, 2020 by Ben Carlson

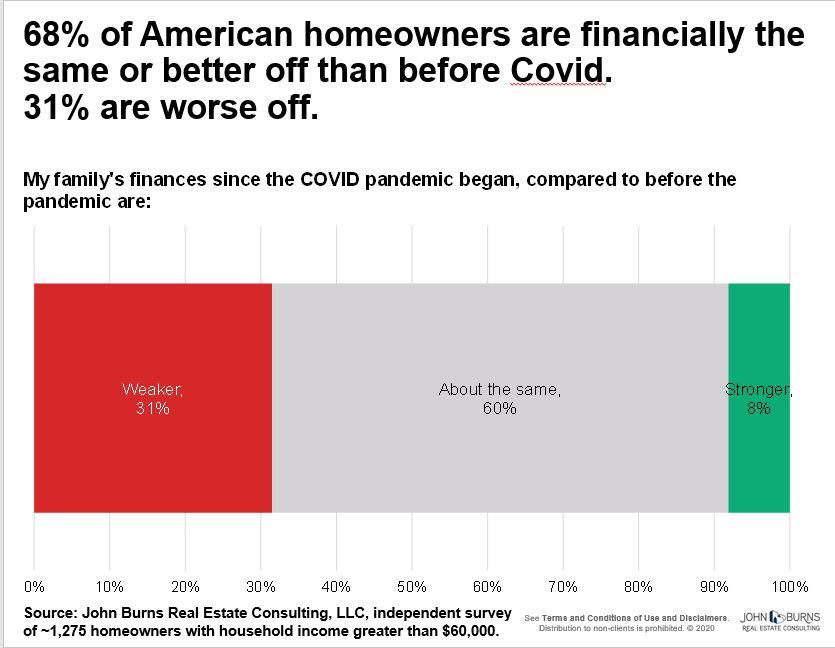

8. 68% of American Homeowners Are Financially the Same or Better During Covid

https://www.linkedin.com/in/johnburns7/

9. Trump executive order to boost U.S. drug manufacturing: Navarro

3 MIN READ

WASHINGTON (Reuters) – U.S. President Donald Trump on Thursday will sign a long-awaited executive order aimed at boosting American production of medicines and medical equipment, and protecting the United States against shortfalls in a future pandemic, a top adviser said.

It will include a “Buy America” provision mandating federal purchases of certain medical supplies and equipment deemed essential, moves to accelerate approval of new U.S. drugs, and steps to boost use of advanced manufacturing techniques, White House adviser Peter Navarro told reporters.

The order had been expected for months as part of a drive by the Trump administration to pull back supply chains from China, but got stalled in a lengthy legal review, Navarro said.

The proposed measure has faced criticism from business groups, which agreed with the goal of reducing reliance on foreign ingredients for medicines but warned against potential backlash from China and other suppliers at a time when more than 1,000 people a day are dying of COVID-19 in the United States.

So far, more than 157,000 people in the United States have died from COVID-19, with 4.8 million known COVID-19 cases.(Open tmsnrt.rs/2WTOZDR in an external browser for a Reuters interactive graphic)

Navarro said it was critical to act now to prevent future crises and ensure sufficient demand so U.S. companies could affordably manufacture pharmaceuticals at home, and end their reliance on key ingredients and supplies from China.

“We are dangerously dependent,” said Navarro. “The United States must protect its citizens, critical infrastructure, military forces and economy against outbreaks of emerging infectious diseases.”

He said the order would also crack down on internet sales of counterfeit medicines, many of which he said came from China.

The Buy America provisions will require the Department of Health and Human Services, the U.S. military and the Veterans Administration to procure only U.S.-made goods to meet certain essential needs, Navarro said.

He said the U.S. Food and Drug Administration would draw up a list of essential medicines, inputs and countermeasures affected by the order.

The order, first reported by USA Today, will also direct the FDA and the Environmental Protection Agency to give priority status to U.S. drug ingredient manufacturers during their regulatory review process.

Trump is scheduled to travel to Ohio to visit a Whirlpool manufacturing plant and hold a fundraiser for his re-election campaign before traveling to his New Jersey golf resort for the weekend, according to the White House.

Reporting by Andrea Shalal and Susan Heavey; editing by Jonathan Oatis

Our Standards:The Thomson Reuters Trust Principles.

MORE FROM REUTERS

3 MIN READ

·

·

WASHINGTON (Reuters) – U.S. President Donald Trump on Thursday will sign a long-awaited executive order aimed at boosting American production of medicines and medical equipment, and protecting the United States against shortfalls in a future pandemic, a top adviser said.

It will include a “Buy America” provision mandating federal purchases of certain medical supplies and equipment deemed essential, moves to accelerate approval of new U.S. drugs, and steps to boost use of advanced manufacturing techniques, White House adviser Peter Navarro told reporters.

The order had been expected for months as part of a drive by the Trump administration to pull back supply chains from China, but got stalled in a lengthy legal review, Navarro said.

The proposed measure has faced criticism from business groups, which agreed with the goal of reducing reliance on foreign ingredients for medicines but warned against potential backlash from China and other suppliers at a time when more than 1,000 people a day are dying of COVID-19 in the United States.

So far, more than 157,000 people in the United States have died from COVID-19, with 4.8 million known COVID-19 cases.(Open tmsnrt.rs/2WTOZDR in an external browser for a Reuters interactive graphic)

Navarro said it was critical to act now to prevent future crises and ensure sufficient demand so U.S. companies could affordably manufacture pharmaceuticals at home, and end their reliance on key ingredients and supplies from China.

“We are dangerously dependent,” said Navarro. “The United States must protect its citizens, critical infrastructure, military forces and economy against outbreaks of emerging infectious diseases.”

He said the order would also crack down on internet sales of counterfeit medicines, many of which he said came from China.

The Buy America provisions will require the Department of Health and Human Services, the U.S. military and the Veterans Administration to procure only U.S.-made goods to meet certain essential needs, Navarro said.

He said the U.S. Food and Drug Administration would draw up a list of essential medicines, inputs and countermeasures affected by the order.

The order, first reported by USA Today, will also direct the FDA and the Environmental Protection Agency to give priority status to U.S. drug ingredient manufacturers during their regulatory review process.

Trump is scheduled to travel to Ohio to visit a Whirlpool manufacturing plant and hold a fundraiser for his re-election campaign before traveling to his New Jersey golf resort for the weekend, according to the White House.

Reporting by Andrea Shalal and Susan Heavey; editing by Jonathan Oatis

Our Standards:The Thomson Reuters Trust Principles.

MORE FROM REUTERS

10. TOP 5 BUSINESS MAXIMS THAT NEED TO GO

AUGUST 2, 2006 ALEXANDER 109 COMMENTS

It ain’t what you don’t know that gets you into trouble.

It’s what you know for sure that just ain’t so.

– Josh Billings (or Mark Twain or Artemus Ward or…)

Much well-known business advice is sadly obsolete but can still be found in articles, business books and, not least, in daily use in the workplace. It seems that some companies are still guided by thinking that is sadly out of date – if it was ever true to begin with.

The worst of these old maxims are not only wrong, they’re bad for people and bad for business. Businesses who use them are making their employees unhappy and are harming the bottom line.

Here’s my pick of the top 5 business maxims in serious need of an update – with a suggested replacement for each.

UPDATE: Now there’s also a Part II post with 5 more horrendous pieces of business advice.

Old maxim #1: Failure is not an option

Meaning: We absolutely, positively must succeed.

Guess what: No matter how many times you repeat this maxim, failure remains an option. Closing your eyes to this fact only makes you more likely to fail. Putting pressure on people to always succeed makes mistakes more likely because:

· People who work under pressure are less effective

· People resist reporting bad news

· People close their eyes to signs of trouble

This is especially true when it’s backed up with punishment of those who make mistakes. Peter Drucker provocatively suggested that businesses should find all the employees who never make mistakes and fire them, because employees who never make mistakes never do anything interesting. Admitting that mistakes happen and dealing constructively with them when they do makes mistakes less likely.

Also, failure is often the path to new, exciting opportunities that wouldn’t have appeared otherwise. Closing your eyes to failure means closing your eyes to these opportunities.

New maxim: Failure happens. Deal with it.

Old maxim #2: The customer is always right

Meaning: The customer is king. We satisfy our customers’ every need.

No. No, no, no. This tired business maxim often means that loyal hardworking employees are scorned in favor of unreasonable customers. It also, ironically, results in bad customer service.

I recently wrote a post outlining 5 reasons “The Customer Is Always Right” is wrong, concluding that sticking to “The customer is always right” makes employees unhappy and that unhappy employees almost always give customers bad service.

New maxim: Happy employees means happy customers.

Old maxim #3: Never be satisfied

Meaning: You can never be satisified and complacent in business. You’ve always gotta want more.

This is a bad mistake which rests on a very fundamental misconception, namely that being satisfied means that you stop acting. That satisfaction breeds complacency and therefore that a happy, satisifed company will be passive. Nothing could be further from the truth. In fact, a constant sense of dissatifaction in an organization sends one powerful message: We’re not good enough! The irony is that this results in worse performance.

People who constantly appreciate all the good in their organization and express their satisifaction create a much more positive working environment characterized by more:

· Motivation

· Energy

· Self-confidence

· Happiness at work

This is not about closing your eyes and pretending things are great if they’re not. It’s about appreciating the fact that people in constant states of dissatisfaction erode an organization’s will and ability to act. The trick is to appreciate what you have and still aim for more.

Replacement: Always be appreciative but never complacent.

UPDATE: “but never complacent” added thanks to Colin G.’s excellent suggestion.

Old maxim #4: Nice guys finish last

Meaning: We can’t be too nice in business. In fact, being nice may hinder your career and impede results.

That’s just not true, of course we should be nice at work. This doesn’t mean that you have to be nice to all of the people all of the time, but it means that you absolutely can be a nice person and succeed in business. I previously wrote about jerks at work and why they’re bad for business. The conclusion: Unpleasant people hurt the bottom line. In a networked world reputation matters, and it’s more important to be generous and likeable than to be ruthless and efficient.

New maxim: Nice guys get the job done.

Old maxim #5: Grow or die

Meaning: A business is either growing or dying. A business can’t be successful if it’s not growing.

It’s interesting to see how growth has been elevated to an automatic good, questioned by very few businesses and executives. Growth certainly has some positive effects especially because it creates new possibilities and challenges for an organization and its people. I’m not saying that growth is bad but that growth isn’t always right for every business. Sometimes a business might be better off spending a quarter or a year not growing but simply consolidating existing business. Consequently not growing or even shrinking does not automatically represent business failure.

That’s what Semco’s CEO Ricard Semler meant when he said this:

There is no correlation between growth and ultimate success. For a while growth seems very glamorous, but the sustainability of growth is so delicate that many of the mid-sized companies which just stayed where they were doing the same thing are much better off today than the ones that went crazy and came back to nothing. There are too many automobile plants, too many airplanes. Who is viable in the airline business?

If someone asks me, ‘where will you be in 10 years’ time?’, I haven’t got the slightest idea. I don’t find it perturbing either if we said, ‘look, in 10 years’ time Semco could have 500 people instead of 3,000 people’; that sounds just as interesting as 21,000 people. I’d hate to see Semco not exist in 10, 20, 50 years’ time, but what form it exists in, what business it’s in and what size it is are not particularly relevant.

Growing also entails its own risks, especially fast growth on borrowed money. This almost killed Patagonia in the early 90’s. Founder Yvon Chouinard says this:

It was back in 1990 or so and we were growing the company by 40 to 50 percent a year and we were doing it by all the textbook business ways — adding more dealers, adding more products, building stores. Growing it like the American dream, you know — grow, grow, grow. And one year we predicted 40 to 50 percent growth and there was a recession and all the sudden we only grew 20 percent. And at the same time, our bank was going belly-up and we had cash-flow problems and it went to absolute hell. And I had been the person who had never bought anything on credit in all my life. I always paid cash for everything, and to have to call someone and say, “I’m sorry, I can’t pay my bills this month,” was killing me. And I realized that I was on the same track as society was — endless growth for the sake of growth.

That’s when I decided to put the brakes on and decided to grow at a more natural rate — which basically means that only when our customers want something do we make more, but we don’t prime the pump.

New maxim: Grow when you gotta.

Wrap-up

The scary thing about maxims is that they’re often accepted unquestioningly because they come in the shape of old addages which are repeated – a little like nursery rhymes used to educate children. That means it’s not enough to oust the old maxims we need to replace them with new ones that are guaranteed to bring better results for people and for the bottom line.

Here they are at a glance, the tired maxims and the suggested replacements:

| Tired old maxim | New maxim |

| Failure is not an option | Failure happens – deal with it |

| The customer is always right | Happy employees means happy customers |

| Never be satisfied | Always be appreciative but never complacent |

| Nice guys finish last | Nice guys get results |

| Grow or die | Grow when you gotta |

I’m working on another post called, in a fit of almost supernatural creativity, five more business maxims that need to go. Do you know any that belong on the list? Tell me about it in the comments.

If you liked this post, I think you’ll also enjoy these:

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.