1. Internet Bubble QQQ +2400% 1990-2000….Today 201-2020 +900%

From Nasdaq Dorsey Wright

From a fundamental valuation perspective, the NDX of today also looks quite different than the NDX of 2000. The index currently has a price-to-earnings (PE) ratio of 32.74, which is the highest level it has reached since the GFC and significantly higher than the S&P 500’s SPX PE of 22.99 (Source: FactSet). At the end of 1999, however, NDX had a PE ratio slightly north of 73, or more than twice its current level! It is also worth noting that the S&P’s PE ratio at that time was above 30, a level it has not breached since 2000.

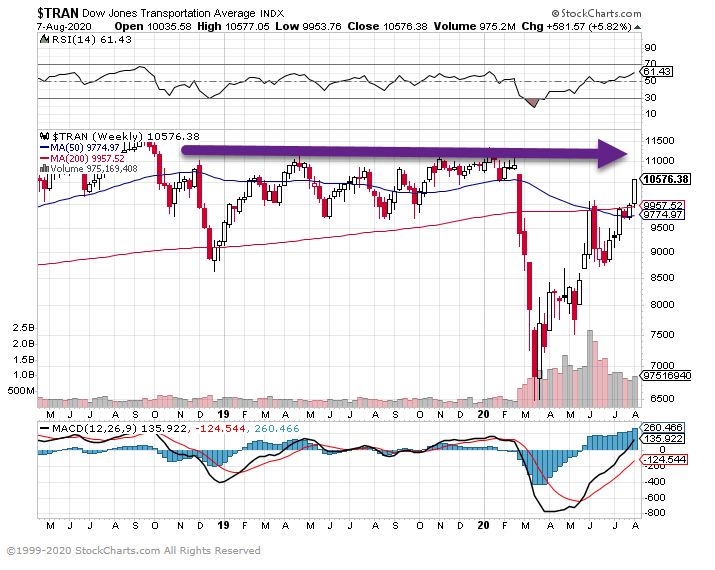

2. Dow Transports Catching up…Making Run at Previous Highs

Transports lagged rally but catching up…Need both Dow Industrials and Dow Transports to make new highs.

Dow Industrials 50 day going thru 200 day to upside

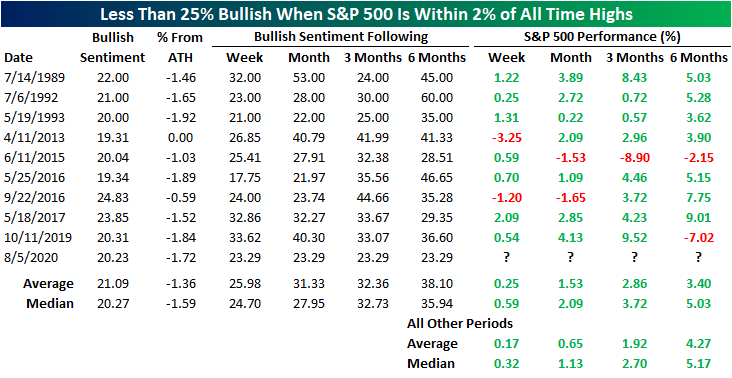

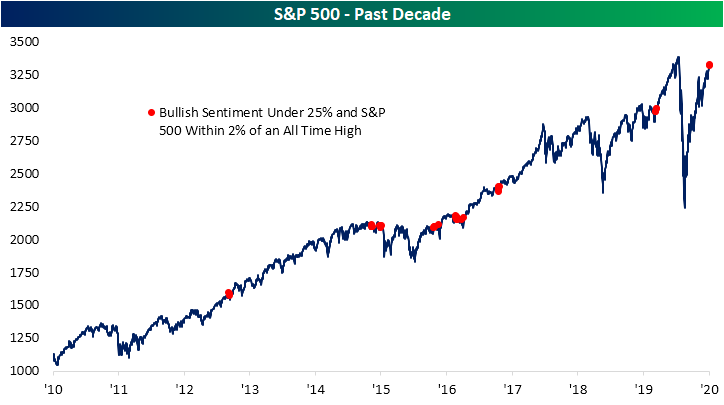

3. S&P Within 2% of All-Time Highs….And Bullish Sentiment Only 25%

Individual Investors Still Don’t Believe As mentioned in a prior post, in the past week the S&P 500 has moved within 2% of its 2/19 high, but at the same time, less than a quarter of AAII respondents are optimistic for the future of stocks over the next six months. That begs the question- if there have been past times that sentiment and price action have been so detached from one another. Since the start of the AAIIsurvey in 1987, there have been 10 periods (including the current one) in which the S&P 500 was within 2% of an all-time high but bullish sentiment was less than 25% without another occurrence in the prior three months. The most recent prior occurrence was not even a full year ago. Back in October, sentiment was only slightly higher as the S&P 500 was 1.84% from its all-time high. Prior to that, there were some scattered instances throughout 2013, 2015, and 2016 but before that, you would have to go back to 1993 to find another similar period. The one occurrence in 2013 stands out as it was both the lowest sentiment reading of these prior occurrences and the only one that occurred with the S&P 500 right at an all-time high.

As for where things stand after such instances, sentiment has tended to reverse higher in the following six months as the S&P 500 has tended to move higher. The S&P 500 has actually tended towards better than average returns over the next three months, although performance six months out has been modestly worse than average, even as it has been higher more often than not. Additionally, as shown in the second chart below, of the more recent occurrences of the past decade, they haven’t marked any major top or bottom for the S&P 500 with occurrences clustered both coming off of lows and in the middle of longer-term uptrends. Click here to view Bespoke’s premium membership options for our best research available.

4. Another Trend Being Pulled Forward by Covid….Robotics

ROBO 1yr chart up double the S&P…Hits new highs.

5. Saudi Aramco profit drops 50% for first half of the year as pandemic batters oil price

KEY POINTS

· Saudi Aramco’s net income plunged to $23.2 billion in the first six months of the year, down by half from $46.9 billion over the same period in 2019.

· Saudi Arabia’s majority state-owned oil company and the world’s largest crude producer also maintained its second-quarter dividend of $18.75 billion, saying it will be paid in the third quarter.

· The financial results for the second quarter reflect the biggest shock to global energy markets in decades.

6. AI-Powered Hedge Funds Vastly Outperformed, Research Shows

Hedge funds using artificial intelligence returned almost triple the global industry average, Cerulli found.

Hedge funds with artificial intelligence capabilities showed a huge competitive edge over investors that didn’t use AI, new research indicates.

AI-led hedge funds produced cumulative returns of 34 percent in the three years through May, a report Tuesday from consulting and research firm Cerulli shows. That compares with a 12 percent gain for the global hedge fund industry over the same period.

“There has long been suspicion of the ability of AI to react to unexpected events, such as the coronavirus pandemic,” said Justina Deveikyte, associate director of European institutional research at Cerulli, in a statement Tuesday. “But there is now a sense that the technology has advanced to the point where it is better able to adapt to unforeseen scenarios via the ever-growing amount of market data available.”

Machine-learning algorithms in finance tend to recognize patterns in historical data, making it tough to adapt to economic lockdowns caused by a one-in-a-century pandemic, according to the report. Still, factors used in machine learning draw from sources such as newspaper stories to collect information daily, spotting trends for investors amid the Covid-19 turmoil, according to Cerulli.

AI-powered funds in Europe saw “strong growth” in assets from 2016 to 2019. Net new inflows dropped in the first four months of this year as the pandemic shook markets, but the research firm found signs that they fared better than the broader universe of managers. European active equity funds led by AI saw a “less pronounced decline” in market appreciation in March.

Quantitative and discretionary managers may use artificial intelligence to extract information on, for example, retail foot traffic, satellite data, and pandemic spread, according to the report. They may also analyze massive volumes of text through natural language processing to gauge sentiment tied to the economy such as employment and business activity.

“Investors that understand how sentiment steers choice and judgment can better gauge how a specific news item will affect markets in terms of both direction and intensity,” Cerulli said in the report

As part of the research, Cerulli consulted firms including RAM Active Investments, PanAgora Asset Management, and NN Investment Partners. PanAgora’s director of equity investments Mike Chen told Cerulli that constructing machine-learning factors is a “balancing act” as fund managers don’t want them to react to quickly to “noise in the market information” — or so slowly that they miss a trend, according to the report.

[II Deep Dive: The Tech Tool One Asset Manager Is Using to Ferret Out Dishonesty]

NN uses behavioral science, AI, and sentiment data —along with fundamental research — to try and anticipate market movements, Cerulli said. RAM fund manager Emmanuel Hauptmann emphasized that “machine learning still relies on a huge amount of data to be efficiently trained.”

The MarketPsych Indice from Thomson Reuters is one way that investors extract macroeconomic information from social and news media, according to the report.

“Even though most machine-learning algorithms are open source, it is possible to keep a technological edge thanks to fine-tuning of hyperparameters for specific tasks and agile management of machine-learning pipelines to continuously incorporate technological improvement,” Nicolas Jamet, a senior quantitative analyst at RAM said in the report.

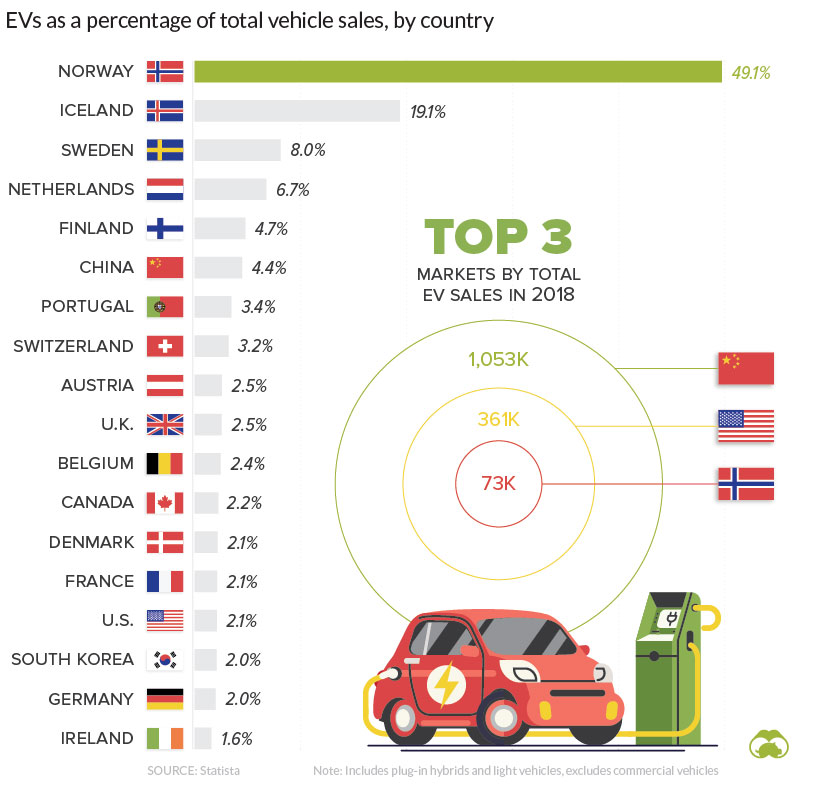

7. With Tesla Stealing the Rally Show….Electric Cars Still Less Than 2% of Global Car Market.

Visualizing EV Sales Around the WorldBy Nick Routley

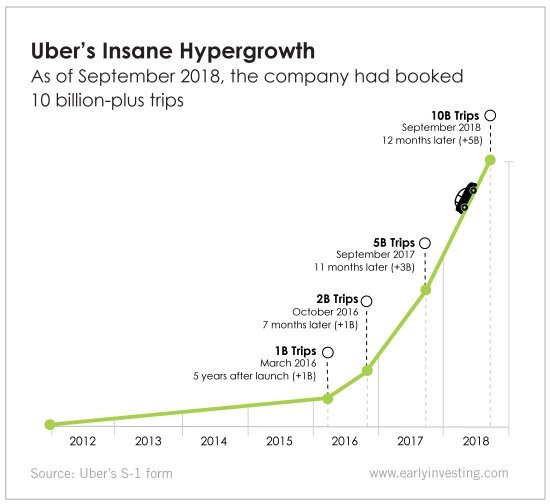

8. Uber Hyper-Growth ….Followed by -75% Bookings in Covid.

Uber’s Got Hypergrowth and Growing Pains

Source: Second Measure

9. Coronavirus surprise: Remittances to Mexico rise during pandemic

A man leaves a bank where customers receive international money wires in Acatlán de Osorio, Mexico. (Fernando Llano/AP)

By

August 6, 2020 at 11:47 a.m. EDT

MEXICO CITY — It was an intuitive prediction, supported by virtually every expert who had studied the subject: As the coronavirus pandemic caused the global economy to tumble, remittances to Mexico and Central America would crash.

It turns out the forecast was wrong.

Instead of collapsing, remittances to Mexico were up year-over-year in five of the first six months of 2020. In June, payments to El Salvador, Guatemala, Nicaragua and Honduras also increased compared with the same period in 2019, after a dip earlier this year.

In March, the month the World Health Organization declared a pandemic, remittances to Mexico topped $4 billion — a record.

“I remember thinking, ‘Oh, my God, what happened here?’ ” said Jonathan Heath, deputy governor of Mexico’s central bank. “It’s the exact opposite of what we were expecting.”

For years, the logic behind remittances — the payments that migrant workers send back home — was straightforward. As more people migrate and as economies in the developed world grow, remittances increase. During economic contractions, when immigrants are disproportionately vulnerable, remittances fall. So when the World Bank predicted in April that the pandemic would cause their “sharpest decline in recent history,” it seemed reasonable.

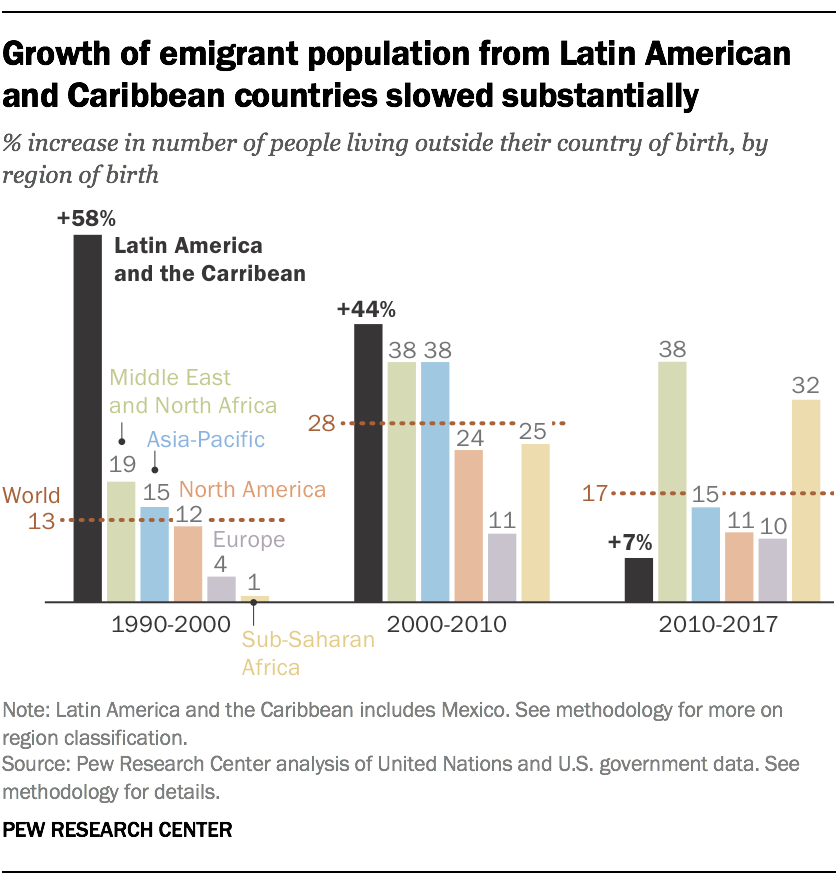

Latin America No Longer Dominant Emigrant Population

The Latin America and Caribbean region was the world’s fastest-growing source of international migrants from 1990 through 2010. However, growth in the number of emigrants from this region has slowed dramatically in recent years – due in large part to a slowdown of people leaving Mexico, according to a Pew Research Center analysis of government data.

10. Players Vs. Pretenders.

By The John Maxwell Company | August 16, 2012 | 2

The year was 1972 and fans packed Munich’s Olympic Stadium to witness the completion of the men’s marathon. By the time the race’s competitors reached the stadium, they would already have run 26 miles! Spectators waited in anticipation to see which contestant would arrive first and to cheer him to the finish line.

A roar from the crowd greeted the first runner to enter the stadium—German Norbert Sudhaus. Fans shouted encouragement and applauded wildly as he began the final, grueling lap of the race. However, cheers turned to gasps as, halfway around the track, Sudhaus was tackled by security guards. As it turns out, Norbert Sudhaus was an imposter. Wearing a blue track vest and yellow running shorts, he had snuck onto the race’s course just outside of Olympic Stadium and had tricked the crowd into thinking he was an actual contestant.

Moments later, when the real leader of the marathon (American Frank Shorter) ran into the stadium, he was dismayed to hear catcalls from the crowd. Shorter thought the boos were directed at him, oblivious that the spectators were still expressing outrage at Sudhaus’ hoax. Shorter would go on to win the marathon, and he remains the last American man to have won an Olympic gold medal in the event.

Players Versus Pretenders

If you’ve ever led people, then you’ve come across followers like Norbert Sudhaus, who would rather act the part than to put in the effort needed to become a champion. These people are pretenders, and while they can sometimes masquerade as players, a keen observer can tell the two apart. For a leader, it’s important to identify the pretenders within an organization before they disrupt the team’s momentum and damage its relationships.

Pretenders look the part and talk the part, but they fall short of fulfilling the part. Here are some of the ways to distinguish between who’s a real team player and who’s merely posturing for self-advancement.

1. Players have a servant’s mindset; pretenders have a selfish mindset.

Players do things for the benefit of others and the organization, while pretenders think only of benefitting themselves. A pretender is singly focused on outcomes that are in his or her best interest.

2. Players are mission-conscious; pretenders are position-conscious.

Players will give up a position to achieve a mission. Pretenders will give up a mission to achieve a position. For players, the progress of the mission is much more important than their own place within it, but a pretender will value his or her position more highly than just about anything else.

3. Players deliver the goods; pretenders only make promises.

A player is a team member who can be counted on to finish a task every time. The pretender will claim the ability to do so; but in the end, he or she does not consistently execute.

4. Players are job-happy; pretenders are job-hunters

Players love what they do and do it well. For them, work is fulfilling and meaningful, and they are devoted to carrying out their responsibilities with excellence. On the other hand, pretenders always see greener grass elsewhere. Since they’re constantly on the lookout to better their situation, they have no loyalty and will break commitments whenever doing so helps them to get ahead.

5. Players love to see others succeed; pretenders are only interested in their own success.

Rabbi Harold Kushner had a player’s mindset when he said, “The purpose of life is not to win. The purpose of life is to grow and to share. When you come to look back on all that you have done in life, you will get more satisfaction from the pleasure you have brought into other people’s lives than you will from the times that you outdid and defeated them.”

I think we all start out as competitors, but the goal is to grow past that mindset. In my adult life, I have evolved from competitor, to personal achiever, to team player, and on to team-builder. A player is happy when another member of the team succeeds because it benefits all. The pretender sees success as a win-lose proposition, and resents it when another person “wins.”

6. Players value integrity; pretenders value image.

In navigation, the rule is that what’s under the surface should be heavier than what is above the surface. Otherwise, the ship will capsize in a storm. Integrity is similar; what’s under the surface must be greater than what is in plain sight. A player can be counted on to do the right thing, even if nobody is looking.

Contrarily, pretenders do the right thing only when being watched, and they do whatever is expedient otherwise. Furthermore, since they focus on appearance rather than character, pretenders won’t admit fault when mistakes are made. They blame others for all of their problems instead of taking personal ownership of them.

7. Players make the hard choices; pretenders make the easy choices.

With a hard choice, the price is paid on the front end; the payoff only comes later. Such choices almost always include risk, and they usually involve the sacrifice of placing the organization above oneself too. Peter Drucker once said, “Whenever you see a successful business, someone once made a courageous decision.” Players aren’t afraid to make those decisions.

8. Players finish well; pretenders fade out.

Some people start as players, but at some point they turn into pretenders. Why? I believe it’s because they overestimate the event and underestimate the process. They make the choice to begin, but they get tired of the work it takes to continue. Or they begin and proceed until they are confronted with the need to change. Unwilling to adjust, they begin pretending in order to get by. On the other hand, a player takes all tasks to completion.

Application:

Do you have a better idea of who the players and pretenders are within your team or organization? Remember that players will always ADD to the team’s efforts. But pretenders, at least in the long run, will COST the team. Knowing the difference between the two means that you’ll count on the right person to get the job done.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.