1. Easy to Buy and Hold? Amazon Average Intra-Year Decline 33%

Irrelevant Investor–The average intrayear decline for Amazon is 33%. Even if you take away the dot-com bubble, so after 2001, the average decline is 26.5%. Investors were rewarded for this risk, but each of these drawdowns was enough to test their endurance.

10 Reasons Why Stocks Fall Posted August 4, 2021 by Michael Batnick https://theirrelevantinvestor.com/2021/08/04/10-reasons-why-stocks-fall/

2. China Small Cap Surviving.

China small cap down -18% vs. China Tech -55%

3. Ether Jumps as Bitcoin Alternative Stages Its Own Supply Rally

Bloomberg Vildana Hajric

Wed, August 4, 2021, 3:38 PM

(Bloomberg) — The digital currency Ether climbed to its highest level in nearly two months during the midst of a software upgrade that will trim the pace at which fresh tokens are minted.

The second-biggest cryptocurrency after Bitcoin rose as much as 10% on Wednesday to trade around $2,726, marking its highest point since early June. Bitcoin increased as much as 4.7% to $39,845.

In some ways, the optimism about the upgrade, known as London, resembles the hoopla surrounding past reductions in the block rewards for Bitcoin miners. While so-called halvings were planned events, Bitcoin typically rallied in anticipation that demand would either remain steady or increase while the pace of issuance slowed.

https://finance.yahoo.com/news/ether-jumps-bitcoin-alternative-stages-193845198.html

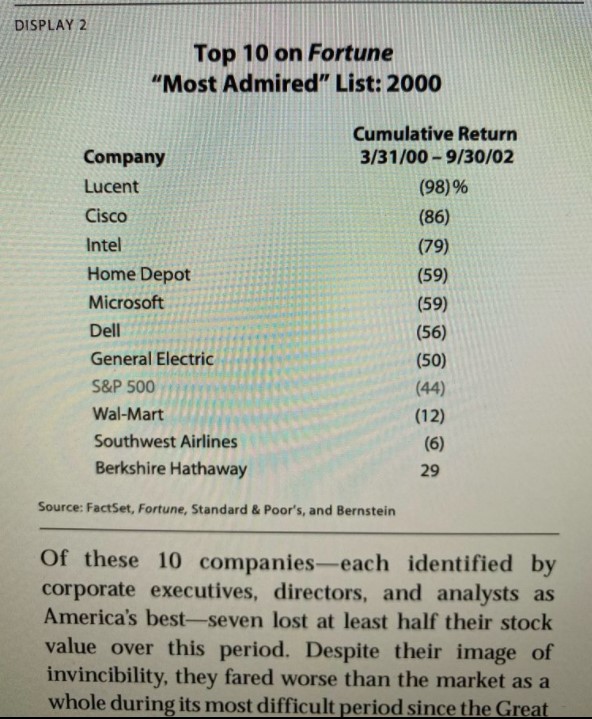

4. Top 10 Most Admired Companies in 2000. How were returns?

Daniel Crosby Orion https://www.linkedin.com/in/danielcrosby/

5. Robinhood Chief Legal Officer. $30m Compensation?

Scott Galloway No Mercy No Malice -Once, that type of disclosure would have dismembered an IPO. Instead, 48 hours after it made the disclosure, Robinhood was publicly trading at $32 billion. Telling point: The company paid its chief legal officer, Daniel Gallagher, more than $30 million in 2020, even though it hired him halfway through the year. From 2011 to 2015, Gallagher was an SEC Commissioner. Our business environment has morphed from capitalism, which depends on the rules of fair play, into cronyism.

https://www.profgalloway.com/hood/

6. Apartment Occupancy Hits 96.5%. No Houses and No Apartment Units Available.

Liz Ann Sonders Schwab

Data, apartment rents surged 14.6% y/y in June, most on record; occupancy reached 96.5%, matching prior high in 2000

7. Mortgage Debt Almost 70% of All Household Debt.

Ben Carlson A Wealth of Common Sense The Most Underappreciated Force in the Economy Right Now. Why low mortgage rates will be felt for years to come.

https://awealthofcommonsense.com/

8. Conservative/Liberal Culture Wars are Global

The Daily Shot Food for Thought: Countries with the highest tensions between liberals and conservatives:

https://dailyshotbrief.com/the-daily-shot-brief-august-2nd-2021/

9. 5 Reasons to Say Goodbye to the Office for Good

Here’s why a full transition to remote work could work for your company.

BY YOUNG ENTREPRENEUR COUNCIL@YEC

Credit: Getty Images

By Beth Doane, an award-winning writer, speaker and entrepreneur and CEO of Main & Rose.

WeWork CEO Sandeep Mathrani set off a firestorm of controversy this year with a statement that I think is as wrong as it was insulting to workers. When asked about his company’s return to the office policy, he equated a preference for virtual or remote work to laziness: “Those who are uberly engaged with the company want to go to the office…those who are least engaged are very comfortable working from home.”

Although it might be news to Mathrani, remote work is the future — not just for the duration of the pandemic, but for a generation to come. Studies show that by 2025, approximately 70 percent of the workforce, across industries, will be working remotely at least five days a month. In total, the percentage of those who will permanently work from home is expected to double this year, with the vast majority of remote workers preferring to maintain this situation. Another study shows nearly three-quarters of workers prefer to work fully remotely, with another 33 percent wanting to work from home several days a week.

Leading the way on remote work is Big Tech. Both Twitter and Square have encouraged workers to continue working remotely for as long as they wish, with Facebook adopting a similar policy. Twitter in particular has been exploring remote work for years, calling flexibility for workers the “Fourth Industrial Revolution” because it will fundamentally change industries and how people work.

At my firm, we have seen a huge influx of applications, as more and more people wish to work remotely. The simple truth is that just because companies used to operate one way, it doesn’t mean we have to operate that way moving forward. Remote work will be the primary disruption to come from the pandemic for most industries.

Based on my firm’s years of experience working with top clients while remote, here are the top five reasons why CEOs should think about ditching the office.

1. Remote work is more profitable.

In 2021, it no longer makes sense for most companies to waste valuable resources on real estate. Going fully remote eliminates this cost, increases efficiency by reducing wasted time on unnecessary meetings and also ensures that employers can invest in their employees, increasing retention and productivity. Studies suggest that if all of the approximately 48 million employees with a remote-work-compatible job worked remotely at least partially, employers could save more than $500 billion per year.

2. Remote work encourages better mental health and performance.

Studies show that a stunning 95 percent of remote workers report being equally or more productive since leaving the office, with major improvements in work-life balance. Data also suggests that giving employees more autonomy and control over their lives improves morale and, therefore, retention and productivity. More than 80 percent of surveyed workers across industries say they would be more loyal to their employer if offered the option of more flexible work.

3. Remote work allows you to hire the best talent in the world.

When you’re remote, your talent pool is no longer constrained to your city or community — it’s now open to the world. In an era of digital connectivity, employers can hire the best talent anywhere, leading to more productive and profitable companies. Workers, too, can seek out employment in firms and industries that they have skills and passion for, instead of settling for convenience and making decisions based on logistical concerns, such as a commute.

4. Remote work can build a strong brand.

It might be counterintuitive, but remote work can be a powerful tool for strengthening a company’s brand. Virtual work requires more active engagement, but CEOs who seize this opportunity have the chance to build a resilient and attractive work culture and brand, which will also help with employee recruiting and retention. At my workplace, we advise clients to hold events like virtual happy hours and yoga that build and reinforce a brand and create a sense of community. Resources not spent on real estate or other costs can also be used on employees, including fun rewards such as concert tickets or weekend getaways.

5. Remote work increases equity and inclusion.

Even the most conscientious workplaces are vulnerable to bias and politicking that can sideline or disadvantage high-quality talent. Remote work can take human bias out of the equation and ensure that employees are hired and promoted based on merits. Remote work also opens the talent pool, meaning that employers can search for and hire a more inclusive and diverse workforce.

10. The Highest Form of Wealth-Morgan Housel.

Wealth is Easy to Measure but Hard to Value–When George Vanderbilt moved into Biltmore – the largest home in America at 178,000 square feet – one newspaper in 1899 wondered what the point was.

The goals of the country’s richest during the Gilded Age, it said, seemed to be “devoting themselves to pleasure regardless of expense.” But often they got the reverse: “Devotion to expense regardless of pleasure.”

George didn’t spend much time in the 250-room mansion which, by the time he died, had nearly bankrupted him.

Twenty years before Biltmore was constructed, the New York Daily Tribune wrote that “The Vanderbilt money is certainly bringing no happiness to its present claimants.”

That wasn’t closet jealousy. Armed with the world’s greatest fortune, the Vanderbilt family seemed committed to proving the idea that money doesn’t buy happiness. They took it a step further, showing that when managed poorly money could in fact buy resentment, insecurity, and social anxiety. It could buy it in bulk.

Money buys happiness in the same way drugs bring pleasure: Incredible if done right, dangerous if used to mask a weakness, and disastrous when no amount is enough.

The highest forms of wealth are measured differently.

A few stick out:

1. Controlling your time and the ability to wake up and say, “I can do whatever I want today.”

Five-year-old Franklin Roosevelt complained that his life was dictated by rules. So his mother gave him a day free of structure – he could do whatever he pleased. Sara Roosevelt wrote in her diary that day: “Quite of his own accord, he went contently back to his routine.”

There’s a difference between working hard because you want to and working hard because someone else told you you had to, and how to do it, and when to do it. Even if you’re doing the same work, the independence of doing it on your own terms changes everything in the same way that sleeping in a tent is fun when you’re camping but miserable when you’re homeless.

To me, the highest form of wealth is controlling your time.

Wealth can lead to time independence, but it’s never assured. It can be the opposite, as whatever created the wealth – whether a company or an inheritance – creates a claim on your time in equal proportion to its financial reward. A great number of CEOs fall into this category: They have an abundance of wealth and not a moment of free time or scheduling control even when it’s desired, which is its own form of poverty.

Charlie Munger summed it up: “I did not intend to get rich. I just wanted to get independent.” It’s a wonderful goal, and harder to measure than net worth.

2. When money becomes like oxygen: so abundant relative to your needs that you don’t have to think about it despite it being a critical part of your life.

There’s a scene in the documentary The Queen of Versailles when the son of a man whose ability to make money was exceeded only by his desire to spend it, causing a family fortune to shrivel near the edge of bankruptcy:

On my wedding day my father gave a speech, and he looked at my wife and he said, “You will never have anything to worry about in your life.”

But now we worry every day.

A high form of wealth is avoiding that mess. And it isn’t necessarily tied to how much money you have.

Keep two things in mind:

- Desiring money beyond what you need to be happy is just an accounting hobby.

- How much money people need to be happy is driven more by expectations than income.

A thing I’ve noticed over the years is that some of the wealthiest people think about money all the time – which is obvious, because it’s causation. But it’s an important observation because most people, despite aspiring to become one of the wealthiest, actually want something different: the ability to not have to think about money.

It’s a different skill, but it’s powerful when you make it work. A person whose expectations relative to income are calibrated so they don’t even have to think about money has a higher form of wealth than someone with more money who’s constantly thinking about making the numbers work.

3. A career that allows for intellectual honesty.

This includes: Being able to say, “I don’t know” when you don’t know. Being able to speak critical truths about your industry without fear of retribution. The ability to make reasonable mistakes, and be open about them, without excessive worry. And not pretending to look busy to justify your salary.

There are high-paying careers that allow all those things. But there are so many that don’t, and a lot of what people pass off as “hard work” and “grinding” is just finding ways to bury the truth. A job that lets you be open and honest pays a bonus that’s hard to measure.

More:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.