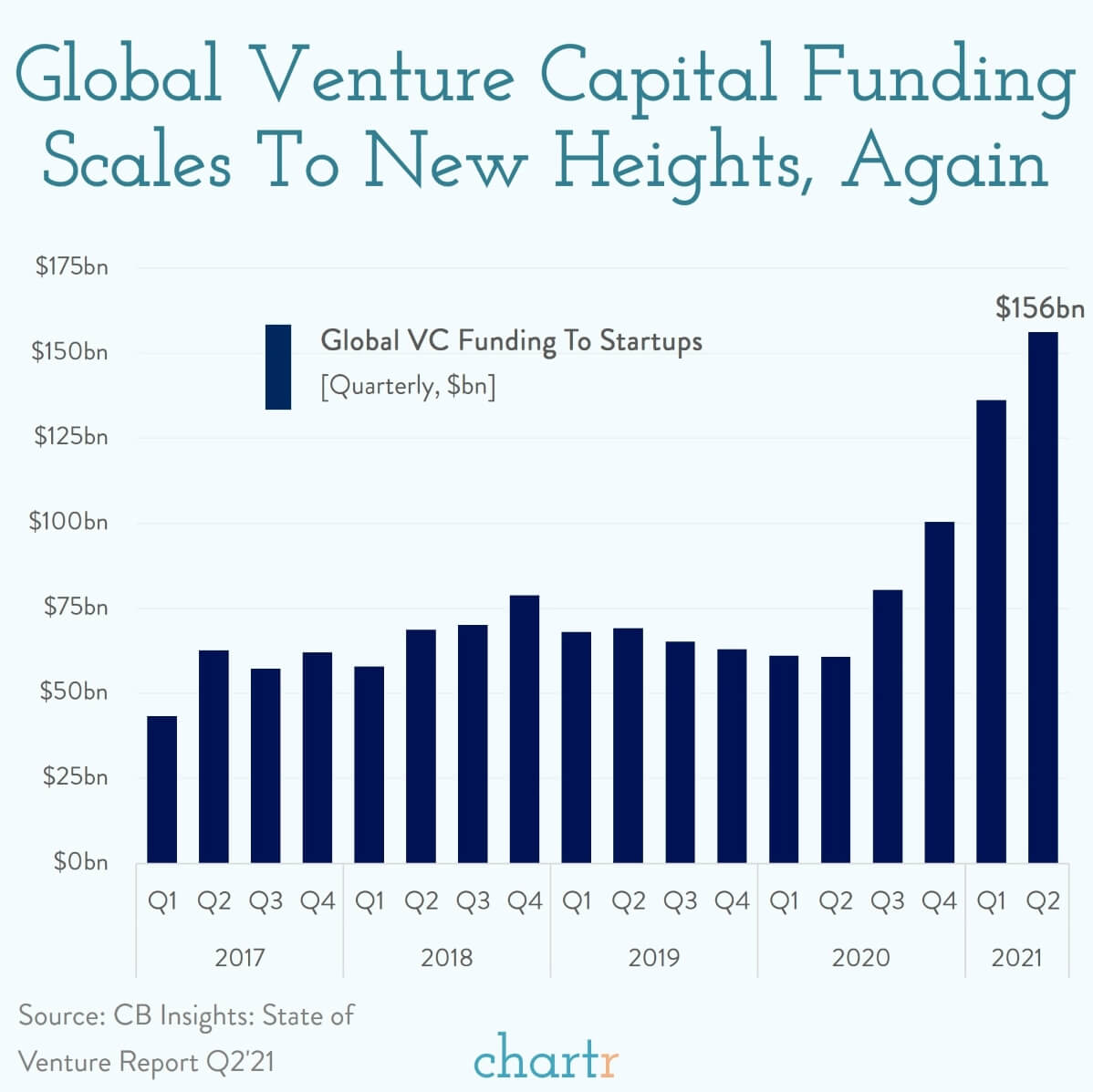

1. Another Look at Global Venture Capital Explosion.. Geographically speaking, almost half of that money has been invested in the US, with Asia picking up another 29%, and Europe 17%.

| We’re running out of superlative adjectives to describe what is happening in financial markets these days. The latest stat that’s breaking our minds is that global venture capital funding hit $156bn in Q2 2021 (three months of April, May and June). That number breaks the record from the first quarter of this year when $136bn found its way into the coffers of promising startups looking to one day become the next letter in the FAATMAN acronym (thanks to CB Insights for the great data from their latest report). Where did you come from? Venture capital investors are able to add the odd zero to the end of their checks these days because investors are entrusting them with more and more money. Many asset classes, particularly stock markets and residential real estate, are at-or-near record high valuations. That means more capital is available to find a home in VC funds. Where did you go? Geographically speaking, almost half of that money has been invested in the US, with Asia picking up another 29%, and Europe 17%. In terms of industries, things are a little more fragmented. Around 20% of all VC dollars invested in Q2 2021 went into fintech companies, which is a pretty broad category that could include investing platforms, digital banks or innovative loan companies. E-commerce companies scooped $16bn, or about 10% of the total, as did startups working in the field of artificial intelligence. |

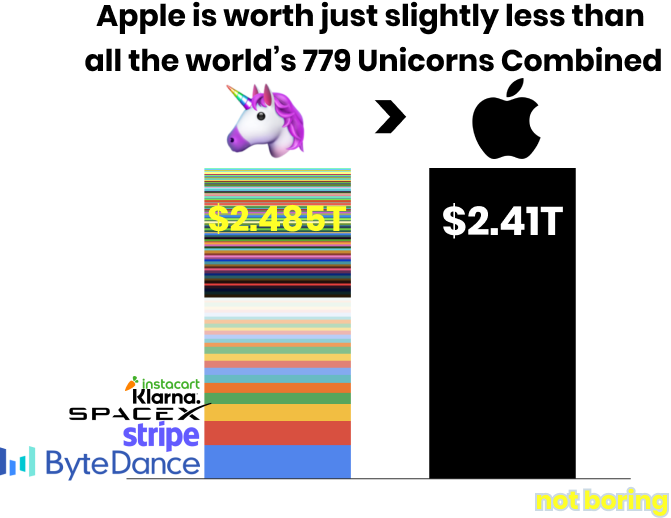

2. Venture Now Created 779 Unicorn Companies.

New Superstar Blogger. Packy McCormick Not Boring- That information is actually stale now. Since I hit send on July 12th, 29 new unicorns have been minted, and all 779 are worth a combined $2.485 trillion, now slightly higher than Apple’s $2.41 trillion market cap.

Full Read

https://www.notboring.co/p/compounding-crazy

3. Customers Downstreamed One Billion Fewer Hours of TV in June than March

Barrons-People are leaving the couch. Roku (ROKU) last week said that customers streamed one billion fewer hours of TV in the June quarter than they had in the March quarter—the first-ever sequential decline. People are watching less and going out more. Zynga’s(ZNGA) shares cratered after the mobile videogame company missed earnings estimates. Zynga blamed “market dynamics related to the great reopening.” Fiverr,which runs a marketplace for freelance creative services, posted disappointing guidance, citing higher vaccination rates, leading to people “taking vacations and getting some off-screen time.”

A New Economic Reality Is Weighing on Tech StocksBy

https://www.barrons.com/articles/reopening-tech-stocks-51628286612?mod=past_editions

ROKU made its second attempt at run to $500 before sell off after earnings

©1999-2021 StockCharts.com All Rights Reserved

4. CROX Insiders Selling While Borrowing to Buyback Stock

Barrons CROX- The top brass has sold 238,578 shares, for net proceeds of $21.4 million—at the same time the company is borrowing to buy back stock.

https://www.barrons.com/articles/companies-families-debt-51628263740?mod=past_editions

CROX comeback….$10 to $140

©1999-2021 StockCharts.com All Rights Reserved

5. One Part of Chinese Market Doing Well…Past 12 months KRGN +80% vs. China Large Cap -10%

KRGN-China Environmental Index ETF

©1999-2021 StockCharts.com All Rights Reserved

6. Dow Industrials and Transports Diverge….Transports -10% Correction vs. Industrials New High

Dow Transports break toward March levels…ultimately in bull market you want to see Dow and Transports making new highs together

©1999-2021 StockCharts.com All Rights Reserved

Dow Industrials make new highs

©1999-2021 StockCharts.com All Rights Reserved

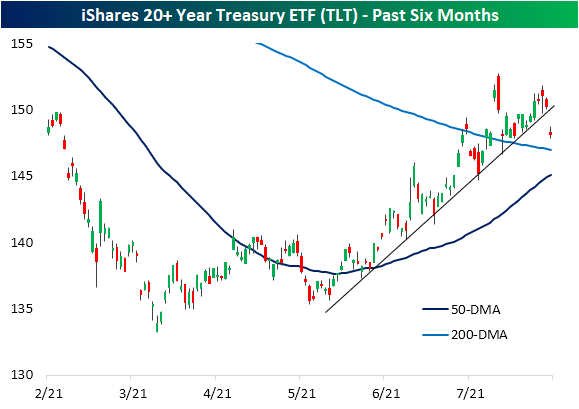

7. Some Technical Damage in Bonds Post Non-Farm Payrolls.

Bespoke Investment Group-Bonds Break Down-In reaction to today’s better than expected Nonfarm Payrolls report, perhaps one of the most notable moves has been in rates. Whereas the S&P 500 is up a modest 0.15%, the iShares 20+ Year Treasury ETF (TLT) is falling 1.5% as of this writing and is on pace for its biggest single-day decline since June 21st. From a charting perspective, the decline is even more notable. Today’s drop has smashed through the uptrend line that had been in place since the spring. With that line broken, TLT’s 50-DMA is likely to be the next area of support to watch.

As for investment-grade corporate bonds, it is the same story. The iShares Investment Grade Corporate Bond ETF (LQD) is down 0.73% today for its worst day since March 12th when it fell over 1%. As with TLT, that decline has broken the ETF’s uptrend that has been in place for most of the past year, and the next area of potential support is its moving averages. More specifically, LQD is closing in on its 200-DMA which recently crossed above the 50-DMA. Click here to view Bespoke’s premium membership options.

https://www.bespokepremium.com/interactive/posts/think-big-blog/bonds-break-down

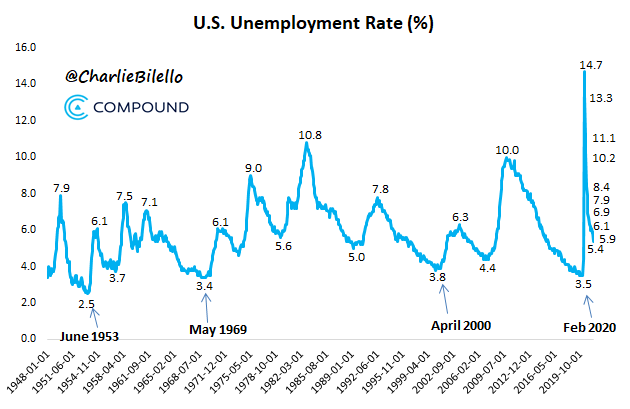

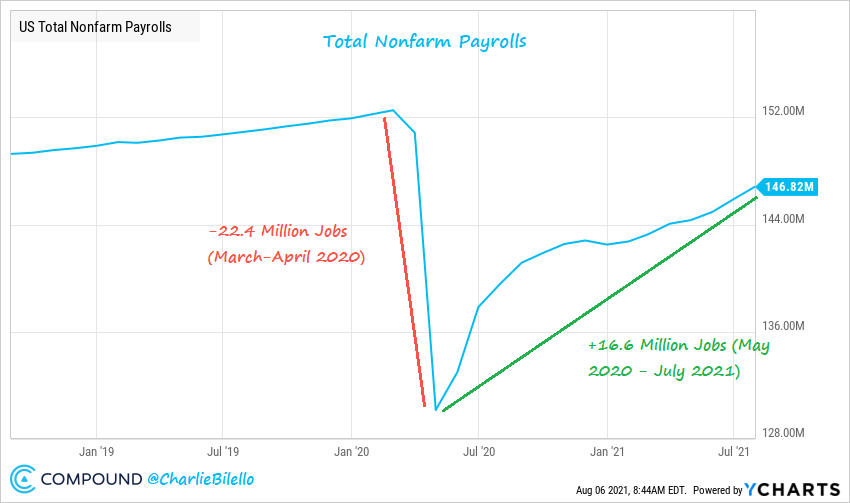

8. Jobs Numbers Have Unemployment Back Down to 5.4%….FED Alert???

Jobs Jump-The US Unemployment Rate moved down to 5.4% in July, its lowest level since the start of the pandemic.

| 22.4 million US jobs were lost in March-April 2020. In a little over a year we’ve regained 16.6 million of them, but that still leaves us 5.8 million below the prior high. |

https://compoundadvisors.com/blog

9. EV’s Contain 4x the Amount of Copper as Combustible Engine

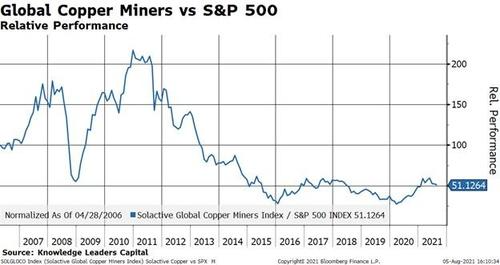

Zerohedge- Finally, relative performance for the group looks to be turning. After underperforming the S&P 500 by 75% since 2011, the group has been in a sideways trend vs the index since 2015 and is finally starting to show signs of life. This of course makes sense since capacity has been hallowed out, growth is picking up, valuations are low, and the price of copper is going up.

The American Push Into EVs Could Set Stage For Full Cycle Outperformance Of Copper Producers-BY TYLER DURDEN

10. The Four S’s of Structure

Leah Marone LCSW

Learn how to create structure in your life without the rigidity and pressure.

Posted August 8, 2021 | Reviewed by Kaja Perina

KEY POINTS

- Pay attention to sleep, sugar, sweat, and silence to stay on a healthy track.

- How we were raised greatly impacts our ability to create structure and care for ourselves.

- Implementing some predictability and sense of control positively impacts your health.

It is a well known fact that people thrive with some degree of structure. Establishing some sort of rhythm or routine helps us feel safe, accomplished, and focused. There are individuals who adopt a lifestyle that is highly structured and when it is challenged, can feel lost or unproductive. Others might implement some structure, but maintain a strong desire to live spontaneously and embrace the unpredictability of life.

Think back to your childhood. Did your caregivers establish a routine that encouraged independence, but also provided security? Did others around you take care of themselves physically and emotionally and which inspired you to do the same? Or were you raised in an environment that was highly unpredictable or chaotic and unfortunately encouraged anxiety or uneasiness? If not, don’t fret, many of us regardless of how structured we were prior to 2020 have been incredibly challenged due to the unpredictability of the pandemic.

Regardless of whether or not you have your days completely mapped out or you are struggling to find your toothbrush in the morning, the 4 S’s (Sleep, Sugar, Sweat, and Silence) can be used as a guide to simplify the art of structuring yourself in a healthy, constructive way. Remember, it is not about rigidity, but understanding what you need to thrive, feel safe, and build confidence.

Sleep

Sleep is your ultimate reset and must be made a priority. Start by establishing a routine that does NOT include your device, sugar/caffeine, or intense/emotional conversations. You will begin to notice positive shifts in your patience, motivation, and mindset.

Sugar

Unfortunately, sugar is everywhere. It is highly addictive and incredibly difficult for most to limit or omit from their lives. Be mindful and begin to identify your behavior patterns. When do you typically crave and consume foods or drinks with sugar? Protect your mornings and evenings and perhaps use these blocks of time as ‘no-sugar zones.’ What you put into your body and when, truly does impact your hormone levels, mood, and cognitive functioning.

Sweat

Some type of movement every day is key. Changing up our blood flow and increasing our body temperature has amazing effects on your body and mind. You don’t necessarily have to break a sweat every day. Practicing yoga or participating in a step challenge can be just as effective. Your body is your sacred tool and on your team. Remember to nurture it daily!

Silence

Setting aside at least a few minutes everyday without distraction positively impacts our mental health and ability to be present in life. Whether you meditate, unplug from your device, or take a quiet walk, your level of self-awareness will increase. This alone time gives you an opportunity to reflect and connect with yourself which is so important and takes practice.

The past year or so has constantly reminded us of the fact that we ultimately do not have control over much. Our freedom lies in how we respond and how we attempt to care for ourselves. Focus on creating a structure and establishing boundaries that encourage hope and motivation, rather than stress and a sense of defeat.

HTTPS://WWW.PSYCHOLOGYTODAY.COM/US/BLOG/GAINING-AND-SUSTAINING/202108/THE-FOUR-SS-STRUCTURE

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.