1. Transitory Inflation……S&P Real Earnings Yield Hits 1970’s Level.

Michaela Arouet

https://twitter.com/MichaelaArouet

2. Consumer Price Index (CPI)-Is the Measurement of Housing Costs Disconnected ?

Opinion: Shock: Rents rising three times as fast as ‘official’ inflation figures

Another reason to own your home in retirement

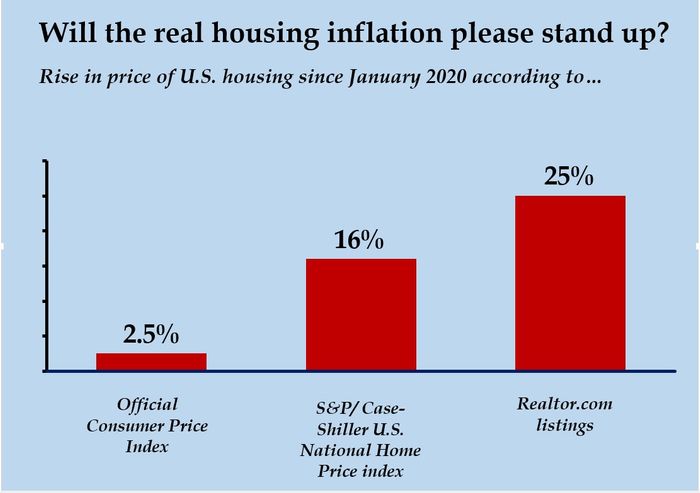

Rise since January 2020 in the “Shelter” component of the official CPI figures, S&P/ Case-Shiller U.S. National House Price Index, and median listing prices at Realtor.com

If you want to be reminded why it’s such a good idea to own your own home in retirement, listen up to Matthew Fine.

He’s the guy who’s taken over Marty Whitman’s old mutual fund, Third Avenue Value TVFVX, -1.02% (up 66% in the past 12 months, incidentally). And in his latest letter to his investors he’s pointed out something that he has been watching and a lot of Wall Street hasn’t.

In a nutshell: The official inflation figures are a bit of a crock (my word, not his, of course). And the reason is that actual house price inflation is running way, way ahead of the official house price inflation.

Not sure where to live in retirement? Our tool can help you decide

You can see the numbers in my chart, above.

The number on the left is what the U.S. Labor Department, which compiles the official inflation data, says is the increase in housing costs from January 2020 through April of this year. (I’ve used what they call the “Shelter” number, which excludes all the other homeownership costs like utilities. This is just the cost of owning the home.)

The number in the middle is what the nationally-recognized S&P/ Case-Shiller U.S. National House Price Index says has happened to house prices over the same period.

The number on the right is what Realtor.com—which, like MarketWatch, is owned by News Corp. NWSA, +0.45% —says has happened to average listing prices over the same period.

Hmmmm.

Nothing to see here, folks! Move along!

Fine is an inflationista: He thinks inflation is likely to be higher than the Federal Reserve expects, and less “transitory.” He has a number of arguments to do with low, low interest rates, and material and labor shortages as the world reopens. But one of them is this issue with the official inflation figures and housing.

“As it relates to inflation as depicted by the Consumer Price Index (CPI),” he writes, “the measurement of housing costs appears to be substantially disconnected from reality.”

“The U.S. government has estimated rental rates for primary residences to be growing at 2% or less in recent months,” Fine writes. After talking to homeowners, he adds, it reckons “market rental rates for owner-occupied homes have been growing slightly above 2% recently and at a decelerating pace.”

I added the italics. You can see why. Have you seen any decelerating pace in real estate costs lately? Where are these people talking to homeowners?

And this isn’t trivial. Shelter costs account for about one-third of the total official inflation figure. Yet the government has to guess at it. The biggest number? They ask owners how much their home would cost to rent. Yes, really.

OK, so house prices and housing costs aren’t the same. You don’t have to buy a new home every year. The collapse in mortgage rates means your monthly housing costs go down, even if house prices stay the same or go up. This is why the government focuses on “rents” rather than purchase prices.

But the numbers here aren’t that helpful for the Labor Department either.

According to the official figures from the Labor Department, rents nationwide rose about 2.5% in the 12 months to June.

But Realtor.com tracks rents too, using actual market data through its website, and it has a different inflation figure.

Try: 8.1%. Yep. In other words, the private market’s estimate of housing cost inflation is more than three times the “official” number.

3. Wall Street Buy Ratings Back to Highest Levels Since Internet Bubble Burst.

https://twitter.com/Schuldensuehner Holger Zschaepitz

4. 10 Year Hit 1.13…Back to Feb. Levels

10 Year Treasury Yields.

5. Peaks in Early August are Normal Under New Party

LPL Research

https://i2.wp.com/lplresearch.com/wp-content/uploads/2021/08/8.2.21-Blog-Chart-2.png?ssl=1

6. Amazon Post Earnings Correction Put the Stock Back in Sideways 1 Year Pattern.

AMZN July 2020 to July 2021 in a Box

7. Capex is Set to Grow for Most Sectors

2021-2023 Capex Growth Sizeable

8. Ratio of MSCI China to U.S. Equities Lowest Since 2005

This weakness has pushed the ratio of Chinese to U.S. equities down to its lowest level since 2005.

9. New SEC Boss Wants More Crypto Oversight to Protect Investors

Bloomberg-The nation’s top securities regulator has unusual expertise in digital assets, but he says he’s no cheerleader for them

By Robert Schmidt and Benjamin Bain

It’s become a parlor game in Washington, on Wall Street, and in Silicon Valley to figure out where U.S. Securities and Exchange Commission Chair Gary Gensler stands on cryptocurrencies. Industry lobbyists tune in when he testifies before Congress. Lawyers parse his speeches. Goldman Sachs Group Inc. wealth advisers recently boasted in a research report about looking for clues in 29 hours of the Blockchain and Money course he developed at the Massachusetts Institute of Technology. That’s an arduous but perhaps not novel undertaking, since videos of the classes have garnered millions of views online, something that amazes even Gensler.

In his first extensive interview about the digital money craze, Gensler signaled that his deep interest in the subject doesn’t mean he’s simpatico with the hands-off oversight approach that many enthusiasts would like to see. Policymakers have struggled with how to respond to the mostly unregulated $1.6 trillion market, which has seen explosive growth and wild price swings. Gensler is contemplating a robust oversight regime, centered on establishing safeguards for the millions of investors who’ve been stocking their portfolios with tokens. “While I’m neutral on the technology, even intrigued—I spent three years teaching it, leaning into it—I’m not neutral about investor protection,” says Gensler, who on Tuesday gave a speech about crypto at the Aspen Security Forum. “If somebody wants to speculate, that’s their choice, but we have a role as a nation to protect those investors against fraud.”

Gensler has asked Congress to pass a law that could give the agency the legal authority to monitor crypto exchanges, but he says the SEC’s powers are already broad. There’s been much discussion over the years about which kinds of digital assets fall under the SEC’s purview. Some such as Bitcoin that act like currencies are considered commodities, not securities. But there are thousands of other coins, and Gensler believes most are unregistered securities that must comply with SEC rules.

Broadly he noted that technology has sparked economic progress throughout human history, and he sees a similar boost from digital assets. That may only come, however, with strong and thoughtful regulation. As an analogy, he says the automobile industry didn’t fully take off until governments laid out driving rules. Speed limits and traffic lights provided public safety but also helped cars become mainstream. “It’s only with bringing things inside—and sort of clearly within our public policy goals—that a technology has a chance of broader adoption,” he says.

Hester Peirce, a Republican commissioner on the SEC known for her advocacy of light-touch regulation of digital assets, says she’s eager to work with Gensler. “A lot people just want more clarity,” she says. “I come from a perspective that people should have the maximum freedom to engage in transactions they want to engage in voluntarily. Society needs to have that discussion about what is the right regulatory framework.

10. The Science Of Sleep: 10 Surprising Health Benefits

Improved sleep habits can be a panacea for modern living. Thomas Rutledge Ph.D.

KEY POINTS

- Sleep may be our most important health habit.

- In lives dominated by mental and emotional stress, our need for sleep is greater than ever.

- The most effective remedies for sleep are behavioral rather than pharmaceutical.

For all its amenities, modern life is surprisingly difficult. A century ago, the primary challenges of living were physical; we worked in factories or on farms, and housework and meal preparation demanded hours of labor. After many millennia of existence defined by dawn-to-dusk physical demands, the burden of modern living has been lightened by vehicles, automated devices, broadband internet, and same-day delivery services. Citizens from the 1920’s, however, would likely be disappointed to learn that a century of unparalleled technological progress has largely exchanged lives dominated by physical stressors with lives dominated by emotional and social stressors. It is difficult to argue that we are happier than a century ago and—despite having longer lifespans boosted by clean water and antibiotics—in most ways less healthy. The same technological forces that shaped modern times have offered many remedies to 21st century ailments. We have activity trackers to inspire exercise, social media to assuage loneliness, diet books and internet health gurus to guide our nutrition, and a dizzying number of entertainment options in the form of television channels and video games.

Yet for all these breakthrough gadgets and expensive technologies, arguably the most effective balm for modern living is sleep. No medicine, supplement, or psychotherapy provides even a fraction of the benefits conferred by sleep to our minds, bodies, and spirits. While a profit-hungry industry strives to create market demand for sleep products, the wise consumer appreciates that healthy sleep is overwhelmingly the product of cost-free habits and lifestyle practices rather than equipment or pharmaceuticals. We know what works: regular sleep and wake routines; morning sunlight to optimize circadian hormones; regular exercise to generate physical fatigue and ameliorate stress; meditation and relaxation for calming the mind; cool and dark bedrooms to facilitate restful slumber; and consistent CPAP use for those with sleep apnea. For the typical person, their sleep can be dramatically improved by the practice of these latter strategies without lightening their wallet. Recent science further demonstrates the diverse ways that sleep improves our well-being. The range may surprise you; virtually no area of physical or mental health is exempt from the effects of sleep.

A summary of sleep science

1. Sleep and pain sensitivity: Even a single night of poor sleep reduces our pain threshold. A study by Matt Walker’s team at UC Berkeley showed that, compared to brain function after a full night’s sleep, pain-related areas of the brain were 42 percent more sensitive to pain stimuli induced by laboratory tests. For context’s sake, a 42 percent difference in pain sensitivity is larger than the effect of many pain medicines.

2. Sleep and alcohol: The relationship between sleep and alcohol use is complex. On one hand, small amounts of alcohol show short-term benefits in helping some people initiate sleep (this benefit wears off, however, for most people within a few days). In contrast, any benefit from falling asleep faster may be nullified by the suppression of REM sleep caused by alcohol. The alcohol-REM suppression effect appears to be dose-related. For example, REM sleep may rebound to higher than normal levels in the second half (i.e., catching up on lost REM) of the night after smaller doses of alcohol have been metabolized. In the case of higher doses of alcohol, however, REM suppression may occur throughout the night as is often seen in persons with alcohol dependence.

article continues after advertisement

3. Sleep and caffeine: With an estimated 90 percent of Americans reporting daily caffeine intake, it is important to understand the effects of caffeine on sleep and health. Research shows that caffeine has an average half-life (the time needed to metabolize 50 percent of the drug) of approximately five hours. However, due to differences in drug metabolism between people, this can range from one and a half to nine and a half hours! In real-life circumstances, this means that the average person consuming a cup of coffee at noon (about 100 mg of caffeine) would still have about 50 mg of caffeine in their body at 5 p.m. and 25 mg at 10 p.m. These results, however, would vary markedly for slower caffeine metabolizers, who might still have a high percentage of caffeine affecting their body in the evening. For these reasons, many researchers encourage stopping caffeine use at least six hours before bedtime.

4. Sleep and vaccine response: In a world dominated by pandemic news and recommendations to vaccinate, a curiously overlooked fact is the importance of vaccinating in a well-rested state. Quality sleep profoundly affects the ability of our immune system to mount a favorable response to vaccination. For example, in one of several studies measuring immune system response to flu vaccines, a group of healthy participants restricted to four hours of sleep for six nights showed less than half the number of antibodies ten days after vaccination. Expressed reversely, this implies that receiving a vaccination in a well-rested state could double its effectiveness.

5. Sleep and learning: Practice does not make perfect. More accurately stated, it is practice—coupled with quality sleep—that enables learning and improvement. In a 2002 study of participants assigned to a motor learning task combined with differing sleep-wake patterns, participants obtaining a regular night’s sleep after learning showed a 20 percent improvement in the task the next day. In contrast, participants staying awake for the same period showed no improvement. Interestingly, more than 50 percent of the improvement could be explained by the amount of stage 2 non-REM sleep that is typically obtained early in the night.

6. Sleep and dementia: Because the brain is an energy-intensive organ, it produces a lot of metabolic waste products. Sleep serves a vital restorative function by facilitating the removal of the waste products accumulated in the brain during the day. Without sleep, this cleaning process does not occur, with potential long-term implications for dementia. For example, in a 2018 cross-over study assigning participants to a normal sleep versus a single night of sleep deprivation, the latter condition was associated with significantly reduced clearance of β-amyloid, a plaque associated with risk of Alzheimer’s Disease.

7. Sleep and hormones: One of the primary roles of sleep is hormone regulation. Optimizing sleep improves the function of appetite hormones such as leptin and ghrelin as well as sex hormones such as testosterone. Even in young men, sleep loss rapidly disrupts hormone function. In a study restricting sleep to five hours per night for one week in a group of healthy men in their 20’s, daytime testosterone levels were lowered by 10-15 percent and accompanied by large self-reported decreases in vigor.

8. Sleep and healing: Whether you are an athlete recovering from training or a patient recovering from surgery, sleep is critical for your body to heal. In addition to the above hormonal and immune system effects of sleep, sleep is also the period of peak protein synthesis. Protein synthesis is the process of creating new proteins and is an essential part of repairing damaged tissues and creating new cells. A 2021 study recruiting healthy young adults found that a single night of sleep deprivation decreased protein synthesis by 18 percent, along with a 21 percent increase in cortisol and 24 percent decrease in testosterone.

9. Sleep and heart rate variability: Heart rate variability (HRV) refers to beat-to-beat variability between heartbeats. Counterintuitively, greater HRV is healthy, representing a dynamic heart capable of responding effectively to internal and external demands. Low HRV is associated with poorer metabolic function and increased risk of cardiovascular events. Improving the quality and quantity of our sleep is one established way to maintaining higher levels of HRV and it is never too young to start. Even in children and young adults, for example, research shows that impaired sleep is associated with reduced HRV.

10. Sleep and insulin sensitivity: Even partial sleep deprivation has rapid adverse effects on insulin sensitivity. For example, in a crossover study of participants with type 1 diabetes obtaining full and four-hour sleep intervals, insulin sensitivity was reduced by more than 20 percent following the night of partial sleep deprivation. Many other studies with type 2 diabetes and even metabolically normal participants show similar results. For comparison’s sake, the improvement in insulin resistance achieved by healthy sleep is as large or larger than established diabetes medicines such as metformin.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.