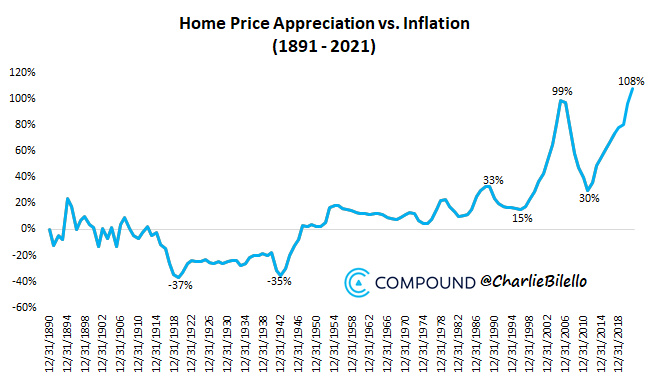

1. The gap between US home price appreciation and overall inflation has never been wider.

Charlie Bilello

2. S&P 500 Held 50 Day 5 Times Since March

3. Future Returns of Nasdaq Based on Historical

Marketwatch-So the real point of these parlor games should be to introduce a reality check into your projections of the market’s future. Recent years have been far better for equities than we have any right to expect going forward.

What is realistic? The answer depends on various factors, such as whether you take the market’s current extreme overvaluation into account. But if you simply extrapolate the past into the future without regard to valuation, you should look at as long a past as possible. In the case of the U.S. market, data is available at least as far back as 1793 (courtesy of a database from Edward McQuarrie, professor emeritus at the Leavey School of Business at Santa Clara University).

Based on his database, here’s what I project for the Nasdaq’s performance in coming years:

· Overall market’s annualized return since 1793: 6.1% annualized above inflation

· Expected inflation over next decade: 1.6% (per Cleveland Fed model)

· Nasdaq Composite’s expected return relative to overall market: Minus 0.1% annualized (per data since 1926 from Dartmouth professor Ken French on the performance of the large-cap growth sector, which is closest to the stocks that dominate the Nasdaq Composite)

The net result: A nominal return of 7.6% annualized in future years. That’s a lot lower than the Nasdaq Composite’s 41.8% return over the past 12 months, or its 23.8% annualized return over the past five years.

In fact, 7.6% annualized is not much better than the Nasdaq Composite’s average return since the top of the internet bubble. At a 7.6% annualized clip, it will take 9.7 years for the index to reach 30,000. Keep in mind that, assuming that the market’s current overvaluation impacts equities’ future return, it will take even longer for the Nasdaq Composite index to reach 30,000.

The bottom line? Trees don’t grow to the sky. While celebrating the good fortune the markets have produced in recent years, most definitely you should not get greedy.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

https://www.marketwatch.com/story/nasdaq-15-000-is-near-do-i-hear-30-000-11627374665?mod=home-page

4. Tesla Good Quarter…Now Valued about 4-and-a-half Volkswagens ($149bn market cap), 12 Ford Motor Companys ($56bn) or 16 Ferraris ($41bn).

| Most investors in Tesla aren’t probably expecting to see major profits at the company any time soon, instead investing in the hope that in 5, 10 or 15 years Tesla will be at the core of the electric vehicle revolution — and making the profits that go with that position. So those investors may have been pleasantly surprised this week when Tesla reported a tidy profit in its latest quarter. They’ll have been even more surprised that Tesla reported a profit even if you were to exclude the $354mthe company got from selling regulatory credits (which it gets because its cars are zero emissions). That’s a first for the company, which historically has always had to rely on selling its excess regulatory credits in order to turn a net profit. Of course, Tesla needs to keep delivering (cars, and eventually profits) in order to justify its massive share price — which currently values the equity in the company at $670bn. That is about 4-and-a-half Volkswagens ($149bn market cap), 12 Ford Motor Companys ($56bn) or 16 Ferraris ($41bn). |

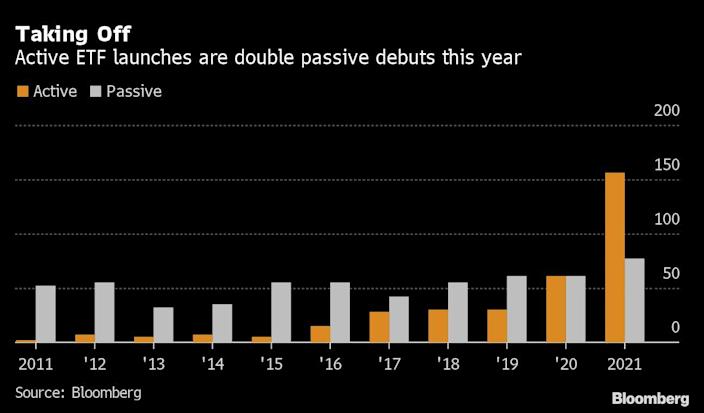

5. ETFs Take Over Active Management …..2021 Active ETFs Arriving at Double the Rate of Passive.

Bloomberg-Sam Potter and Elaine Chen

Sat, July 31, 2021, 8:00 AM

(Bloomberg) — Record inflows. Record fund launches. Record assets. If active money management is in decline, someone forgot to tell the ETF industry.

Amped up by a meme-crazed market and emboldened by the success of Cathie Wood’s Ark Investment Management, stock pickers are storming the $6.6 trillion U.S. exchange-traded fund universe like never before — adding a new twist in the 50-year invasion from passive investing.

Passive funds still dominate the industry, but actively managed products have cut into that lead, scooping up three-times their share of the unprecedented $500 billion plowed into ETFs in 2021, according to data compiled by Bloomberg. New active funds are arriving at double the rate of passive rivals, and the cohort has boosted its market share by a third in a year.

Cathie Wood Is Just a Start as Stock Pickers Storm the ETF World

https://finance.yahoo.com/news/cathie-wood-just-start-stock-120000320.html

6. Fixed Income Returns YTD.

Bespoke-Fixed Income Weekly: In this week’s report we look at the long term history of real rates.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

https://www.bespokepremium.com/interactive/posts/think-big-blog/fixed-income-weekly-7-28-21

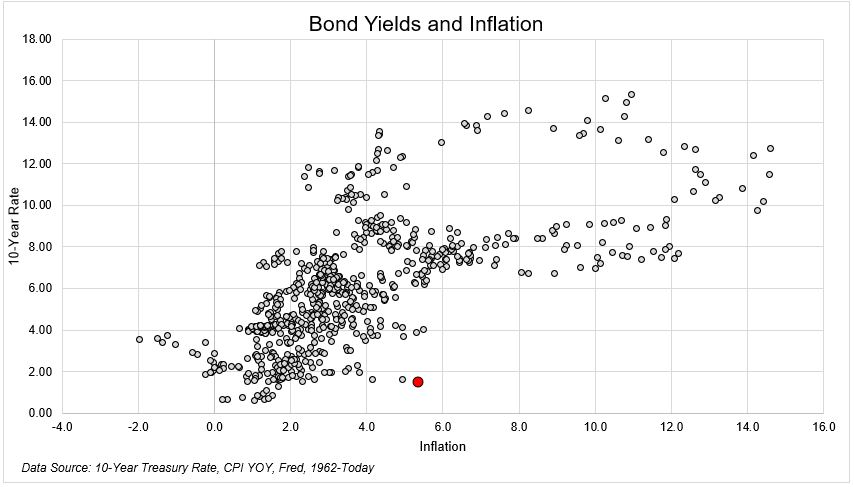

7. Inflation has Never Been this High with Bond Yields this Low.

Bonds and Inflation Posted July 26, 2021 by Michael Batnick

So this is different. Inflation has never been this high, with bond yields this low.

Rates should, in theory, be a way to gauge what market participants think about future inflation. Higher inflation would cripple today’s coupons, so again, in theory, investors would demand higher rates for that risk.

But investing isn’t about theories. At some point, we need to acknowledge reality. It’s probably time we update our models, mental and otherwise.

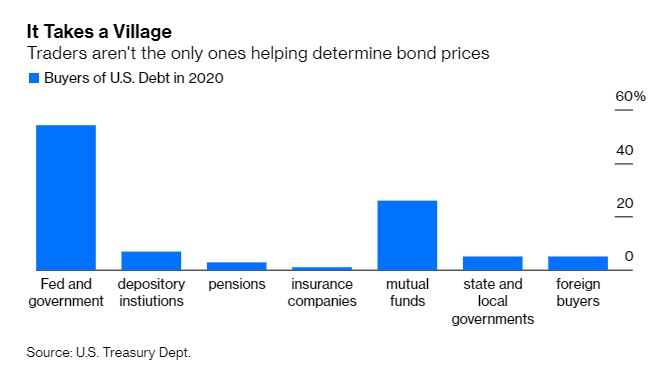

There are varying explanations as to why this relationship may no longer hold, and I think the most compelling one is that there are so many price-insensitive buyers.

Allison Schrager recently highlighted this, showing that 54% of U.S. debt was purchased by the fed and government last year.

Tracy Alloway has been all over this concept of “flows before pros,” first writing about it in 2017.

In a world with so much money, buyers are as important as fundamentals. This concept is widely discussed, but I think still underappreciated. It impacts everything and isn’t going away any time soon.

8. A Few Things to Know About FED Bond Buying

Deal Book NY Times…Here are a few key things to know about the bond-buying, and key details that Wall Street will be watching:

- The Fed is buying $120 billion in government backed bonds each month — $80 billion in Treasury debt and $40 billion in mortgage-backed securities.

- Economists mostly expect the central bank to announce plans to slow those purchases this year, perhaps as soon as August, before actually dialing them back late this year or early next. That slowdown is what Wall Street refers to as a “taper.”

- There’s a hot debate among policymakers about how that taper should play out. Some officials think the Fed should slow mortgage debt buying first because the housing market is booming. Others have said mortgage security buying has little special effect on the housing market. They have hinted or said they would favor tapering both types of purchases at the same speed.

- The Fed is moving cautiously, and for a reason: Back in 2013, markets convulsed when investors realized that a similar bond-buying program after the financial crisis would slow soon. Mr. Powell and crew do not want to stage a rerun.

- Bond-buying is just one of the Fed’s policy tools, and is used to lower longer-term interest rates and to get money chugging around the economy. The Fed also sets a policy interest rate, the federal funds rate, to keep borrowing costs low. It has been near zero since March 2020.

- Central bankers have been clear that tapering off bond purchases is the first step toward moving policy away from an emergency setting. Increases in the funds rate remain off in the distant future.

Jeanna Smialek writes about the Federal Reserve and the economy. She previously covered economics at Bloomberg News, where she also wrote feature stories for Businessweek magazine. @jeannasmialek

Jumping prices and the ghost of 2013’s market meltdown loom over the Fed.

Found at Crossing Wall Street https://www.crossingwallstreet.com

9. Infrastructure Bill May Tax Crypto

“Not A Drill”: Infrastructure Bill Could Sink American Crypto Industry

BY TYLER DURDENAuthored by Jeff John Roberts via Decrypt.co,

The government aims to partially cover the cost of a massive infrastructure bill by taxing crypto companies… and the entire industry will feel it.

Things just got ugly for crypto in Washington, D.C.

For years, the threat of major regulation has been raised like a hammer, ready to smash the crypto industry. Now, the hammer is ready to drop in the unlikely form of a major infrastructure bill in the U.S. Senate.

“This is not a drill,” writes Jake Chervinsky, an influential crypto lawyer and a sober voices in a hype-prone industry. In a must-read Twitter thread, Chervinsky explains how the $550 billion bill – which is primarily about roads and bridges – could shiv American crypto companies.

The pain comes in the part of the bill that explains how the U.S. will help pay for those roads and bridge. Namely, the bill states that Uncle Sam plans to cover $28 billion of the costs by squeezing crypto brokers.

The trouble is that the bill defines “broker”—a term normally used to describe the likes of Coinbase and Robinhood—as basically any business that touches crypto.

As Chervinsky writes,

“This definition is so broad, it could apply to nearly every economic actor in the US crypto industry, if read literally.”

The catch-all “broker” term could apply to miners, DeFi startups, and others who will have to file customer forms with the IRS, a task that is in some cases impossible.

The upshot is that the U.S. crypto industry is in the same position as the online gambling industry a decade ago when Congress regulated it out of existence. In the eyes of lawmakers, crypto companies—like online casinos—appear to be both sinful and rich, which makes them the perfect target for a revenue raid.

https://www.zerohedge.com/crypto/not-drill-infrastructure-bill-could-sink-american-crypto-industry

10. People Complain About Everything.

Hiram Figueroa Jr• 2ndCo Host Leaders Lead the PodCast, KeyNote Speaker, PHP Cooridinator, Entrepreneur Leadership within the Veteran Community, Never Above you, Never Below you, Always Besides you.6d • 6 days ago

Follow

Imagine being born in 1900.

When you are 14 years old

World War I begins

and ends when you are 18,

with 22 million dead.

Shortly after the world pandemic,

flu called ′′ Spanish “,

killing 50 million people.

You go out alive and free,

and you are 20 years old.

Then at the age of 29 you survive the global economic crisis that started with the collapse of the New York Stock Exchange causing inflation, unemployment and hunger.

Nazis come to power at 33.

You are 39 when world war 2. begins

and it ends when you are 45 during the Holocaust (Shoah), 6 million Jews die.

There will be a total of more than 60 million dead.

When your 52th Korean war begins.

When you are 64, the Vietnam war begins and ends when you are 75.

A baby born in 1985 believes his grandparents have no idea how hard life is,

and survived several wars and disasters.

A boy born in 1995 and 25 today believes that the end of the world when his Amazon package takes more than three days to arrive or if he doesn’t exceed 15 likes for his posted photo on Facebook or Instagram…

In 2020., many of us live in comfort, have access to various sources of entertainment at home and often have more than needed.

But people complain about everything.

They have electricity, phone, food, hot water and a roof.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.