1. VIX-Volatility Pulled Back to April Lows.

VIX hit 20 and bounced

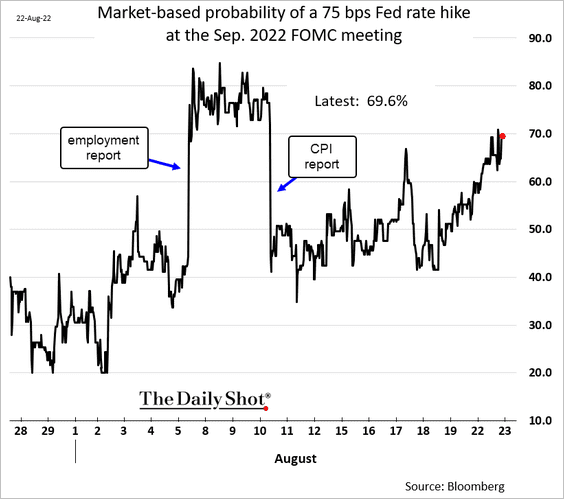

2. The Probability of 75 Basis Point Rate Hike in September 70%

The United States: To begin, the probability of a 75 bps rate hike in September is near 70% as Fed officials strike a hawkish tone.

Source: The Daily Shot

https://dailyshotbrief.com/

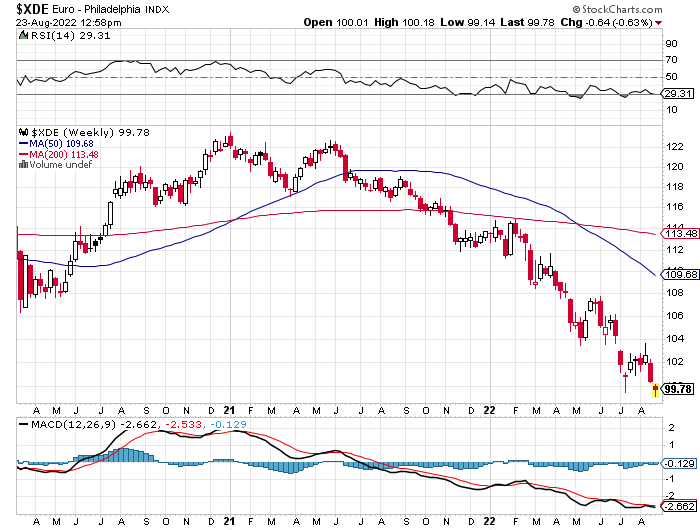

3. Euro New Lows…Straight Shot Down

4. Interesting Financial Engineering by Apple

Eddy Elfenbein -Crossing Wall Street —Apple Goes to the Bond Market

There’s some interesting news this week from Apple (AAPL). In a filing with the SEC, the computer giant said it’s going to issue long-term bonds and use the proceeds to pay out dividends and buy back its own stock.

In plainer terms, Apple is borrowing money to invest in itself. That’s not a bad idea if you can borrow for less than what you’re investing in. Right now, Apple pays a tiny dividend yield of 0.55%.

However, I think this move by Apple raises some important questions. The first is, should a company be involved in financial engineering? Some investors, including myself, believe a company should be solely focused on making money. What to do with that money should be left to the owners—the shareholders. I see moves like this as management encroaching on an area that’s not their concern. Unfortunately the government’s shifting tax policy has played a role in determining what companies do with their profits.

This isn’t just a buyback; Apple is borrowing money to fund the buyback. That raises another issue, what if Apple is paying too much for itself? Cisco famously lost billions of dollars investing in its inflated stock. A cash dividend to shareholders gives them the option to buy more or to invest their funds elsewhere.

What’s also interesting about this offering is that the bonds have a maturity of 7 to 40 years. According to Bloomberg, the offering is for $5.5 billion, and the bonds yield 118 points over similarly-dated Treasuries. The initial discussions were for a premium of 150 basis points, meaning there was unexpected demand for the bonds.

In December, Moody’s (MCO), a Buy List favorite, raised its long-term rating on Apple to AAA. That’s a huge deal. That’s roughly Wall Street’s equivalent of being a “made man” in the mafia. No one can touch you. Microsoft (MSFT) and Johnson & Johnson (JNJ) are the only other current members of the AAA club. If Wall Street thinks you’re on the same level as a sovereign government, perhaps you should have a similar debt load? Eh, I’m not so sure.

Apple is sitting on nearly $180 billion in cash. Four years ago, Apple had a cash position of $285 billion. There was a time when Apple had enough cash to buy every single team in the NFL, NBA, NHL and MLB.

Apple could also be taking advantage of lower interest rates. There’s been a surprising recovery in the bond market. During July, the yield on the 10-year Treasury fell by 33 basis points. That was the largest decline in yields in over two years.

Perhaps Apple sees inflation continuing to be a problem. One of the major issues with inflation is that it benefits borrowers at the expense of lenders. If the Fed is going to continue hiking rates, this offering could be quite remunerative for Apple.

This move also sends a positive message from Apple to the market that it plans to buy its stock for many years to come. Also, if Apple does something, then it gives cover for other boards of directors to do the same thing.

https://www.

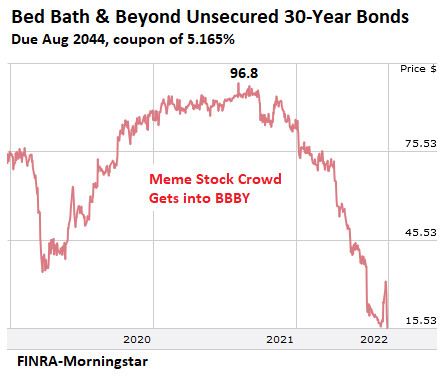

5. Bonds of Bed Bath & Beyond Collapse on Bankruptcy Fears as Suppliers with Unpaid Bills Halt Shipments

Wolf Street by Wolf Richter Meme-stock crowd got crushed, shares collapsed 69% in four days. Their billionaire hedge-fund hero, who might have known about the unpaid bills, got out in time.The $675 million of senior unsecured 30-year bonds that meme-stock darling Bed Bath & Beyond issued in 2014, and that are due in 2044, with a coupon interest of 5.165%, collapsed to a new closing low of 15.8 cents on the dollar today, with some trades being below 15 cents, after having plunged all last week from the meme-stock inspired dead-cat bounce.

That would be a yield to maturity of 33%, assuming that the company pays the interest for the life of the bond and doesn’t default, and at maturity pays off the bond. But with this yield, the bond market is signaling that a default and a bankruptcy filing are imminent, with a massive haircut for unsecured bondholders (chart by FINRA/Morningstar):

https://wolfstreet.com/2022/08/22/bonds-of-bed-bath-beyond-collapse-on-bankruptcy-fears-as-suppliers-with-unpaid-bills-halt-shipments/

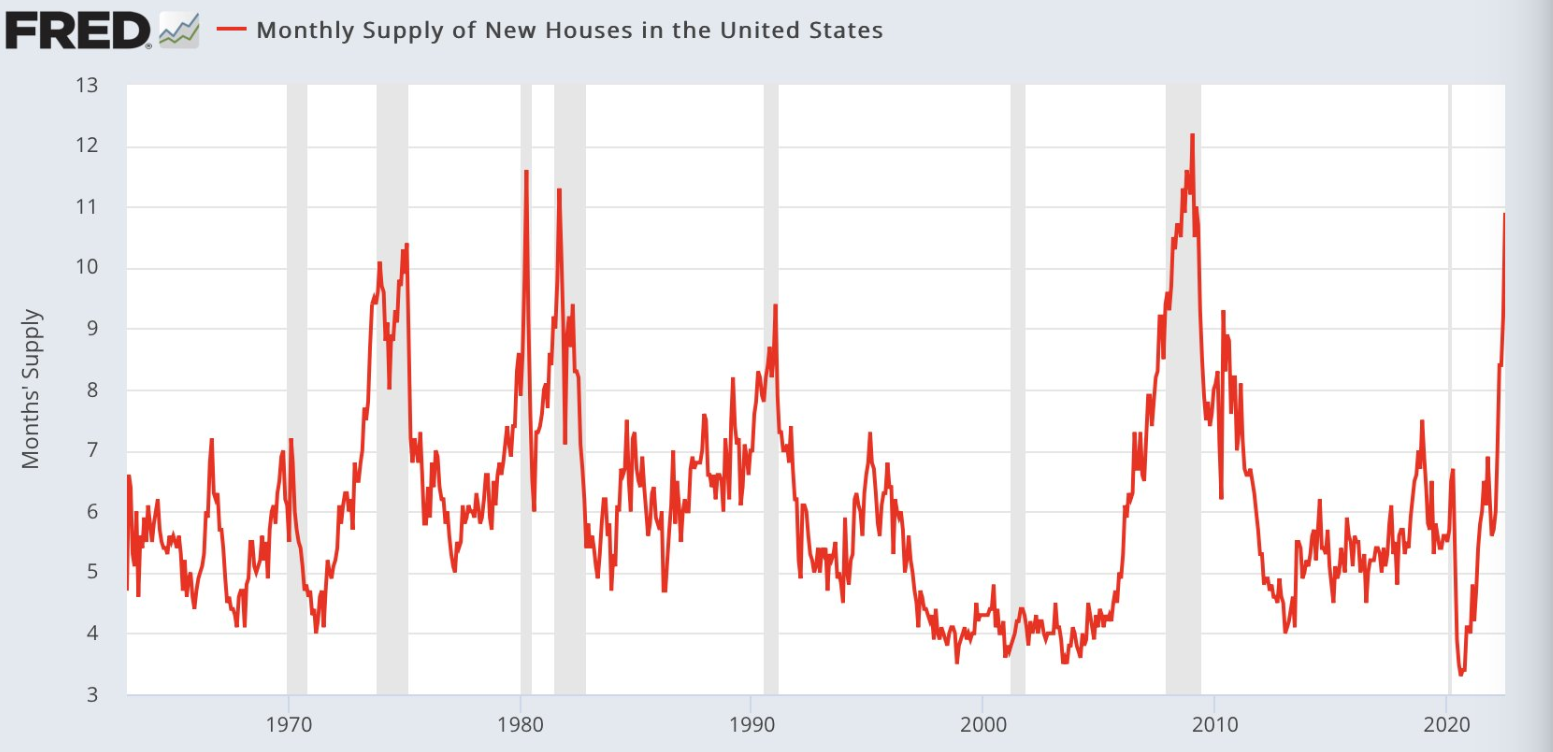

6. Every time monthly supply of new houses has exceeded 9 months a recession has ensued. Currently at 10.8 months.

@NorthmanTrader

https://twitter.com/NorthmanTrader

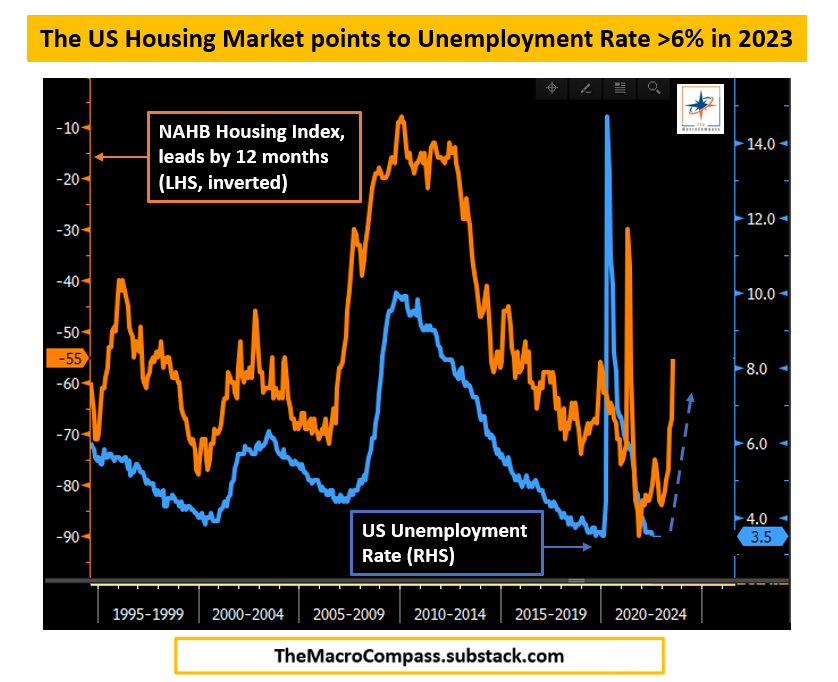

7. Not Familiar with this Chart but Housing a Big Part of GDP

Housing market trends lead economic and labor market cycles by 6-12 months. Right now, the US housing market is signalling unemployment rate will likely be above 6% in 2023: another data point which is inconsistent with a soft landing.

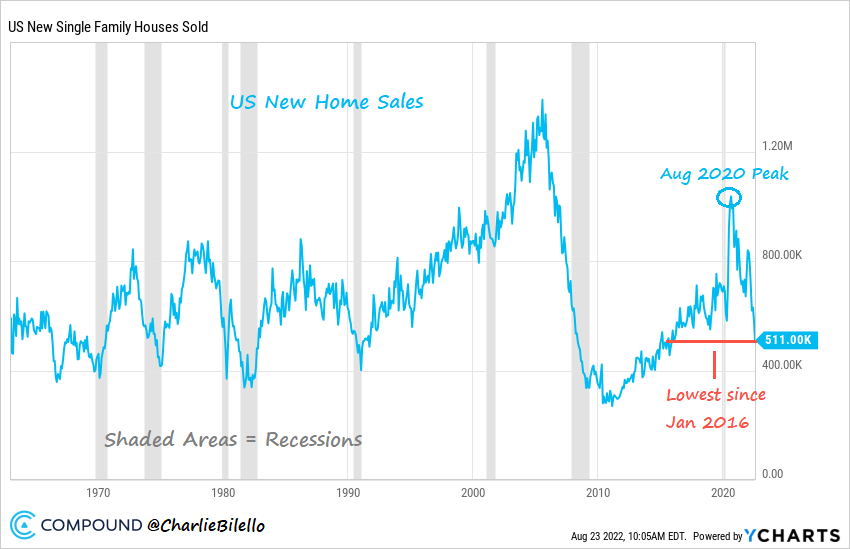

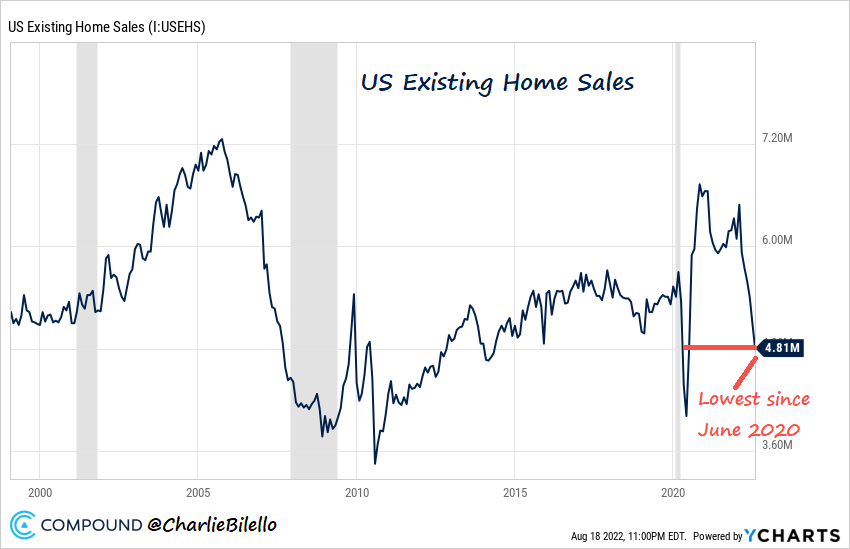

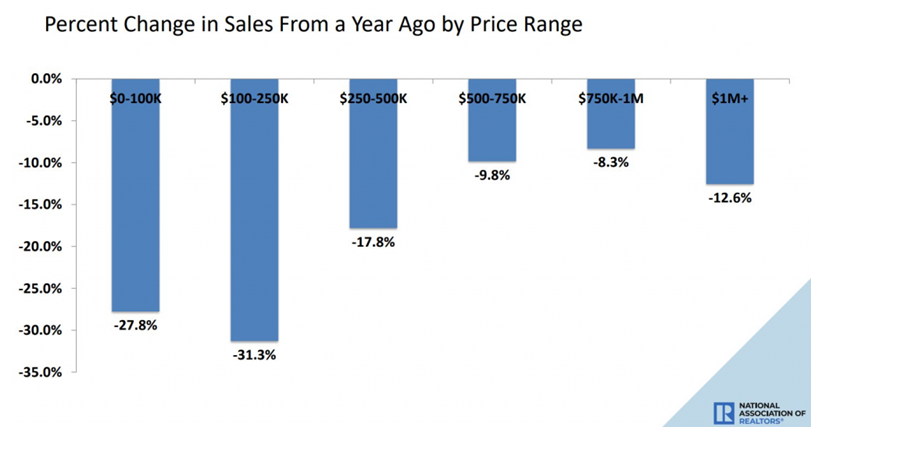

8. Housing Summary…New Home Sales Hit 6 Year Low

New Home Sales hit a 6-year low in July, down over 50% from their 2020 high.

–Existing Home Sales continue to plummet, down 20% over the last year and at their lowest levels since June 2020.

Here’s the breakdown in existing home sales by price range, which is now showing declines in transactions across the board (from low end to high end).

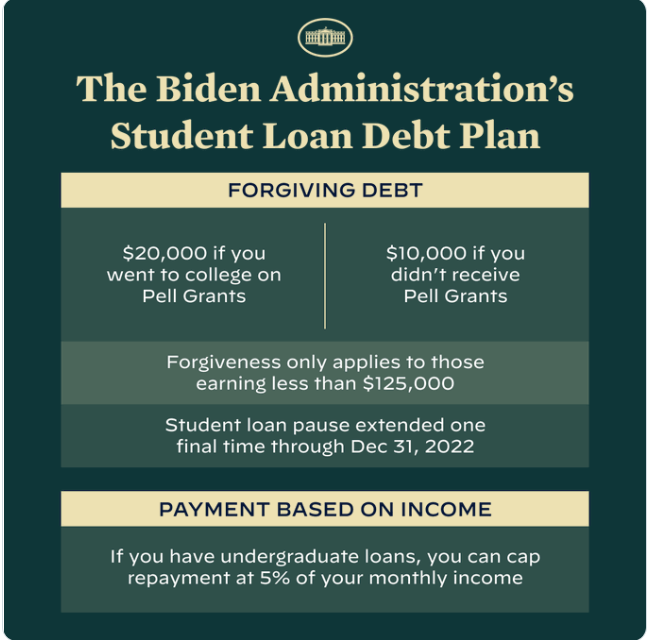

9. Student Loan Forgiveness Summary

https://www.bloomberg.com/news/articles/2022-08-24/biden-set-to-freeze-student-loan-repayments-for-four-more-months?srnd=premium&sref=GGda9y2L

10. Choosing Quality Over Quantity-One Frugal Girl Blog

If given the option, would you choose quality over quantity?

As a child, I loved receiving new toys and clothes. Whenever my mom left for the store, I’d say, “buy me something.”

When Christmas came, I counted my gifts to see how many I received, and then counted my brother’s for comparison.

I counted the number of eggs I collected on Easter Sunday, the number of friends who wrote in my yearbook, and the stacks of clothing that filled my closet. I desired more of everything.

Unfortunately, the desire for more isn’t just a problem in childhood. As adults, we can count the number of likes on Facebook, the number of cars in our driveway, and the amount of money piled into our bank accounts.

Choosing Quality Over Quantity

How often do you choose quality over quantity? And how often do you do the reverse?

Do you choose possessions, likes, and money over more meaningful measurements?

Many of us select the most abundant option when given a choice. We learn to care more about counting possessions than carefully selecting which ones to cherish.

If we aren’t careful, we can waste our lives searching for quantity when we should be searching for quality. Measuring success in terms of numbers is an inaccurate assessment of our lives.

The Quest for More

When we focus on quantity, we can quickly lose track of the things that matter. In school, we aren’t happy with a handful of friends; instead, we want to be the most popular.

At work, we aren’t happy with our jobs. We want to reach higher rungs of the corporate ladder.

We want higher bandwidth, increased capacity, and quicker transactions.

But striving for a quantity-based life can lead us to feel ungrateful. When we choose quantity over quality, we can’t stop counting.

This quest for more can make our lives feel empty. We wonder if happiness exists around the corner. Perhaps my next possession will fulfill me in a way I’ve yet to feel fulfilled before.

Our consumer-driven culture motivates us to upgrade possessions and increase the number of things we own. But the quantity of our belongings doesn’t improve the quality of our lives. Instead, it impairs it.

In the quest to increase the number of items we possess, we stay on the hedonic treadmill. We continue to perform jobs we don’t love and earn money buying stuff we don’t care about.

We can never have enough when we focus on quantity. We are always searching for more but fail to feel satisfied. We live our lives constantly, longing for more.

Choosing Quality

Multiple times a day, we face the option to choose quantity over quality.

We can buy fewer high-quality products in favor of many cheap ones. Spend more time collecting social media likes than forging deep, meaningful relationships or waste countless hours staring at smartphones rather than spending a few moments with people we love.

But is this how we want to live our lives? Can we learn to stop counting and focus on quality over quantity instead?

Choosing Happiness

Having more of something doesn’t always bring greater happiness. When my son turned eight, we asked him how he wanted to celebrate his birthday.

“We can throw a big party in our backyard with all of your classmates,” I suggested.

“I only want to invite three people,” he told me. “I’d rather have a couple of friends I care about than a house full of people.”

We took three friends bowling that year because my eight-year-old didn’t need a room full of kids singing happy birthday. Instead, he wanted a few good friends to stand beside him as he blew out his candles.

My son didn’t need more friends to create a better birthday party. Deep inside, he knew a few good friends was more than enough.

Choosing Quality Time

When my dad was diagnosed with cancer, I became hyper-aware of the quality versus quantity conundrum.

At every office visit, my father’s oncologist looked him in the eye and said, “We must consider the quality of your life over the quantity of it.” My father died this spring, and those words echo in my ears louder than ever.

I didn’t want my father to die, but I didn’t want him to suffer either. My father’s death and the days and months leading up to it forced me to contemplate quality over quantity.

How do we spend time when we are feeling alive and well? How much time do we spend with those we love, and what do we do when we are together?

When in the presence of others, do we answer text messages or concentrate on the person sitting directly in front of us?

Quality time means devoting the space to the people you love and talking with them without distractions. These quality moments are the ones we commit to memory and happily recall when walking down memory lane.

Choosing Quality Relationships

Would you rather have hundreds of so-called friends on social media or a few meaningful relationships?

The majority of social media interactions are meaningless. Yet we waste our days scrolling through pages full of people we’ve never met or haven’t seen in years.

In the meantime, we don’t take the time to reach out to real friends.

Catching up with old friends a few times a year is more rewarding than interacting with acquaintances on social media daily.

It’s not the amount of time that creates meaningful relationships but the amount of quality time we spend sharing stories, catching up on new events, and supporting one another.

Think of all the deep, meaningful conversations you’ve shared that impact your heart and mind long after speaking with someone you cherish. These moments may have changed your life trajectory or taught you a valuable lesson about the world or your place in it.

When we tend to our relationships, we share tidbits of wisdom and advice that can remain with us for the rest of our lives. We discover our interests, values, and ways we can make this world a better place.

Choosing Quality Interactions

If you’ve read this blog before, you probably know that I’ve been blogging for seventeen years. But the most meaningful part of blogging isn’t seeing likes on social media or the number of times my articles are shared. It’s not appearing in Forbes or other online publications either.

While I am grateful for those interactions, the best part of writing is the correspondence and comments I receive from readers.

When a woman reaches out in fear of a call-back mammogram or a new mom emails about becoming a stay-at-home parent, I know my stories are helping others.