1.XLE Energy ETF -20% Correction

XLE closes below 200day moving average on new virus

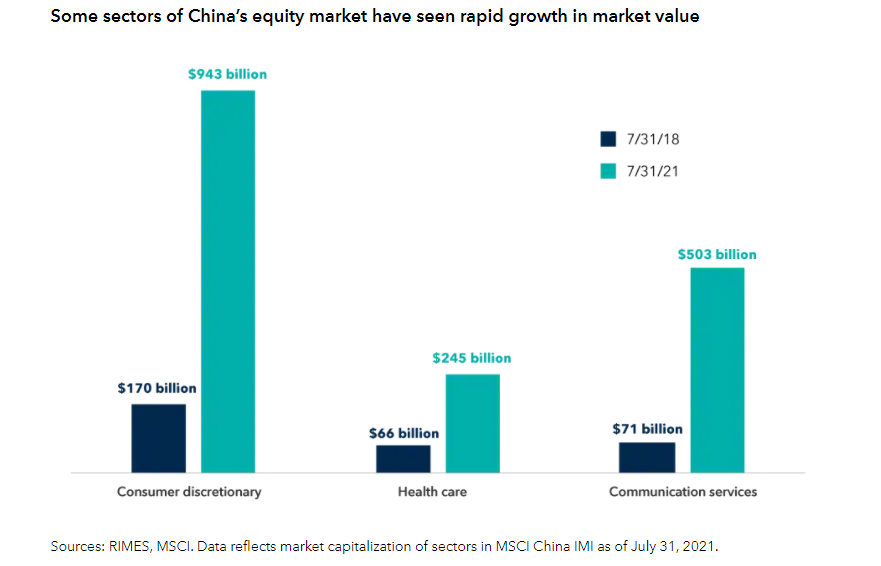

2.Sectors in China that Grew Rapidly

Capital Group Blog

What does heightened China risk mean for investors? What does heightened China risk mean for investors? | Capital Group

3.Robinhood Crypto and Options Trading

Chartr Blog

| Robinhood, the trading platform popular with retail investors, has long touted its mission to “democratize finance”. The company’s main focus — and what it’s been known for — is making it easy for retail investors to trade stocks, and some complicated financial derivatives, right from their phone. But, increasingly, that’s not how Robinhood makes its money. Stocks are…boring? Robinhood did $451m in transaction-based revenue last quarter, more than half of which ($233m) was from users trading cryptocurrencies. Just $52m was from trading vanilla equities (stocks and shares), while $165m was from options trading, which are usually a much higher-risk instrument, that can be significantly more complicated to understand. But the most worrying stat was that 62% of the cryptocurrency trading revenue was from the specific trading of Dogecoin, the cryptocurrency that was originally designed as a satirical joke on the speculative trading of other cryptocurrencies. Ironic. Not so fast So on the surface, Robinhood is growing really, really fast. In its most recent quarter, transaction-based revenue jumped 141% year-on-year. However, if you strip out cryptocurrency entirely, then Robinhood’s transaction revenue grew at a much more sedentary 20% year-on-year. For good or bad, a bet on Robinhood is increasingly a bet on crypto. |

4.How Millennial Investors Lost Millions on Bill Ackman’s SPAC

Institutional Broker

“Robinhood also makes trading options seem easy. “They dumb it down for you,” he says. “If I had not used Robinhood, I would not even know how to trade options. When I look at Fidelity for buying options, it’s like, ‘Okay, this is way too complicated.’ I would just be like, ‘You know what? Forget about it. I’ll just buy the shares.’”

As another retail investor in Ackman’s SPAC puts it, “People are doing this stuff en masse with less sophistication these days. The technology’s sophisticated, but the people on the other side of it are less sophisticated. The problem is that the retail investor doesn’t live in the same world.”

On June 13, a Reddit user calling himself Krurd posted a warning on the social media site: “Don’t buy calls on pre-DA SPACs.”

Krurd, as it turns out, is a 35-year-old unmarried Chicago psychiatrist who had invested, and subsequently lost, nearly $1 million — all of his savings — in call options on Bill Ackman’s special-purpose acquisition company, Pershing Square Tontine Holdings, before it found a merger partner and inked a definitive agreement, or DA.

SPACs are simply publicly traded boxes of cash — blank-check companies — that exist to take a private company public via merger. Until that time, however, investors in a SPAC have no clue what they are buying. That hasn’t stopped them from rushing in.

“Just because I have specialized training doesn’t mean I can’t be just as much of a fool as the guy next door,” the psychiatrist lamented to Institutional Investor in an hour-long phone conversation in July.

Raised in California as the son of Indian immigrants — his mom was a teacher, his dad an IT consultant — he had no expertise in finance but started playing the market with the extra money he had earned moonlighting as a resident doctor. In two years, he had saved more than $300,000. (The psychiatrist asked that II not reveal his name.)

With his student loan payments on hold during the Covid-19 pandemic and his working hours spent in either hospitals or nursing homes, he turned to Robinhood, the popular trading app.

Last fall, he started hearing about the boom in SPACs, and Ackman’s Tontine stuck out: It was the largest, with more than $4 billion to shop for a company. Ackman, a legendary hedge-fund manager who’d just made $2.6 billion on a timely Covid short bet, was behind the SPAC, and he claimed it was the most investor-friendly one ever.

In November, when Ackman told investors in his hedge fund that he expected to be able to announce a deal with a target company by the end of the first quarter, the psychiatrist jumped in.

The SPAC market was red hot, with SPACs sponsored by venture-capital guru Chamath Palihapitiya and former Citigroup investment banker Michael Klein also soaring. In early February, Ackman tweeted a rap video about SPACs minting money, and Redditors went crazy. “That video literally single-handedly caused the stock to rise 10 percent,” recalls the psychiatrist.

The sense of urgency was palpable. “It was like, okay, this is coming very soon. If you don’t get in now, you’re going to miss it,” he says. “There’s just that frenzy of wanting to get in on the ground floor. It’s like getting in an IPO at the ground level” — something that is unavailable to retail investors and a key reason why they buy shares of SPACs before deals are announced.

By March, the psychiatrist was plunking all of his capital into call options on Tontine, which goes by the stock symbol PSTH. “Whatever money I had, I pretty much was putting it all into buying more of it,” he says.

At one point, his stake in Tontine was worth over $1 million on paper. He lost it all when his June 18 calls — with a strike price of $25 — expired worthless; the stock was around $23 at the time.

The Reddit gang had convinced themselves that Ackman’s Tontine was going to merge with a unicorn like Stripe, the online payments processor, or Elon Musk’s Starlink — largely because Ackman himself had joked about “marrying a unicorn” when he launched his SPAC last July. The media was also obsessed with the unicorn theme. But most everyone seemed to ignore the fact that Tontine’s prospectus listed unicorns as just one type of company that Ackman was chasing.

Full Read How Millennial Investors Lost Millions on Bill Ackman’s SPAC | Institutional Investor

5.Asset Class Performance with Higher Inflation

Blackrock Blog

https://www.blackrock.com/us/individual/insights

6.Another Commodity Correction-Iron Ore -40%

One of this year’s hottest commodities is flaming out. The price of iron ore has fallen roughly 40% since mid-July on concerns about demand from China, which makes more than half of the world’s steel. The downturn has dealt a blow to producing countries, notably Australia and Brazil, that are battling to protect fragile economic recoveries from outbreaks of the highly contagious Delta variant of the coronavirus, WSJ notes.

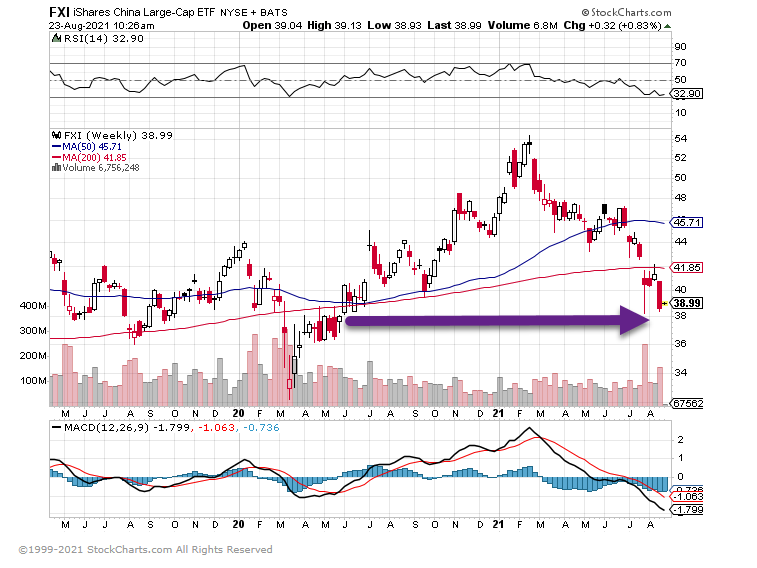

7.China Large Cap -30% from Highs…China Small Cap -25% from Highs

FXI-China Large Cap -30% Correction

China Small Cap -25% Correction

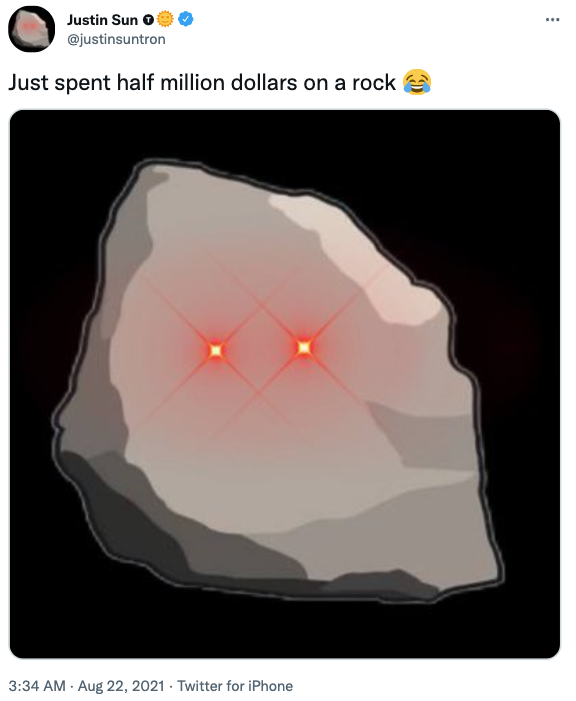

8.NFT Justin Sun Buys NFT of a Rock for More Than Half a Million Dollars

Justin Sun Buys NFT of a Rock for More Than Half a Million Dollars

He can’t even take it home and pet it

Actually, 31-year-old crypto mogul Justin Sun spent $611,710 to buy an EtherRock NFT yesterday. And he can’t even take it home and pet it. Because it’s literally just a Clipart of a rock.

What’s going on: EtherRocks are one of the latest crazes in the world of NFTs (non-fungible tokens), which allow people to acquire ownership of digital assets using blockchain technology.

So why would you want to own one? The same reason you’d buy a rare baseball card—the originals are scarce and some people believe they have tremendous value. EtherRock was one of the earliest NFT projects from way back in 2017.

- “These virtual rocks serve NO PURPOSE beyond being able to be brought and sold, and giving you a strong sense of pride in being an owner of 1 of the only 100 rocks in the game :)” the EtherRock website states.

As of yesterday, the cheapest EtherRock available was selling for 321.12 ether, or $1.05 million.

Zoom out: Reports of NFTs’ deaths have been greatly exaggerated, and after a short lull demand has soared this summer. OpenSea, for instance, became the first NFT marketplace to pass $1 billion in monthly trading volume this month. The platform had just over 300 users in January 2021…now it has nearly 26,000.

Justin Sun Buys NFT of a Rock for More Than Half a Million Dollars (morningbrew.com)

9.Top 10 Home Amenities Search Words

Point 2 Blog –https://www.point2homes.com/news/us-real-estate-news/real-estate-keywords-popular-post-pandemic.html

10.Nobody Wants Money-Breaking the Market Blog

There is a theory in marketing that you don’t sell someone a drill, you sell them the quarter inch hole in a wall.1 Taken further: you don’t sell them the hole in the wall, you sell them a picture hanging on the wall. Even still you don’t sell them the picture, you sell them the beautifully decorated home.

When pushed to their conclusion, these chains always end at some deep emotional need. You don’t sell someone a beautiful home, you sell the family memories made in the home, displayed in the picture. This concept of marketing and advertising is how you end up with commercials of two people in a bath tub at the top of a cliff when the product has nothing to do with any of those things.

All good marketing sells past the actual product to some deep rooted desire or need. And while at times this seems ridiculous, it works, and there is more than a little bit of truth to it.

Anybody who watched the TV show Mad Men is familiar with this concept. They didn’t sell the product, they sold happiness.

Money is the Start of This Chain

It’s rarely ever discussed that money starts this chain. It’s the thing marketers want you to trade away. And we are constantly giving it away.

You want money because you want a new car.

You want money because you want a new house.

You want money because you want to go on a vacation.

You want money because you want to pay for a wedding.

Nobody wants money for money’s sake. Everyone wants money because it gets you something else. Money itself has no value. At all.

It’s just an imaginary concept. Really, it’s just a bunch of numbers on a sheet of paper. Or in a computer. But it’s not real. The drill is real. The hole is real. The picture is real. The emotions are real. But money isn’t.

Money’s Value

Money’s value comes from what it can be traded for, not what it is. So how does this apply to investing?

Well what is the value of a stock? Is it the present value of all future cash flows? Future cash flows are still just money. They are just money through time. And as we’ve said money is useless by itself. It’s not what you or I want.

I want to send my little girls to college someday. And if the money in the future lets me do that, then it’s valuable to me because I can trade it for something valuable: an education. So when I trade money for an S&P index fund in their 529 plan I’m doing it for the expectation of future education.

But I’m also buying the feeling of being a good parent. The feeling that I’m taking care of my family. It’s difficult to separate the two.

An investment is still something you have to purchase, and people don’t buy anything for the immediate product. We buy something because it brings us closer to meeting a deep emotional need or desire.2

Do Investments Provide More Than Returns?

Many investments portray this concept perfectly.

Do investors buy Tesla stock for future cash flows? Somewhat. Do they also buy it because it means they are innovative, trend setting, bold, contrarian, and they agree with Tesla’s vision of the future? Absolutely.

Tesla cars are expensive. Can’t buy a Tesla car? Well you can be part of the mission by purchasing the stock.3

ESG is another example. Do people buy ESG funds because they expect higher returns on their money? Somewhat. Do they also do it because it means they are socially conscious, aware, compassionate, and forward thinking? Absolutely.

Taken a step further, there are now “activist” ETFs where the ETF’s goal is to own a large enough part of the company to command board seats and change the underlying practices of the company towards thier own goals. This isn’t activist investing to make more money, it’s activist investing for a greater purpose.

Did WSB and their followers buy Gamestop stock because of the returns, or because they wanted to make a statement? A couple hundred dollars to be part of a collective mission expressing your views and commanding the attention of the world. Seems like a deal.

And finally Bitcoin. Bitcoin’s most valuable quality is it’s original whitepaper, born out of the financial collapse of 2008. Bitcoin isn’t a currency, it isn’t a store of value, it is a mission, a greater purpose. It is a gigantic Fuck You statement to the monetary system that bailed out banks in 2008 but didn’t bail out everyone else.4 That’s why it creates so much passion in its proponents.

Nobody argues about thier municipal bond on social media. But they do argue about about their mission, their passions, and their beliefs all the time.

Do you truly believe in the mission and purpose of Tesla, ESG, VOTE, WSB and Bitcoin if you don’t own these investments? Can you still believe in the mission if you sell them?

What is a Rational Investment?

For many, the answer is no. And let me be clear, there’s nothing wrong with this.5 These may not necessarily be pristine long term investments in the traditional financial sense6. A financial return is great, but it’s secondary to the deeper emotional fulfillment being purchased.

Some would say this isn’t rational. The investment is an inferior investment. It’s a bubble. You shouldn’t own it.

And yet, nobody wants money. Nobody. We all want what money will provide later. So when you say that an investment is worth X because of the money it will provide in the future, you’re only addressing part of the equation.

Look at the paths. Money is far, far away from the end goals we all seek. If an investment jumps some steps in the chain and provides the end goal right away–right now–why not take that shortcut? We’re not really going to want the money in the future anyway.

Are the rational people those who evaluate the worth of something based only on its future cash flows? Or–if we don’t truly want money in the first place–are they the irrational ones?

Nobody Wants Money

When you hear a financial analyst bemoan that an asset has become a bubble or its price is irrational, think about the marketing chain. From a financial perspective the analyst may be right. But from another perspective, a perspective closer to our true needs and wants in life, there probably isn’t a bubble. Instead, it’s marketing fulfilling our deepest desires with products that many don’t believe should serve that purpose.7

Now on a grand scale, this can be dangerous. It’s not heathy for any single product to to define who we are as a person, and it’s not a good idea for a single investment product to define our portfolio. Everything in moderation.

However, it’s always a good idea to remember from time to time why we invest in the first place.

We invest to provide for our families.

We invest for a secure future.

We invest to build a better life for ourselves.

We invest to belong to something bigger than ourselves.

We invest to express our values.

We invest to give back to the world.

But we don’t invest for money. Never forget that.