1. Russell 1000 Value is a Short of Technology Sector.

The Big (Tech) Short

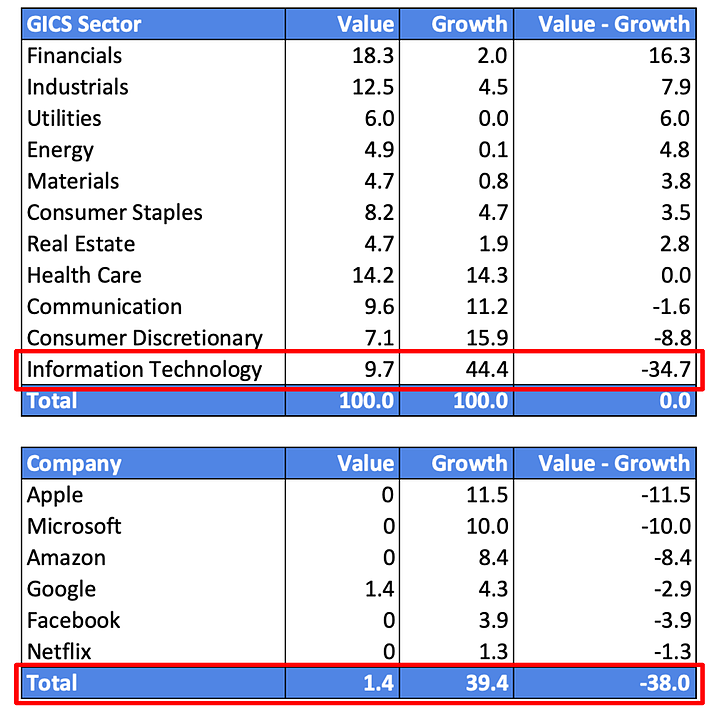

In the Great War, there are many battlefronts. Investors furiously debate the role of low interest rates, outdated accounting rules, and passive flows on value investing. Rather than get caught up in an academic discussion, let’s look at the companies you actually get when you buy a value portfolio. Exhibit 4 shows the sector composition of Russell 1000 Value and Growth.

Value investors are making an epic 34.7% short bet against the technology sector. Moreover, this bet is more than fully explained by their underweight to the FAANG+M companies. Value has a meager 1.4% position in FAANG+M compared to Growth’s 39.4%. Not only are value investors short tech, but they are short Big Tech. And in a big way.

Exhibit 4

Russell 1000 Value vs. Growth Exposures

Source: Sparkline, iShares, FTSE Russell (as of 8/6/2020)

· Kai Wu–Value Investing Is Short Tech Disruption

https://www.sparklinecapital.com/post/value-investing-is-short-tech-disruption

Found at Barry Ritholtz Blog https://ritholtz.com/2020/08/weekend-reads-431/

2. Disruption Subthemes Outperformance….Disruptor Sub-Sectors

We next examine the performance of portfolios built around each of these subthemes. These portfolios have all done quite well, but some have done better than others. For example, cloud computing has been consistently profitable, while robotics has only heated up more recently.

Exhibit 15

Disruption Subtheme Performance

Source: Sparkline, MSCI, S&P (as of 7/31/2020)

3. The Fortune Global 500 is now more Chinese than American..China/Taiwan 133 vs. U.S. 121

3.The Fortune Global 500 is now more Chinese than American..China/Taiwan 133 vs. U.S. 121

The Top 10

Revenues ($M)

ALAN MURRAY and David Meyer

The Fortune Global 500 list is out this morning, and you can find it here. Walmart once again tops the list, followed by three Chinese companies—Sinopec, State Grid and China National Petroleum. The big story is this: for the first time, there are more Fortune Global 500 companies based in Mainland China and Hong Kong than in the U.S.–124 vs. 121. Add in Taiwan’s companies, and the Greater China total jumps to 133.

It’s hard to overstate the significance of the change in the global economy that represents. As Fortune Editor-in-Chief Cliff Leaf points out, when the Global 500 list first came out in 1990, there were no Chinese companies on the list. In the intervening three decades, the Chinese economy has skyrocketed, powered by a global trade boom that expanded from 39% of global GDP to 59%.

So now what? That’s the question Geoff Colvin explores in his piece here. The U.S. and Chinese economies are intertwined in so many ways, it’s hard to imagine them ever truly “decoupling.” Yet powerful political forces on both sides seem to be propelling them in that direction.

It’s worth noting that the Global 500 ranking is based on revenues, and many of the Chinese companies on the list—like the three mentioned above—earned their spot not necessarily because of their business dynamism, but because they are state-supported monopolies in the world’s largest market.

And by the way, being on the list is no guarantee of profitability. The five biggest losers on this year’s list—Pemex, Schlumberger, Softbank, the U.S. Postal Service and Nissan—lost $52 billion in 2019. (Sixth and seventh in the money losers’ ranking were Deutsche Bank and General Electric, which together lost another $11 billion.) Saudi Aramco, on the other hand, netted $88 billion in profits and is Fortune Global 500’s most profitable company for the second consecutive year.

Enjoy the list. It remains the world’s best snapshot of the state of global business. More news below.

Alan Murray

@alansmurray

alan.murray@fortune.com

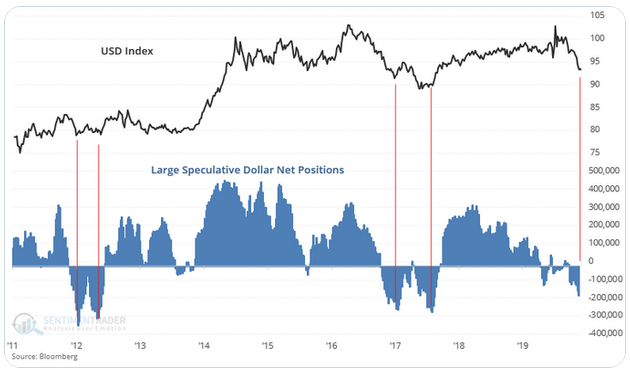

4. Speculative Traders Never So Bearish on Dollar-Contra-Indicator?

From Dave Lutz at Jones Trading

SentimentTrader notes Traders have rarely been this bearish on the Dollar – Large speculative Dollar net positioning is at the *lowest level in years* – This is a crucial risk for equities. A dollar rally could put significant pressure on stocks. The dollar index was headed for an eighth consecutive week of losses, its longest weekly losing streak since June 2010.

Will This Dollar Ever Weaken?

Kenneth Rapoza Senior Contributor

King dollar. Who will dethrone it? Surely not the Fed. At least not yet. Despite rate cuts, the … [+]

Will this dollar ever weaken? President Trump thinks the only way is to drive real rates down to zero. Or negative. Will the Federal Reserve take that route, just to weaken the dollar?

During the Great Recession, the dollar was supposedly finished. Nobody wanted it. It was as good as toilet paper, the Apocalypse traders and their pundits said. The dying dollar was their version of the “peak oil” theory from 2002.

And now for the last three years, global investors have been wondering when the dollar would weaken. That is especially true for fund managers invested in emerging markets. A strong dollar is a headwind for them, and a hard sell to bring in new money to emerging market portfolios who tend to underperform when the dollar is too strong.

The dollar has had the kitchen sink thrown at it, and nothing hurts it.

Interest rates in the U.S. declined surprisingly last, which tends to make the dollar less attractive to foreign bond buyers. Less demand for dollar assets, like Treasurys, means a weaker dollar. That didn’t happen.

Last year the Fed cut the Federal Funds rate three times instead of expectations for four rate hikes. The dollar responded by strengthening against most emerging market currencies.

“President Trump has managed to be successful at influencing much of the financial markets through policies and tweets, with the sole exception of the dollar,” Steven Li Jen, CEO of London-based Eurizon SLJ Capital, wrote in a note on January 20.

The U.S. dollar – as measured by the Federal Reserve’s Trade Weighted Dollar Index – is up about 9% since the start of 2018. The factors behind the currency’s rally — a rally no one in the emerging market world hoped would happen, at least — are varied. Here are the three main developments, according to BlackRock’s iShares U.S. ETF director, Christopher Dhanraj.

· The “carry trade”: Widening growth differentials between the U.S. (strong) and other advanced economies (Europe, weak) have been manifested in interest rates. Eurozone has had negative interest rates, and the U.S. had at least 2% interest rates. European banks could borrow at zero in euros and were basically guaranteed 2% in dollars. This led to the revival of the “carry trade” not just between the euro and dollar, but globally. Dhanraj sees this trend as a key driver of dollar strength.

· Dovish central banks: While the Fed hiked in 2018, the rest of the world was either on hold (Europe) or cutting (Brazil, Russia, China…). In 2019, the Federal Reserve reversed course and cut rates, but other major central banks were still cutting so the net impact on dollar demand was unchanged.

· Demand for U.S. assets: Global attraction to U.S. based assets is another tailwind for the dollar. Rising protectionism and geopolitical tensions influenced demand for U.S. Treasuries within sovereign bond funds and a preference for U.S. equities among global investors who have been greatly rewarded for putting money to work in the S&P 500, Dow and Nasdaq, all at record-breaking highs.

Global investors pour into the U.S. stock market. More demand for dollar-denominated assets means a … [+]

The dollar has had an impressive run over the last two years.

Rate cuts caused by trade war uncertainties and low inflation have done nothing to weaken it.

Emerging market stocks have underperformed the U.S. for the last several years. Ask a foreign fund manager if they think that’s coming to an end and they’ll all say yes. They’ve been saying this now for at least three years.

Over the last five years, BlackRock’s iShares MSCI Emerging Markets (EEM) ETF has gained 9%. If you had invested in State Street’s SPDR S&P 500 (SPY) instead and just let it ride, you would have gained 59%.

The dollar’s “safe haven” role also helped during the trade war. No economy is as big and as strong as the U.S. economy. Strong economy, strong dollar.

The dollar’s strength and high stock market valuation may limit its upside, but no one expects the rug to be pulled out from under King Dollar.

“The dollar is the high yield safe haven now, especially within the G10,” says Emily Weis, macro strategist for State Street. “Dollars are doing well in risk-on and risk-off these days. All of a sudden something that used to have carry appeal, like the Brazil real, is losing out to the dollar.”

“It’s been very popular to call the top in the dollar,” says Weis. “We think it’s overvalued, too. And you got slower growth here that’s not bullish for the dollar. But you can’t hold this thing down, so we’re not calling a top yet.”

https://www.forbes.com/sites/kenrapoza/2020/01/29/will-this-dollar-ever-weaken/#5bcc2a533046

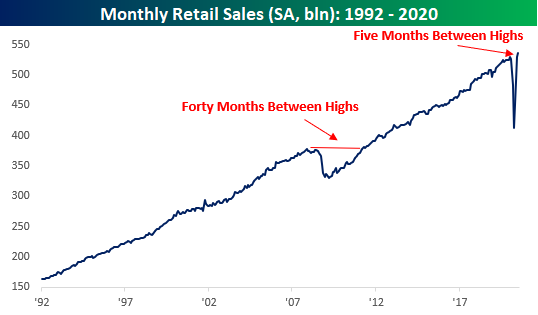

5. Retail Sales Rock to New Highs

Bespoke Investment Group–At the headline level, July’s Retail Sales report disappointed as the reading missed expectations by nearly a full percentage point. Just as soon as the report was released, we saw a number of stories pounce on the disappointment as a sign that the economy was losing steam. Looked at in more detail, though, the July report wasn’t all that bad. While the headline reading rose less than expected (1.2% vs 2.1%), Ex Autos and Ex Autos and Gas, the results were much better than expected. Not only that, but June’s original readings were all revised higher by around a full percentage point.

Besides the fact that this month’s report was better underneath the surface and June’s reading was revised higher, it was also notable as the seasonally-adjusted annualized rate of sales in July hit a new record high. After the last record high back in January, only five months passed until American consumers were back to their pre-Covid spending ways. For the sake of comparison, back during the Financial Crisis, 40 months passed between the original high in Retail Sales in November 2007 and the next record high in April 2011. 5 months versus 40? Never underestimate the power of the US consumer!

While the monthly pace of retail sales is back at all-time highs, the characteristics behind the total level of sales have changed markedly in the post COVID world. In our just released B.I.G. Tips report we looked at these changing dynamics to highlight the groups that have been the biggest winners and losers from the shifts. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-

https://www.bespokepremium.com/interactive/posts/think-big-blog/retail-rocks-to-new-highs

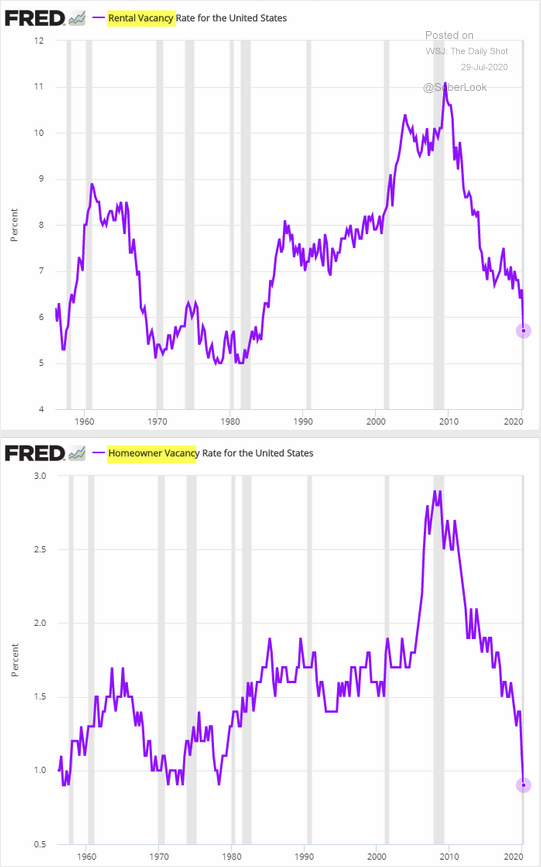

6. The US rental vacancy rate dipped to the lowest level since the 1980s.

WSJ-The Daily Shot

7. 96% Increase Home Inventory for Sale San Fran

Zerohedge

According to the company’s “2020 Urban-Suburban Market Report,” home prices in the city have fallen 4.9% year-over-year, while inventory has jumped 96% during the same period, as a flood of new listings hit the market. Zillow notes that they aren’t seeing the same trend in cities such as Miami, Los Angeles, Washington D.C. or Seattle.

Via Zillow:

When comparing the principal city to its surrounding suburbs, the San Francisco metro area does break the mold. Higher levels of inventory, up 96% YoY following a flood of new listings during the pandemic, are sitting on the market in the city proper, a significantly larger jump than the surrounding suburbs. Whereas in similar cities like Los Angeles, Miami, Boston, Seattle, and Washington, D.C., declining or flat inventory is a consistent trend within and outside the city limits. Relatively higher inventory has different causes by city, and is not clearly attributable to either supply or demand. In San Francisco, though, the softening is clear as sellers inundate the market and buyers have not changed their pace to match — newly pending sales in the city are up only 1.7% YoY.

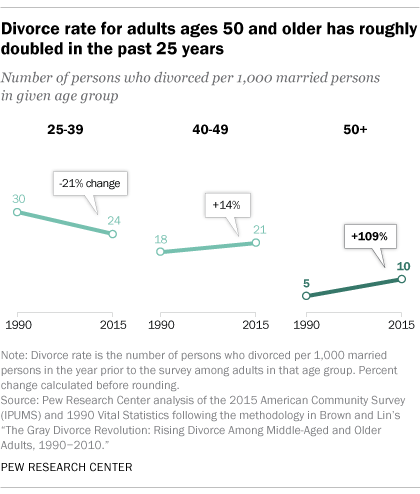

8. Divorce Rate Doubled for Over 50 Couples.

In 2015, for every 1,000 married persons ages 50 and older, 10 divorced – up from five in 1990, according to data from the National Center for Health Statistics and U.S. Census Bureau. Among those ages 65 and older, the divorce rate has roughly tripled since 1990, reaching six people per 1,000 married persons in 2015.

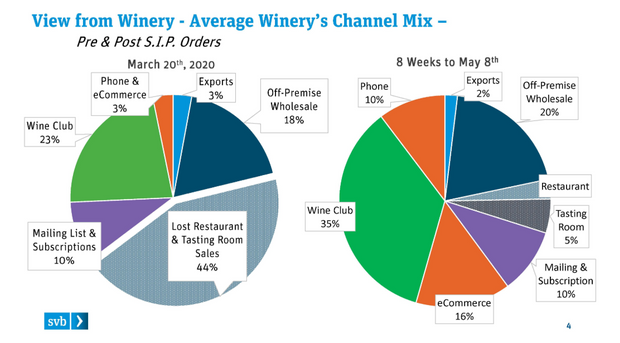

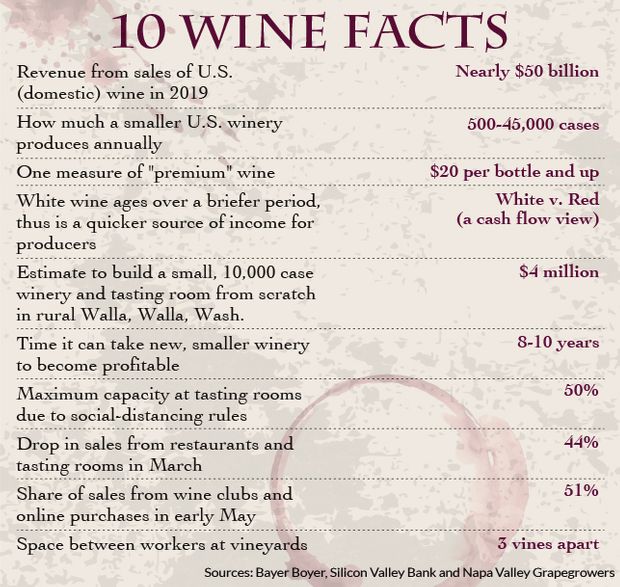

9. How the pandemic is upending business in wine country

Two U.S. wine industries

The puzzle for smaller, premium winemakers to solve has been how to reach customers when retail sales have been booming, but mostly benefiting the nation’s wine Goliaths.

“There’s two wine industries,” McMillan said. “Roughly 75% comes through the largest 13 wineries,” he said, pointing to top sellers that include the E&J Gallo Winery, The Wine Group and Constellation Brands STZ. “They make wine, sell it to wholesalers, restaurants or grocery stores, and then it goes to the consumer,” he said. “The smaller wineries don’t get much wholesale attention.”

What has been working, for some smaller producers, has been efforts to reach customers directly to spur sales, including online through their own websites, instead of relying on restaurants and others to create a buzz.

That’s meant repurpurposing staff and going back to the basics, including hitting the phones to drive sales. “It’s not like small wineries figured out overnight how to do outreach for online retail,” McMillan said. “For some, the only thing on their website was a shopping cart icon.”

This chart breaks down how sales have shifted at many U.S. wineries after shelter-in-place orders took hold, as producers ramped up business through wine clubs, online and over the phone.

Wine buying shift in 2020

SVB

Further into summer, as more restaurants reopened under new social-distancing rules, off-premise alcohol sales remained robust.

Spirits have led the charge higher, with sales jumping 29.3% for the week ended July 18, versus a year prior, while wine sales rose 19.7%, according to the latest data from Nielsen.

“A lot about wine is the story,” said Russ Colombo, a senior vice president at Baker Boyer, a lender in Walla Walla, Wash., focused on financing smaller wineries in the region. “The first bottle you sell or place at a restaurant is difficult enough,” he said, but after that “it’s all about momentum.”

For winemakers able to drum up their own support and sell directly to customers, a bonus is that they don’t have to pay a middleman, which can mean about twice as much profit for a producer when compared with wholesale transactions, Colombo said.

On the other hand, Colombo also called wineries “one of the toughest things to finance,” not only because of the fierce competition, but also because winemaking takes talent, a long view and probably luck.

“Winemakers are good at agriculture,” he said. “But for higher-end red wine, even before it hits the market, it could be two years. And in those two years, the world changes a lot.”

Wine Facts

One boon for smaller producers during the national tug of war over reopening, face masks and social-distancing restrictions has been visitors flocking to nearby wineries and vineyards for a bit of respite.

How the pandemic is upending business in wine country

Retail sales have been booming, but mostly benefiting the nation’s wine Goliaths, leading smaller wine makers to reach out to customers directly

10. Five Leaders Share Their No. 1 Tip for Building (and Sustaining) A Purpose-Driven Business

Purpose demonstrates why employees should show up to work excited.

BY MARCEL SCHWANTES, FOUNDER AND CHIEF HUMAN OFFICER, LEADERSHIP FROM THE CORE@MARCELSCHWANTES

Purpose is a term that confuses many leaders.

We often see a company’s “purpose” as friendly-sounding platitudes about customer-centricity or people, but purpose is one leg of the culture stool (along with mission and vision) that should motivate and provide clarity to employees. Purpose demonstrates why employees should show up to work excited.

Seventy-one percent of professionals say they would be willing to take a pay cut to work for a company that has a mission they believe in, according to a recent LinkedIn survey.

As the U.S. economy braces for a bounce back and companies begin thinking about hiring, ensuring your business is grounded in purpose and supported by a strong mission is more important than ever.

I connected with five executives to uncover how they’ve successfully built purpose-driven businesses. Here are their top tips:

1. Explicitly define your culture with purpose in mind

“Vagueness is the enemy. Few purpose statements are explicit enough to drive behavior,” says Jason Korman, CEO and founder of innovative Culture Design group, Gapingvoid.

The goal is to inform the behavior of employees. Korman suggests asking yourself: ‘If people show up each day believing this purpose statement, will it guide the execution of their roles?’.

“Culture is the most powerful management system leaders have at their disposal,” shared Korman. “Purpose is an essential part of building culture as it has the potential to inform behavior at scale.”

2. Let your “why” be a KPI

While companies often look at things like revenue and sales as metrics of success, purpose-driven businesses also measure themselves against their mission. “Having a clear vision of the ‘why’ behind a business is critical to creating long-lasting success,” says Bansi Lakhani, Founder and Chairman of family-owned fashion house and scrub retailer, Healing Hands.

Lakhani believes that you can’t have purpose without passion and everything you do should be measured against your mission. “Purpose-driven businesses are founded out of the desire to make a change – for the consumer, an industry or even the world,” he says.

Lakhani suggests looking at each project from the perspective of ‘how can this product help my consumers?’ not ‘how much of this can we sell?’ – be thoughtful and prioritize quality over quantity. This allows your team to feel more connected to the work they’re doing and provides a clear understanding of the motivation behind each business decision.

3. Tackle problems at the community level

When businesses come together to achieve a collective impact, it forces the rethinking of how communities can work together. This is where purpose is born.

“Take some time to understand the social challenges facing your communities,” suggests Manik Bhat, Founder and CEO of Healthify, a company that works with payers and providers to create social determinants of health infrastructures. “By doing so, corporations can develop strategies and interventions that improve the health of the community and drive positive change.”

With a pulse on communities, businesses can do their part to identify where critical help is needed and deploy their local workforce to aid in the solution.

4. Inspire your team to invest in the mission

When building a purpose-driven business, it’s crucial to put the right team in place that’s equally invested in your company’s mission. This starts with ensuring you’re giving your employees a reason to be inspired and providing them with the right tools for success.

According to Vetri Vellore, CEO & Founder of business operations and goal setting software company, Ally.io, “As a leader, it’s your job to ensure everyone is equipped with what they need to do their jobs successfully and meet their goals.” This means taking a look at your company holistically. Are the right people supporting the right roles?

“Your business’s success is predicated on the team being motivated, mentally and emotionally safe, and bought into your mission,” adds Vellore.

If you genuinely believe in what you’re doing, you’ll inspire your team to feel the same. It’s critical to never lose sight of the “why” behind your business.

5. Ask yourself tough questions

“To lead with purpose, you need to ask tough questions,” says Robert E.G. Beens, Co-Founder and CEO of Startpage, creator of the world’s first private search engine. “Ask yourself ‘is my business model ethical?’ and ‘am I withstanding the pressure of (often shorter-term) financial gains in order to stay true to my business’s purpose?'”

Beens recommends approaching each decision with the same exercise of asking if it aligns with your purpose. “We have regular team discussions on the essentials of privacy, and its technical ramifications within our product,” says Beens. “Do what you believe is right, not what everyone else is doing.”

Leading a company today will undoubtedly look different than ever before. By reflecting, investing and inspiring, companies can ensure they’re building a business with purpose.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.