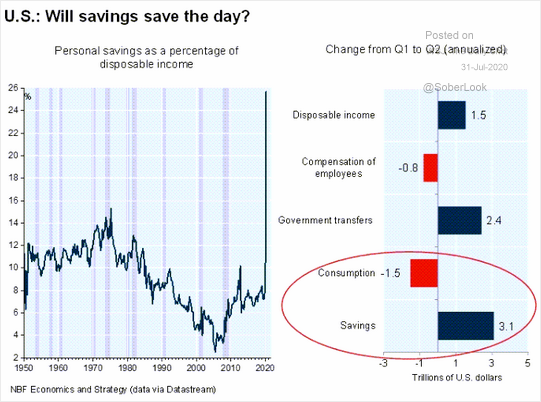

1. Will the Huge Spike in U.S. Savings Rate Lead to Pent Up Demand?

The Daily Shot https://blogs.wsj.com/dailyshot/2020/07/31/the-daily-shot-online-job-seeking-activity-slows/

2. Nasdaq Volatility Index Down But Not Yet Back to Pre-Covid Lows.

VXN Nasdaq Volatility Index

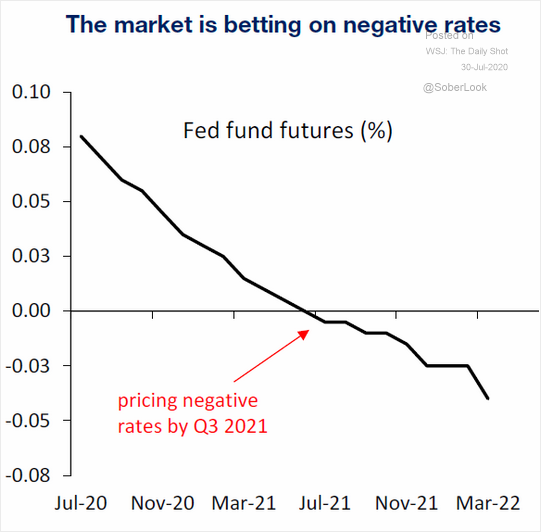

3. The Market is Betting on Negative Rates.

In fact, the market continues to price in the possibility of negative rates next year.

Source: Piper Sandler

https://blogs.wsj.com/dailyshot/2020/07/30/the-daily-shot-the-distorted-phillips-curve/

4. Yield Has Historically Been a Strong Predictor of High-Yield Returns.

AllianceBernstein

https://www.linkedin.com/in/damien-ramondo-35abaa26/

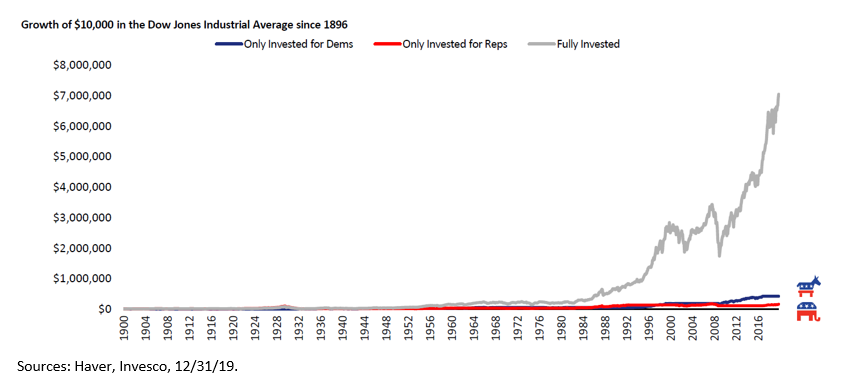

5. As The Election Approaches…..

And finally, and to reinforce the main message of this letter, there is a big difference between what tax hikes mean to individuals compared to markets. Markets tend to find a way to perform, regardless of who is in office, and despite any changes in tax policy. This chart tells the story quite nicely.

ELECTIONS AND THE MARKETS-PETER MALLOUK https://creativeplanning.com/blog/elections-and-the-markets/

6. U.S. Bankruptcies at 10-Year High As Pandemic Takes Its Toll

by Felix Richter,

As the coronavirus pandemic continues to wreak havoc on the U.S. economy, bankruptcies are on track to hit the highest level in at least 10 years according to figures compiled by S&P Global Market Intelligence.

According to the analysis, which only includes public companies and private companies with public debt and/or assets/liabilities over $2 million or $10 million, respectively, 424 companies announced their bankruptcy through August 9 this year, up 22 percent from the same period last year and the highest level since 2010.

Consumer-focused companies were most affected by the pandemic, with more than 100 of them filing for bankruptcy this year. Due to the lockdown, the already battered retail sector was hit by a wave of bankruptcies that swept away household names such as J.Crew, Ascena Retail and J.C. Penney.

https://www.statista.com/chart/22563/bankruptcies-in-the-us/

7. Public Firms Borrowing at Record Rates But Banks Tightening Standards for Small Business.

Much of America Is Shut Out of The Greatest Borrowing Binge Ever

Stimulus has helped Amazon, Visa borrow at record-low rates

Small companies face tighter conditions, threatening recovery

Unprecedented government stimulus has allowed more companies to borrow at lower rates than ever before. Yet amid the credit boom, smaller firms that power America’s economic engine are often being shut out, hamstringing the recovery just as it begins.

The Federal Reserve’s pledge to use its near limitless balance sheet to buy corporate bonds has aided stricken airlines, oil drillers and hotels. It’s also helped companies from Alphabet Inc. and Amazon.com Inc. to Visa Inc. and Chevron Corp. access some of the cheapest financing ever seen. All told, firms have sold about $1.9 trillion of investment-grade debt, junk bonds and leveraged loans this year, according to data compiled by Bloomberg.

Survival Uncertain

It’s a battle that smaller companies are decidedly losing.

Some 70% of bank senior loan officers surveyed by the Fed said they have tightened lending standards on loans for small commercial and industrial firms in the third quarter. That’s the highest proportion since late 2008. The trend also extends to mid-size and larger firms as well, though the latter enjoy unprecedented access to capital markets. About 54% said they increased premiums for small borrowers, the most in over a decade.

“Everyone is willing to lend to the biggest firms,” said Olivier Darmouni, a professor of finance at Columbia Business School. “But since the pandemic has not been tamed, creditors are now asking if the businesses will actually survive and they’ll get their money back. For smaller firms, there’s a lot more uncertainty of that.”

In a bid to encourage banks to extend credit to mid-size firms, the Fed introduced its $600 billion Main Street Lending Program in April, wherein those making eligible loans can sell 95% of them to the central bank. Despite efforts to broaden the program, it’s issued just $253 million in loans as of Aug. 10. That’s compounded criticism that it only works for a narrow set of companies, is too complex and doesn’t provide enough incentive to risk-averse lenders.

Boston Fed President Eric Rosengren said Wednesday that as borrowers and banks become more familiar with the program, it’s seeing a steady increasein participation, adding that it may become even more essential should the coming months bring a resurgence of the virus.

A spokesman for the Fed referred Bloomberg to Rosengren’s remarks when contacted for comment.

Still, the facility stands in contrast to the Paycheck Protection Program, run by the Small Business Administration and the Treasury, which dolled out more than 5.2 million loans totaling $525 billion before closing last week. The PPP facility, for its part, has gotten its own share of criticism, with some saying the smallest companies and those in disadvantaged areas have been shut out, while politically connected businesses and firms that aren’t struggling have gotten funding.

Read more: Direct lending boom fizzles with investors looking elsewhere

Making matters worse, direct lenders, which often provide financing to small and mid-size firms, have been retrenching for months as they tend to their own portfolios, while those sitting atop the most capital are increasingly targeting bigger deals.

Business development company Ares Capital Corp. said on a second quarter earnings call that the average Ebitda size of companies it finances has doubled versus the same period a year ago, and that it’s also charging more to lend. Apollo Global Management Inc. set up a new lending business last month focusing on loans of around $1 billion.

“There is little the Fed can do when there are liquidity issues outside the banking system,” Financial Insyghts’s Atwater said. “It has really highlighted the challenge in trying to provide credit to small businesses in a way that is prudent for the lender.”

Cerebro Capital, an online platform that allows middle-market borrowers to source credit facilities, saw a surge in demand for its services amid the tighter lending market, according to Allan Smallwood, senior director of capital markets at the firm. At the end of July, Cerebro helped a fifth generation family-owned commercial printing business close a deal after its existing bank lender exited when it tripped a loan covenant, he said.

Haves, Have Nots

Of course, the tale of diverging ‘haves’ and ‘have nots’ is hardly new in credit, manifesting when economic turbulence prompts lenders to retrench and investors to seek the relative safety of stable, blue-chip firms.

But the magnitude of the disparity this time around is more alarming when combined with expectations for record corporate defaults this year and following second quarter data showing the economy suffered its sharpest downturn since at least the 1940s. A growing chorus is also warning on inflation, which can hit smaller firms particularly hard. One of those is Larry McDonald, founder of The Bear Traps Report investment newsletter.

“It’s an inequality explosion in terms of financial sustainability,” said McDonald, who also authored the book ‘A Colossal Failure of Common Sense’ about the demise of Lehman Brothers Holdings Inc. “You have financial conditions tightening in some spots, and then wide open for the big guys — it’s crazy.”

— With assistance by Kelsey Butler, Molly Smith, James Crombie, and Davide Scigliuzzo

Thousands of Small Businesses Going Bankrupt in US Are Uncounted in Covid

Have a confidential tip for our reporters?

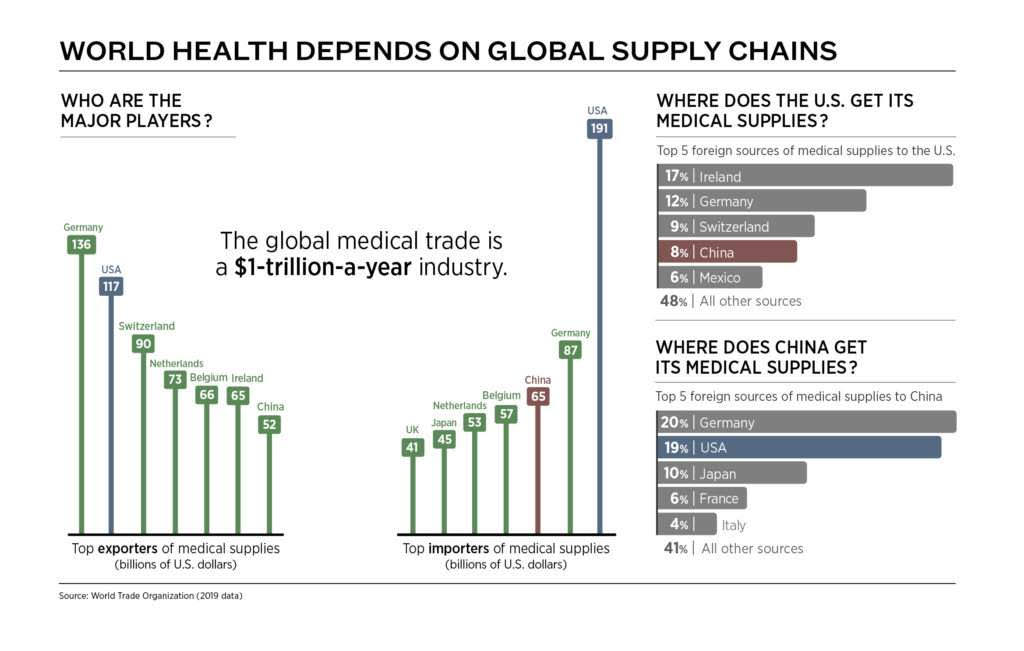

8. Major Players in World Health Supply Chain.

Found at Barry Ritholtz blog https://ritholtz.com/

9. Fortnite Takes On Apple

By Dylan Byers

Epic Games, the maker of the popular video game “Fortnite,” became locked in a dramatic standoff with Apple and Google on Thursday that immediately renewed questions about the two tech giants’ power over the digital marketplace.

The standoff pits Epic Games, a $17 billion gaming company, against the trillion-dollar tech giants over how money flows between the companies — an issue that has also been raised by many other app-makers who argued that Apple and Google use their market power to take a cut of money that they have no right to.

The situation began after Epic intentionally circumvented a much-criticized Apple policy that requires certain apps to give the iPhone giant up to a 30 percent cut of all in-app purchases.

That led to Apple removing Fortnite, which has 350 million registered players, from its app store. Epic Games, appearing to anticipate the move by Apple, responded by suing the company for anticompetitive behavior.

Later, on Thursday night, Google removed Fortnite from the Google Play store for similarly circumventing the fee it requires on in-app purchases.

Epic Games becomes the most high-profile company yet to challenge Apple and Google’s rules around payments — and at a crucial time. All of this comes as Apple and Google are facing antitrust scrutiny in Washington.

Epic Games and its founder, Tim Sweeney, have long criticized Apple and Google, the world’s primary smartphone makers, for requiring certain apps to give them a cut of all in-app purchases. Ahead of last month’s tech antitrust hearings, he accused them of being a duopoly.

JULY 30, 202002:23

But while many companies have complained for years about the fees that Apple and Google charge developers, Epic Games on Thursday became the first company to take action and force their respective hands.

On Thursday, Epic implemented its own in-app payment system for Fortnite, effectively circumventing the 30-percent fees. Apple and Google responded by removing the Fortnite app from their systems entirely.

“Today, Epic Games took the unfortunate step of violating the App Store guidelines that are applied equally to every developer and designed to keep the store safe for our users,” Apple spokesperson Fred Sainz said in a statement. “As a result their Fortnite app has been removed from the store.”

10. How to Spend the First 10 Minutes of Your Day

If you’re working in the kitchen of Anthony Bourdain, legendary chef of Brasserie Les Halles, best-selling author, and famed television personality, you don’t dare so much as boil hot water without attending to a ritual that’s essential for any self-respecting chef: mise-en-place.

The “Meez,” as professionals call it, translates into “everything in its place.” In practice, it involves studying a recipe, thinking through the tools and equipment you will need, and assembling the ingredients in the right proportion before you begin. It is the planning phase of every meal—the moment when chefs evaluate the totality of what they are trying to achieve and create an action plan for the meal ahead.

For the experienced chef, mise-en-place represents more than a quaint practice or a time-saving technique. It’s a state of mind.

“Mise-en-place is the religion of all good line cooks,” Bourdain wrote in his runaway bestseller Kitchen Confidential. “As a cook, your station, and its condition, its state of readiness, is an extension of your nervous system… The universe is in order when your station is set…”

Chefs like Anthony Bourdain have long appreciated that when it comes to exceptional cooking, the single most important ingredient of any dish is planning. It’s the “Meez” that forces Bourdain to think ahead, that saves him from having to distractedly search for items midway through, and that allows him to channel his full attention to the dish before him.

Most of us do not work in kitchens. We do not interact with ingredients that need to be collected, prepped, or measured. And yet the value of applying a similar approach and deliberately taking time out to plan before we begin is arguably greater.

What’s the first thing you do when you arrive at your desk? For many of us, checking email or listening to voice mail is practically automatic. In many ways, these are among the worst ways to start a day. Both activities hijack our focus and put us in a reactive mode, where other people’s priorities take center stage. They are the equivalent of entering a kitchen and looking for a spill to clean or a pot to scrub.

A better approach is to begin your day with a brief planning session. An intellectual mise-en-place. Bourdain envisions the perfect execution before starting his dish. Here’s the corollary for the enterprising business professional. Ask yourself this question the moment you sit at your desk: The day is over and I am leaving the office with a tremendous sense of accomplishment. What have I achieved?

This exercise is usually effective at helping people distinguish between tasks that simply feel urgent from those that are truly important. Use it to determine the activities you want to focus your energy on.

Then—and this is important—create a plan of attack by breaking down complex tasks into specific actions.

Productivity guru David Allen recommends starting each item on your list with a verb, which is useful because it makes your intentions concrete. For example, instead of listing “Monday’s presentation,” identify every action item that creating Monday’s presentation will involve. You may end up with: collect sales figures, draft slides, and incorporate images into deck.

Studies show that when it comes to goals, the more specific you are about what you’re trying to achieve, the better your chances of success. Having each step mapped out in advance will also minimize complex thinking later in the day and make procrastination less likely.

Finally, prioritize your list. When possible, start your day with tasks that require the most mental energy. Research indicates that we have less willpower as the day progresses, which is why it’s best to tackle challenging items – particularly those requiring focus and mental agility – early on.

The entire exercise can take you less than 10 minutes. Yet it’s a practice that yields significant dividends throughout your day.

By starting each morning with a mini-planning session, you frontload important decisions to a time when your mind is fresh. You’ll also notice that having a list of concrete action items (rather than a broad list of goals) is especially valuable later in the day, when fatigue sets in and complex thinking is harder to achieve.

Now, no longer do you have to pause and think through each step. Instead, like a master chef, you can devote your full attention to the execution.

Ron Friedman, Ph.D., is an award-winning psychologist and the founder of ignite80, a company that teaches leaders practical, evidence-based strategies for working smarter and creating thriving organizations. He is the author of The Best Place to Work: The Art and Science of Creating an Extraordinary Workplace, and frequently delivers keynotes and workshops on the science of workplace excellence. To receive an email when he posts a new article, click here.

https://hbr.org/2014/06/how-to-spend-the-first-10-minutes-of-your-day

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.