1. 75% OF S&P Beat Earnings…Companies that Reported Below Consensus Saw Stock Rise

Bill Stone Glenview–One of the more fascinating anomalies from this earnings season was companies reporting earnings below consensus estimates rising rather than falling. As one would expect, companies posting earnings below estimates typically decline. According to FactSet, companies missing estimates are unchanged this season, while those exceeding estimates gained 2.1%. While the anomaly has faded from the extreme levels to start the season, it is still evidence that the market is focusing on forward guidance more than usual due to the high level of inflation and the precarious state of the economy.

S&P 500 Earnings Season GLENVIEW TRUST, FACTSET

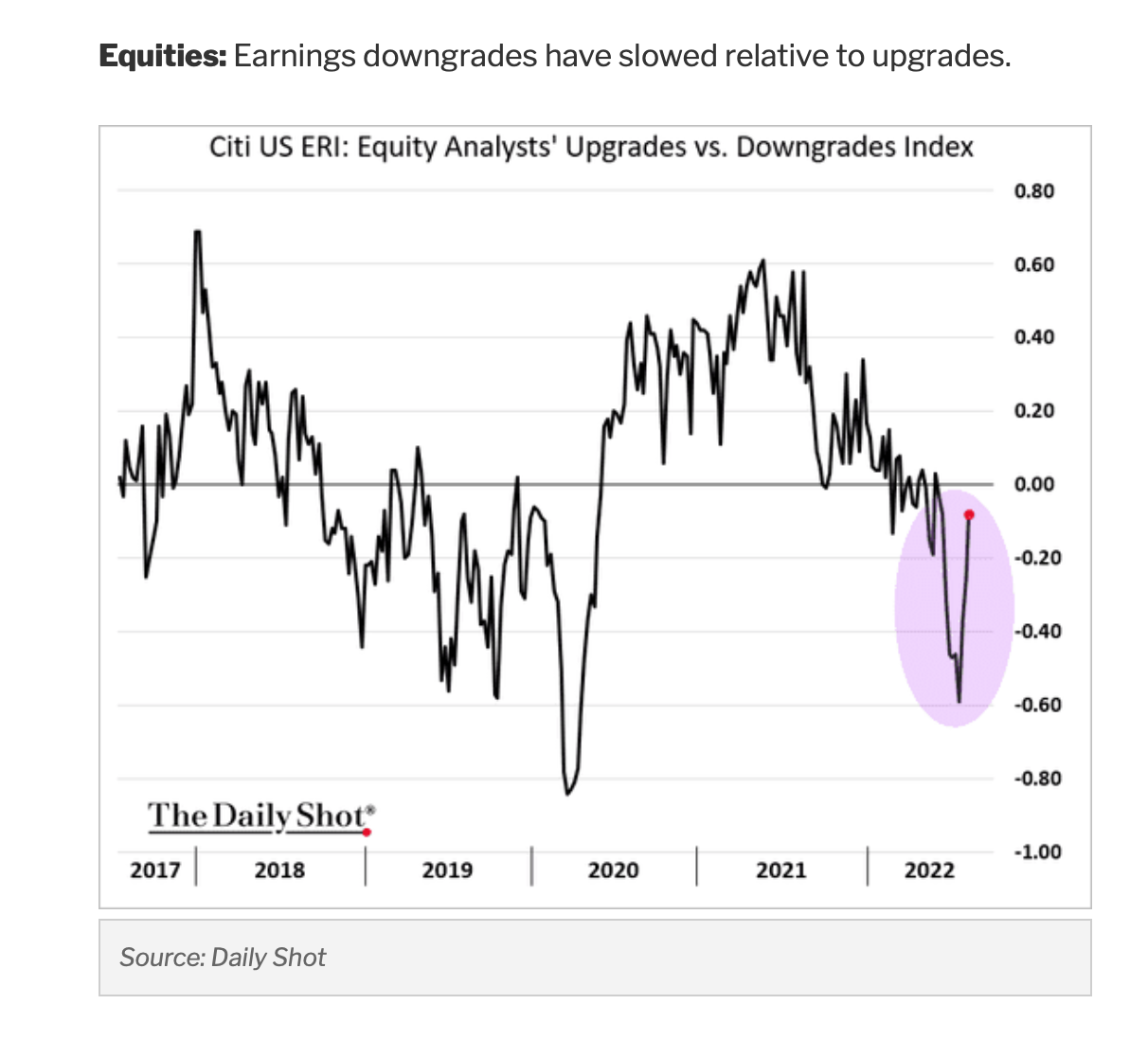

2. And Earnings Downgrades Slowing

https://dailyshotbrief.com/the-daily-shot-brief-august-12th-2022/

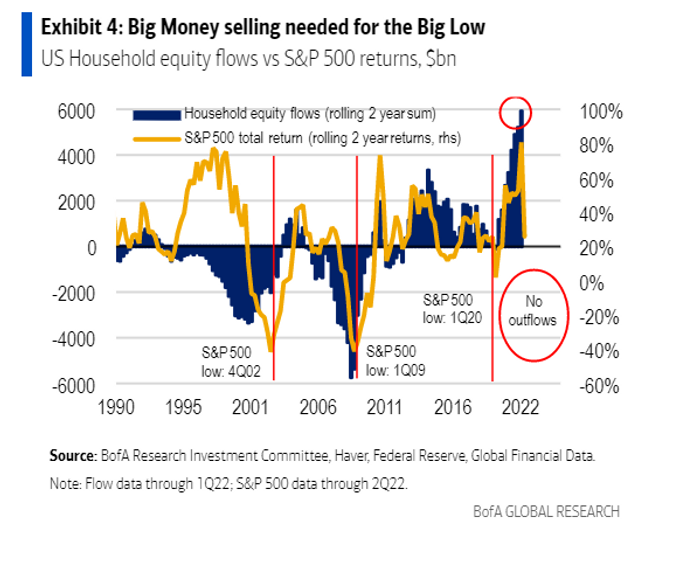

3. Retail Investors Held Tight During 2022 Stock Market Correction

Marketwatch-U.S. households now own roughly 52% of the stock market. And a look at three major market plunges since 2000 (see chart) shows that equities only bottomed a few quarters after significant selling activity from households occurred. By

Joy Wiltermuth

https://www.marketwatch.com/story/have-stocks-bottomed-not-until-this-gorilla-in-equity-markets-budges-warns-bofa-11660239363?mod=home-page

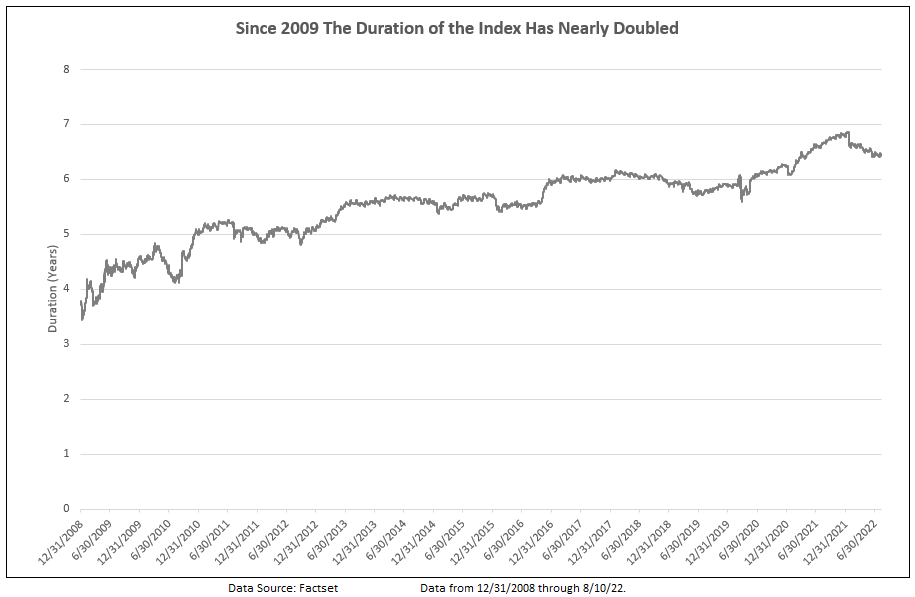

4. AGG Bond Index Duration Hit All-Time Highs Before Pullback

The combined effect has pushed the rate sensitivity of the Agg to all-time highs while bond holders are receiving historically low yields.

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

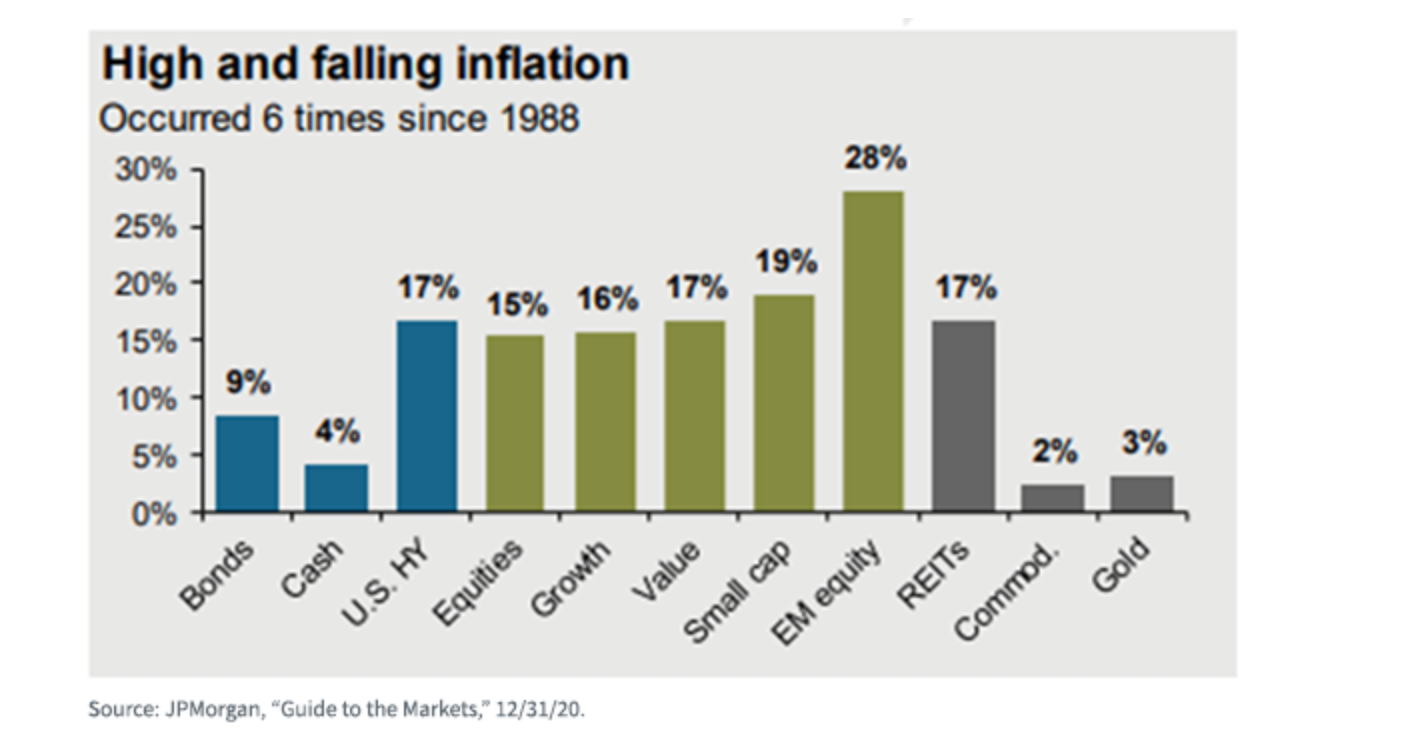

5. Historically…High and Falling Inflation Positive for Emerging Markets

JP Morgan

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?gclid=EAIaIQobChMI5N2vv8nG-QIVQsLCBB228gBeEAAYASAAEgIiDfD_BwE&gclsrc=aw.ds

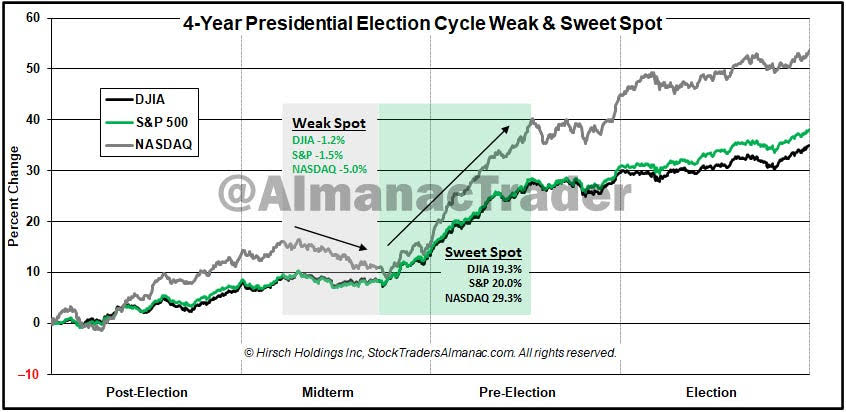

6. If You Believe in Seasonality….Weak Spot in Next Few Months Followed by Rally

Callum Thomas Chart Storm-Worth noting that we are still in the middle of a seasonally sketchy part of the year (/election cycle) — from Stock Trader’s Almanac: “seasonal/cycle outlook is for a lower low or retest of the lows over the next three months as we are in the worst two months of the year and are smack dab in the *Weak Spot* of the 4-Year Cycle”

Source: @AlmanacTrader

https://chartstorm.substack.

7. What History Tells Us About Markets Coming Out of Bear

https://www.linkedin.com/in/johnburns7/

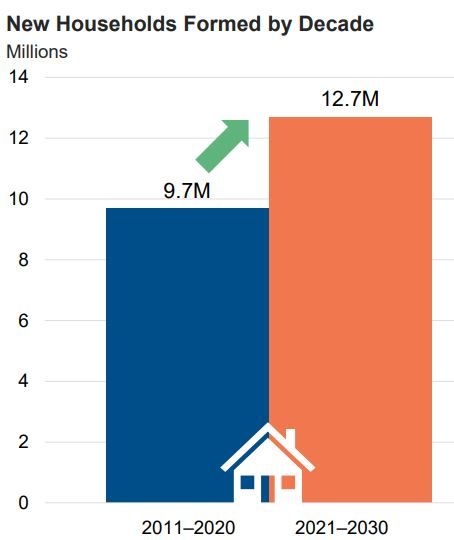

8. Follow Up From Last Weeks Home Equity Comments…..Opposite of 2008…It’s an Equity Rich Market

Almost Half of Mortgaged Homes in US Now Considered Equity-Rich

From Barry Ritholtz Blog https://ritholtz.com/2022/08/

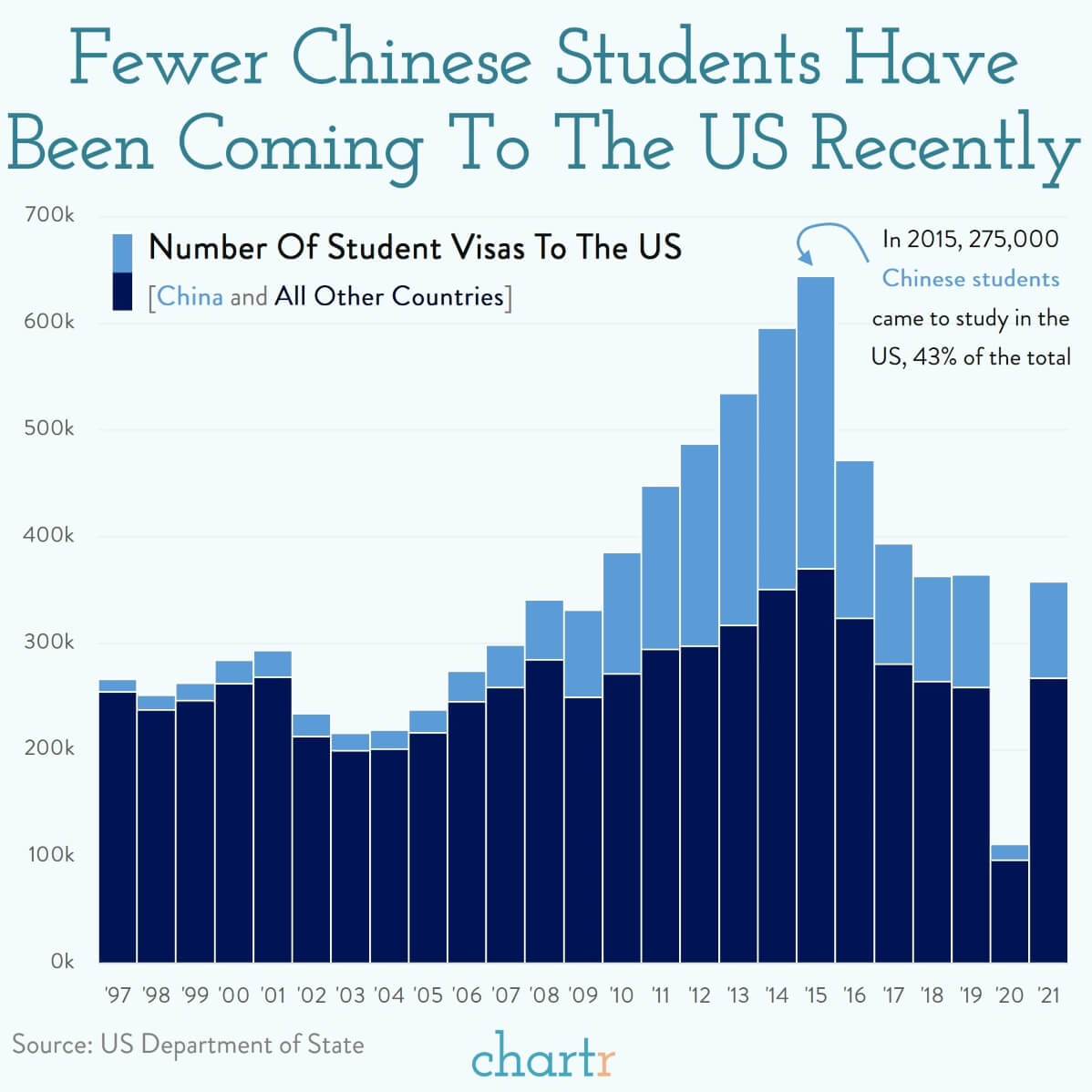

9. Fewer Chinese College Students Coming to the U.S.

|

10. The Huge Obstacle of Feeling Foolish-Farnam Street Blog

Tiny Thought-A huge obstacle to success is a fear of appearing foolish.

When we learn to walk, we fall over and over again until we can do it. We look foolish until the minute we don’t. That is how we learn. As adults we often tell ourselves that failing in front of other people is bad, so we don’t try things that might make us look foolish.

During boom times, people who aggressively went all in appear to be prospering and make a more financially stable approach seem foolish. Only those who were properly positioned, however, can take advantage when the boom ends.

So much advantage in life comes from being willing to look foolish in the short term.