1.U.S. 10 Year Break Even Inflation Numbers Triple Off Covid Low .50 to 1.63%

US Inflation expectations (10-yr breakeven) rise to their highest level since February 20: 1.63%.

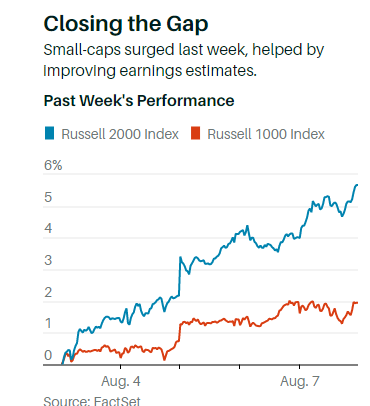

2. Small Caps Surge 6% in a Week to Close Big Gap with Large Cap

Small-Cap Stocks Are Playing Catch-Up. Stronger Earnings Revisions Are a Tailwind.

Small-cap stocks broke out last week, with the Russell 2000 index surging 6%. But that hardly made a dent in its year-to-date underperformance compared with bigger companies. The Russell 1000 is ahead of the Russell 2000 by more than 10 percentage points in 2020.

By Nicholas Jasinski https://www.barrons.com/articles/small-cap-stocks-stronger-earnings-revisions-cyclicals-51597092253?mod=hp_LEADSUPP_2

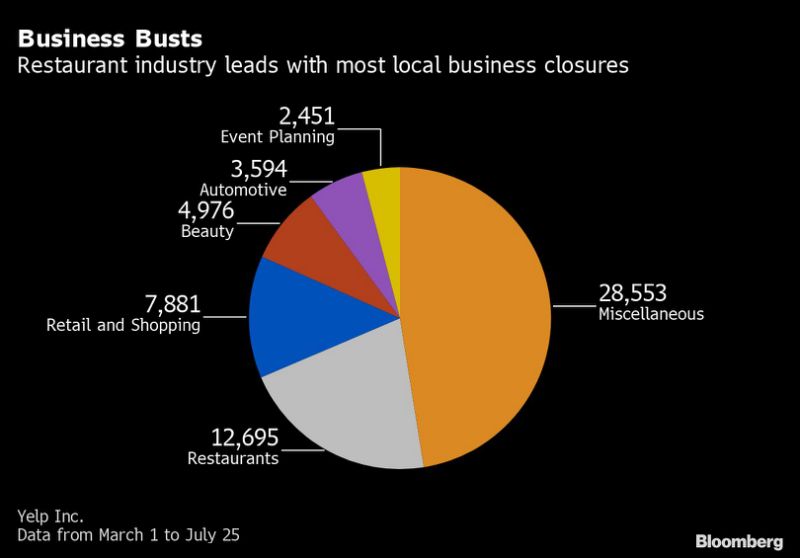

3. Small Businesses Are Dying by the Thousands — And No One Is Tracking the Carnage

(Bloomberg) — Big companies are going bankrupt at a record pace, but that’s only part of the carnage. By some accounts, small businesses are disappearing by the thousands amid the Covid-19 pandemic, and the drag on the economy from these failures could be huge.

This wave of silent failures goes uncounted in part because real-time data on small business is notoriously scarce, and because owners of small firms often have no debt, and thus no need for bankruptcy court.

“Probably all you need to do is call the utilities and tell them to turn them off and close your door,” said William Dunkelberg, who runs a monthly survey as chief economist for the National Federation of Independent Business. Nevertheless, closures “are going to be well above normal because we’re in a disastrous economic situation,” Dunkelberg said.

Yelp Inc., the online reviewer, has data showing more than 80,000 permanently shuttered from March 1 to July 25. About 60,000 were local businesses, or firms with fewer than five locations. About 800 small businesses did indeed file for Chapter 11 bankruptcy from mid-February to July 31, according to the American Bankruptcy Institute, and the trade group expects the 2020 total could be up 36% from last year.

While the businesses are small individually, the collective impact of their failures could be substantial. Firms with fewer than 500 employees account for about 44% of U.S. economic activity, according to a U.S. Small Business Administration report, and they employ almost half of all American workers.

Justine Bacon permanently shut her Yoga Brain studio in Philadelphia after deciding it was too dangerous to hold indoor classes because of the pandemic. Bacon didn’t file for bankruptcy, she just simply closed up shop and went out of business on June 30.

“I felt it better to close with some money in the account and not have to worry about bankrupting the business,” said Bacon, 35.

No Help

Chapter 11 bankruptcy gives a business protection from its creditors while the owners work out a turnaround plan. For smaller companies, though, the extra time might not make any difference. “Bankruptcy cannot create more revenue,” said Robert Keach, a restructuring partner at New England-based Bernstein Shur and former president at the American Bankruptcy Institute.

Some owners fear bankruptcy could scar their credit reports and hurt their future chances to rebuild. Bankrupt businesses have a nearly 24 percentage point higher likelihood of being denied a loan, according to the SBA, and a filing can show up on a credit report for 10 years.

That’s one of Rebecca Schner’s concerns. Things were looking up for Schner, 51, and her jewelry and fair trade shop New Lotus Moon in The Woodlands, Texas. She opened in 2018 and finally started to break even at the start of this year.

Then the virus hit. After the store closed to walk-in customers, she said sales dropped and she couldn’t cover rent. She emptied the shop around mid-May, moved her jewelry cases into storage, and dismissed her part-time employee. She’s making minimum payments on nearly $50,000 in loans.

“What if I want to have a mobile boutique and go buy a vehicle for that? Would I be able to get a loan?” Schner said.

Lost Revenue

To be sure, small business attrition is high even in normal times. Only about half of all establishments survive for at least five years, according to the SBA. But the swiftness of the pandemic and the huge drop in economic activity is hitting hard among typically upbeat entrepreneurs. About 58% of small business owners say they’re worried about permanently closing, according to a July U.S. Chamber of Commerce survey.

In a June 2020 NFIB survey, a net 31% of owners reported lower sales in the past three months, while 7% reported higher sales a year earlier. In the same survey, only 13% of business owners said it was a good time to expand, a dip from 24% a year earlier.

Jose Gamiz, 45, and Leticia Gamiz, 52, closed their restaurant in Glendale, Arizona on July 31. The bills started piling up, and while thousands in government loans helped, they weren’t taking in enough cash. They had four part-time employees.

It was too much of a gamble to keep Mi Vegana Madre open, Jose Gamiz said. The couple knew the dangers of taking risks after they lost the first house they bought during the 2008 crisis.

“We wanted to take that as a lesson,” Jose Gamiz said. “Sometimes it’s okay to let it go and not expend every penny.”

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

https://finance.yahoo.com/news/small-firms-die-quietly-leaving-130841210.html

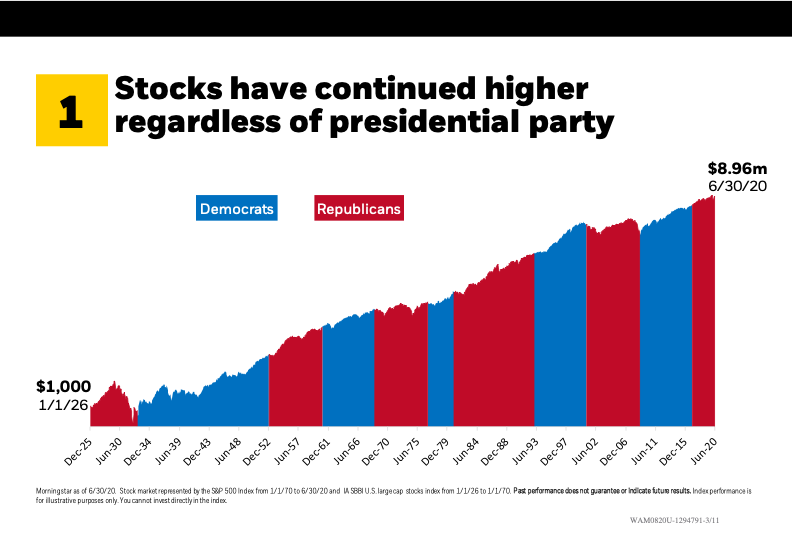

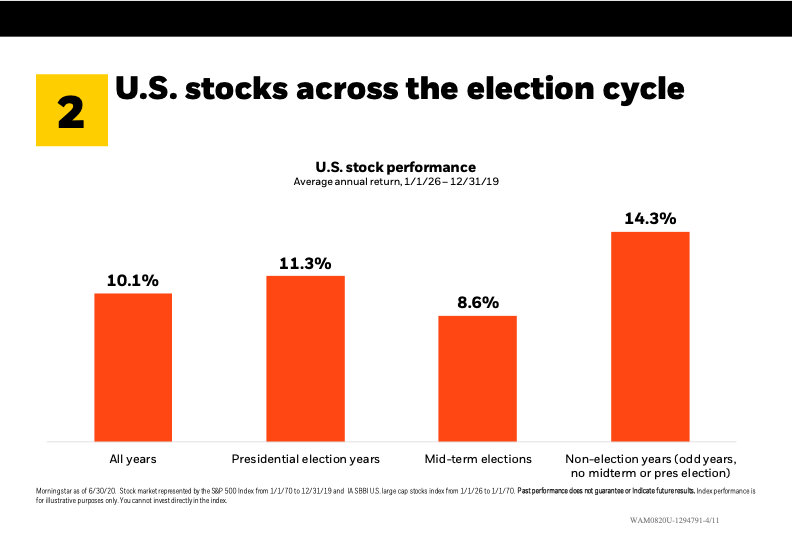

4. Stocks and Presidential Elections–Blackrock

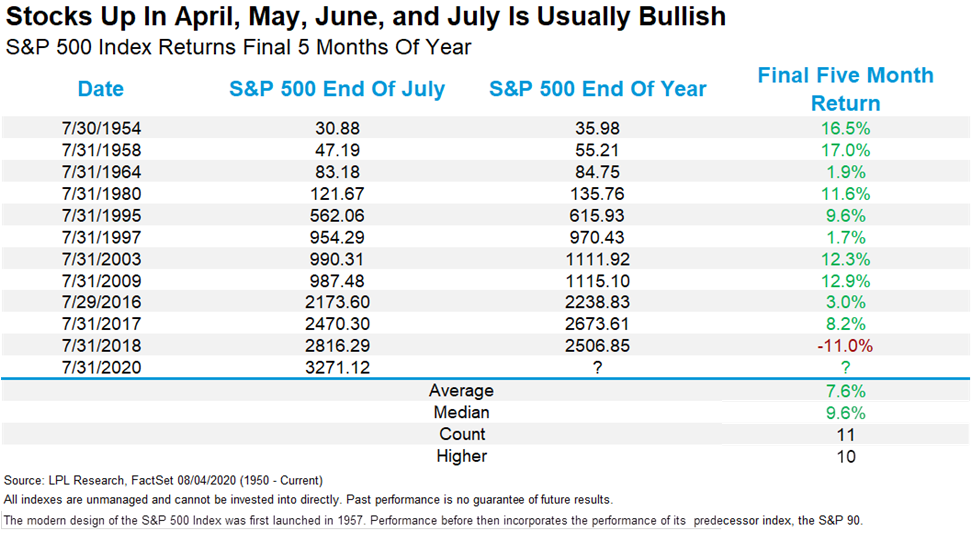

5. Historical Comparison to this 4 Month Run

LPL Blog

After a historic drop in March, the S&P 500 has closed higher in April, May, June, and July. This rare event has happened only 11 other times, with stocks gaining the final five months of the year a very impressive 10 times. Only 2018 and the nearly 20% collapse in December saw a loss those final five months.

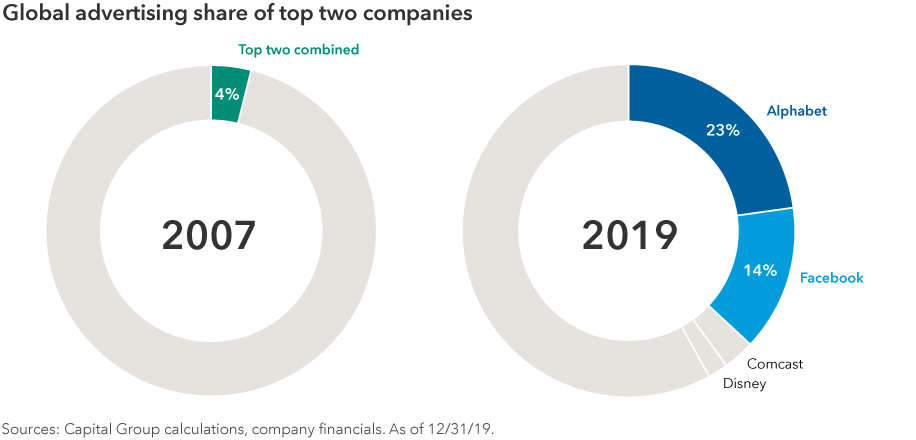

6. Global Advertising 2007 vs. 2019

10 investment themes for the next 10 years

https://www.capitalgroup.com/advisor/insights/articles/10-themes-next-10-years.html

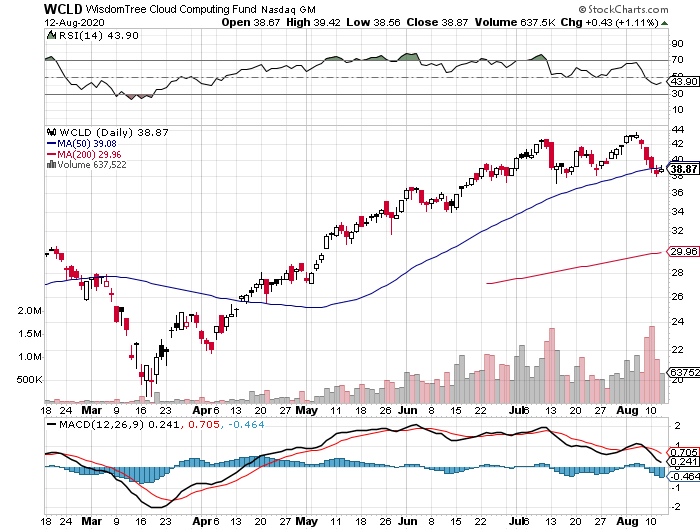

7. Cloud Computing ETF

WCLD Provides Unique, Targeted Cloud Exposure

WCLD, through a collaboration with Nasdaq, leverages the expertise of Bessemer Venture Partners (BVP), a leading venture capital investor in cloud-based businesses with more than a decade of investment success in the cloud computing industry.

WCLD seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD). BVP, in collaboration with Nasdaq, sets the investment parameters for selecting eligible cloud company constituents within EMCLOUD’s investment methodology.

Among key investment criteria are revenue thresholds and growth requirements that are suited to identifying emerging cloud companies with rapid growth potential. The end result of these constraints is a unique basket of 52 cloud stocks that has very limited overlap with benchmark indexes for U.S. equities, tech and growth strategies. The S&P 500, S&P 500 Growth, S&P 500 Information Technology and Nasdaq 100 Indexes only share four to five companies in common with WCLD—and they all hold less than 10% of their weight across these companies.7

The coronavirus pandemic could drive permanent changes in standards for remote work and data management. We see WCLD as a potential way for investors to position for long-term growth in the cloud computing industry and as a hedge against disruptive forces of change in technology and in our current operating environment.

8. Another Electric Car Entry….Morning Brew

AUTO

The upcoming Lucid Air. Photo: Lucid Motors

| Electric vehicle startup Lucid’s new sedan, the Lucid Air, is very real. And it can go the distance—independent testing showed the Air can travel 517 miles on a single charge, crowning it one of the longest-range EVs on the market. That means you could drive from NYC to Philadelphia, realize you forgot your wallet, go back to get it, drive back to Philly, realize you’re in love with your best friend, drive back to NYC to tearfully reunite with him on the Brooklyn Bridge, then head to a cottage upstate…without having to recharge your EV. It’s about 115 miles farther than Tesla’s highest-range vehicle, the Model S. How he built this: CEO and CTO Peter Rawlinson (a former Tesla employee) creditedLucid’s high-tech motors, which were created in-house, for the best-in-class range. Looking ahead…Lucid will unveil the final version of the Air on Sept. 9, and production is set to start next year. + While we’re here: Tesla announced a five-for-one stock split, which doesn’t materially change anything about the company’s valuation but does make its stock more affordable to individual investors. Shares gained ~7% after hours. |

9. US budget deficit climbs to record $2.81 trillion

By MATT OTT – yesterday

SILVER SPRING, Md. (AP) — The U.S. budget deficit climbed to $2.81 trillion in the first 10 months of the budget year, exceeding any on record, the Treasury Department said Wednesday.

The nation’s budgetary shortfall is expected to eventually reach levels for the fiscal year that ends Sept. 30 more than double the largest annual deficit on record.

The federal government rang up a $63 billion deficit in July, the department reported. That’s a relatively modest amount compared to red ink that spilled in the spring months when the government tried to revive an economy that all but ground to a halt due to the coronavirus outbreak.

ADVERTISEMENT

Last month’s deficit was sharply lower than June’s $864 billion, in part because the government collected a record amount tax revenue in July — $563 billion — after extending the filing deadline to July 15. That extension allowed Americans more time to sort through the economic havoc wrought by the pandemic.

Outlays to the Small Business Administration, which doled out $511 billion as part of the Paycheck Protection Program in June, fell to about $26 billion in July.

So far this budget year, government receipts total $2.82 trillion, off just 1% from the same period last year, Treasury officials said, crediting the “income replacement” provided by various government aid packages. In other words, unemployment benefits and other aid are still taxable.

Outlays so far this budget year total $5.63 trillion, a 50% increase over the $3.73 trillion at this point in 2019, with the vast majority of the extra spending related to fortifying the country’s economy in the wake of the coronavirus pandemic.

Congress has already passed rescue packages totaling nearly $3 trillion this year, but Democrats and Republicans remain far apart on another relief bill, just as an expanded unemployment benefit of $600 per week expired on July 31.

President Donald Trump issued a series of presidential directives last weekend to prolong the extended unemployment benefits at $400 a week, with 25% to be paid for by the states. But it’s unclear how much of an economic boost the extension would provide, given the economic uncertainty and funding that could run dry after five weeks.

Democrats in the House passed another bill with $3 trillion in aid, but the Republican-led Senate is pushing for a package closer to $1 trillion and did not bring the House bill up for a vote before going on August recess.

The Congressional Budget Office has forecast a $3.7 trillion deficit for this fiscal year as the country fell into a deep recession in February, ending a record expansion of nearly 11 years. The Trump administration is predicting that the economy will bounce back in second half of 2020, but many private forecasters are concerned that consumers will dial back spending as infections surge in states like Florida. Consumer spending drives the U.S. economy, making up about 70% of all economic activity.

Last month, the government reported that the gross domestic product declined at a record 32.9% annual rate in the April-June quarter, as a resurgence of the viral outbreak pushed businesses to close for a second time in a number of regions.

For 20 consecutive weeks, more than a million Americans have sought jobless benefits. The unemployment rate fell last month to 10.2%, still higher than any point during the financial crisis of 2008-2009.

That was also when the federal government set the record for an annual deficit, hitting $1.4 trillion in 2009 as it tried to dig the country out of recession. The U.S. blew past that mark in May.

https://apnews.com/b91e66dc273756b3fab87fe89c7cf29c

10. Jeff Bezos Uses This Simple Leadership Trick to Overcome Toxic Mindsets

It starts with a simple but challenging fact. And if you’re not careful, it can lead to more problems.

BY BILL MURPHY JR., WWW.BILLMURPHYJR.COM@BILLMURPHYJR

Here’s a simple trick that Jeff Bezos suggests using to overcome a basic business leadership problem.

It stems from the fact that the most important business decisions are often also the hardest ones–and those tough decisions often result in an additional cascade of leadership challenges.

It’s pretty simple, really. If you make a choice from among several reasonable choices in your business, some of your team members or stakeholders will likely conclude you’ve made the wrong choice.

And once you’ve made that decision, they might have a hard time getting on board with it.

Here’s a basic example. Let’s say you’re debating the retail price of a new product.

A low price might mean higher sales, but a high price might reinforce the perception of a premium product.

Your sales team wants to make fast sales, so they’d prefer the low price. Your marketing team would rather promote something that’s seen as more exclusive.

And you can make the case for either choice. But you have to decide.

How do you get the team members who will inevitably think you’ve chosen wrong to move past that disagreement? That’s where Bezos and Amazon come in.

Overcoming the toxic mindset

Let’s call the failure to commit what it is: a toxic mindset — although one that reflects such basic, human, emotional needs that it’s hard to condemn people for it.

Recognizing this, Bezos shared a technique to overcome it in the annual shareholder letter he released on April 17, 2017.

Bezos wrote that he values making fast decisions, which often means deciding before you have all the information you’d like. He puts the sweet spot at acting when you have 70 percent of needed information.

The lack of information makes tough decisions even tougher, however, and that prompts the cascade of leadership challenges described above. To overcome them, Bezos introduced a simple linguistic trick that stops these toxic mindsets in their tracks, and cuts off the metastasis of difficulties.

It’s just a three-word phrase. Bezos wrote: “Disagree and commit.”

The phrase can save a lot of time. If you have conviction on a particular direction even though there’s no consensus, it’s helpful to say, “Look, I know we disagree on this but will you gamble with me on it? Disagree and commit?”

By the time you’re at this point, no one can know the answer for sure, and you’ll probably get a quick yes …

If you’re the boss, you should do this too. I disagree and commit all the time.

Even the Kindle

Bezos goes on to give the example of when his team advocated for a particular Amazon Studios show that he personally didn’t think made sense. He told them: “I disagree and commit and hope it becomes the most watched thing we’ve ever made.”

And here’s another high-level example I love even more: Jeff Wilke, a top executive known as the “second-most important Jeff” at Amazon, shared the story of how he originally thought the Kindle wasn’t a good fit for Amazon.

But, he told The Wall Street Journal, “I disagreed and committed, and I’m very glad I did.”

So, let’s unpack this powerful three-word phrase, and why I think it’s so effective.

1. “Disagree … ”

It all starts here. How many times have you heard that the goal in a business decision-making process is to “build consensus”? But that’s wrong: The goal isn’t to convince everyone; it’s to review facts and make fast decisions.

Sometimes, you’ll make mistakes. By putting “disagree” right into the decision-making goal, you give people an option to go on record, record their opposition, and move on quickly to helping the team.

2. ” … and … ”

It’s just a conjunction, true, but it points out that this isn’t just a mechanism to “agree to disagree.” There’s a second component coming up — a more important one, frankly.

3. ” … Commit”

The more I think about this word, the more I love it in this context.

First, it makes clear once more that the goal here isn’t agreement; it’s concerted, coordinated action.

Second, it’s an implicit promise from the members of your team who might have disagreed: “I might have made a different decision if I were the final authority. But I recognize we’ve made another decision, and I will now put my best efforts behind it.”

Saying it helps inoculate against the all-too-human toxic mindset at the root of the whole problem.

Commitment over consensus. It’s a powerful concept.

And if it works for Bezos and Amazon, maybe it can work for your business, too.

AUG 8, 2020

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/bill-murphy-jr/jeff-bezos-uses-this-leadership-trick-overcome-toxic-mindsets.html?cid=sf0100

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.