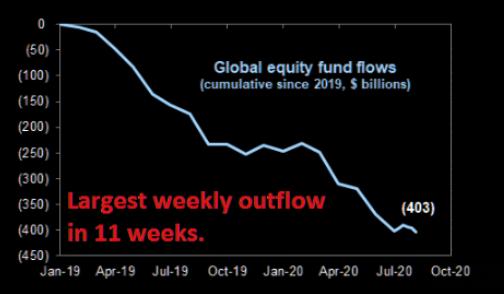

1. Last Week Was Biggest Equity Outflows Year to Date..

From Dave Lutz at Jones Trading

Goldman notes last week saw the biggest equity outflows YTD..

2. The Most Hated Bull Market Ever…Relationship Between Inflows and Returns Has Weakened.

Morgan Stanley

Found at The Irrelevant Investor Blog https://theirrelevantinvestor.com/2020/08/09/these-are-the-goods-177/

3. Apple Bigger Than Entire Russell 2000 Small Cap Stocks??

4. VIX Volatility Index Falling Close to Pre-Covid Range.

VIX falling below $20

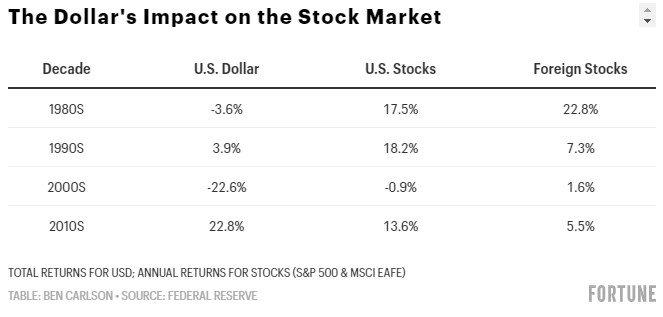

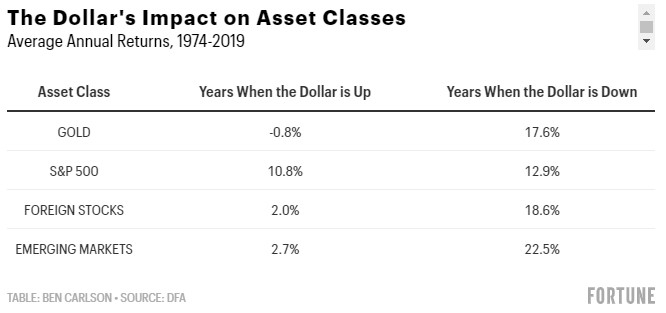

5. Which Investments Benefit From a Weaker Dollar?

Posted August 10, 2020 by Ben Carlson

The performance of the dollar, U.S. stocks, and foreign stocks by decade offers a clear picture of this relationship:

When the dollar is up, gold, foreign developed, and emerging-market stocks tend to perform poorly. And when the dollar is down, gold, foreign developed, and emerging-market stocks tend to perform admirably.

https://awealthofcommonsense.com/2020/08/which-investments-benefit-from-a-weaker-dollar/

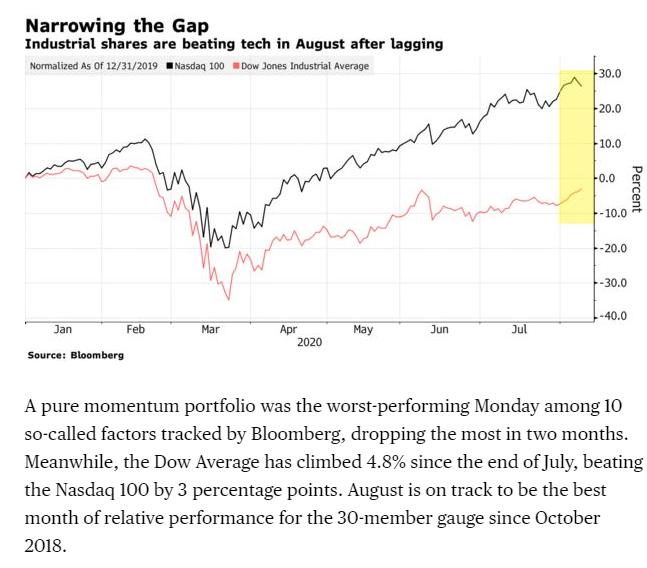

6. Dow Jones Beating the Naz 100 by 3 Percentage Points Since the End of June.

Blue Chips Crush Tech Titans With Stock Rotation Taking HoldBy Katherine Greifeld

7. FAANG Grew Earnings 2% …Rest of S&P Earnings -38%

The punchline: In aggregate, FAAMG EPS grew by 2% year/year in 2Q compared with an aggregate decline of -38% for the other 495 S&P 500 companies: “The FAAMG stocks benefit from secular trends expedited by the coronavirus, such as cloud spending and e-commerce, and continue to capture an increasing share of their respective market.”

Earnings Season Shocker: FAAMG Earnings Grew By 2% While EPS For The Other 495 S&P Companies Plunged 38%—by Tyler Durden

8. July Job Cuts..3rd Largest on Record..Entertainment-Leisure-Transportation.

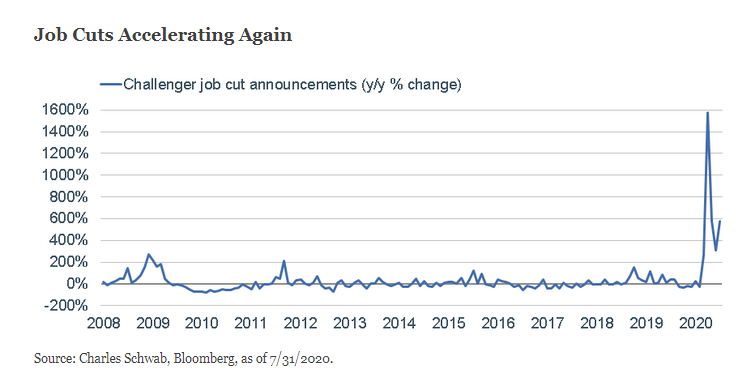

Unemployment claims are, always and now, a leading economic indicator. But there are other labor market indicators that even lead claims, including job cut announcements. July’s announced job cuts, measured by Challenger, Gray & Christmas, jumped 576% year-over-year vs. 305% in June. It was the third-largest on record (with the other two in April and May); with the majority coming from entertainment/leisure and transportation.

Job Cuts Accelerating Again

Another Tricky Day: Dissecting July’s Labor Market Report By Liz Ann Sonders

9. 1/3 of Americans Dipped into Retirement Funds to Pay Bills During Covid.

Hard times: One in four Americans have missed a bill payment since COVID-19 emerged

by John Anderer Paying off bills is tough for many these days, and a new survey shows that Americans are cutting costs or even adopting a ‘minimalistic’ lifestyle to make ends meet.

NEW YORK — From our social lives to professional careers, life as we know it has shifted since the beginning of 2020. Well, almost everything; millions may have lost their jobs due to COVID-19, but that doesn’t mean the bills have stopped coming. Indeed, paying off bills are an unavoidable part of life, even during a pandemic. Unfortunately, a new survey of 2,000 Americans finds that one in four (24%) have already missed at least one payment since the pandemic began.

Among that group, 26% say they haven’t paid their cell phone or cable bills. Another 25% failed to pay for streaming services, and perhaps more worryingly, some of their electricity or utilities bills.

On average, Americans who admit to skipping a bill payment have missed five bills altogether.

Commissioned by EnergyBot, the survey set out to gauge just how much COVID-19 has dealt a blow to Americans financially. Predictably, money is a big concern these days. In fact, 63% say the’re “always” worried about paying all their bills right now. Similarly, 58% are battling extra stress over their bills since the pandemic started.

Ways we’re cutting back

With those last stats in mind, it makes sense then that 65% of respondents admit they’ve had to make some sacrifices lately to make ends meet. What type of sacrifices are we talking about? Many have cancelled subscription services (38%) and gym memberships (39%). Others are cutting costs by no longer ordering takeout food (35%).

All in all, 52% say they only buy the “essentials” these days. Another 43% are no longer buying premium quality goods (toilet paper, gas) in an effort to save some cash. Some are adopting new lifestyles: 41% say they’re following “minimalistic” approach to life.

Moreover, about two in five people never use their credit card anymore because it encourages them to spend more.

Raiding retirement to pay off bills

A third of Americans have also been forced to dip into their savings accounts because of COVID-19. On that note, 55% of respondents often feel “overwhelmed” by just how much the coronavirus has changed their financial footing.

Even small expenses, like repairing a broken home appliance, just aren’t possible right now. A significant portion of respondents (35%) have learned to live without a broken appliance because they just can’t afford to fix it. Meanwhile, 68% have tried to fix the appliance themselves (or asked a spouse to fix it). Others (33%) have used some of their savings to solve such issues when they were unable to fix the item themselves.

Another 37% say, however, that they wouldn’t even have enough savings to fix appliances if they were to break.

A few other common ways Americans are saving money through this pandemic are: turning off lights when they’re not needed (62%); turning off appliances when they’re not being used (46%); closing windows/doors when the heat is on (42%); opening the windows instead of using AC (36%); and using blinds to adjust room temperature (33%).

The survey was conducted by OnePoll.

https://www.studyfinds.org/quarter-americans-missed-bill-payment-covid-19/

10. Stanford Professor: These 3 Small Actions Make You a Magnet for Attracting Luck

A crash course on creating your own luck in business and life.

BY BETSY MIKEL, OWNER, AVECK@BETSYM

Shutterstock

Many believe luck is a lightning bolt that strikes when you least expect it. It’s a right-place-right-time kinda thing.

Stanford entrepreneurship professor Dr. Tina Seelig would like you to strike that perception of luck from your brain entirely. In 20 years of observing what makes some people luckier than others, she can definitively say this: The luckiest people tend to be those who create that luck for themselves.

In a recent TED Salon talk, Seelig uses a wind analogy to describe luck. Sometimes it’s a light breeze. Sometimes it’s a windstorm. But you never really know when–or from which direction–it will come.

Her advice is to build your sail. Bit by bit, you’ll be more equipped to catch luck when it breezes by. Here’s how she coaches her students to improve the probability that luck will blow their way.

Embrace your inner kid to take baby-step-size risks.

Take risks.

Step outside your comfort zone.

We’ve heard this advice before. Seelig gets more tactical. She challenges her students to think strategically about the risks they need to take to open themselves up to luck. They will be different for you than the person sitting next to you.

These risks can be baby steps, something we used to do all the time as kids. Take riding a bike: Going from training wheels to a two-wheeler requires a risk and discomfort. It takes quite a few tries to finally gain your balance and ride in a straight line. But each try gets you closer.

In her class, Seelig has her students do a riskometer exercise. She challenges them to rate their comfort level with the following types of risk:

· Intellectual

· Physical

· Financial

· Emotional

· Social

· Political

· Ethical

Students compare their riskometers and realize no two look the same. She encourages them to push themselves toward the risks that feel most uncomfortable. For example, if you’re more introverted and shy, you might challenge yourself to talk to someone you don’t know.

Taking all these micro-risks will not guarantee your success. But the direction some risks might take you in could be surprising.

Seelig ultimately landed her first book deal by striking up a conversation with a stranger next to her on a plane. It seems like she got a lucky break–but it would have never happened if she had just put her headphones on and ignored her seatmate.

Show appreciation, even in rejection.

Like many happiness researchers, Seelig fully embraces gratitude. Showing appreciation can take you quite far–even when you’re disappointed in the outcome.

Maybe you weren’t offered your dream job. Perhaps you were flat-out rejected from what you thought was a perfect-fit opportunity. Swallow your pride. Take a moment to reflect on what you learned from the experience. Then thank the people who helped along the way.

“When someone does something for you, they’re taking that time that they could be spending on themselves or someone else,” Seelig says.

Expressing gratitude even when it’s tough is a huge step many fail to take, but Seelig says it’s critical making your own luck.

She runs a few highly competitive fellowship programs at Stanford. When people don’t get in, Seelig often receives notes. Some complain. Others ask for feedback so they might have more luck next time. One note stood out above them all. A student named Brian, who had been rejected twice, wrote: “I want to thank you for the opportunity. I learned so much through the process of applying.”

Seelig ended up meeting with Brian. They developed a custom independent study program together. He didn’t end up getting into her program, but perhaps got something even better. All from a thank-you note after being rejected.

Find the good stuff in bad ideas.

Got an idea but you’re worried it sucks? It might. But there’s probably something good in there that you can mine.

Seelig doesn’t believe ideas are either good or bad. “In fact, the seeds of terrible ideas are often something truly remarkable,” she says. She encourages student to look at bad ideas with a lens of possibility.

What ultimately turns out to be a good, workable idea might never come to you in a sudden light-bulb moment. It’s kind of like luck. Both luck and remarkable ideas are multidimensional and multi-layered.

“We rarely see all the levers that come into play to make people lucky,” explains Seelig. It’s the same with successful companies and million-dollar ideas. There likely were many bad ideas along the way, taking several twists and turns.

Each of these steps contributes something different to your future lucky self. Take small risks. Say thank you more often. Mine bad ideas for good ones. Over time, they all stitch together to build your sail. When luck blows your way, you’ll be ready to catch it.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.