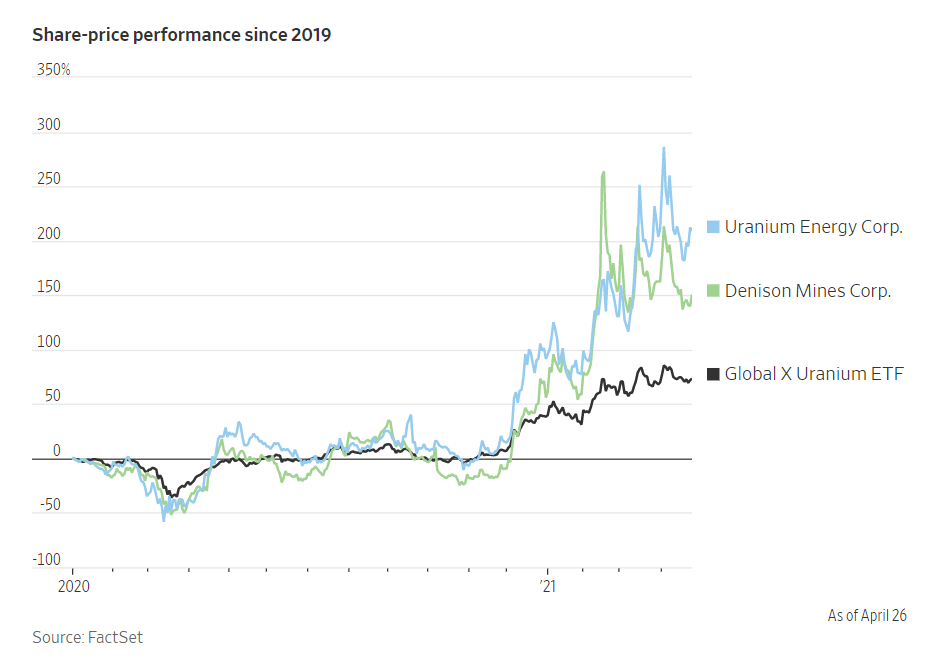

1. Uranium ETF Bottomed at $7 During Covid….$19 Last.

URA Chart—50day blue line thru 200day red line to upside….Bars show the increase in volume on rally.

WSJ–Investors have been sending shares in companies including Canada’s Denison Mines Corp. DNN -0.96% and Corpus Christi, Texas-based Uranium Energy Corp. UEC -1.41% higher starting late last year. The Global X Uranium ETF, URA 0.78% which tracks shares of companies with operations linked to uranium and nuclear components, has surged 78% since the end of October.

Uranium Miners Seeking a Foothold Take Unorthodox Approach: Buying Uranium–By

Joe Wallace and Rhiannon Hoyle

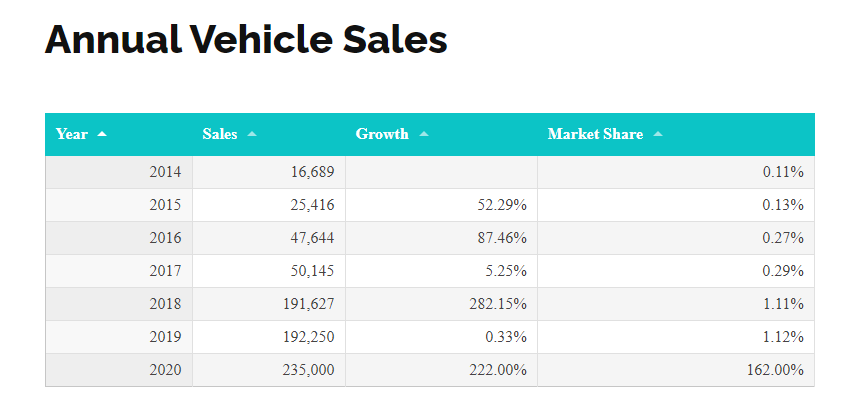

2. Tesla U.S. Market Share of EV Dropped from 82% to 70% Q12020

Tesla Annual U.S. Sales Data

https://carsalesbase.com/us-tesla/

3. Treasury Yields not Confirming Commodities Bull Yet

Treasury yields are signaling the global economy will be too weak in the coming years to sustain the explosion in commodity prices.

Source: Bloomberg

Bond Traders Laugh Off Commodities Supercycle Dreams-BY TYLER DURDEN

HTTPS://WWW.ZEROHEDGE.COM/MARKETS/BOND-TRADERS-LAUGH-COMMODITIES-SUPERCYCLE-DREAMS

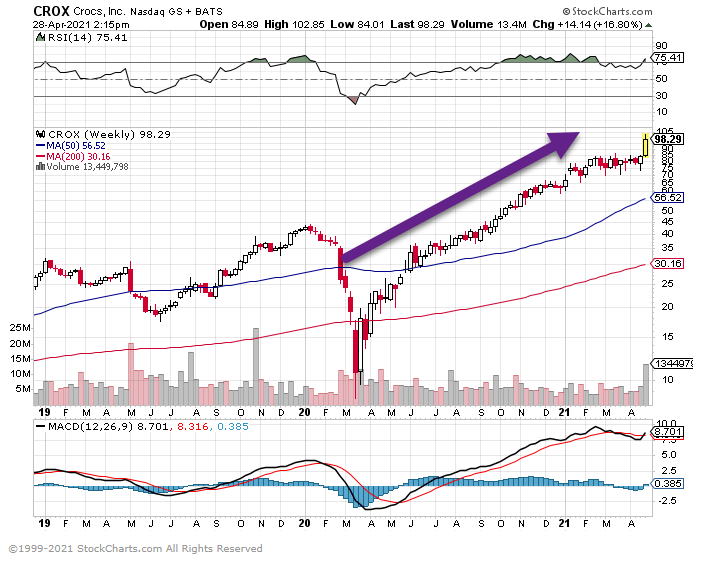

4. CROX $10 TO $98

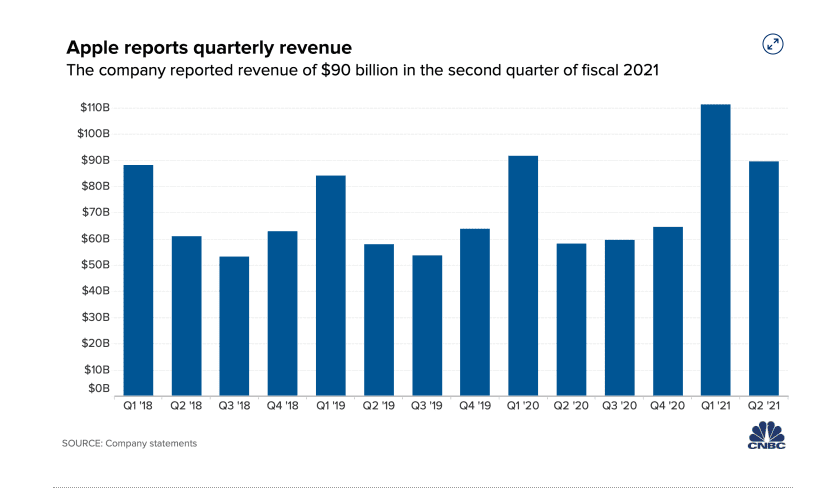

5. APPLE QUARTERLY REVENUE GROWTH 2018-2021

CNBC

Apple (AAPL) earnings Q2 2021 (cnbc.com)

6. QUICK SUMMARY OF POWELL COMMENTS

Perhaps the biggest takeaway from Fed Chairman Jerome Powell’s press conference Wednesday is just how committed he is to keeping his foot on the accelerator even as the economy is poised to boom.

“I just don’t see why anyone doubts the Fed’s commitment to their strategy. They are all in. Powell just doesn’t blink,” tweeted Ian Shepherdson, chief economist at Pantheon Macroeconomics.

“While the recovery has progressed more quickly than generally expected, it remains uneven and far from complete,” Powell said in remarks after the bank’s regular two-day meeting among senior officials.

Read: Fed sticks to easy-money strategy even as it sees a strengthening U.S. economy

Powell also addressed one of the Fed’s most vocal critics — former Treasury Secretary Larry Summers, who thinks the Fed’s easy policy stance is risky, especially in light of the massive stimulus packages passed and planned by a Congress controlled by Democrats.

Asked about Summers, Powell spent five minutes pushing back against his concerns, leading one economist to tweet a GIF of Michael Jordan dunking:

In addition to Powell’s resolve, here are some other things we learned from Powell’s press conference:

Will the Fed start to talk about slowing down the $120 billion per month in asset purchases?

“No. it is not time yet,” Powell said.

He repeated it would be “some time” before the Fed has that conversation. Some economists think the earliest this might happen is at the Fed’s next meeting in June, but more are thinking Powell might use his annual speech at the Jackson Hole, Wyo., conference in late August to start that conversation.

The housing market is not a bubble

Powell said he was somewhat uneasy about the runup in housing prices, saying it was not an “unalloyed good,” but gave no hint that the Fed is thinking about thinking about getting involved. He pegged the problem on lack of supply and high demand. “My hope would be that, over time, housing builders can react to this demand and come up with more supply,” Powell said. “We don’t have that kind of thing where we have a housing bubble where people are over levered,” he said.

Read: Fed is standing aside and letting housing market rip

Asked why the Fed needed to buy $40 million per month of mortgage-backed securities if the housing market was so strong, Powell said the purchases “are not meant to provide direct help to the housing market.” He repeated the Fed will taper when the time comes.

Fed won’t let inflation overheat

Powell said the economy is facing “unprecedented events,” but that the Fed thinks price pressures will be temporary. “If inflation were to move persistently and materially above 2%,” the Fed would use its tools to bring inflation down. “We’re all very familiar with the history of the 1960s. That is a very different situation,” he said. “We understand our job,” he said.

Powell sees “froth” in financial markets

Many economists think the main impact of the Fed’s asset purchases will be rising asset prices. Powell seemed to raise his level of concern here. “You are seeing things in capital markets that are a bit frothy,” he said. And Fed policy does play a role, he said.

“Overall financial stability picture is mixed, but on balance, it is manageable,” he said.

Powell says it will take time for labor market supply and demand to balance

Powell has been consistent in his belief that the Fed is “a long way” from its goals primarily because of a weak labor market, where 8.5 million fewer Americans are working now than before the pandemic. At the same time, employers are complaining to the Fed that they can’t find workers for their vacancies.

Powell said “a number of things” were at play and that he thought the equilibrium between labor supply and demand might take some months to achieve. The Fed chairman said the lack of workers wasn’t all caused by the pandemic, as some workers lack skills and don’t live where there are job openings. The effects of the pandemic linger as some schools are yet to reopen and some workers remain afraid of catching COVID-19. In addition, a sizeable number of people have reported that they have decided to retire and its too soon to know if they will change their minds. Jobless benefits may also be playing a role, he said. Wages haven’t moved up yet, which would happen in a tight labor market.

Fed’s Powell ‘doesn’t blink,’ and 5 other things we learned from his press conference

Published: April 28, 2021 at 6:00 p.m. ET

By Greg Robb Fed’s Powell ‘doesn’t blink,’ and 5 other things we learned from his press conference – MarketWatch

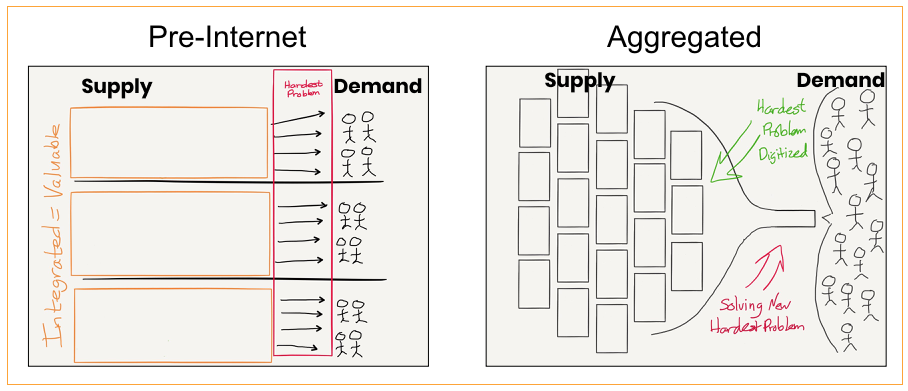

7. Who Will Disrupt the Disruptors?

Not Boring Blog-Packy McCormick

The more consumers companies can spread their fixed costs over, the more profitable they become. Facebook is free, as are its subsidiaries, WhatsApp and Instagram. It monetizes through ads, with near-zero marginal cost to serve them. More eyeballs, more profit. It would cost nearly $100 million to individually purchase all of the songs that you can listen to on Spotify for $9.99 per month. Amazon famously views your margin as its opportunity.

In Beyond Disruption, Thompson argues that when Christensen wrote Disruptive Technologies in 1995, it was the pinnacle of management theory (emphasis his), but that because of the nature of the internet, it no longer works:

Many of the most important new companies, including Google, Facebook, Amazon, Netflix, Snapchat, Uber, Airbnb and more are winning not by giving good-enough solutions to over-served low-end customers, but rather by delivering a superior experience that begins at the top of a market and works its way down until they have aggregated consumers, giving them leverage over their suppliers and the potential to make outsized profits.

Internet giants can move upmarket and downmarket at the same cost, giving every consumer the same great experience, and amassing consumers who they can use to bend the will of suppliers. That’s the point of Thompson’s Aggregation Theory.

Use demand to get power over supply, thereby lowering costs and increasing profits. How does a new entrant compete with that? How do you low-end disrupt a company that provides an excellent experience at no cost to every consumer?

Thompson might argue that you don’t. In two separate articles, five years apart, he made two separate arguments that suggest that today’s internet giants are undisruptable:

1. You can’t low-end disrupt Aggregators because they serve every consumer segment well and cheaply.

2. Even if a new computing interface comes along, the incumbents are still in the best position to take advantage.

Maybe this really is the end of the beginning…

But you know that’s not how I feel, because we’re less than 2,000 words in. This is just the beginning of the beginning.

Today’s tech giants are more vulnerable than they look. They’re not going anywhere tomorrow. They’re probably very safe for the next five years. But over the next decade and beyond, one or more of today’s category-leading tech companies will be overtaken by a crypto-native competitor.

Full Read

Who Disrupts the Disrupters? – Not Boring by Packy McCormick

8. Top 10 Emerging Real Estate Markets

The list includes cities in New Hampshire, Ohio and Montana. Looking to the top 50 cities in the index, fewer than half were located in the Sun Belt.

| RANKING | MARKET |

| 1 | Coeur d’Alene, Idaho |

| 2 | Austin-Round Rock, Texas |

| 3 | Springfield, Ohio |

| 4 | Billings, Mt. |

| 5 | Spokane, Wa. |

| 6 | Lafayette-West Lafayette, Ind. |

| 7 | Reno, Nev. |

| 8 | Concord, N.H. |

| 9 | Manchester-Nashua, N.H. |

| 10 | Santa Cruz-Watsonville, Calif. |

The No. 1 emerging property market in America isn’t in Texas or Florida — you may never even have heard of it–By

Jacob Passy

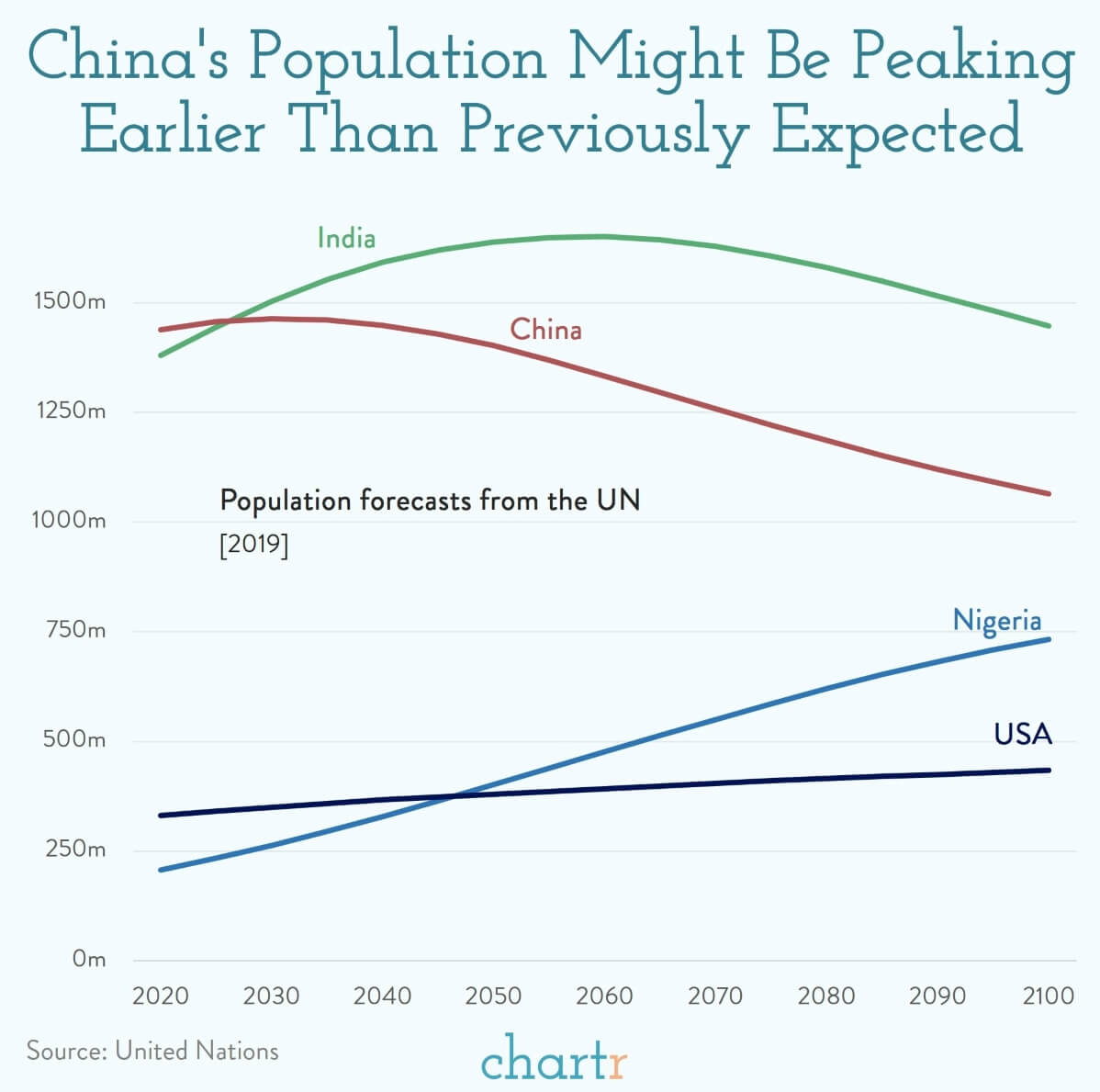

9. China Population Peaking Earlier than Expected.

| China has a bit of a population problem, but it might not be what you expect. A scoop from the Financial Times reports that China is set to announce its first population drop in five decades — meaning that China’s population has peaked well ahead of previous expert forecasts from the UN (shown in the chart above). UN forecasts had China’s population beginning to fall in the late 2020s, but the leaked census data — which has not yet been made public and is said to be very sensitive for Chinese officials — suggests that the relaxation of the controversial one-child policy in 2015 has done little to re-invigorate a baby boom. Isn’t this a good thing? As we’ve written before, whenever birth rates are unusually high or low, countries end up with really different sized generations. That’s not too bad on the way up (lots of young people), but if things reverse you get a top-heavy demography, with young people having to support a greater number of older people. Taking the super long-term view, fewer people consuming resources obviously puts less stress and strain on our planet, which is a good thing — but that doesn’t make it easy for China (or any other country) to plan for an ageing population. |

10. How to Make Better Decisions Faster

People often take too long to choose between equally-valued options.

Posted Apr 27, 2021 | Reviewed by Abigail Fagan

KEY POINTS

- People often spend too much time choosing between options that are equally valuable.

- People take longer to distinguish between two numbers when there is a small discrepancy than when there is a large one.

- When presented with two options, it may be best to choose the option with the possibility of a larger upside.

Imagine you are faced with two options for where to attend college:

1. UC Berkeley

2. UCLA

Now imagine you have weighed the pros and cons. But you still have difficulty deciding. You decide to give it more time, and reflect a bit more.

Research on decision-making suggests you might be making a mistake.

People Can Spend Too Much Time on Simple Decisions

Consider the findings of a fascinating paper titled “Irrational time allocation in decision-making.” At the start of the study, participants viewed images of different snack foods and indicated how much they would be willing to pay for each item. Next, participants looked at images that contained pairs of different foods (e.g. the screen would display a Kit Kat and a Mars Bar). They had to choose which item they preferred to eat at the end of the study.

The researchers found that participants spent more time choosing between options that were roughly equal in value than between options in which there was a large value disparity. “Value” here means how much participants said they would be willing to pay for each item at the start of the study. In other words, people took longer than they should have when deciding between two equally appealing choices.

When shown an unpleasant food alongside a favored food, participants in the study chose quickly. When shown a favored food alongside another favored food, people took a while. But this is irrational. If two choices are equally appealing (as rated by the decision-maker), then the decision shouldn’t take so long. After all, you’ll receive the same enjoyment no matter what you choose.

When making decisions, we spend too much time choosing between options that are equally pleasant.

In another study, participants viewed a series of images that contained two fields of dots (e.g., 20 dots on one side of the screen and 10 dots on the other). In each trial, they were shown a different image with two fields of dots. Participants had to decide which side had more dots. They were paid based on how many trials they got right. The more trials they responded to, the more they got paid.

In trials in which the number of dots on each side of the screen was nearly equal, participants took significantly longer to choose than when there was a clear disparity. Again, this is irrational. Participants would have made more money if they had just quickly made a decision and moved to the next trial.

In some of the trials, the researchers imposed artificial time constraints. Participants made decisions faster and thus made more money when researchers told them they had a limited amount of time to respond in each trial.

The researchers conclude, “People apparently misallocate their time, spending too much on those choice problems in which the relative reward is low.”

Why Decision-Making Can Be Difficult

Let’s go back to the example at the beginning. If choosing between an expensive and unknown for-profit university and UC Berkeley, then the choice is probably easy. We wouldn’t spend much time deciding.

Now imagine choosing between UC Berkeley and UCLA. Many people would, even after weighing the pros and cons and figuring that they would enjoy the experience at both colleges, spend a painstaking amount of time on this decision.

Or take vacations. If your choices for a holiday are Barcelona or Pyongyang, the choice is (probably) easy. If deciding between Barcelona or Rome, maybe this should be easy too.

Relatedly, there is research suggesting that people take longer to distinguish between two numbers when there is a small discrepancy than when there is a large one. For example, people take longer to determine which number is larger between 47 vs. 49 than for 12 vs. 35. Researchers sometimes call this “numerical discrimination.”

A recent paper titled “The Adaptive Value of Numerical Competence” describes the idea: “Similar numerical values are difficult to discriminate, but discrimination performance is systematically enhanced the more different (or distant) two values are (an effect called ‘numerical distance effect’).”

Perhaps this tendency is one reason why people take so long to choose between two options with roughly equal payoffs. In the same way that we have difficulty distinguishing numbers that are nearly equal in value, we also have difficulty choosing between options that are roughly equally pleasant.

I am curious whether this works in the opposite direction—whether duration of decision-making implies that options are equal. When options are roughly equal, people tend to take a long time to decide. Does this suggest that if people take a long time to decide, then options are roughly equal? Maybe in some instances, the longer we take to make a decision, the less it matters what we actually choose.

Another way to think about decisions comes from George MacGill: “When presented with two options, choose the one that brings about the greater amount of luck.” So even if two choices appear to be roughly the same, it may be wise to go with the one that has the possibility of a larger upside.

https://www.psychologytoday.com/us/blog/after-service/202104/how-make-better-decisions-faster

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information include herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.