1. No Correlation Between Cap Gains Rate and Stock Returns

Virtually no relationship between changes in capital gains tax rate & S&P 500 returns in year of change … last time cap gains went up (in 2013), S&P 500 had stellar year (up 30%)

From Barry Ritholtz Blog https://ritholtz.com/2021/04/weekend-reads-466/

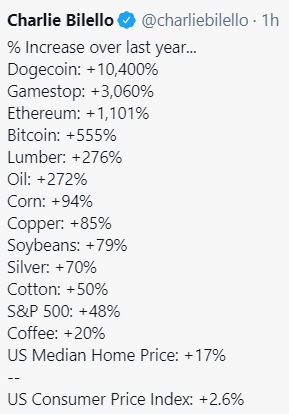

2. No Inflation Yet?

3. Commodity Index Closing in on Previous Highs

CRB commodity index hitting 2018-2019 levels

4. 10 Year U.S. Treasury Rate Just Ended Record Streak of 166 Days Above 50 Day

All Streaks Eventually End

Fri, Apr 23, 2021

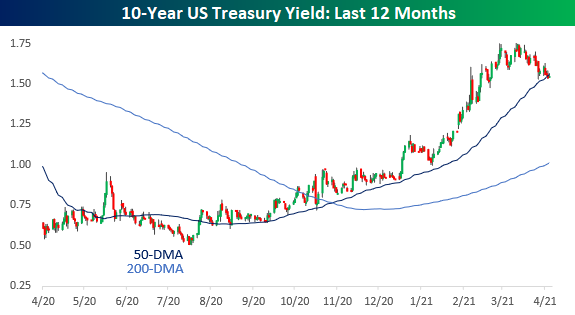

Interest rates have been steadily on the rise ever since last summer as optimism over the economy re-opening and concerns regarding ballooning federal deficits and potential inflation have pushed borrowing costs higher. In recent weeks, we have seen a bit of a reversal in this trend as the yield on the 10-year US Treasury has dropped from about 1.75% to just over 1.5% even as economic data has continued to come in very strong. What’s also notable about the recent decline in yields is that on Thursday, the yield on the 10-year actually closed marginally below its 50-day moving average (DMA) for the first time since August 21st.

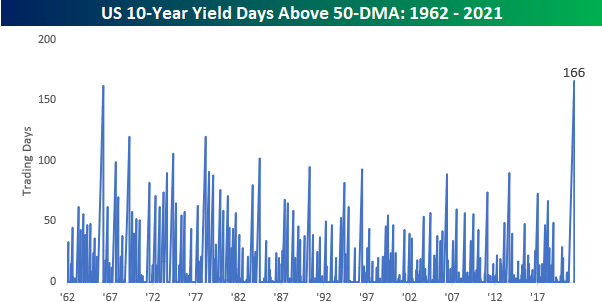

At 166 trading days, the just-ended streak of days where the 10-year yield closed above its 50-DMA was the longest on record going back to at least 1962, eclipsing the prior record of 162 trading days from March 1966. Also, since 1962, there have only been five other streaks that lasted even 100 trading days with the last occurring all the way back in 1984.

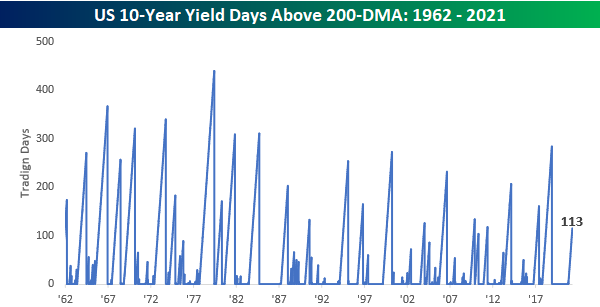

While the 10-year yield just ended a record streak of closes above its 50-DMA, its current streak of closes above the 200-DMA is much more ‘normal’ relative to history. At 113 trading days, it doesn’t even rank anywhere near the top ten in terms of longest streaks. With the 200-DMA only barely above 1%, though, that streak isn’t in danger of coming to an end any time soon. Click here to view Bespoke’s premium membership options for our best research available.

https://www.bespokepremium.com/interactive/posts/think-big-blog/all-streaks-eventually-end

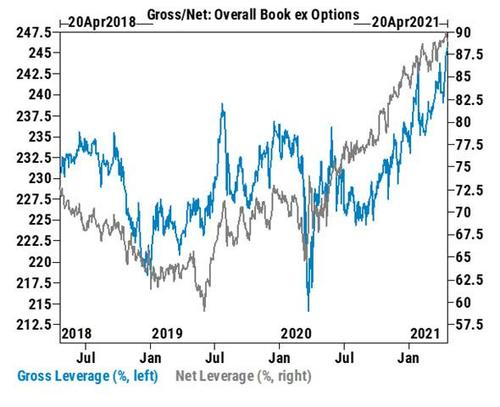

5. Hedge Funds Gross Leverage the Highest on Record

ZeroHedge

And while the article echoed many of the stats we have discussed previously, what was left unsaid is just how broken the market has become as a result of this unprecedented bullish pile up which has not only eradicated all the shorts but has pushed hedge funds all in to never before seen levels, with Goldman’s Prime Brokerage noting last week that hedge fund gross leverage is now the highest on record.

6. 25% of U.S. Stocks are Owned in Taxable Accounts

https://theirrelevantinvestor.com/2020/10/25/who-owns-the-stock-market/

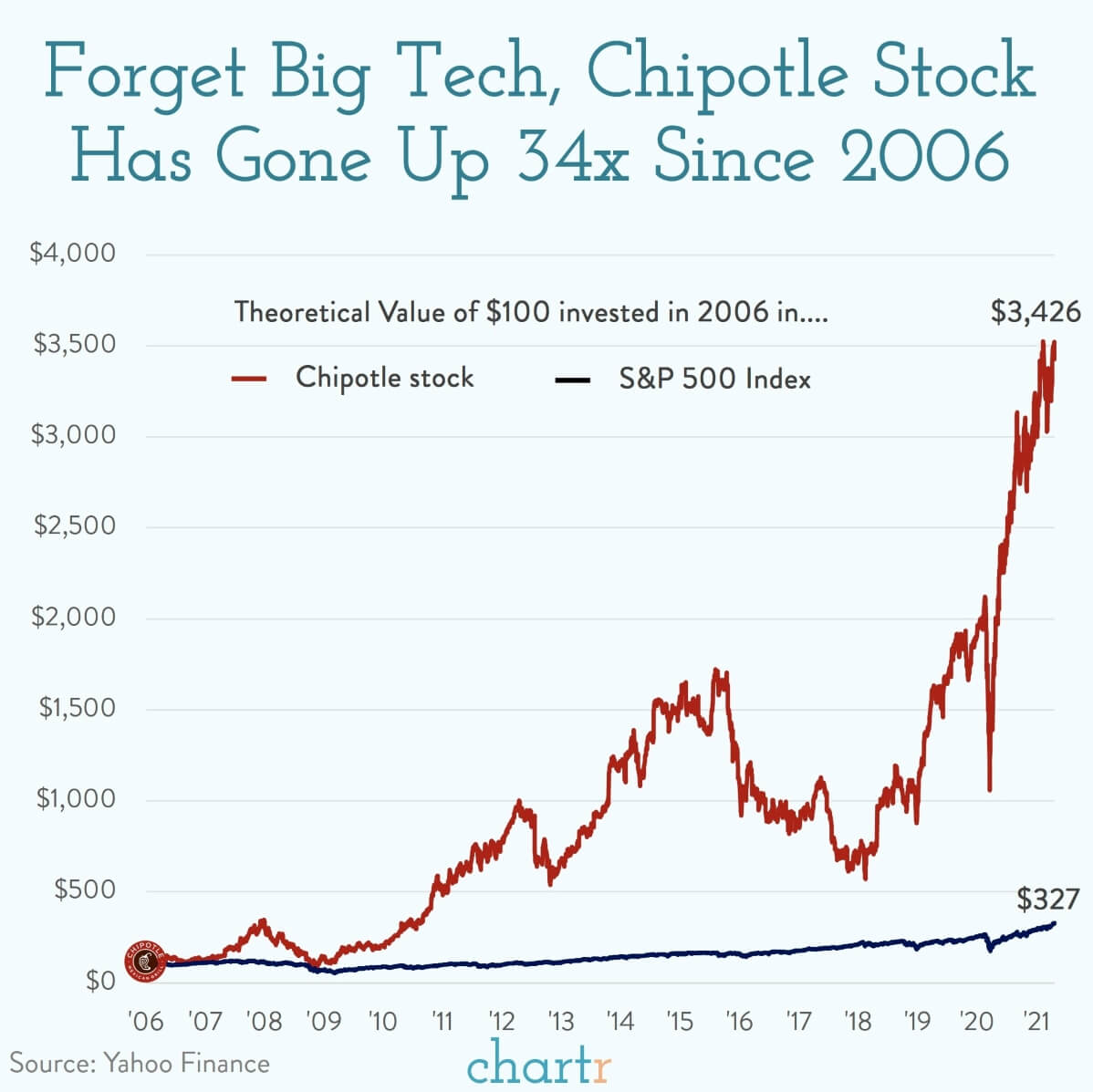

7. Big Tech Crushed by Tacos

| A lot of people regret not investing in many of the largest technology companies when they had the chance 10, 15, or 20 years ago. If you have those regrets already you can add Chipotle, the fast casual Mexican restaurant, to the list. Chipotle shares have increased 34x in value since 2006. Burritos go digital It’s sometimes easy to over-analyse why companies do well. In Chipotle’s case they clearly make tasty Mexican food that people want to eat, but they’ve also been quick to embrace online ordering in recent years. In 2020 Chipotle’s digital business grew 174% year-on-year and this week they announced that, for the first time ever, digital sales made up more than half of their total revenue in a quarter. That news comes a month after Chipotle announced that they had invested in autonomous delivery company Nuro, which “uses robotics in their fleet of on-road, occupantless and autonomous vehicles to deliver everyday consumer goods”. If that investment pays off and goes mainstream maybe Chipotle will end up being a tech company after all. https://www.chartr.co |

8. Walmart Is Pulling Plug on More Robots

Retailer has been phasing out automated pickup towers as curbside services have become popular

Walmart’s use of automated pickup towers for online orders had been showcased in presentations to investors.

By Sarah Nassauer

At Walmart Inc., WMT 0.16% the robots are losing their jobs.

The retailer is phasing out the hulking automated pickup towers that were erected in more than 1,500 stores to dispense online orders. The decision reflects a growing focus on curbside pickup services that have become more popular during the Covid-19 pandemic and continues a broader retreat from some initiatives to use highly visible automation in stores.

Over the past year Walmart has started to remove or turn off the 17-foot-tall machines often placed at the front of stores. About 300 machines are being removed from stores, and around 1,300 “hibernated” while Walmart focuses on other services, said Larry Blue, chief executive of Bell & Howell, a Durham, N.C.-based automation services company that installed and maintains the devices for the retailer.

https://www.wsj.com/articles/walmart-is-pulling-plug-on-more-robots-11619036906

9. After more than two decades, there’s a new world’s busiest airport

Marnie Hunter, CNN •

(CNN) — Seven of the world’s top 10 busiest airports in 2020 were in China while the former world’s busiest airport — Hartsfield-Jackson Atlanta International Airport in the United States — fell to No. 2 in the rankings after 22 consecutive years in the top spot.

Guangzhou Baiyun International Airport in China was the world’s busiest airport in 2020, rising to the No. 1 spot from its No. 11 ranking in 2019, according to preliminary figures released Thursday by airport trade organization Airports Council International (ACI).

Dramatic shifts in the top 10 list for passenger numbers — and the decimation of global air traffic overall — is of course because of the Covid-19 pandemic that continues to disrupt travel all over the globe.

2020’s busiest airports for passenger traffic

1. Guangzhou (CAN) — 43.8 million passengers in 2020; traffic dropped 40% from 2019

2. Atlanta (ATL) — 42.9 million passengers in 2020; traffic dropped 61% from 2019

3. Chengdu (CTU) — 40.7 million passengers in 2020; traffic dropped 27% from 2019

4. Dallas/Fort Worth (DFW) –39.4 million passengers in 2020; traffic dropped 48% from 2019

5. Shenzhen (SZX) — 37.9 million passengers in 2020; traffic dropped 28% from 2019

6. Beijing (PEK) — 34.5 million passengers in 2020; traffic dropped 66% from 2019

7. Denver (DEN) — 33.7 million passengers in 2020; traffic dropped 51% from 2019

8. Kunming (KMG) — 33 million passengers in 2020; traffic dropped 31% from 2019

9. Shanghai (SHA) — 31.2 million passengers in 2020; traffic dropped 32% from 2019

10. Xi’an (XIY) — 31.1 million passengers in 2020; traffic dropped 34% from 2019

10. HOW TO CONSISTENTLY IMPROVE EMOTIONAL INTELLIGENCE SKILLS IN 7 STEPS

Together as a team, create a list of 8-12 norms to establish how you work together. . Then work to hold each other accountable to them through positive reminders.

As a group, revisit your norms regularly. This isn’t intended to be something you beat people over the head with when they fail, but a way to come alongside each other andbuild your capacity to recognize and meet each other’s needs in the workplace.

2. TRULY LISTEN, DON’T JUST WAIT TO SPEAK

This one is hard for many of us …

It’s tempting to just think about what we are going to say next in a conversation, rather than really listening to what the other person is saying. This stems either from the need to be perceived as smart or make sure to get our point across (usually to rebut the other party’s idea).

If we resist this urge, we can make more of an impact by being confident in who we are and allowing ourselves to listen intently to what the other person is saying, thus demonstrating respect.

3. EXHIBIT IMPECCABLE COMMUNICATION

Most of us genuinely believe we are communicating well, and many times we don’t even realize that we could be misinterpreted or that someone could understand us differently than we intend.

Some tips to keep in mind for enhancing our communication:

- Don’t have meetings after the meeting: Make sure that we say what we need to say when the team is together to make a decision. Otherwise, we are likely to undermine the decision with side conversations later.

- Get stuff that is “under the table” and put it “on the table”: For items that aren’t being discussed because we feel they are too sensitive, embarrassing, or uncomfortable, muster courage and show some vulnerability by talking to the other person about that “under the table” item. Do this in a non-threatening, kind way with a focus on understanding their side of the issue; it usually helps to do this in private.

- Deliver the mail to the correct address: Simply put … don’t gossip. If you have an issue with someone, that person deserves to hear it from you directly, in private and with sensitivity. Gossip only tears a team further apart.

Emotionally intelligent leaders work to create a psychologically safe environment where people feel safe to have the conversations that really matter. It’s one of the biggest leadership challenges you can face, and one of the biggest gifts you can give your team.

Connect your feelings with your thoughts. Some people have no problem with this; others struggle in this area. Sometimes, it helps to write your daily thoughts and feelings down in a journal to tune into your unconscious feelings by reflecting on the day.

Emotionally intelligent leaders understand how their emotions could be influencing their actions and the people around them. They know how to slow down, check their feelings, and respond with intention.

As you get better at recognizing your own emotions, you’ll get better at sensing them in others, too. That can help you gauge when someone needs a wellbeing check-in or extra empathy in moments that matter at work.

5. PRACTICE EMPATHY

Choose to relate to others with feeling, not simply as a transaction required to get the job done. Try to connect to what they’re saying and take in their concerns. An empathic leader helps someone feel seen and heard.

Putting yourself in another person’s shoes isoften a humbling act, since it requires us to recognize that, perhaps, there is a different point of view at play in the situation.You don’t have to agree with someone to practice empathy. But you do have to listen with an open mind and an open heart.

If you are weak in this area, consider emotional intelligence training or working with a coach who will help you build these skills.

6. EXPLORE “WHY” THE OTHER PERSON IS FEELING/ACTING THAT WAY

Perhaps your c0-worker’s recent outburst was completely unrelated to the task at hand. Are they going through a divorce? Did they just get bad news about the health of a loved one?

There are many times when the emotion displayed has little to no bearing on the work involved. It can simply be related to their personal lives. Find a caring way to ask them how they are doing and how you can help, and you might find that their emotional walls come down.

7. SOLICIT DIFFERENT BUT GENUINE PERSPECTIVES FROM OTHERS

There’s nothing like an “It’s my way or the highway” attitude to squelch growth and innovation at work. Emotionally intelligent leaders solicit feedback and make a habit of perspective-taking.

To be authentic though, you have to value honesty, even when the message is hard to hear. We grow as people and as organizations when we’ve built the kind of culture where it’s safe for people to say, “Here’s what I need” and “Here’s how I think we could do better.”

Emotionally intelligent leaders ask questions with genuine curiosity and an open mind.

HTTPS://WWW.INITIATIVEONE.COM/INSIGHTS/BLOG/EMOTIONAL-INTELLIGENCE-IN-LEADERSHIP/#QR-3

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information include herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.