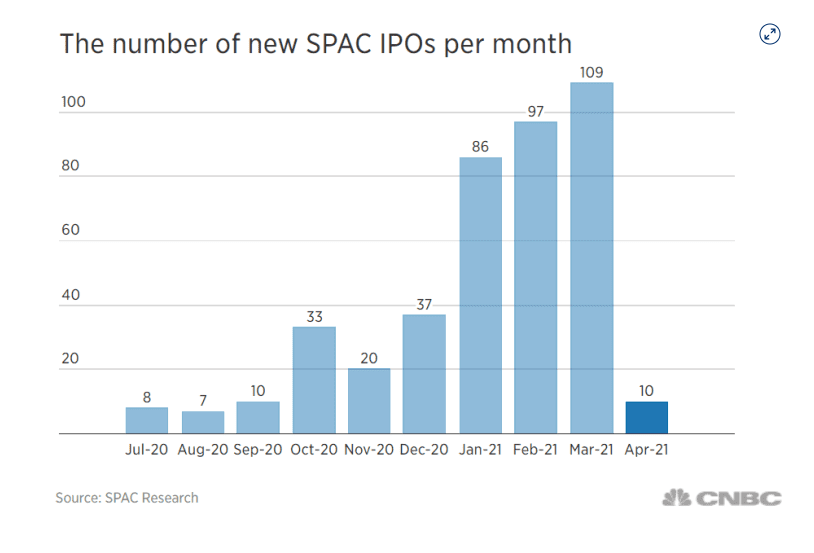

1. SPAC IPOs 109 in March vs. 10 in April.

SPAC transactions come to a halt amid SEC crackdown, cooling retail investor interest Yun Li@YUNLI626

SPAC transactions come to a halt amid SEC crackdown, cooling retail investor interest (cnbc.com)

2. Real Estate ETF Quietly Beating S&P 500 YTD.

SPDR XLRE Real Estate +15% vs. SPY 10.4%

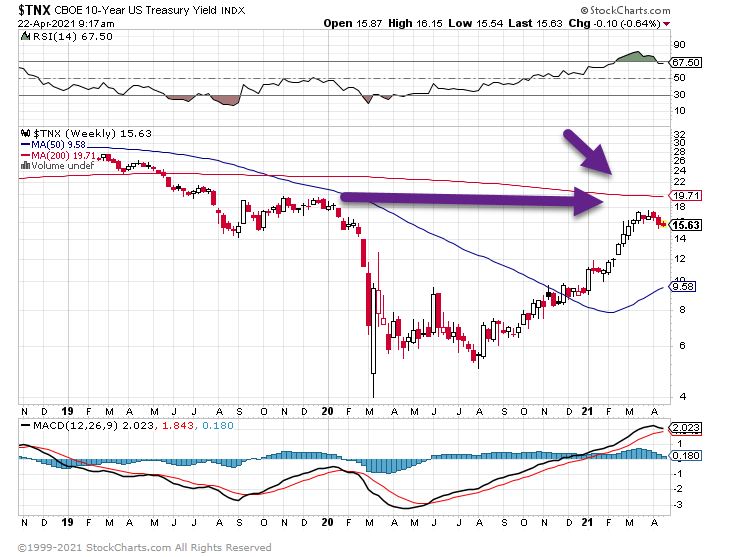

3. Technical Action on 10 Year Treasury Yield.

10 Year yield falls back to 50day moving average.

Longer-term chart rallied back to 2020 highs then rolled over….stayed below 200 day moving average

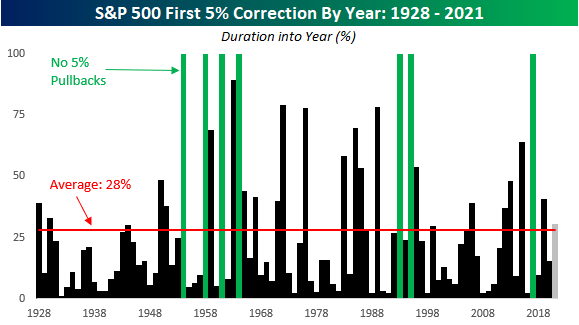

4. The S&P from 1928-2020 Only Seven Years Without a 5% Pullback

Bespoke Investment Group–In order to see how this year stacks up to prior years, the chart below shows the duration into each year (on a percentage basis) that the S&P 500 first closed down 5% or more from its YTD peak. Years in green indicate that there wasn’t a single point in the entire year that the S&P 500 experienced a 5% decline. The last occurrence was in 2017, and there have been a total of seven years since 1928. As we near the end of April, we’re nearly a third of the way into 2021, and compared to the ‘average’ year, we’ve already gone longer without a 5% pullback. Since 1928, the S&P 500 usually experiences its first 5%+ pullback 28% of the way into the year, which coincidentally enough works out to April 15th – the day before Federal taxes are typically due! In fact, at this point in prior years, the S&P 500 has already experienced its first 5%+ pullback more than 65% of the time. Believe it or not, in 30% of all years since 1928 the first 5% drop occurred in the month of January.

Based on prior years, the market to this point has in fact been stingy in terms of providing opportunities for investors to add exposure, although based on today’s reports of new capital gains tax increases from the Biden Administration, that window may open.

https://www.bespokepremium.com/interactive/posts/think-big-blog/dips-in-short-supply

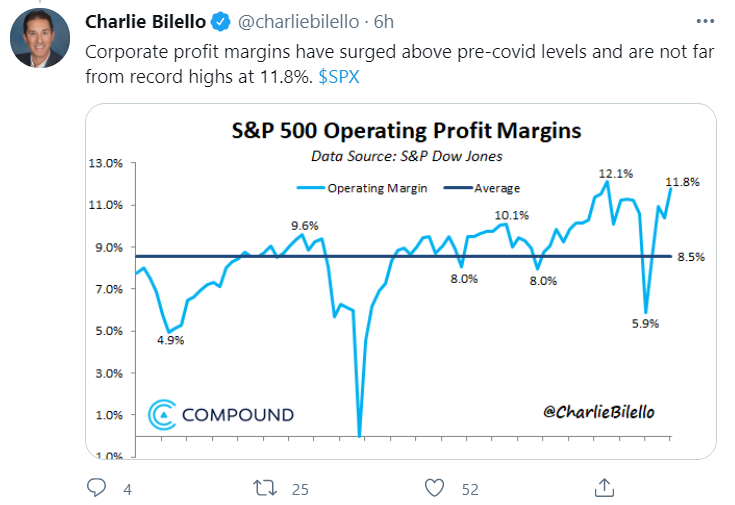

5. Corporate Profit Margins Near Record Highs

6. ARKK Latest Trades Cathie Wood Loads Up On DraftKings, Coinbase, Palantir, Sells Nvidia, Square

ARKK-sideways..which way will it break?

Cathie Wood Loads Up On DraftKings, Coinbase, Palantir, Sells Nvidia, Square

Rachit Vats

Wood’s firm also sold 233,147 shared worth about $57.2 million of Square Inc (NYSE: SQ), one of its three top holdings.

ARKW sold 44,500 shares of the fintech company, representing 0.16% of the ETF. ARKK sold another 188,647shares, representing 0.197% of the ETF.

Other Ark Buys On Tuesday:

- JD.Com (NASDAQ: JD)

- Opendoor Technologies (NASDAQ: OPEN)

- Pinduoduo (NASDAQ: PDD)

- Recursion Pharmaceuticals (NASDAQ: RXRX)

- Ionis Pharmaceuticals (NASDAQ: IONS)

- Berkeley Lights (NASDAQ: BLI)

- Beam Therapeutics (NASDAQ: BEAM)

- TuSimple (NASDAQ: TSP)

- Workhorse Group (NASDAQ: WKHS)

- Jaws Spitfire Acquisition (NYSE: SPFR)

- Niu Technologies (NASDAQ: NIU)

- Iridium Communications (NASDAQ: IRDM)

- 3D Systems (NYSE: DDD)

- Tencent (OTC: TCEHY)

- Roblox (NASDAQ: RBLX)

- Peloton Interactive (NASDAQ: PTON)

- Okta (NASDAQ: OKTA)

- Reinvent Technology Partners (NYSE: RTP)

Other Ark Sells On Tuesday:

- LendingTree (NASDAQ: TREE)

- Novartis (NYSE: NVS)

- Roche (OTC: RHHBY)

- Thermo Fisher Scientific (NYSE: TMO)

- Twitter (NYSE: TWTR)

- Roku (NASDAQ: ROKU)

- PACCAR (NASDAQ: PCAR)

- Taiwan Semiconductor Manufacturing (NYSE: TSM)

- Xlinx (NASDAQ: XLNX)

- Pure Storage (NYSE: PSTG)

- Intercontinental Exchange (NYSE: ICE)

Photo by World Poker Tour on Flickr

https://finance.yahoo.com/news/cathie-wood-loads-draftkings-coinbase-072915569.html

7. Sustainability Reports Now Commonplace from S&P 500 Companies.

By Jack Denton Marketwatch https://www.marketwatch.com/story/goldman-sachs-says-s-p-500-returns-may-tumble-as-u-s-economic-growth-peaks-buy-these-stocks-11619090474?mod=home-page

8. Used Car Prices.

Used car prices in the U.S. are soaring. The Manheim U.S. Used Vehicle Value Index, a gauge of pricing trends, soared to a fresh record Tuesday as factors ranging from chip shortages to a rebounding economy conspired to keep pressure on automotive inventories. The index, which updates mid-month, rose by 6.8% in the first 15 days of April from the final March figure and jumped 52% from the same period a year ago to a level of 191.4.

Used-Car Prices Leap on U.S. Economic Recovery, Supply Crunch By Edward Ludlow https://www.bloomberg.com/news/articles/2021-04-21/used-car-prices-leap-on-u-s-economic-recovery-supply-crunch?sref=GGda9y2L

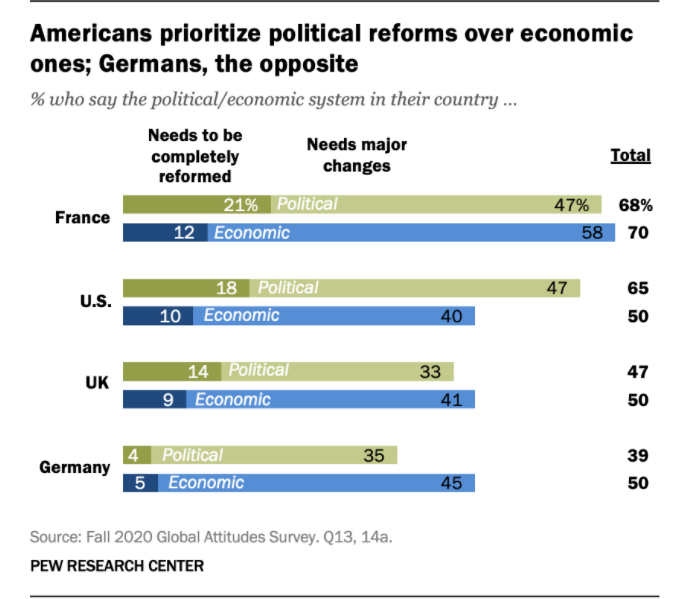

9. Americans prioritize political reforms over economic ones; Germans, the opposite

https://www.pewresearch.org/ft_2021-04-21_econreform_01/

10. Modern Cruise Ship vs. Titanic.

https://www.visualcapitalist.com/visualized-comparing-the-titanic-to-a-modern-cruise-ship/

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information include herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.