1. Chinese Firms IPO in U.S. at Record Pace 2021

Chinese Firms Are Listing in the U.S. at a Record-Breaking Pace-Julia Fioretti and John Cheng

(Bloomberg) — Chinese companies are listing in the U.S. at the fastest pace ever, brushing off tensions between the world’s two biggest economies and the continued risk of being kicked off American exchanges.

Firms from the mainland and Hong Kong have raised $6.6 billion through initial public offerings in the U.S. this year, a record start to a year and an eightfold increase from the same period in 2020, data compiled by Bloomberg show. The largest IPO is the $1.6 billion listing of e-cigarette maker RLX Technology Inc., followed by the $947 million offering of software company Tuya Inc.

That’s even as Sino-U.S. tensions show few signs of easing and the threat of Chinese firms being delisted from U.S. exchanges remains. In fact, the U.S. Securities and Exchange Commission said last month it would begin implementing a law forcing accounting firms to let U.S. regulators review the financial audits of overseas companies. Non-compliance could result in a delisting from the New York Stock Exchange or Nasdaq.

https://finance.yahoo.com/news/chinese-firms-listing-u-record-210000577.html

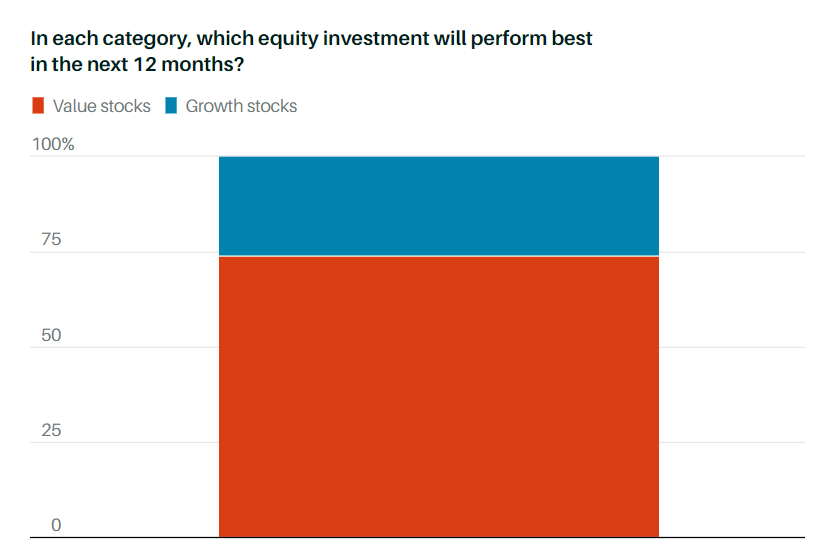

2. Barron’s Big Money Poll….Pros Favoring Value Over Growth Next 12 Months.

This Bull Market Is Far From Over, Pros Say. Where They’re Investing Now. By Nicholas Jasinski https://www.barrons.com/articles/stocks-have-more-room-to-rise-says-barrons-big-money-poll-51619222301?mod=past_editions

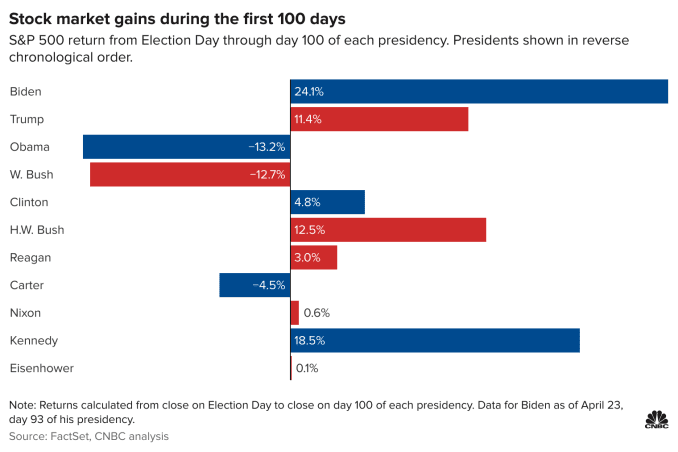

3. Stock Market Gains First 100 Days of Presidency

Biden’s 100-day stock market performance is the hottest going back to the 1950s–Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

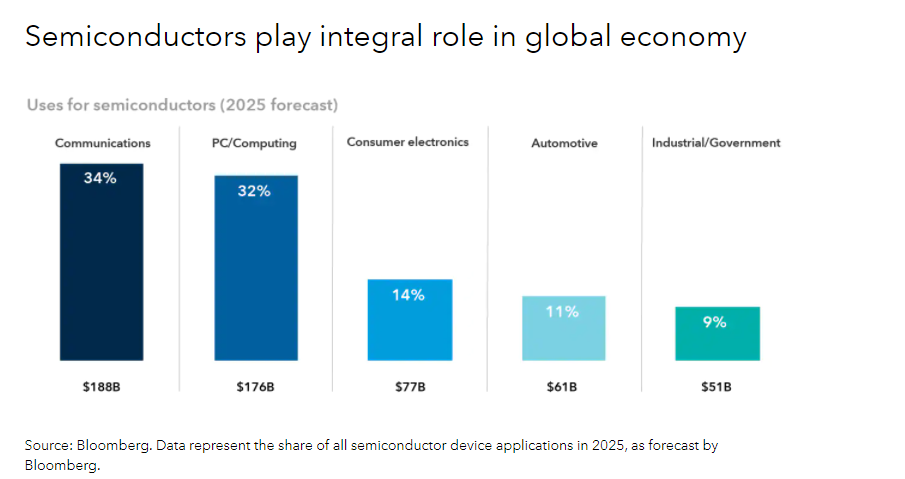

4. Good Read on Semi Shortage

Capital Group Blog

A massive semiconductor spending cycle is coming

The world’s largest semiconductor companies are planning to spend billions of dollars on new manufacturing facilities to meet new demand, as well as to navigate geopolitical tensions with semiconductors being seen as a national security priority. The U.S. and Europe both seek to bring critical supply chains closer to home, given that Taiwan controls a majority of the high-end manufacturing production for semiconductors.

Industry bellwether Taiwan Semiconductor Manufacturing (TSMC) plans to spend $100 billion through 2023 for new chip fabrication facilities, including a large site planned for Arizona. TSMC holds close to 80% market share for leading-edge chip production, and its clients include Apple, Qualcomm and Broadcom.

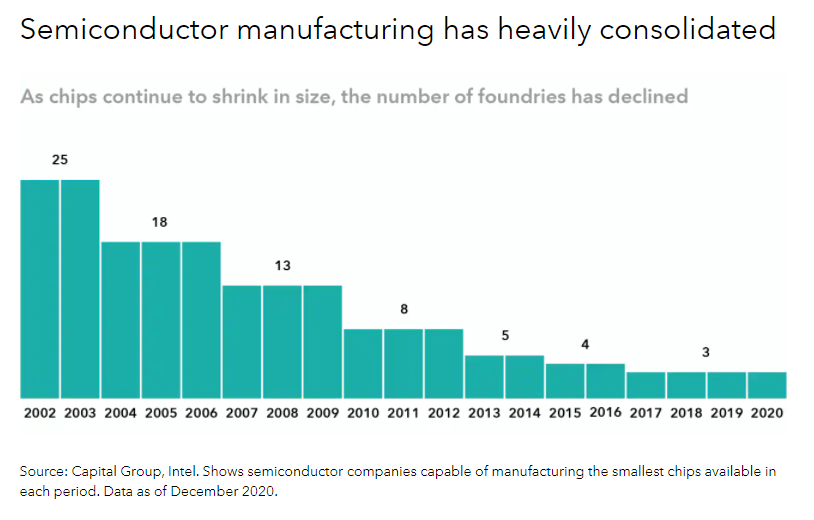

Semiconductor manufacturing has heavily consolidated

Souce: Capital Group, Intel. Shows semiconductor companies capable of manufacturing the smallest chips available in each period. Data as of December 2020

. https://www.capitalgroup.com/institutional/insights/articles/semiconductor-shortage-chips.html

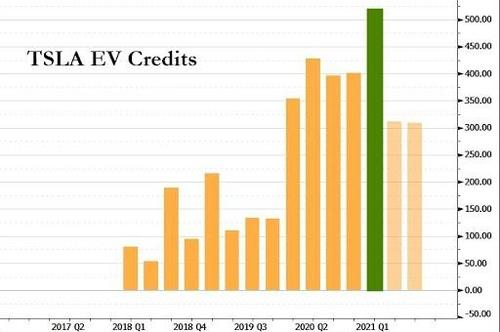

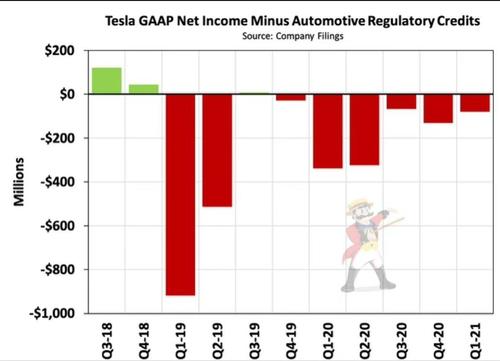

5. Tesla Beats on EV Credits and Bitcoin Sale

Zerohedge–But here is the problem: TSLA reported $594MM in income from operations, but regulatory credits accounted for a whopping $518MM of it, the highest on record and up from $401MM in Q4 2020.

Of course, some will claim that none of this matters, and that TSLA has in fact generated 7 consecutive quarters of profits, although if one strips reg credits from the GAAP Net Income, this is what one gets.

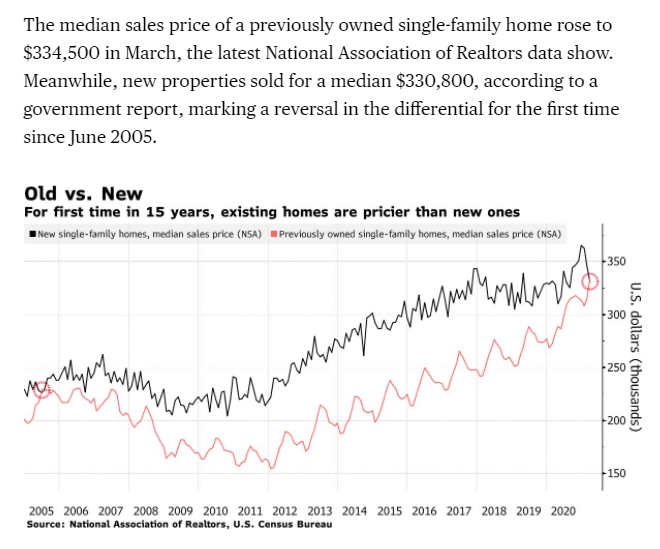

6. Existing Homes Now More Expensive than New Construction

Previously Owned U.S. Homes Are Now More Expensive Than New OnesBy Jordan Yadoo https://www.bloomberg.com/news/articles/2021-04-26/previously-owned-u-s-homes-are-now-more-expensive-than-new-ones?srnd=premium&sref=GGda9y2L

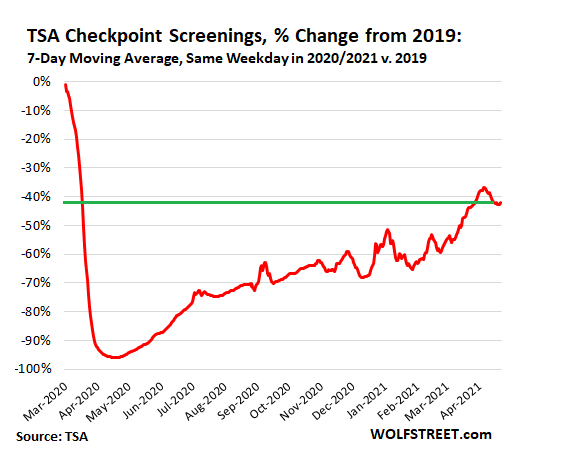

7. TSA Checkpoint Screenings Halfway Home

How much are people and boxes flying?

The number of air passengers that pass TSA checkpoints to enter the security zones of US airports is still down 42% from the same day in 2019, based on the seven-day moving average of daily screenings. The peaks and valleys in the chart represent calendar shifts of holidays. The most recent bump was the shift in the calendar of Easter:

8. Fort Lee Surpasses Las Vegas as Gambling Hot Spot

New Jersey border towns surpass Las Vegas as sports gambling hotspot

FORT LEE, N.J. — “Which Starbucks?” the police officer was asked.

“It’s gotta be the one at Linwood Plaza,” a friendly officer with the name tag Liguori responded.

“We get ‘suspicious person’ calls on the place all the time.”

Those ”suspicious” people are actually New Yorkers with too much time and too much money. They are flocking to Fort Lee, N.J. every single day with so much gambling gusto that they have made the border town of approximately 40,000 people — the first exit in New Jersey after crossing the George Washington Bridge from New York — one of the top gambling hotspots in the entire United States.

Sportsbook insiders say Fort Lee is often pulling in more money on any given day than the entire state of Nevada, as the U.S. legalized sports gambling marketplace continues to boom. Often, those bets come in from the parking lots of three Starbucks coffee shops near highway exit ramps. Sports gambling will be legal in New York eventually, but the law passed earlier this month at the state capitol in Albany is problematic.

“I was talking to an [NBA] owner who told me in three-to-five years, we will not even need the TV money. That’s how big this thing is going to be,” Charles Barkley said to BasketballNews.com, who quipped after the 2007 NBA All-Star game in Las Vegas that the oversized $50,000 check he was handling represented “two hands of blackjack.”

Barkley is well-versed in gambling, and so are more and more Americans as the nation continues to pass gambling legalization laws nearly three years after the Supreme Court overturned PASPA – the Professional and Amateur Sports Protection Act, allowing states to make their own rules.

New Jersey, which was the plaintiff in Christie v. NCAA — the lawsuit that led to the overturning of PASPA — is one of two states, along with Michigan, that allows gamblers to wager on both sports and casino games from their phones.

New York has legalized sports gambling, but will not have it up and running for several months, and New Yorkers are seeking someplace to have a little action. They are ponying up the $16 toll to drive to New Jersey and back into NY via the George Washington Bridge, Lincoln Tunnel or Holland Tunnel, or are boarding trains that travel under the Hudson River and heading into New Jersey’s border cities and towns, including Hoboken and Jersey City. As a result, they’ve become the gambling capitals of America — in terms of where the most money is being wagered.

Sports gambling industry insiders explained that smartphone technology allows them to ‘ping’ with high levels of precision to discover where wagers are coming from, and a small strip mall in Fort Lee with an H-Mart, a pizzeria and a teeny-tiny Starbucks is lighting up the geo-locator boards at the books.

“What we also are seeing consistently is that East Rutherford, the Meadowlands, has become the No. 1 sportsbook on the East Coast in terms of the number of bets, and anecdotally, it is bigger than anything in Las Vegas on a daily basis,” said Kevin Hennessey, a spokesman for FanDuel. “Twenty five percent of our customer base is New Yorkers, and 50% of our daily handle comes from the Meadowlands.”

PointsBet spokesman Patrick Eichner said the border town phenomenon in Northern New Jersey is similar to what they were seeing before Pennsylvania legalized sports gambling.

“We were getting heavy traffic from Camden and Cherry Hill, places just across the water from Philadelphia. Now, going on the PATH train to New Jersey and placing bets on games, then grabbing breakfast and going back to New York on an NFL Sunday has become a ritual.”

All of the sportsbooks guard their financial information very closely, and none were willing to quantify exactly how much money they are handling on a daily, weekly or monthly basis. But sports gambling stocks have been very strong since the pandemic shut down most of the world, with Penn National Gaming closing at $99.94 on Friday on the NASDAQ. It was trading at $7.89 on March 20, 2020.

DraftKings stock closed at $57.98 Friday, up from $12.25 on March 30, 2020. Roundhill Sports Betting & iGaming is up 96 percent since debuting on the market last June, and tracking the hottest sports gaming company stocks has become a bit of an obsession for day traders and large investors alike.

Talented gamblers are known as “sharps,” and semi-retired New York sportswriter and broadcaster Andy Roth is now making a living by gambling, having to cross state lines to do it.

He is sitting on several Most Improved Player tickets on Julius Randle of the New York Knicks at odds as high as 65-1, and his Defensive Player of the Year Strategy was to play Ben Simmons of Philadelphia at 40-1, Myles Turner of the Indiana Pacers at 100-1 and Rudy Gobert at 3-1. Simmons ($17,000) and Turner ($14,000) would provide the biggest payouts, and Roth feels fortunate to have gotten those wagers in because BetMGM and Borgata have tagged him as a sharp. The last time he tried to wager at BetMGM, they limited his maximum wager to 70 cents.

Last season, Roth made $3,000 on a $150 wager on Nick Nurse to win Coach of the Year and the Toronto Raptors to win the Atlantic Division.

“The trick is being able to ID talent that bookmakers cannot see and odds that are the wrong price, and it’s no secret that the oddsmakers are not all that good at pricing the futures market,“ said Roth, who also has an open ticket on Corbin Burnes of the Milwaukee Brewers to win the National League Cy Young Award at spring training odds of 50-1.

The odds on Burnes, who has 30 strikeouts and no walks allowed on 18 ½ innings this season (allowing only four hits with an ERA of 0.49) have dropped to 5-1.

Obviously, Roth — a New York resident — has found a way to make it work. Judging by the amount of action we’re now seeing in New Jersey, scores of others are, as well.

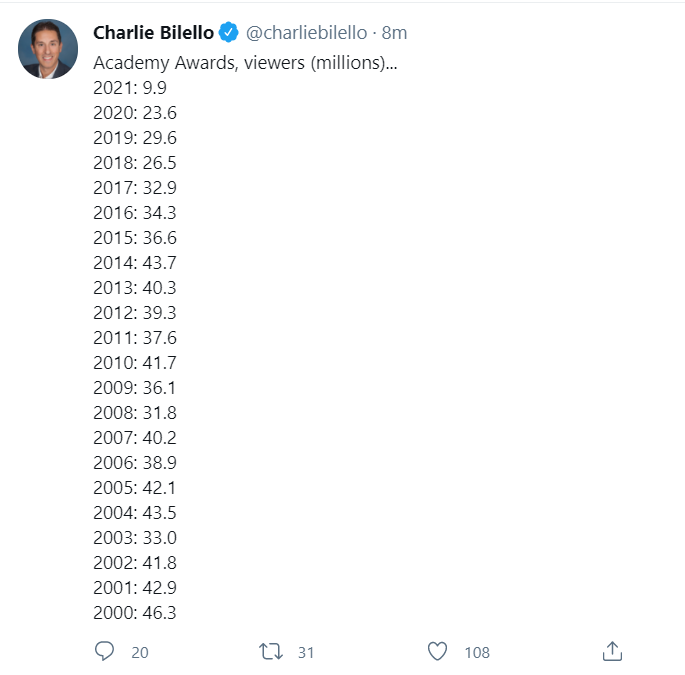

9. Massive Drop in Academy Award Viewers

https://twitter.com/charliebilello

10.Your brain wants you to take breaks between meetings. Outlook aims to help

Microsoft’s research confirms that back-to-back meetings create stress and sap productivity. So it’s adding features to carve off some downtim

BY HARRY MCCRACKEN5 MINUTE READ

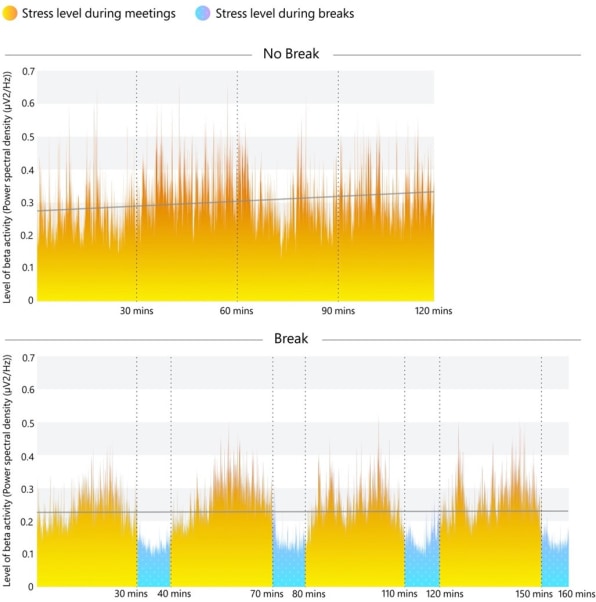

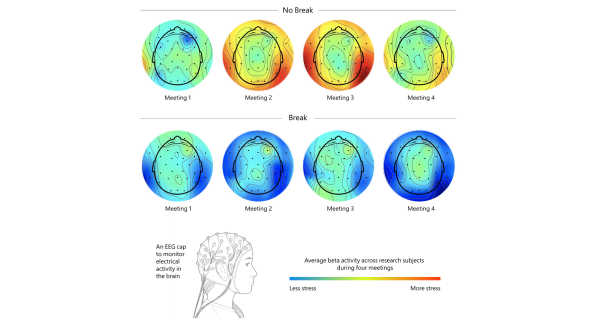

Recently, Microsoft’s Human Factors Lab conducted an experiment. It involved 14 test subjects sitting through Microsoft Teams meetings concerning typical business tasks such as writing a marketing plan and planning office space. And the whole affair was intended to simulate real-world situations except for one thing: The attendees wore electroencephalogram (EEG) caps that allowed Microsoft to monitor electrical activity in their brains.

On one day, the subjects participated in four back-to-back half-hour video meetings. That made for two nonstop hours of collaboration. On another day, participants also did four half-hour video calls. But this time, rather than ending one session and immediately diving into another, they paused for ten minutes and meditated using the Headspace app.

During those meditation breaks, EEG readings showed the test subjects’ stress levels tumbling, as you’d expect. But though their stress then increased during the subsequent meetings, it still fell well short of the stress levels recorded when the same people attended consecutive meetings with no breaks.

Take a break between meetings, and your stress level dips—and stays lower than if you hadn’t taken the break. [Image: courtesy of Microsoft]A break, in other words, isn’t just a break. “Taking breaks is good for your brain’s health, but also it’s good for keeping you actually productive,” says Michael Bohan, a senior director in Microsoft’s Human Factors Engineering group. “There’s an irony here—I think that people feel like if they take a break, they’re not being productive.”

By “break,” Bohan does not mean “spending ten minutes frantically trying to catch up on email.” Microsoft had everyone meditate using Headspace for the sake of consistency in its testing methodology. (The company also announced a partnership last year that integrated Headspace into Microsoft Teams.) But Microsoft 365 corporate VP Jared Spataro says that any pleasant activity that isn’t about getting stuff done should do the trick: “It’s less about meditation and it’s more about disengaging your brain from the work. In our own research, we’ve seen that sketching, doodling, and reading can have very similar effects.”

Now, this isn’t an instance of research data that’s going to lead anyone to reassess what they thought they knew about a topic. Of course being trapped in endless meetings is bad for your ability to bring your full intellect and energy to your work. Microsoft just confirmed what anyone who’s ever done three meetings in a row—as I did this morning—could have told you.

Even though too many meetings with too few breaks isn’t a new problem, the company says that the era of virtual meetings compounds it. “Our brains are wired for talking with human beings in the real 3D world and not in flattened grids—digitized people that you only see part of,” explains Bohan. “You feel compelled to stare at people, but in the real world, you don’t do that.” A single typical video meeting is more stressful than its in-person equivalent; three or four in a row may be downright excruciating.

Microsoft’s EEG test shows stress building as you do meeting after meeting without a break. [Image: courtesy of Microsoft]As the maker of some of the world’s most used products for scheduling and conducting meetings, Microsoft is in a place to turn its findings into new features. Last year, for example, it gave Teams a Together mode that displays coworkers in settings such as a simulated auditorium rather than as a Brady Bunch-style checkerboard of video windows. The company says that helps reduce the stress of online meetings.

And now Microsoft is tweaking the calendar features in Outlook to permit customers to specify defaults that carve out break time, with both the meeting and break default lengths user configurable. For instance, what might have been a 30-minute meeting starting at 2 p.m. could become a “shortened” 20-minute meeting ending at 2:20 p.m., with ten minutes for a brain-clearing break. (Alternatively, the ten minute break could start at 2 p.m., pushing the meeting to 2:10 p.m.)

Besides letting individuals shorten their own meetings this way, Outlook will let organizations set default meeting and break lengths, thereby encouraging everyone to err on the side of briefer meetings that don’t collide with each other. A pop-up message will explain that such policies have been instituted at the organization level.

All along, of course, it’s been possible to keep meetings brief and preserve plenty of downtime—it’s just that such discipline doesn’t come naturally to many of us. Microsoft hopes that the new options will help. “You could have already done this before, just adjusting the meeting time,” says Spataro. “But because it’s so easy to click on your calendar and take the default within that block, we see so many 30 minute, 60 minute meetings, and people fill the time.”

IN PART, BACK-TO-BACK MEETING CULTURE IS A RESULT OF CALENDAR APPS DEFAULTING TO HOUR-LONG MEETINGS.

So far, I haven’t tried this new functionality for myself. I’ve only read about it in some Microsoft materials and heard Spataro and Bohan explain it. But I confess that I wonder if the whole concept of your calendaring software shortening meetings isn’t overcomplicating matters. It seems to presume that people’s impulse will continue to involve scheduling long meetings, with Outlook intervening to cut them down them for everyone’s good.

Microsoft isn’t the only calendar company who thinks about it this way. For almost a decade, Google Calendar has had a Speedy meetings option which describes itself as ending “30 minute meetings 5 minutes early and longer meetings ten minutes early.” But a 60-minute meeting that ends ten minutes early isn’t a speedy 60-minute meeting; it’s a 50-minute meeting. It should be embraced on its own merits!

When it comes to being engaged in a meeting, Microsoft says, your brain waves showing Frontal Alpha Asymmetry is a good sign. [Image: courtesy of Microsoft]There’s a cultural aspect here that software may have trouble overriding. Neither Microsoft nor Google is preventing anyone from ignoring the defaults and making meetings even longer so that they take an hour (or more) even after break time has been accounted for. Nor is there any guarantee that someone won’t schedule a new meeting that cuts into the break time that Outlook created before or after a previously scheduled meeting.

That’s not even accounting for the many meetings that just keep on going well after their official scheduled time has elapsed. It’s all too easy to envision people treating Outlook’s 50-minute meetings and ten-minute breaks like . . . well, a one-hour meeting.

In part, back-to-back meeting culture is a result of calendar apps defaulting to hour-long meetings, which they’ve done for as long as I can remember. That dramatically increases the chances that you’ll end up with two (or more) meetings in a row and no breathing space in between. It seems to me that simply allowing an organization to set the default meeting length at 50, 45 minutes, or less would go a long way toward addressing this problem, without introducing the wrinkle of “shortening” meetings or making them “speedy.”

Still, I appreciate what Microsoft is trying to do with these new features. If more people err on the side of keeping meetings short and remembering to recharge their mental batteries, it can only be progress. For years, Outlook has facilitated meeting overload; it’s about time it did something to discourage it.

ABOUT THE AUTHOR

Harry McCracken is the technology editor for Fast Company, based in San Francisco. In past lives, he was editor at large for Time magazine, founder and editor of Technologizer, and editor of PC World.

https://www.fastcompany.com/90626866/microsoft-outlook-teams-shorten-default-meetings

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information include herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.