1. What Happens After the First Fed Rate Hike?

2. The Most Shorted Stock Lagging Again After GME Led Event in Feb.

The Daily Shot

https://dailyshotbrief.com/the-daily-shot-brief-april-21st-2021/

3. Netflix Still in Sideways 1 Year Tunnel

NFLX trades down to 50day..last time it closed below 50 day was March 2020

4. Small Cap Russell 2000 Sector Revenue Growth.

Stocks Rebound as Dip Buyers Fuel Reopening Trade: Markets WrapBy Rita Nazareth and Kamaron Leach

5. Gold Bounced Higher Recently But….

GLD ETF broke blue trendline going back to 2018 before recent small bounce

6. Rental Inflation Slowed During Covid.

This will be one of the post-covid world charts to follow

Perhaps most significant is the ongoing slowdown in rental inflation. According to the Bureau of Labor Statistics, rents rose just 1.8% over the past 12 months, compared to an average inflation rate of 3.7% in the years before the pandemic. Surveys of homeowners also suggest that the implied rate of rental inflation for owner-occupied housing units has also slowed, albeit less markedly.

From Greg Horn at Persimmon Capital

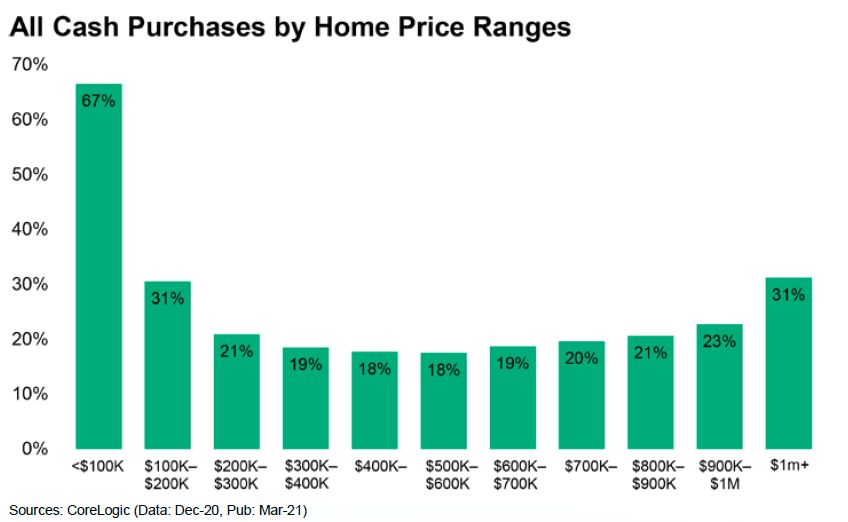

7. All Cash Home Buyers by Price Range

All cash buyers dominate the market at the lowest price points.

Interestingly, many of these affluent buyers also pay 100% cash for their own homes.

https://www.linkedin.com/in/johnburns7/

8. Real Estate by Generation

Millennials Increasing but a Long Way to Go

From Tim Hussman at Wharton Hill

9. Regent is making a flying electric ferry with a top speed of 180 miles per hour

KEY POINTS

· Boston start-up Regent is developing an “electric seaglider” that can motor out of a harbor on a hydrofoil, take off at a low speed using the water as a runway, then fly over the waves at a top speed of 180 miles per hour.

· The company raised $9 million in seed funding from Caffeinated Capital — an early backer of supersonic jet startup Boom — Mark Cuban, Peter Thiel’s Founders Fund, Y Combinator and others.

· The company’s name stands for Regional Electric Ground Effect Naval Transport.

A Boston start-up called Regent wants to make flying ferries the best way to travel between coastal cities.

The start-up is developing an “electric seaglider” that can motor out of a harbor on a hydrofoil, take off at a low speed using the water as a runway, then fly over the waves at a top speed of 180 miles per hour to bring passengers to their destinations, according to co-founders CEO Billy Thalheimer and CTO Michael Klinker.

The duo previously worked for a Boeing company, Aurora Flight Sciences, and both are FAA-licensed private pilots. Thalheimer told CNBC that Regent wants to make trips between coastal cities fast, safe, affordable and reliable with the smallest possible environmental footprint. (The company’s name is an acronym for Regional Electric Ground Effect Naval Transport.)

The seagliders that Regent designed technically fall in the category of Wing in Ground Effect craft, or WIGs. They have not historically been regulated by the Federal Aviation Administration, but instead by the U.S. Coast Guard.

Importantly, Regent is developing its seagliders to work with existing harbor infrastructure, the CEO says. He notes that charging is still needed at harbors for mainstream adoption of electric vehicles there, whether electric air taxis, boats or ground vehicles.

The company will seek to establish passenger routes between major hubs like Boston and New York, Los Angeles and San Francisco, or shorter routes like New York City to the Hamptons or routes connecting the islands of Hawaii.

(Illustration) REGENT is developing a flying, electric sea glider with a top speed of 180 miles per hour.

10. How to Pitch Your Ideas in 10 Minutes or Less

Use these three strategies to quickly grab your audience’s attention.

Image: Getty Images. Illustration: Inc. Magazine

There’s something magical about 10 minutes, and smart entrepreneurs know it.

John Medina, a molecular biologist at the University of Washington, says we have a built-in clock that causes us to tune out of a pitch, presentation, or lecture after 10 minutes. Fortunately, there are proven ways to make the most of that time.

As a communication coach, I know this 10-minute rule is true. For example, Richard Branson used to hold pitch competitions at his home on Necker Island. Each entrepreneur was given 10 minutes to pitch their idea. Branson told me that if you can’t get the idea across in 10 minutes, it’s too complicated.

Similarly, two years ago, military instructors teaching advanced tactics in nuclear weapons proliferation asked me to speak to their class at an airbase in New Mexico. The class had been assigned one of my public speaking books to help them communicate concisely.

One instructor told me, “These officers will be sent to the Pentagon and other parts of the world after this class. They will be asked to share their analysis of a situation at a moment’s notice with senior leaders. And they’ll get 10 minutes to do it — if they’re lucky.”

So whether you’re pitching to a celebrity entrepreneur, sharing key ideas to leaders, or on a call with a potential investor, here’s how to make the most of the 10 minutes you have by answering three questions.

1. What’s the idea?

Journalists often say “don’t bury the lead.” A pitch or informational presentation isn’t a novel where your audience has the patience to wait until the end to find out what happens.

Michael Moritz, an early investor in Google, once told me that Sergey Brin and Larry Page explained their idea in one sentence. “Google organizes the world’s information and makes it universally accessible.” In one sentence, Moritz was hooked.

The same strategy works for an informational presentation. If you’re meeting to discuss the new budget, start with a headline:

“Hi, everyone. You’ll be happy to know that, thanks to our team’s great work, we’ve been approved for a budget increase of 10 percent over last year.”

In one sentence, you’ve got their attention. Now you can answer the second question every person has on their mind.

2. What’s in it for me?

I recently met with a senior manager at one of the world’s largest tech companies. He said sales professionals are taught the 10-minute rule before pitching the company’s services to potential customers — but it’s the first 60 seconds that really count.

A sales pitch might begin like this: “We ran the numbers. By adopting our service, you’ll be saving your company millions of dollars, which your CEO will love to hear, and it’ll cut the time you spend installing updates by 50 hours a month.”

This powerful opening pitch accomplishes two things: It tells the listener that they’ll look like a hero to the boss, and they’ll get precious time back to spend on other activities.

Sell the benefit of your idea as soon as possible.

3. Do you have a story or example?

Few people will remember every detail on your slides, but they’ll remember the stories you tell. Storytelling is an ancient rhetorical technique to transfer information. Today, science is proving that it does, indeed, work like magic.

A CEO of a company that sells software once told me that its top sales staff were those who used a relevant customer story or case study in the first 10 minutes of their presentations. The sales data proved it — good storytellers have a distinct advantage.

So the next time you’re on deck to present in-person or on a Zoom call that’s scheduled for 30 or 60 minutes, make no mistake, your audience will tune out after 10 minutes. They may remain on the call, but their attention will drop dramatically.

Your job in the first 10 minutes is to identify your big idea, sell the benefit, and tell a story. Your audience will love you for it.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

APR 20, 2021

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/carmine-gallo/how-to-pitch-your-ideas-in-10-minutes-or-less.html?cid=sf01003

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.