1. The Median Short Interest in S&P 17 Year Low

The median short interest in members of the S&P 500 sits at just 1.6% of market value, near a 17-year low, according to Goldman – At the same time, hedge-fund longs are around the highest relative levels in years at JPMorgan Chase & Co.’s prime brokerage.

From Dave Lutz at Jones Trading

2. Have Bear Markets Changed Forever?

Posted April 17, 2021 by Michael Batnick

We’ve never seen a bear market like the one we just lived through. Nothing comes close in terms of how quickly it started and how quickly it ended.

In just 19 days, the Dow was 20% below its highs. In 22 days, it was 30% below. And in just 27 days, it was all over. The bottom was in. To call this unusual is an understatement. You can see in the chart below that most bear markets take literally hundreds of days to bottom.

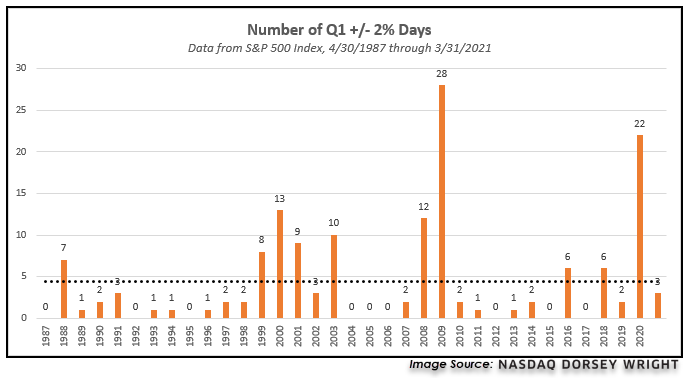

3. Number of Daily 2% Moves Days Q1 Lowest Since 1988

Dorsey Wright- Our test also looks at the number of days in which the S&P 500 Index saw a daily move exceeding 2%, which only occurred on 3 days in the first quarter of this year. That is lower than the average number of 2% days seen in the first quarter since 1988, which sits at 4.41 but just above the median number of 2 days. Perhaps unsurprisingly, this was again significantly lower than the 22 days in the first quarter of last year in which SPX had a gain or loss of at least 2%.

4. Retail Traders Only Buyers Last Week….Buyers 8 Weeks in a Row…Call Buying Slows

Myles Udland-Yahoo Finance

And according to data from Bank of America Global Research published this week, individuals remain a durable source of buying in this market. And last week, retail was the only bid still out there.

“Retail clients were the only buyers last week, while institutional and hedge fund clients sold,” said Bank of America strategists led by Jill Carey Hall. “Retail clients have been buyers for the eighth straight week, while hedge fund clients sold for the third straight week.”

The team at Bank of America notes that cumulative equity flows last week totaled a net $5.2 billion worth of outflows, the largest one-week move out of stocks since November and the fifth-largest on record. In the past, these kinds of exoduses from the market have portended shaky periods for investors.

“In the prior times weekly flows were this (or more) negative, the subsequent week’s returns were -1% on avg/median with negative returns 75% of the time,” the firm notes. “Four-week average flows have been trending lower in recent weeks and have now turned negative for the first time since mid-Feb, suggesting a pause to increasingly euphoric sentiment.”

Stocks on Tuesday fell for the second-straight day this week after closing at record highs last week. Action that is certainly in-line with what Bank of America’s work suggests.

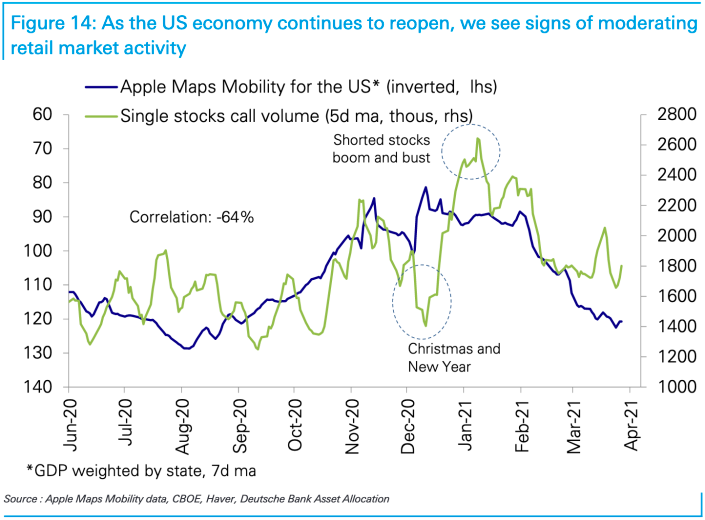

But data from strategists on the Street does show that retail’s participation in this market is not what it once was. The strategy team over at Deutsche Bank led by Binky Chadha published a report late last week showed that single-stock call options — a core part of the YOLO trade powered by retail — has been declining in recent weeks.

Deutsche Bank’s work does, however, capture the same relative strength in retail flows last week as was picked up by Bank of America. But the firm writes that “as the economy has been reopening and the stimulus payments mostly behind us, we have seen signs of this group reducing its market activity.”

“Most recently, retail activity looks to have ticked up modestly again, though it remains well below its January peak.” the firm adds. “We expect retail activity to continue to fade with reopening and especially a return to work.”

Single-stock options activity has declined, a sign to analysts at Deutsche Bank that retail enthusiasm in the market has waned in recent weeks. The bank expects this trend to continue as the economy re-opens. (Source: Deutsche Bank)

By Myles Udland, reporter and anchor forYahoo Finance Live. Follow him at@MylesUdland

https://finance.yahoo.com/news/retail-investors-are-still-buying-stocks-morning-brief-100203508.html

5. Real Rates Nowhere Near “Normal” Levels

Real rates have a ways higher to go to reach “normal” levels – let alone levels reflective of a very strong, fiscal-fueled economy.

Source: Jefferies Trading Desk

Percy Allison

Jefferies LLC

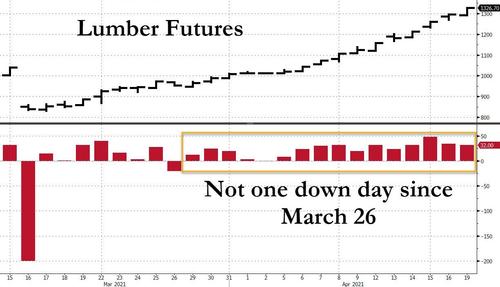

6. Lumber Hasn’t Had A Down Day Since March 26

BY TYLER DURDEN-ZERO HEDGE Less than a week ago, we published an article explaining that the ongoing “Supply Chain Collapse Leads To Lumber Frenzy, Soaring Home Prices.” Since then the lumber buying frenzy has gotten even more out of control, with prices surging another 12%, and as Bloomberg’s Aoyon Ashraf points out, “lumber hasn’t had a down day since March 26 and keeps hitting all-time highs with few signs of stopping.” In an amusing comparison, Ashraf also notes that while Lumber futures have climber a staggering 58% in just the past month since bottoming on March 16, “Bitcoin has fallen 3% and S&P 500 returned only 5% over this period” (of course, any comparison that is not goalseeked and stretches further beyond just a few weeks will show bitcoin trouncing lumber, but we get the idea).

Ashraf then echoes what we said last week, namely that “the reason for lumber’s meteoric rise is simple: low supply and surging demand. Slow ramp-ups at sawmills, trucking delays and worker shortages all are feeding into it.” The Bloomberg reporter than boldly suggests that going long lumber is a safer choice than bitcoin:

7. The state of the plant-based food industry

We’re eating more meatless meat than ever, but it’s still not much.

By Kenny Torrella Apr 16, 2021, 8:30am EDT

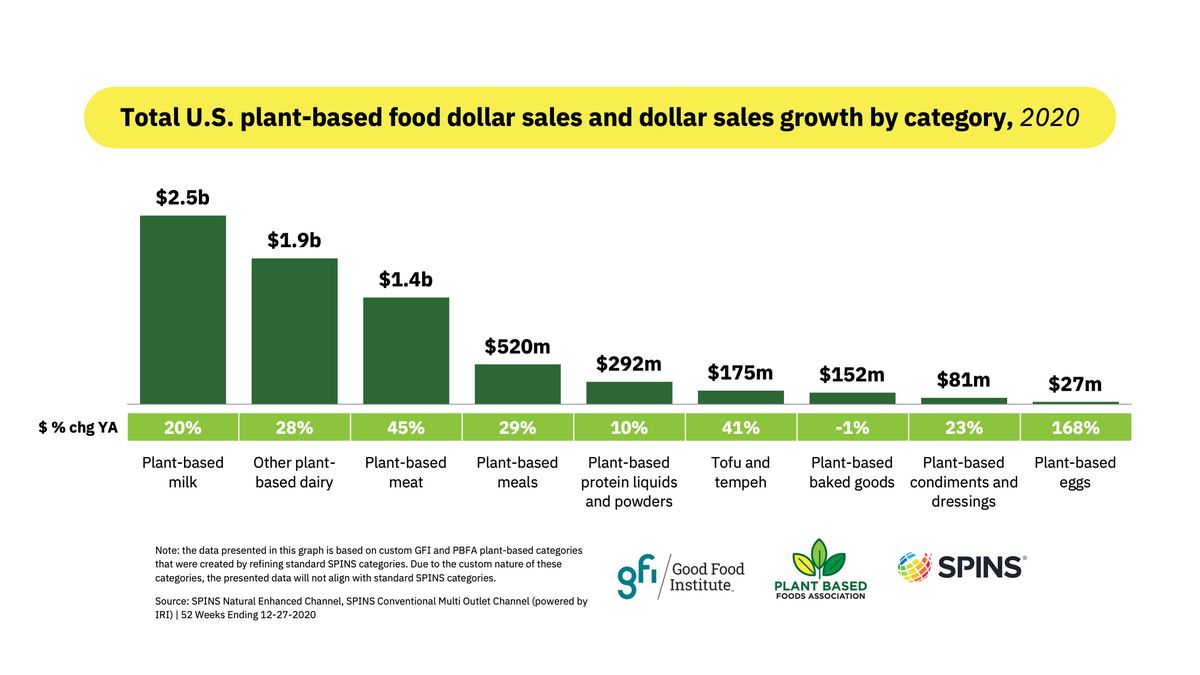

Their latest report looked at 2020 sales figures and found that — as with the previous year — plant-based food retail sales grew much faster (27 percent) than the total US retail food market (15 percent). And this wasn’t just on the coasts; there was more than 25 percent growth in all US census regions.

Plant-based meat sales grew by 45 percent and plant-based milk sales were up 20 percent from 2019.

The retail market for plant-based food grew significantly from 2019 to 2020. SPINS, The Plant Based Foods Association, The Good Food Institute

The growth may be eye-popping, but there’s a big caveat here: Supermarkets had an unusually good year. Early in the pandemic, panic-buying sent grocery sales surging, and earnings remained high throughout 2020 as people cooked at home more to avoid crowds and save money, giving the sales of both plant-based and animal-based foods a big bump.

https://www.vox.com/future-perfect/22385612/plant-based-meat-milk-alternative-protein

8. Single Family Houses Sold Chart Rolls Over Due to No Inventory.

Single Family Houses Sold

©1999-2021 StockCharts.com All Rights Reserved

9. What national marijuana legalization would mean for Colorado

John Frank, author of Denver

Illustration: Sarah Grillo/Axios

Colorado’s cannabis industryis enjoying an era of prosperity as national attitudes toward marijuana become more relaxed.

Driving the news: 17 states have legalized recreational marijuana sales and pot enjoys its highest popularity ever with 68% of adults backing legalization, according to a recent Gallup poll.

What’s next: Congress is discussing legislation to legalize marijuana.

What they’re saying: “It’s not a done deal, by any means, but it’s the closest we’ve gotten in the last couple years so we are obviously excited about it,” said Nancy Whiteman, CEO of Wana Brands, a Colorado-based marijuana edibles company now in 12 states and expanding to Massachusetts soon.

Why it matters: Federal legalization is the final step in the effort to legitimize Colorado’s marijuana industry.

- It would allow the industry access to the financial sector (such as loans for small businesses) and remove any doubt about potential enforcement actions to crack down on sales.

Zoom out: The broader acceptance comes at a time in which the industry is grappling with serious challenges, from how to build equity into the business and address the legacy of the war on drugs to questions about health effects and potency.

State of play: The challenges don’t seem to be slowing the cannabis industry in Colorado, where marijuana is part of the state’s fabric.

- The state boast’s America’s first pot governor who declared dispensaries re an essential business during the pandemic lockdown.

- Total marijuana sales topped $10 billion in January with annual numbers posting growth each year since their start in 2014.

- The state’s marijuana tax revenues are expected to reach near $459 million in the coming fiscal year.

The industry’s growthcame as other states opened doors to marijuana and it’s one reason why local leaders aren’t worried about competition from broader legalization.

- “As other states roll out legalization, it helps to destigmatize cannabis even more,” said Lisa Gee at Lightshade, an independent dispensary company with nine locations.

Between the lines: The industry has evolved significantly since voters legalized recreational adult-use marijuana with Amendment 64 in the 2012 election.

- The initial laws to keep the industry small and controlled were relaxed to allow outside investors, public consumption and delivery.

- The tax revenues no longer go exclusively to education and the industry’s regulation but help cover the cost of various government programs.

- And bud — the traditional form of marijuana — now represents less than half of sales after an explosion of new products.

Of note: Livwell Enlightened Health is debuting the first Colorado TV ads for a cannabis company this week.

- “There’s a much stronger sense this is an industry like any other industry,” said Mason Tvert, a longtime marijuana advocate in Denver.

Yes, but: The commercialization and growth of the industry is exactly what critics feared when Colorado legalized marijuana because it normalizes the behavior for children and makes it easier for them to get their hands on higher potency products, said Kevin Sabet, the president and CEO of Smart Approaches to Marijuana, a group critical of marijuana.

10. The Power of Writing by Hand

Jeremy Anderberg • April 13, 2021

In spite of the countless note-taking and to-do list apps and software I’ve experimented with over the years, I always come back to writing things down on paper. Though I still use the apps for checklists and for master lists of things, my day-to-day note-taking and prioritizing happens on pen and paper (or dry erase marker and whiteboard).

While there have been plenty of studies in recent decades that aim to explain the durable allure of “manual” writing, if you look at the research closer, a lot of the benefits attributed to it aren’t exclusive to that kind of writing, nor have they always been replicated in subsequent studies.

But I don’t need scientific verification to affirm what I have discovered intuitively though my own firsthand, n=1 experiments. Below I outline a bunch of benefits to writing things down by hand that I’ve observed through simple field-testing; try taking up a pen (or pencil) more often yourself, and you may find similar advantages, or others entirely your own.

Boosts your memory through encoding.

If there is one scientifically-proven and replicable benefit of manual writing, it’s this: when you write something by hand you can improve your memory, and therefore your ability to recall information, through the process of encoding.

There are a number of factors at play here, but the gist is that writing manually uses far more brain processing systems than typing. You’re physically coordinating your brain and hand in a deeper way; you’re forced to organize information more concisely (more on that below); you have to actually think a little harder to write something with your hand versus on a keyboard or screen. All of this leads to the information coming out of your writing utensil being encoded on a deeper level into your memory. When you type, it’s almost like the information is simply using your body as a conduit for being transferred onto a screen; when you write, the information is actually being stored and processed for later use and recall.

Forces you to think and filter.

When you write something down by hand, you’re taking advantage of the benefits of constraints. By limiting yourself both in physical space (you can only get so much on a page) and physical ability (you can only write so quickly), you’re forcing yourself to decide what’s most important. If you’re taking notes or writing out to-dos on a screen, there’s literally endless space to do so; it’s actually pretty easy to mindlessly type out highlights from a lecture or make a list of every single thing that you’re thinking about in the moment. You’ll type out a forest and have no sense of the trees.

No matter your canvas when writing by hand, you’ve got boundaries. You have to pay more attention, think it all through a little more carefully, decide which items to cut and which to keep. Think of the page as being a built-in filter for the stuff floating around in your consciousness.

Creates a visual reminder that keeps things top of mind.

While list-making and note-taking apps are handy, once the screen is turned off or put into your pocket, those ideas go away. Out of sight, out of mind — truly. For example, while I still use Todoist every day, it inevitably gets lost among the dozen tabs I have open on my computer, and I sure don’t think of it when I’m on my phone because I’m using a handful of other apps all the time. There’s too much digital clutter for it to be top of mind when it seems like I really need it, which is when I’m distracted — it’s kind of a catch-22.

In contrast, I can keep something that I’ve written down — whether it’s a list of tasks or an inspiring phrase — constantly in front of my eyes. I don’t have to remember to remember it.

I recently bought a FluidStance desktop whiteboard and have really benefited from it. When I write down a research plan for an article or my top few priorities for the day — Rule of 3 for the win! — I don’t have to spend mental energy on remembering those things. I know that they’re recorded and will continually be in my peripheral vision for the entire work day. When I get distracted, all I have to do to snap myself back on track is simply glance down and see my written reminders of what needs to be done.

Minimizes distraction.

Things that are written down by hand are not only readily accessible in the midst of distraction, but won’t put you in touch with other distractions.

Swipe into your phone to take a note in your note-taking app . . . and you’ll find your finger wandering over to the Instagram app. And the Twitter app. Soon enough, even though you finished typing your note ten minutes ago, you’re still twiddling with your phone.

Fight it with time limits and app blockers all you want, but the digital distraction dragon cannot be slayed once and for all. I’ve come to accept it. Moving to pen and paper for my daily note-taking and list-making — again, the checklists and master lists of things still reside in Todoist — has ensured that I stay more focused throughout the day and get my most valuable tasks taken care of. Writing things down with pen and paper minimizes the need to toggle from screen to screen, app to app, and tab to tab, which presents me with fewer opportunities to get sucked into the internet’s “infinity pools.” I still get distracted, sure, but it takes far less time to get back on track when I’m not relying on my screen to guide my to-dos or my article writing.

Allows for more creative organizing and mental processing.

One of the things I appreciate most about writing things on paper (or whiteboard) is the ability to organize things in a way that goes beyond the line-by-line format offered by most note-taking and to-do list apps. I can draw boxes around important items, I can make arrows between connected ideas, I can set lists in columns and even draw pictures if needed. Some apps allow for that sort of freeform writing, but they’re invariably clunky.

The mind does not often operate on a clear-cut, step-by-step path. Allow your writing to follow its back and forth, loop-de-loop processes by writing things out manually.

There’s a unique kinetic energy to it.

Though certainly not a measurable benefit, there’s a unique, unexplainable power to the idea that words are flowing from your brain, through your arm and hand, and out onto a page. It’s a very physical process that just isn’t the same when it’s words flowing through a keyboard and into the digital ether. The slowness of writing forces deeper contemplation; the way your hand muscles get just a little bit tired (surely because we simply don’t use those muscles much anymore!) is physical evidence that you’re doing work; the visual and tangible proof of ideas come to life is far more inspiring than seeing it on a Word Doc.

There’s a reason that some of our greatest modern writers — J.K. Rowling, Neil Gaiman, Stephen King, Joyce Carol Oates, the list goes on — still prefer longhand to a digital manuscript (for first drafts, at least). It’s ineffably simple: There’s more magic, and power, to be found on the page than on the screen.

https://www.artofmanliness.com/articles/benefits-writing-by-hand/

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..