1. Top 10 Largest Semiconductor Companies in the World..Samsung 45% of Revenue Pie

Semiconductor Industry Statistics – Import and Exports

- Global sales reached $468.8 billion in sales.

- The global semiconductor market is expected to post a CAGR of close to 9% by 2023.

- The United States imports approximately $53.7 billion worth of semiconductors.

- The semiconductor industry in North and South America totals about $106 billion each year.

- Samsung generates over 30% of global DRAM sales.

- Intel holds a 13.8% share of global semiconductor revenues.

- The semiconductor industry in the USA invests approximately 20% of its revenues into R&D.

- South Korea accounts for 17% of the world’s semiconductor production.

- China, USA, Taiwan, Japan, and South Korea account for 84% of semiconductor manufacturing equipment sales.

https://blog.bizvibe.com/blog/top-semiconductor-companies

2. KWEB China Internet ETF -28% from Highs

KWEB China Internet ETF

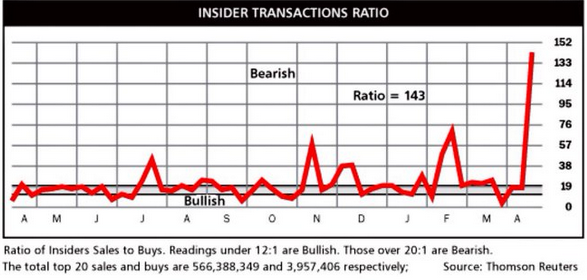

3. Insider Selling Spike

Dave Lutz at Jones Trading Quite a spike in insider selling, Reuters notes.

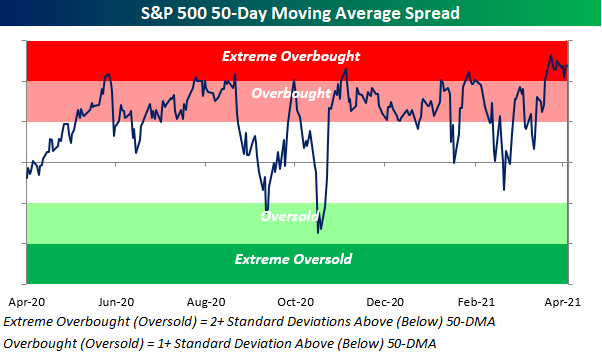

4. Short-Term Overbought Measures for S&P

Even after today’s pullback, the streak of ‘extreme’ overbought readings for the S&P 500 extended to a 12th day (barely).

Bespoke, @bespokeinvest https://twitter.com/bespokeinvest

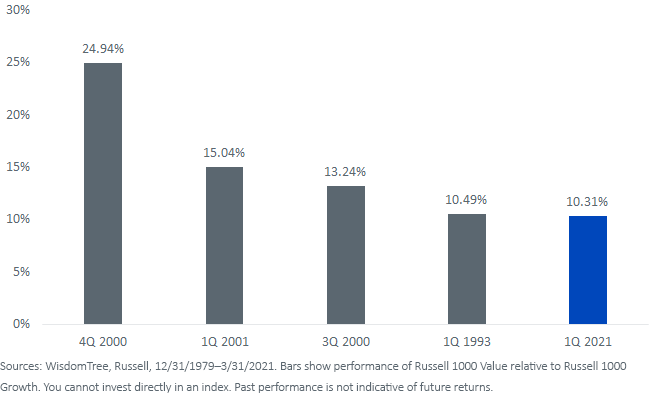

5. Q1 2021 Russell 1000 Value Outperformance 5th Best in History

Wisdom Tree

The first quarter’s outperformance of value relative to growth was historic. The Russell 1000 Value Index bested the Russell 1000 Growth Index by 10.31%—the fifth-best quarterly relative performance in history.

See 3 quarters coming out of Internet Bubble

Top Five Value Outperformance

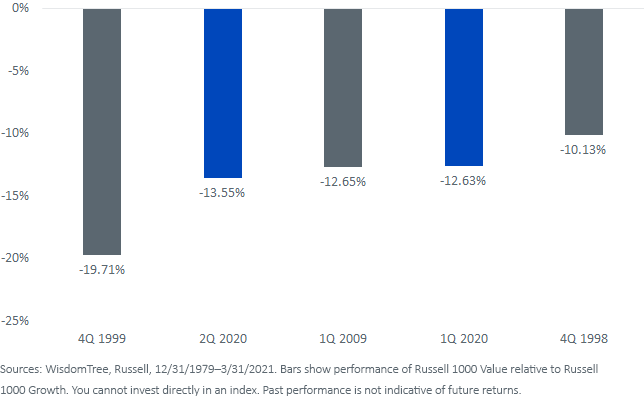

However, this outperformance comes on the heels of a decade of value underperformance and two historic quarters of growth outperformance in the first half of 2020.

Top Five Value Underperformance

Value and Dividends: A Rising Tide- Matt Wagner, CFA https://www.wisdomtree.com/blog/2021-04-12/value-and-dividends-a-rising-tide

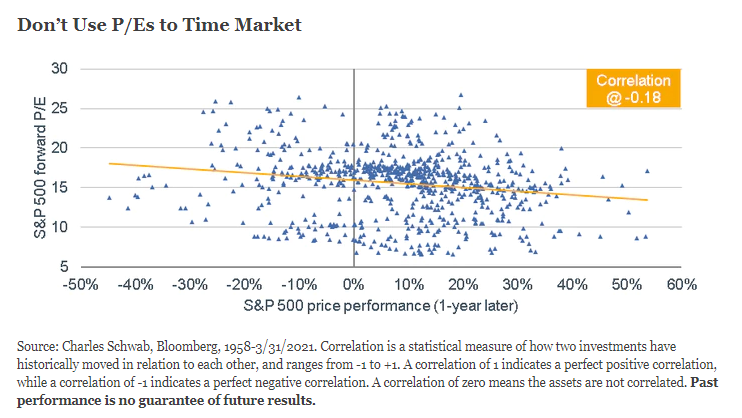

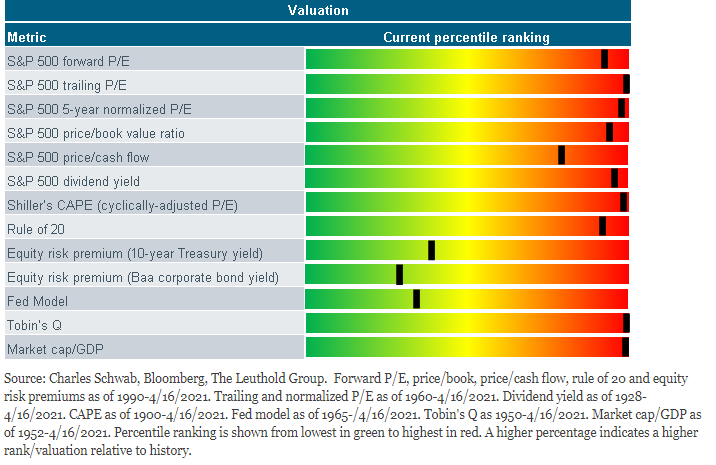

6. Valuations and Forward Returns

Liz Ann Sonders Schwab–Regardless of whether the forward P/E is cheap, expensive or something in between; it’s always important to remind investors that valuation is not an effective market timing tool. Markets can become expensive and stay expensive for some time, without a deleterious impact on stock prices—especially when investor sentiment and momentum are dominant drivers, as is the case today. As shown in the scattergram below; although there is a negative correlation between the forward P/E and subsequent one-year S&P 500 performance (i.e., higher P/Es have been followed by weaker stock market returns), it’s a very slight negative. In fact, even with a quick glance at the scattergram, you can see that the “exceptions” to the yellow correlation trend line are far and wide.

Forward P/Es are, of course, among many valuation metrics that investors tend to track. In the “heat map” below, you can see that although the forward P/E has retreated, it remains well in the red zone in terms of historical percentiles. Most other P/E valuation metrics are also well into the red zone; as well as price/book, Tobin’s Q (market value/assets’ replacement cost), and market cap/GDP (“Buffett Model”). Still in the green, however, are the yield-based valuation metrics of equity risk premiums and the Fed Model.

https://www.schwab.com/resource-center/insights/content/pump-it-up-earnings-season-starts-off-strong

7. China’s $87 Billion Electric-Car Giant Hasn’t Sold a Vehicle Yet

China Evergrande New Energy Vehicle Group Ltd.’s expansive pop-up showroom sits at the heart of Shanghai’s National Exhibition and Convention Center. With nine models on display, it’s hard to miss. The electric car upstart has one of the biggest booths at China’s 2021 Auto Show, which starts Monday, opposite storied German automaker BMW AG. Yet its bold presence belies an uncomfortable truth — Evergrande hasn’t sold a single car under its own brand.

China’s largest property developer has an array of investments outside of real estate, from soccer clubs to retirement villages. But it’s the recent entry into electric cars that’s captured investors’ imaginations. Shareholders have pushed Evergrande NEV’s Hong Kong-listed stock up more than 1,000% over the past 12 months, allowing it to raise billions of dollars in fresh capital. It now has a market value of $87 billion, greater than Ford Motor Co. and General Motors Co.

Such exuberance over an automaker that has repeatedly pushed back forecasts for when it will mass produce a car is emblematic of the froth that has been building in EVs over the past year, with investors plowing money into a rally that briefly made Elon Musk the world’s richest person and has some concerned about a bubble. Perhaps nowhere is that more evident than in China, home to the world’s biggest market for new energy cars, where a mind-boggling 400 EV manufacturers now jostle for consumers’ attention, led by a cabal of startups valued more than established auto players but which have yet to turn a profit.

Evergrande NEV was a relatively late entrant to that scene.

In March 2019, Hui Ka Yan, Evergrande’s chairman and one of China’s richest men, vowed to take on Musk and become the world’s biggest maker of EVs in three to five years. Tesla Inc.’s Model Y crossover had just had its global debut. In the two years since, Tesla has gained an enviable foothold in China, establishing its first factory outside the U.S. and delivering around 35,500 cars in March. Chinese rival Nio Inc. earlier this month reached a significant milestone when its 100,000th EV rolled off the production line, prompting Musk to tweet his congratulations.

Read more: Nio, Xpeng Exude Optimism as EVs Boom: Shanghai Auto Show

Despite his lofty ambitions and Evergrande NEV’s rich valuation, Hui has repeatedly pushed back car-production targets. The tycoon’s coterie of rich friends, among others, have stumped up billions, but making cars — electric or otherwise — is hard, and hugely capital intensive. Nio’s gross margins only flipped into positive territory in mid-2020, after years of heavy losses and a lifeline from a municipal government.

https://finance.yahoo.com/news/china-87-billion-electric-car-210000336.html

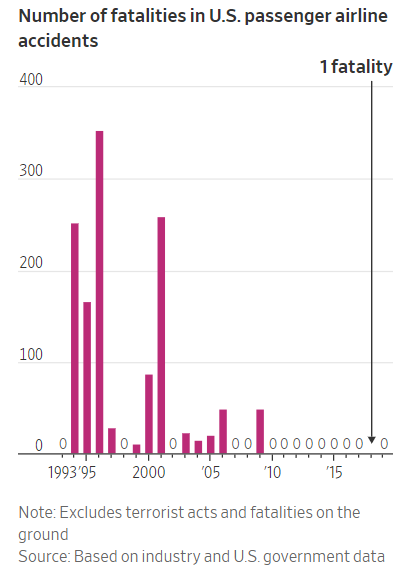

8. 12 Years U.S. Airlines Carried 8B Passengers with Zero Fatalities.

WSJ-By , Andy Pasztor1x

Over the past 12 years, U.S. airlines have accomplished an astonishing feat: carrying more than eight billion passengers without a fatal crash.

Such numbers were once unimaginable, even among the most optimistic safety experts. But now, pilots for domestic carriers can expect to go through an entire career without experiencing a single engine malfunction or failure. Official statistics show that in recent years, the riskiest part of any airline trip in the U.S. is when aircraft wheels are on the ground, on runways or taxiways.

The achievements stem from a sweeping safety reassessment—a virtual revolution in thinking—sparked by a small band of senior federal regulators, top industry executives and pilots-union leaders after a series of high-profile fatal crashes in the mid-1990s. To combat common industry hazards, they teamed up to launch voluntary incident reporting programs with carriers sharing data and no punishment for airlines or aviators when mistakes were uncovered.

The Airline Safety Revolution

https://www.wsj.com/articles/the-airline-safety-revolution-11618585543

9. The End of Cash – Another Trend Pulled Forward by Covid…64% of UK Adults Have Not Used Cash in 12 Months.

Around 64 per cent of adults in the UK haven’t completed a purchase with cash in the last 12 months according to research by www.merchantadviceservice.co.uk.

Up to 61 per cent of adults have also admitted they have adopted a new payment method over the last year, 77 per cent of those made a contactless payment using smart tech for the first time.

The study found that 86 per cent of adults favour contactless payment methods over other options such as chip and pin, with debit or credit cards being the preferred methods.

Smartphone payment followed with 25 per cent of adults preferring to use their phones to pay through services such as Apple Pay, or Google Pay.

Two fifths of adults still have cash in their home that they’re planning to put in the bank or gift as birthday gifts.

The research found that 78 per cent of adults don’t want to be handling cash at the moment as a result of the pandemic.

About 53 per cent don’t want to use ATMs and 33 per cent feel it is more convenient to carry a bank card or a smartphone than a wallet or purse with cash in.

Over half the adults surveyed said they would continue to use contactless payment as their preferred checkout method with non-essential retail reopening this week.

One in five adults claimed they would opt to keep money in the bank and continue with their cashless lifestyle

“Cash has become somewhat redundant since the UK first went into lockdown and most shops, other than supermarkets and essential retail, were forced to close their doors, co-founder of Merchant Advice Service Libby James said.

“Contactless payment methods have been gaining in popularity for many years, but the past year has seen many more trying out the technology as it allows them to reduce contact with others, helping to reduce the chances of an infection or disease, such as Covid-19, being transmitted so easily.”

10. Ego Is the Enemy of Good Leadership

by Rasmus Hougaard And Jacqueline Carter

Summary. The inflated ego that comes with success – the bigger salary, the nicer office, the easy laughs – often makes us feel as if we’ve found the eternal answer to being a leader. But the reality is, we haven’t. An inflated ego makes us susceptible to manipulation; it narrows…more

On his first day as CEO of the Carlsberg Group, a global brewery and beverage company, Cees ‘t Hart was given a key card by his assistant. The card locked out all the other floors for the elevator so that he could go directly to his corner office on the 20th floor. And with its picture windows, his office offered a stunning view of Copenhagen. These were the perks of his new position, ones that spoke to his power and importance within the company.

Cees spent the next two months acclimating to his new responsibilities. But during those two months, he noticed that he saw very few people throughout the day. Since the elevator didn’t stop at other floors and only a select group of executives worked on the 20th floor, he rarely interacted with other Carlsberg employees. Cees decided to switch from his corner office on the 20th floor to an empty desk in an open-floor plan on a lower floor.

When asked about the changes, Cees explained, “If I don’t meet people, I won’t get to know what they think. And if I don’t have a finger on the pulse of the organization, I can’t lead effectively.”

This story is a good example of how one leader actively worked to avoid the risk of insularity that comes with holding senior positions. And this risk is a real problem for senior leaders. In short, the higher leaders rise in the ranks, the more they are at risk of getting an inflated ego. And the bigger their ego grows, the more they are at risk of ending up in an insulated bubble, losing touch with their colleagues, the culture, and ultimately their clients. Let’s analyze this dynamic step by step.

As we rise in the ranks, we acquire more power. And with that, people are more likely to want to please us by listening more attentively, agreeing more, and laughing at our jokes. All of these tickle the ego. And when the ego is tickled, it grows. David Owen, the former British Foreign Secretary and a neurologist, and Jonathan Davidson, a professor of psychiatry and behavioral sciences at Duke University, call this the “hubris syndrome,” which they define as a “disorder of the possession of power, particularly power which has been associated with overwhelming success, held for a period of years.”

An unchecked ego can warp our perspective or twist our values. In the words of Jennifer Woo, CEO and chair of The Lane Crawford Joyce Group, Asia’s largest luxury retailer, “Managing our ego’s craving for fortune, fame, and influence is the prime responsibility of any leader.” When we’re caught in the grip of the ego’s craving for more power, we lose control. Ego makes us susceptible to manipulation; it narrows our field of vision; and it corrupts our behavior, often causing us to act against our values.

Our ego is like a target we carry with us. And like any target, the bigger it is, the more vulnerable it is to being hit. In this way, an inflated ego makes it easier for others to take advantage of us. Because our ego craves positive attention, it can make us susceptible to manipulation. It makes us predictable. When people know this, they can play to our ego. When we’re a victim of our own need to be seen as great, we end up being led into making decisions that may be detrimental to ourselves, our people, and our organization.

An inflated ego also corrupts our behavior. When we believe we’re the sole architects of our success, we tend to be ruder, more selfish, and more likely to interrupt others. This is especially true in the face of setbacks and criticism. In this way, an inflated ego prevents us from learning from our mistakes and creates a defensive wall that makes it difficult to appreciate the rich lessons we glean from failure.

Finally, an inflated ego narrows our vision. The ego always looks for information that confirms what it wants to believe. Basically, a big ego makes us have a strong confirmation bias. Because of this, we lose perspective and end up in a leadership bubble where we only see and hear what we want to. As a result, we lose touch with the people we lead, the culture we are a part of, and ultimately our clients and stakeholders.

Breaking free of an overly protective or inflated ego and avoiding the leadership bubble is an important and challenging job. It requires selflessness, reflection, and courage. Here are a few tips that will help you:

- Consider the perks and privileges you are being offered in your role. Some of them enable you to do your job effectively. That’s great. But some of them are simply perks to promote your status and power and ultimately ego. Consider which of your privileges you can let go of. It could be the reserved parking spot or, like in Cees ‘t Hart’s case, a special pass for the elevator.

- Support, develop, and work with people who won’t feed your ego. Hire smart people with the confidence to speak up.

- Humility and gratitude are cornerstones of selflessness. Make a habit of taking a moment at the end of each day to reflect on all the people that were part of making you successful on that day. This helps you develop a natural sense of humility, by seeing how you are not the only cause of your success. And end the reflection by actively sending a message of gratitude to those people.

The inflated ego that comes with success — the bigger salary, the nicer office, the easy laughs — often makes us feel as if we’ve found the eternal answer to being a leader. But the reality is, we haven’t. Leadership is about people, and people change every day. If we believe we’ve found the universal key to leading people, we’ve just lost it. If we let our ego determine what we see, what we hear, and what we believe, we’ve let our past success damage our future success.

Rasmus Hougaard is the founder and CEO of Potential Project, a global leadership, organizational development and research firm serving Microsoft, Accenture, Cisco and hundreds of other organizations. He is author of The Mind of the Leader – How to Lead Yourself, Your People and Your Organization for Extraordinary Results with HBR Press and will be publishing his next book Compassionate Leadership – Doing Hard Things the Human Way with HBR in 2021.

- Jacqueline Carter is a partner and the North American Director of Potential Project. She is co-author of The Mind of the Leader – How to Lead Yourself, Your People and Your Organization for Extraordinary Results (HBR Press, 2018) as well as co-author with Rasmus Hougaard on their first book One Second Ahead: Enhancing Performance at Work with

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..