1. Your New SPAK Investment Banking Team.

SPAK ETF -30% from Highs

2. A Record Number of Stocks Above 200 Day Moving Average.

Charlie Bilello…lifts all boats. 96.4% of stocks in the S&P 500 are above their 200-day moving average, the highest % ever.

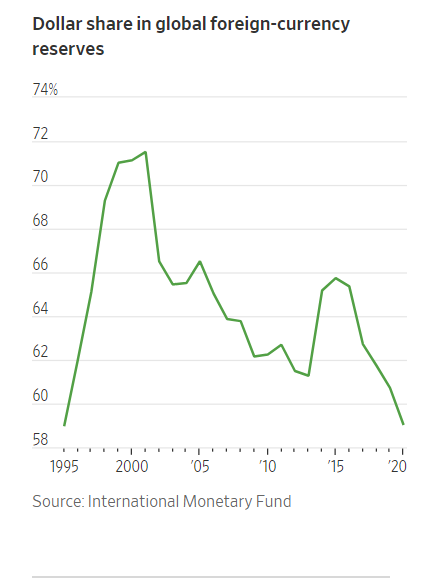

3. Dollar Share of Foreign Currency Reserves Falls to 1990’s Levels

WSJ The Dollar’s Sliding Share in Global Currency Reserves Is a Red Herring By Mike Bird

U.S. Dollar rolling back over after not making it to late 2020’s levels

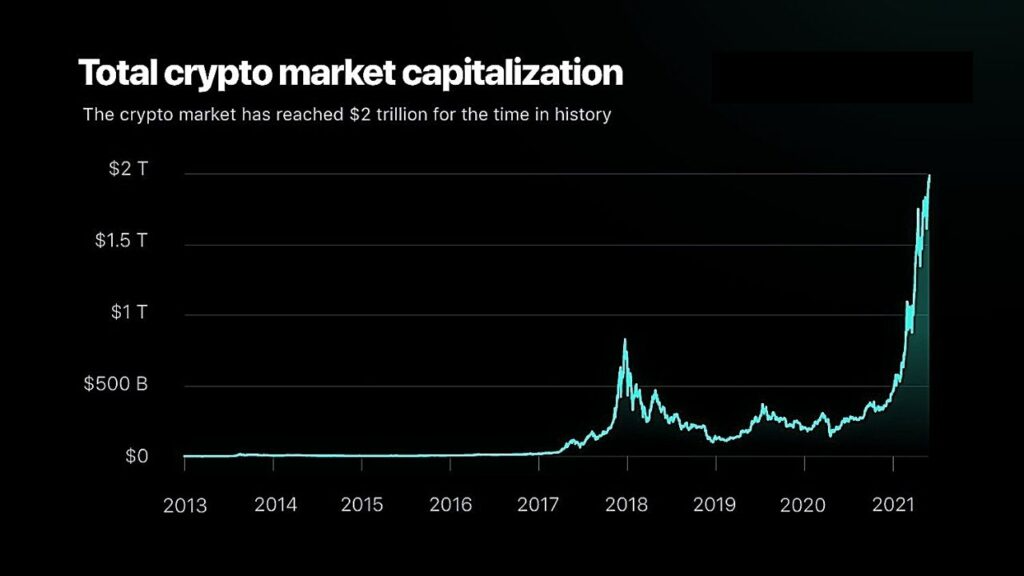

4. Total Crypto Market Cap Hits $2 Trillion

CRYPTO GETS HIT OVER Weekend –Bloomberg-The world’s biggest cryptocurrency plunged as much as 15% just days after reaching a record. It was down 7.7% at 56,169 at around 4:30 p.m. in New York. Ether, the second-biggest, dropped as much as 18% to below $2,000 before also paring losses to the 7% range. Binance Coin, XRP and Cardano each lost more than 12% at one point. Dogecoin, the token started as a joke, bucked the trend to jump more than 10%, according to Coinbase.

The weekend carnage came after a heady week for the industry that saw the value of of all coins surge past $2.25 trillion amid a frenzy of demand for all things crypto in the runup to Coinbase’s direct listing on Wednesday. The largest U.S. crypto exchange ended the week valued at $68 billion, more than the owner of the New York Stock Exchange.

Coinbase Hangover Rattles Crypto Assets With Bitcoin Falling By

https://bitcoinke.io/2021/04/crypto-market-cap-crosses-2-trillion-dollars/

5. You Thought Crypo was Out of Main Stream ..Off the Grid…Now Minting Lobbyists-Deal Book

Crypto Is Minting Lobbyists

A growing web of trade groups aims to influence policies that will aid (or squash) the digital gold rush.

By Ephrat Livn

A week before Coinbase made its blockbuster debut on Wall Street on Wednesday, the cryptocurrency exchange was part of a much quieter, but symbolically important, launch — in Washington, D.C.

Yep, here come the lobbyists.

Along with the asset manager Fidelity, the payments company Square and the investment firm Paradigm, Coinbase established a new trade group with “a mission to unlock the transformational promise of crypto.” The Crypto Council for Innovation hopes to influence policies that will be critical for expanding the use of cryptocurrencies in conjunction with traditional finance (and, by extension, the businesses of the group’s members).

It opens a new front in the war over how cryptocurrency will — or will not — be regulated. And the battle lines are just beginning to be drawn.

Cryptocurrencies are still mostly held as speculative assets, but some experts believe Bitcoin and related blockchain technologies will become fundamental parts of the financial system. To many, Coinbase’s successful debut, which valued the company at $86 billion, far more than operators of stock and bond exchanges, is a signal that this transformation is already well underway. At the least, investor interest in Coinbase forces traditionalists to take digital currency and associated tech — once easier to dismiss — very seriously.

But Coinbase’s success may also invite more attention from regulators. “We’re going to increasingly be having scrutiny about what we’re doing,” Brian Armstrong, Coinbase’s chief executive, said on CNBC. “We’re very excited and happy to play by the rules,” he added, but regulation of crypto should be on a “level playing field with traditional financial services.”

Crypto companies often boast about their ability to disrupt the status quo. But Washington is different. Lobbyists follow an established playbook. Indeed, one way Coinbase has been able to grow to its current grandeur is by recognizing that even currency renegades had to play nice with officials to help create a hospitable regulatory environment that enabled its executives to become billionaires. Since 2015, the company has spent more than $700,000 on government lobbying, according to the Center for Responsive Politics.

It has long cooperated with other crypto businesses to advance its causes, though some industry observers say the launch of its new trade group may reveal a fissure that could become a deep divide.

Players, observers, lobbyists and the lobbied alike consider this a critical moment for crypto and its influencers. Succeeding or failing to persuade officials now will determine whether regulation allows the digital gold rush to accelerate or slows it to a sputter.

What’s at stake?

Here are four of the big issues keeping crypto lobbyists busy:

Reputation. The impression that crypto facilitates crime is voiced with some frequency by lawmakers and regulators, and it remains a significant hurdle to legitimacy. The Crypto Council’s first commissioned publication is an analysis of Bitcoin’s illicit use, and it concludes that concerns are “significantly overstated” and that blockchain technology could be better used by law enforcement to stop crime and collect intelligence.

Reporting requirements. New anti-money-laundering rules passed this year will significantly expand disclosures for digital currencies. The Treasury has also proposed rules that would require detailed reporting for transactions over $3,000 involving “unhosted wallets,” or digital wallets that are not associated with a third-party financial institution, and require institutions handling cryptocurrencies to process more data. The Financial Action Task Force, an intergovernmental watchdog and standards body, recently provided draft guidance on virtual assets that would require service providers to hand over further information.

Securities insecurities. When is a digital asset a security and when is it a commodity? Not technically a riddle, this question has puzzled regulators and innovators for some time. Bitcoin and other cryptocurrencies that are released via a decentralized network generally qualify as commodities and are less heavily regulated than securities, which represent a stake in a venture. Tokens released by people and companies are more likely to be characterized as securities because they more often represent a stake in the issuer’s project.

The Securities and Exchange Commission sued Ripple Labs in December, accusing it of selling unregistered securities in the form of a token called XRP. Ripple insists that XRP is a commodity. A decision in this case may prove to be a watershed for determining how to properly characterize cryptocurrencies in the future.

This week, an S.E.C. commissioner, Hester Peirce, published an updated “safe harbor” proposal that would give developers a grace period to issue a token without fear of mischaracterization and to keep regulators informed. “The idea is to give people a three-year runway,” Ms. Peirce said.

Catching up with China. The Chinese government is already experimenting with a central bank digital currency, a digital yuan. China would be the first country to create a virtual currency, but many are considering it. Some crypto advocates worry that China’s alacrity in the space threatens the dollar, national security and American competitiveness.

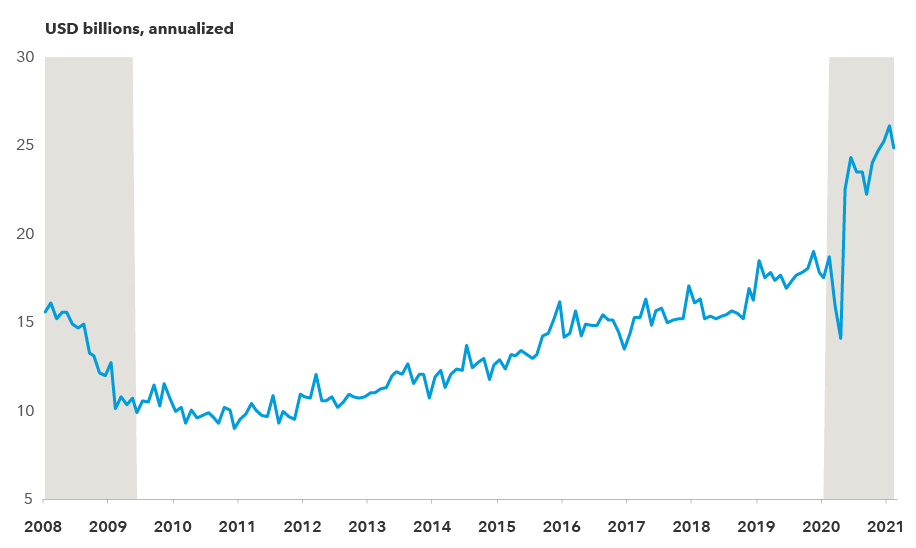

6. Boat Market Record Sales.

American Funds-High seas: U.S. consumer spending on pleasure boats soars

We’re seeing many signs of economic acceleration. Look no further than the recent surge of U.S. consumer spending on pleasure boats. While some American families have saved their stimulus payments, as reflected in a savings rate close to 15%, others have essentially viewed them as a bonus. While purchases of pleasure boats is a signal of high-end spending, we’re starting to see a more broad-based increase in consumer spending as well.

https://www.capitalgroup.com/advisor/insights/articles/how-high-rates-go.htm

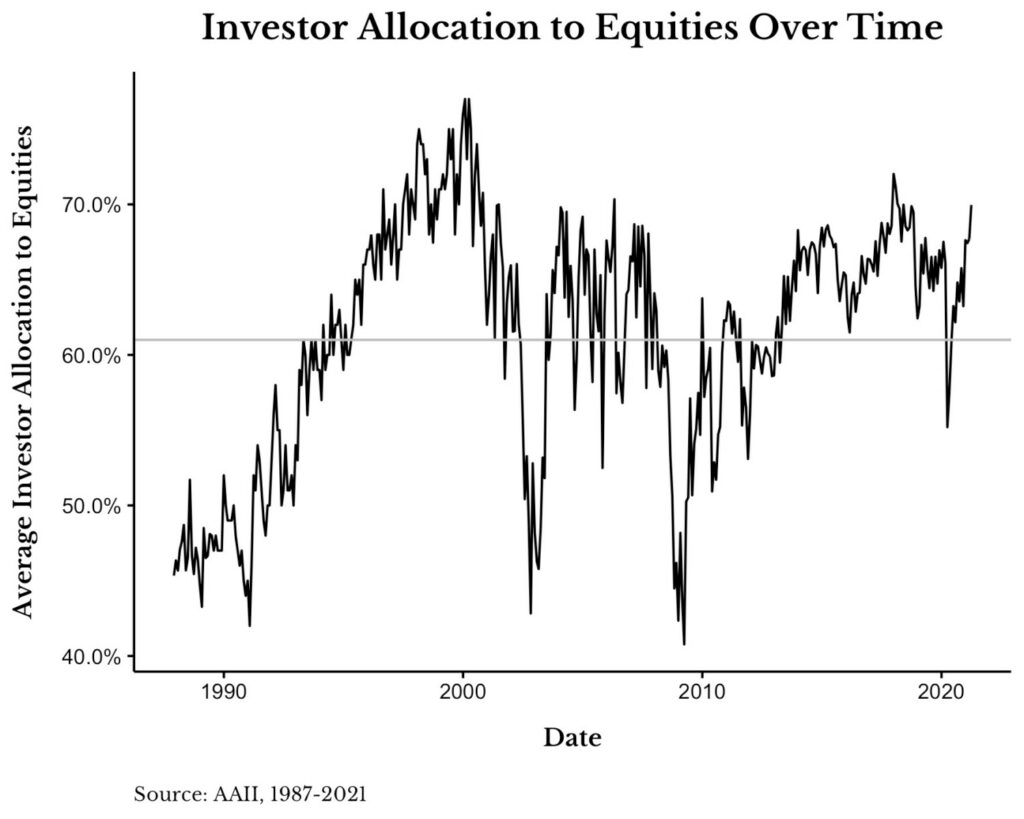

7. Allocation to Equities Close to 70%

Cash on the Sidelines?!?by Barry Ritholtz

Consider the Asset Allocation Survey data collected by the American Association of Individual Investors. The historical average exposure to equities is just over 60%, while cash averages about 23%. Those numbers swing around the long-term baseline by about 15%. At market peaks, equities approach 75%, and near the lows they are in the 45% range. It seems that cash in those accounts are the key drivers.

Like so many indicators, this one is useful only infrequently and at great extremes. In November 1987, right after one of the worst stock market crashes in history, equity was at 45% and cash was 35%. In January 2000, a few months before the dot-com crash, equities were 77% and cash was a mere 14%. At the lows of the financial crisis in March 2009, equities were 41% and cash was 45%.

One of the great tells that the pandemic-related crash in early 2020 did not end the bull market was that individual equity allocations never fell below 55.2% and cash never rose above 26.1%.

https://ritholtz.com/2021/04/cash-on-the-sidelines/

8. Amazon Hired 500,000 New Employees in One Year

|

| Jeff Bezos has written his final shareholder letter as CEO of Amazon, the e-commerce company he started in 1995. Although he discusses the business, a significant focus of the letter is Amazon’s employee base, which has been in the headlines a lot this year. First the company denied that delivery drivers and other employees occasionally had to pee in bottles while at work in order to meet busy schedules, and then there was the battle to unionize in Alabama, which Amazon won. It’s perhaps no surprise that things with your employees sometimes go wrong when you have a workforce of 1.3 million people and a population the equivalent of the entire city of Atlanta (~500,000) joined your company last year alone. It’s hard to make 13 employees 100% happy, let alone 1.3 million. Nevertheless, this is really the Amazon founder’s first admission that things could be improved for employees, with Bezos writing that “I think we need to do a better job for our employees”. It doesn’t get much more direct than that. Perhaps Bezos 2.0 will change his customer-obsession into an employee-obsession. |

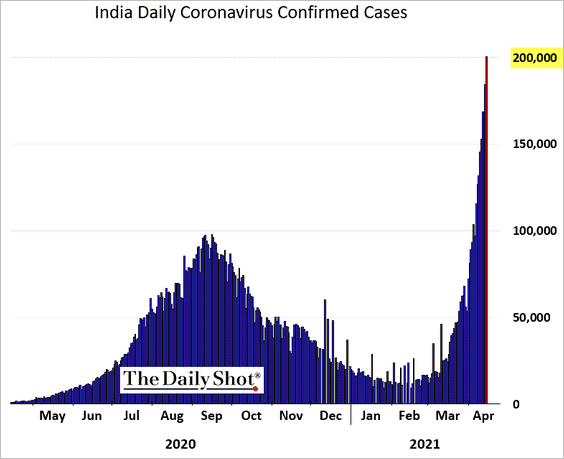

9. India Coronavirus Spike

The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-april-15th-2021/

10. How to Get Your Brain to Focus on What Matters

written by JAMES CLEAR

DELIBERATE PRACTICE FOCUS SELF-IMPROVEMENT

It was the first game of the season and Peyton Manning, one of the greatest quarterbacks in the history of the National Football League, already had a chance to set another NFL record.

Late in the fourth quarter, with the ball on his own 22-yard-line, Manning stepped up to the line of scrimmage and surveyed the defense. Just before snapping the ball, he noticed something.

The Baltimore Ravens defenders were moving around in front of Manning, preparing for the play, but something didn’t feel right. After the game, Manning would simply say that he “saw something.”

Baltimore was going to blitz and Manning knew it. He took a step forward, spread his arms to signal a new play call, and yelled out the play, “Alley! Alley! … Alley! Alley! Alley!”

The Broncos snapped the ball. The Ravens, as expected, blitzed. Manning threw a perfectly planned pass to wide receiver Demaryius Thomas, who ran 78 yards for a touchdown. The Baltimore defenders never laid a hand on him.

It was Manning’s seventh touchdown pass of the game, tying the NFL record. And perhaps more impressive, it took Manning just four seconds to step up to the line of scrimmage, analyze the location of all eleven defenders, compare their coverage to the play he had called, recognize that they were preparing to blitz, and then call a new play. All that, in just four seconds.

Let’s talk about how Peyton Manning can do that, and how you can develop expertise in the areas that matter to you.

The “Cocktail Party Effect”

In a variety of studies, researchers have shown that website visitors have learned to ignore the common areas of webpages loaded with advertisements. In many cases, the readers breeze right past the advertisements like they aren’t even there. Known as “banner blindness” this phenomenon is essentially saying that as you read more articles online, you learn to ignore the irrelevant or unimportant pieces of the experience.

This basic idea – that you can focus on one part of an experience and ignore others – is a cognitive psychology concept known as selective attention. It’s also called the “cocktail party effect,” which is named after the idea that your brain can pay attention to a single conversation while standing in a crowded room full of people talking. Selective attention helps you filter out the noise and focus on the signal.

Selective attention is what allowed Peyton Manning to instantly assess the defense of the Baltimore Ravens and change his play call accordingly. Manning has put in thousands of hours playing the game, studying film of opposing defenses, and learning from his mistakes. As a result, his brain instinctively knew what was signal and what was noise. He knew what to focus on and what to ignore.

The result is that Peyton Manning can make snap decisions that are based on thousands of hours of experience. While a young quarterback might see a dozen possible options for what will happen, Manning can narrow it down to a few options, perhaps even one option, by using selective attention to pay attention to the right factors. The result is increased success, and it’s a major difference between amateurs and experts.

The Truth About Hacks

It seems that the world is obsessed with quick fixes and performance hacks. I get it. I’ve felt that way too. We all want to “hack” our bodies and brains, to find a hidden solution to mastering our mental and physical performance.

The thing is, when you look at how the top performers in the world operate and examine what is really going on in their minds and bodies, you often see the complete opposite of a hack. You see repetitions and consistency.

- When LeBron James wants to increase his recovery and physical performance, he sleeps for 12 hours.

- When Kobe Bryant wants to improve his skill set, he shoots 800 times.

- When Peyton Manning wants to see holes in the defense, he puts in thousands of hours in the film room.

Sure, these athletes are blessed with one-in-a-million genetics, but chalking their success up to innate talent ignores a very big piece of the puzzle. I’m willing to bet that their tireless approach to mastering the fundamentals and unwavering commitment to consistency would pay dividends for nearly anyone in any field, regardless of genetic talent.

The Secret to Selective Attention

That said, Peyton Manning does have one distinct advantage over most people looking to develop expertise: statistics.

Everything that Manning does is measured. How many interceptions he throws. How many touchdowns he throws. How many passes he completes. How much weight he lifts in the gym. How fast he runs his sprints. It’s all measured.

Why is this important? Because he has proof of whether or not he is making progress in his life and work. Because he is measuring these numbers, he is also looking to improve these numbers. And when he does something new and the numbers go up, that is a clear signal to him that this new behavior is working.

The only way to figure out what works and what doesn’t is to measure your results. If you repeat this cycle for 20 years, then you end up becoming very good at focusing on the things that matter and ignoring the things that don’t.

If you want to get better, then practice consistently and measure constantly. Use that feedback to figure out what is working and what isn’t. Then, spend your time putting in more reps rather than searching for another hack. Experts spend more time focusing on what works. And the only way to know what works is to put the time in.

If you want more practical ideas for breaking living better, check out my course The Habits Academy,a premier training platform for organizations and individuals that are interested in building better habits in life and work.

https://jamesclear.com/selective-attention

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..