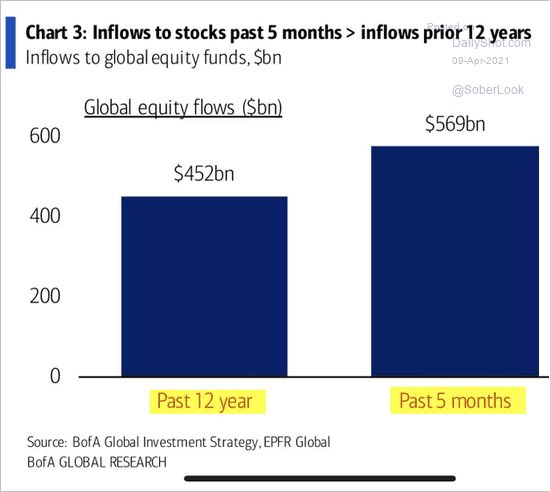

1. Maybe the Most Stunning Stat I’ve Seen in 25 Years in Business…More Inflows in Last 5 Months than Last 12 Years

Chris Akins

https://www.linkedin.com/in/christopher-akins-19a40472/

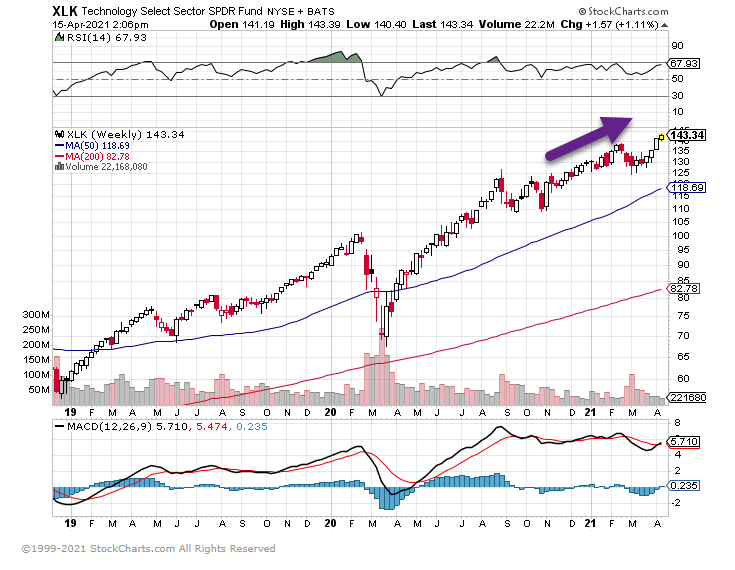

2. XLK Tech ETF New Highs.

Technology Back to Leadership 1 Month …New Highs XLK

3. Europe Stocks Hit Record High

From Dave Lutz at Jones Trading-European stocks hit a record high on Thursday as a rally in commodity prices lifted miners, while some positive earnings reports offset worries about the pace of COVID-19 vaccination.

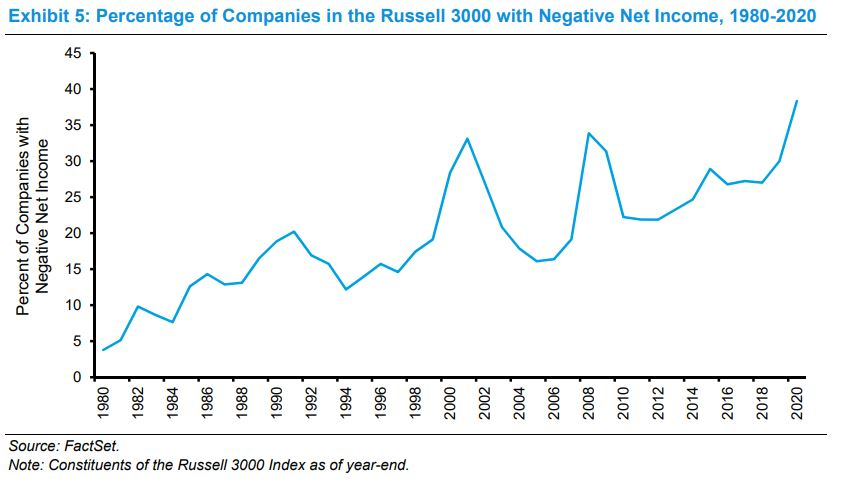

4. “Money Losing Companies Hits Record High”

Posted April 14, 2021 by Michael Batnick

It seems corporate America has adopted MMT. At least that’s the conclusion you could draw by looking at this chart below.

And if that was your conclusion, then the implications are clear; The stock market is a house of cards.

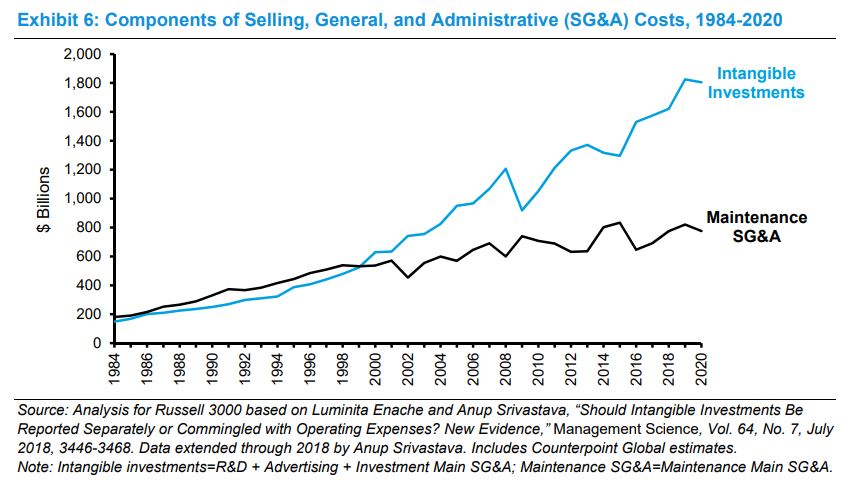

Thanks to a new report from Michael Mauboussin and Dan Callahan, we know that there is more to the story than meets the eye. What’s really going on in this chart is the rise of intangible investments, which show up on the income statement and not the balance sheet. These “expenses” make more companies appear unprofitable.

Just how big are intangibles that they’re impacting the net income of a company? Very, very big. Here are Mauboussin and Callahan:

Investments in intangible assets were roughly $1.8 trillion in 2020, more than double the $800 billion in capital expenditures. These data put the lie to the assertion that companies are investing less than they used to.

Data without context can be worse than no data at all. The whole thing, as with all of their stuff, is worth taking the time to read. Hit the link below.

https://theirrelevantinvestor.com/2021/04/14/money-losing-companies-hits-record-high/

5. What Happens to IPOs Over the Long Run

AUTHOR Phil Mackintosh

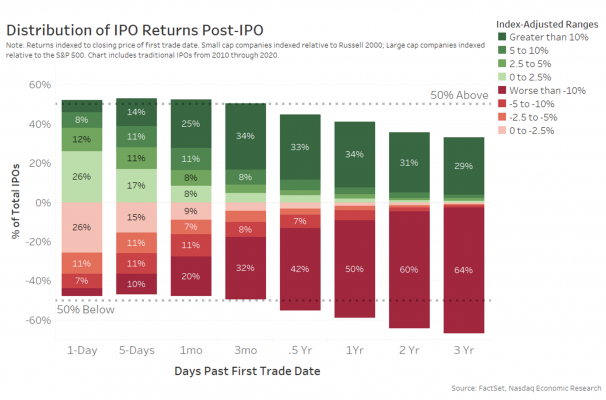

Over the long run, IPO returns deviate significantly

Given all this, it’s interesting to look at what happens to IPO stock prices in the years after a company first IPOs, especially as it gives insight into whether earnings growth expectations on day one are accurate (and the market is efficient) or not.

We analyzed the performance of companies that came to market between 2010 and 2020.

What we find is long-run performance varies significantly, and even more so the longer the timeframe. In Chart 3, we show the distribution of IPO performance up to three years post IPO. The colors show the magnitude of out (or under) performance. For example, the day after the IPO, just over 50% of companies outperformed the market (green colors), with a quarter (26%) of companies beating the market by less than 2.5% and another quarter underperforming by less than 2.5%. That shows that mostly the overnight placement price is close to the valuation struck in the market on day one.

However, a year later, we see that the majority of companies are either outperforming or underperforming the market by more than 10%. We also see that more companies are underperforming than beating the index (the red bars stretch below the 50% line).

That seems to indicate that for some companies, the initial IPO enthusiasm wanes or expected earnings are not met, and investors reprice the IPO to reflect the actual, slower growth of the company.

Chart 3: Most IPO returns turn negative in the long run

A few IPO winners outpace those who underperform

Three years after their IPO, we calculate that almost two-thirds of IPOs are underperforming the market, with most (64%) more than 10% behind the market’s returns.

However, while the outperformers only represent around 29% of the total IPOs, they outperform by much more (on average), with some doubling or tripling in price (Chart 4). The data show that the top 10% of IPOs earn an average market-adjust return of over 300%, while stocks in the 9th and 8th deciles earn significantly lower market-adjusted returns of 75% and 25%, respectively.

Robert Jankiewicz, Research Specialist for Economic Research at Nasdaq, contributed to this article.

Good Full Read Below

https://www.nasdaq.com/articles/what-happens-to-ipos-over-the-long-run-2021-04-15

6. LCTU-Blackrock U.S. Carbon Transition Readiness ETF Biggest ETF Launch Ever

Why LCTU?

1. Broad exposure to large- and mid-capitalization U.S. companies tilting towards those that BlackRock believes are better positioned to benefit from the transition to a low-carbon economy

2. Harness BlackRock’s thinking in sustainable investing through a strategy utilizing research-driven insights

3. Use in your equity portfolio to seek long-term capital appreciation

INVESTMENT OBJECTIVE

The BlackRock U.S. Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large-and mid-capitalization U.S. equity securities that may be better positioned to benefit from the transition to a low-carbon economy.

Stock Largest Holdings

as of Apr 14, 2021

| Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Shares | CUSIP | ISIN | SEDOL | Accrual Date |

| AAPL | APPLE INC | Information Technology | Equity | $66,161,157.21 | 5.16 | 66,161,157.21 | 501,107.00 | 037833100 | US0378331005 | 2046251 | – |

| MSFT | MICROSOFT CORP | Information Technology | Equity | $62,233,097.92 | 4.85 | 62,233,097.92 | 243,488.00 | 594918104 | US5949181045 | 2588173 | – |

| AMZN | AMAZON COM INC | Consumer Discretionary | Equity | $43,475,652.00 | 3.39 | 43,475,652.00 | 13,044.00 | 023135106 | US0231351067 | 2000019 | – |

| GOOGL | ALPHABET INC CLASS A | Communication | Equity | $26,806,517.87 | 2.09 | 26,806,517.87 | 11,957.00 | 02079K305 | US02079K3059 | BYVY8G0 | – |

| FB | FACEBOOK CLASS A INC | Communication | Equity | $25,674,896.52 | 2.00 | 25,674,896.52 | 84,786.00 | 30303M102 | US30303M1027 | B7TL820 | – |

| GOOG | ALPHABET INC CLASS C | Communication | Equity | $24,510,110.80 | 1.91 | 24,510,110.80 | 10,870.00 | 02079K107 | US02079K1079 | BYY88Y7 | – |

| TSLA | TESLA INC | Consumer Discretionary | Equity | $19,898,350.25 | 1.55 | 19,898,350.25 | 27,175.00 | 88160R101 | US88160R1014 | B616C79 | – |

| BRKB | BERKSHIRE HATHAWAY INC CLASS B | Financials | Equity | $16,285,086.16 | 1.27 | 16,285,086.16 | 60,872.00 | 084670702 | US0846707026 | 2073390 | – |

| JPM | JPMORGAN CHASE & CO | Financials | Equity | $15,121,604.84 | 1.18 | 15,121,604.84 | 100,004.00 | 46625H100 | US46625H1005 | 2190385 | – |

| MDT | MEDTRONIC PLC | Health Care | Equity | $14,949,402.30 | 1.17 | 14,949,402.30 | 120,657.00 | G5960L103 | IE00BTN1Y115 | BTN1Y11 | – |

Sector Exposure Breakdowns

- Sector as of Apr 14, 2021

% of Market Value

| Type | Fund |

| Information Technology | 27.23 |

| Health Care | 13.11 |

| Consumer Discretionary | 12.64 |

| Communication | 10.94 |

| Financials | 10.05 |

| Industrials | 9.15 |

| Consumer Staples | 5.25 |

| Materials | 2.89 |

| Real Estate | 2.80 |

| Energy | 2.61 |

| Utilities | 2.31 |

| Cash and/or Derivatives | 1.03 |

https://www.ishares.com/us/products/318215/blackrock-u-s-carbon-transition-readiness-etf

7. U.S. Housing Market Is Nearly 4 Million Homes Short of Buyer Demand

Freddie Mac says gap has widened significantly in past two years as builders struggle to keep up

The building industry, hit hard by the 2007-09 recession, is contending with shortages of labor, materials and developed land.

PHOTO: GEORGE SKENE/ORLANDO SENTINEL/ZUMA PRESS

By Nicole Friedman

The U.S. housing market is 3.8 million single-family homes short of what is needed to meet the country’s demand, according to a new analysis by mortgage-finance company Freddie Mac.

The estimate represents a 52% rise in the nation’s home shortage compared with 2018, the first time Freddie Mac quantified the shortfall.

The figures underscore the severity of the housing deficit, which is a major factor fueling the current red-hot housing market. The shortage is especially acute for entry-level homes, which makes it more expensive for first-time home buyers to enter the market, said Sam Khater, chief economist at Freddie Mac.

“We should have almost four million more housing units if we had kept up with demand the last few years,” Mr. Khater said. “This is what you get when you underbuild for 10 years.”

Freddie Mac reached its shortage figure by assessing the amount of single-family home building needed to match demand from household formation, second-home purchases and replacements of damaged or aging U.S. homes, and comparing that with the pace of construction.

8. Madoff Revisited by by Erin Arvedlund Philly Inquirer Reporter Who Broke the Story Originally in Barrons…75 Cents on Dollar Recovered.

Net cash lost? About $20 billion. Roughly $15 billion has been recovered, about 75 cents on the dollar.

December 2008

The markets were crashing; Madoff investors were calling every day, trying to get money out. By Dec. 8, 2008, the mastermind “knew the firm was running out of money. He told a key employee, Frank DiPascali, and they printed out a list of feeder-fund investors” who would get the last remaining dollars, Roberts recalled.

“No. Family first,” DiPascali told Madoff.

The boss then wrote out checks for roughly $270 million to himself, his brother, family, workers, and key investors. The FBI found those un-cashed on Madoff’s desk.

But it was too late. By Dec. 10, 2008, Madoff’s sons claimed they were turning in their father to regulators. And the FBI showed up at Madoff’s penthouse on Dec. 11, 2008, to arrest him.

DiPascali “knew it was over. He became the most cooperative of Madoff’s employees,” Duffy said. “He gave us intricate details of where we could find the missing documents and money. It would have been so much harder to go to trial without DiPascali.”

DiPascali revealed how Madoff’s team created fake statements and wired money from the hedge fund to prop up the brokerage firm, which by the late-1990s was bleeding money.

“Once, when KPMG auditors came to visit the office, Perez, O’Hara, and Joann Crupi would print out statements that were supposed to be old. To cool them off, they’d put the papers in the freezer, and throw them around to make them look old,” Duffy explained. Upstairs, DiPascali was soft-shoeing with the auditors, buying time.

By The Numbers

· Ponzi scheme total: $64.8 billion

· Net cash lost: $20 billion

· Money recovered: $15 billion

· Victims: 10,000-plus

· Madoff’s arrest: Dec. 11, 2008

· Years of criminal activity: 45

A decade after Bernie Madoff’s arrest, FBI agents reveal more about his Ponzi scheme-FBI agents are revealing, 10 years later, the detailed forensic investigation of Wall Street’s notorious criminal.– by Erin Arvedlund

9. 100 Best Companies to Work For—Fortune Mag

100 Best Companies to Work For | Fortune

10. Your Words Are Powerful: 8 Positive Speaking Habits to Build Yourself Up

By Margie Warrell | May 18, 2018 | 9

Have you ever heard yourself saying:

“This situation (or person) is just impossible.”

“I’m a total failure at…” or “I’m hopeless at…”

“I’ll never be able to figure this out.”

“I’ll try, but…”

“It’s just such a nightmare.”

If you answered “yes” to any of those, then it’s likely you’ve unconsciously been sabotaging your success simply by how you speak. Psychological research has found that your subconscious interprets what it hears very literally. Your mind and body will follow the direction your words lead. So if you want more influence, confidence, connection or opportunities to come your way, begin with what you’re projecting into the world each time you open your mouth.

The words you use hold immense power. Power to fuel your confidence and ambition and power to make you feel anxious and inadequate. Power to make a strong first impression and power to be quickly forgotten. Power to create opportunities and power to shut them down.

As someone who speaks at conferences around the world, I’ve had hundreds of people say to me, “I could never do you what you do,” or, “Public speaking scares me to death.” Of course, not everyone feels called to be on a stage on a regular basis, but using language like “never” and “scared to death” can keep people who would benefit from building their presentation skills from even trying.

The saying, “The words you speak become the house you live in,” holds great truth. The world mirrors yourself back to you. If you use positive language about yourself and your ability to meet challenges and achieve your goals, then that is what will show up for you externally. Likewise, if you continually make declarations about yourself or your circumstances that echo hopelessness, incite fear, nurture anxiety and breed pessimism, then those words will shape your reality, too. And not in good ways!

Your language also impacts how others perceive and relate to you. If you often feel overlooked or undervalued, consider how your speech patterns are contributing to how others engage with you. Using “out of power language”—like talking yourself down, making excuses or second-guessing your opinion before you’ve even shared it—can completely undermine your authority, presence and power. Listen to any successful person and you will notice they use language that is positive, precise, action-focused and continually puts deposits of trust into their relationships.

As I wrote in Stop Playing Safe, neuroscience has proven that every one of us has the ability to rewire our brains with ongoing practice and to replace destructive habits of thought, speech and behavior with more positive ones. Turning negative speech habits into positive ones begins with transparency (since we often aren’t even aware of how we’re sabotaging our own success, it’s so habitual!). I recommend two things. First, begin by monitoring your language over the next 24 hours. Second, ask someone else to monitor you as well, as our habits are often invisible to us! Then make the decision to replace language that is qualifying, passive and imprecise with language that is positive, specific and declarative—the kind that puts you firmly in command, shifts your energy and, in doing so, makes you someone others want to listen to.

1. Hold yourself powerfully.

How you hold yourself physically—your posture, your facial expression, the space you take up—profoundly, yet subtly, shapes how you feel emotionally and how the words come out of your mouth. So first up, stand (or sit) tall, shoulders back, a light smile on your face and plenty of eye contact with people around you. That will amplify your presence, and it will ensure that the words you say come out in a way that will have optimal impact on who hears them.

2. Reframe forward.

Instead of expressing yourself in terms of what you cannot do, reframe your language in ways that express forward movement. In other words, instead of “I can’t, I don’t, I won’t, I want, I need,” say, “I can, I am, I will, I choose, I have, I love, I create, I enjoy.”

3. Avoid absolutes.

Instead of “They are complete idiots,” say, “They see things differently from me. I wonder what they see that I don’t.” Instead of “No one around here ever listens to a word I say,” try, “Some people don’t seem to listen to me. I wonder how I can speak in ways that make others want to pay more attention.”

4. Don’t apologize for your opinion.

Many people, particularly women, will preface their opinion with an apology or something else that minimizes the chances of ruffling feathers. If that’s you, stop. You don’t have to apologize for having an opinion. Just express it respectfully.

5. Shelve the “shoulds.”

The word “should” sounds harmless enough. However, as I wrote in my most recent book Make Your Mark, what often lies beneath it are unconscious and unhelpful social expectations, biases and rules. So rather than use the word “should,” which carries a judgment of better/worse, use the word “could” and insert an alternative option that aligns with your personal desires. For instance, instead of saying “I should have everyone over for 4th of July,” say, “I could invite everyone here, or we could go out instead.”

6. Express commitment. (Stop “trying”!)

I recently called my daughter Maddy to get her new voicemail message: “Please leave a message, and I’ll try to get back to you as soon as I can.” I left her a message: “Update your recording, honey, and remove the word ‘try.’” Saying you’ll try to do something provides an excuse for not doing it. So don’t try. Do.

7. Limit the labels.

Labels create a subconscious mental boundary that confines you. Labeling yourself as “lazy” or “disorganized” or “pathetic with money” or a “terrible networker” keeps you from being anything but that and only reinforces an undesired state. Just because you’ve been lazy and disorganized doesn’t mean you can’t choose to be different. Far better to say, “I’ve not been very proactive about this, but I will be,” or “I’ve never prioritized getting organized, but I’ve now decided to start managing my time better.”

8. Rephrase problems as opportunities.

We all have “problems”—what differentiates the most successful people is how they approach them. Got a bad boss? What a wonderful opportunity to develop your ability to manage up. Got a lot on your plate? What a great opportunity to improve your ability to delegate, prioritize and develop efficiency. When you change the way you describe your “problems,” it opens up whole new avenues for dealing with them. Instead of “This is a nightmare,” say, “This is an interesting challenge,” and you will more easily approach it as such.

We live in language. Choose to speak in ways that bring out your best and make you feel more positive about your ability to do what inspires you and to change what doesn’t. If there’s one thing I know for sure, it is this:

You are capable of far more than you think.

Realizing just how capable you truly are begins the moment you decide to use words that embolden you.

Related: Say This, Not That: 7 Responses for Common Negative Thoughts

https://www.success.com/your-words-are-powerful-8-positive-speaking-habits-to-build-yourself-up/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..