1. Big $40 million options trade bets on near-term stock market tumble

By Reuters Staff- A MASSIVE TRADE IN THE U.S. OPTIONS MARKET ON THURSDAY APPEARS TO BE BETTING THAT THE CALM ENVELOPING U.S. STOCKS IN RECENT WEEKS WILL GIVE WAY TO A BIG RISE IN VOLATILITY OVER THE NEXT THREE MONTHS.

One or more traders laid out a roughly $40 million bet that the Cboe Volatility Index – often called Wall Street’s fear gauge – will break above the 25 level and rise towards 40 by mid-July, trading data showed Thursday.

The VIX closed at 16.95 on Thursday, its lowest close since February 20, 2020, just before the coronavirus pandemic spooked investors and roiled global financial marketSome 200,000 of the VIX July 25 – 40 call spread traded over the course of two hours on Thursday, starting at 10 a.m. The trades made up about a third of the average daily trading volume in VIX options, according to Trade Alert.

The trades involved the purchase of the spread’s lower strike calls for an average price of about $3.37, partly funded through the sale of the higher strike calls at about $1.30 per contract.

For the trade to be profitable, the VIX would need to rise above 25 by mid-JulGiven that big rallies in the options-based index tend to come during turbulent periods for stocks, the trade could represent a bearish outlook for equities.

The S&P 500 closed at a record high on Thursday helped by a rise in technology and other growth stocks. (Reporting by Saqib Iqbal Ahmed; editing by Diane Craft)

2. U.S. High Yield Credit Spread

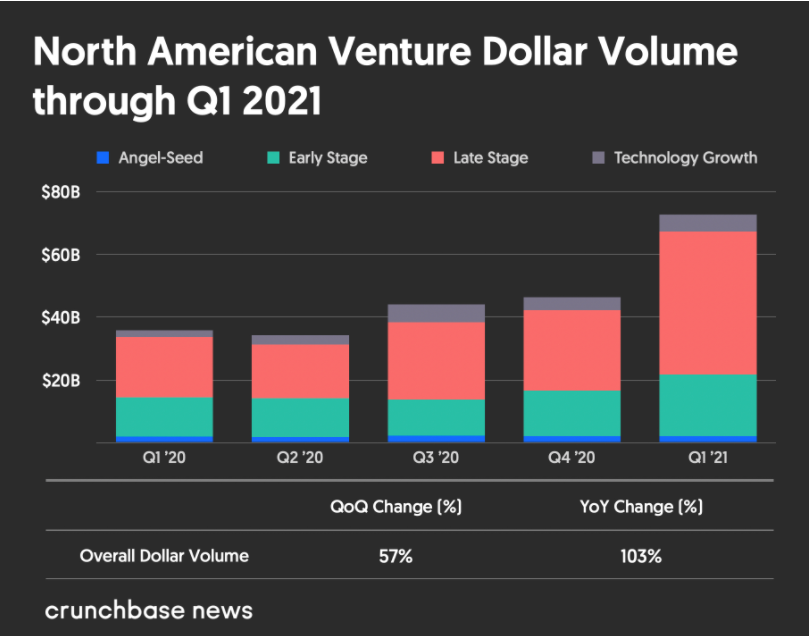

3. Seed Money Hits Record in Q1 2021

The first quarter of 2021 was one of those rare periods in startup funding and exiting in which it seemed everyone was bullish about everything.

There were enormous late-stage funding rounds. Major public market debuts. Big M&A deals. Even early-stage was way up over the prior quarter and year-ago levels.

Overall, investors put $72.7 billion into seed through technology growth-stage rounds for North American startups in the first quarter of this year, according to Crunchbase reported data. The total is the highest in the history of the dataset.

Funding in Q1 was roughly double year-ago totals. Investment also rose 57 percent from Q4, as detailed in the chart below:

Funding totals were juiced by massive individual rounds for hot unicorns. There were 194 rounds of $100 million or more in Q1, per Crunchbase data. While rounds of that size were once rare, it’s now routine to see several in a single day. Investors also scored some big exits, topped by public offerings for gaming platform Roblox and point-of-sale lender Affirm.

All told, it added up to quite an extraordinary quarter. We break down the major trends below, focusing on stages, big deals, M&A and public market debuts.

North American Startup Funding Was On Fire In Q1Joanna Glasner

North American Startup Funding Was On Fire In Q1 – Crunchbase News

4. Why The Air Force Has Its Own Venture Capital Fund

AFVentures matches technology startups with military needs while helping them navigate the “valley of death” and the labyrinthine world of defense contracts.

BY MARK SULLIVAN4 MINUTE READ

The Defense Department is trying to renew its once robust relationship with Silicon Valley to find the technologies needed to confront 21st-century threats. The Air Force is taking the novel approach of establishing a venture capital firm within its ranks that locates, invests in, and opens doors for promising defense startups.

AFVentures is a division of an Air Force technology acquisition and development group called AFWerx (the AF stands for Air Force and Werx is shorthand for “work project”) established in 2017. AFWerx is something like the Defense Innovation Unit (DIU) within the DOD, which began looking into the private sector for promising defense technologies back in 2015.

For many years the DOD has relied chiefly on technologies developed either within the government or by a small group of large contractors such as Boeing or Raytheon. There’s a growing belief within defense circles that to address the new nontraditional and cyberwarfare threats on the horizon, the U.S. needs to tap into the cutting-edge innovation happening outside those universes.

SIDESTEPPING THE ‘VALLEY OF DEATH’

One of the biggest things AFVentures does is help small startups survive the brutal process of qualifying for a defense contract.

The DOD’s procurement process is famous for its complexity and slowness. It’s a five-phase affair that starts with technology analysis, then moves to product prototyping, then engineering and manufacturing, then production and deployment, and ends with operations and support—and that’s if the project isn’t rejected or starved of funding. It’s a mind-numbingly labyrinthine systemclogged with red tape and paperwork. Larger contractors have large staffs of people to wade through the process, but smaller tech companies face a real challenge managing all the work.

https://www.fastcompany.com/90620774/air-force-venture-capital-silicon-valley-afventures

5. Bitcoin 0.11 Correlation to Stock Market

Barrons-Versus the stock market, Bitcoin had a correlation of just 0.11 from the start of 2018 through November 2020, according to data from Leuthold Group’s chief investment strategist, Jim Paulsen. That compares with bonds’ and stocks’ -0.24 correlation and gold’s and stocks’ 0.31. (1 is a perfectly positive correlation, -1 is a perfectly inverse relationship, and 0 means no correlation whatsoever.) Bitcoin also had a correlation with bonds of under -0.01 in that same period.

By

GBTC-Bitcoin Trust

©1999-2021 StockCharts.com All Rights Reserved

6. Infrastructure Money Breakdown

From Slow and Boring Blog www.slowandboring.com

7. America’s Bridge and Road Ranking in World

As Kevin Drum notes, the World Economic Forum surveys say that America has some of the best roads in the world.

Found at Morning Brew https://www.morningbrew.com/

8. Booking.com CEO: Business travel will be ‘forever lower’

Business class of an American Airlines flight, 2018. Photo: Jeff Greenberg via Getty Images

In an interview with Axios on Monday, Booking.com CEO Glenn Fogel said he believes “the share of business travel will be forever lower than pre-pandemic.”

Why it matters: Business travel has an outsized impact on parts of the travel and leisure industry, which is in the midst of adapting to post-pandemic demand.

- For example, only about 12% of air travel comes from business passengers, but they represent 75% of an airline’s profits, according to travel software provider Trondent.

What’s happening: Booking.com introduced a new $50 credit for future travel as an incentive to help drive demand for leisure trips — a segment that is expected to pick up faster than business travel.

- “We need to help get this industry back up and running, traveling safely,” Fogel said.

The big picture: The CDC issued new guidelines on Friday for U.S. domestic travel as the number of people who have been fully vaccinated climbs to near 20%.

Thought bubble from Axios transportation correspondent Joann Muller: There are unmistakable signs of pent-up demand for leisure travelers, but business travel is likely going to take much longer to recover, in part because companies are still trying to figure out what return-to-work looks like.

- It will be easy to replace some corporate travel with virtual Zoom meetings, but when it comes to things like sales, where competition is intense and it’s important to “read the room,” travel will become a necessity once more.

9. U.S. Ramping Up Vaccinations

In the last 7 days the United States has administered more than 21 million COVID-19 vaccinations, which is equivalent to roughly 6.5% of the entire US population receiving a dose in a single week (data from Our World In Data).

Pump those numbers up

The pace being set in the US is now among the fastest in the world, surpassing even the UK’s best week from the last few months. If the US maintains this pace (a big “if”) it would mean full vaccination coverage could take just another ~15 weeks, assuming “full coverage” is around 75% of a population having had 2 doses. Despite a slower start, Australia, Canada and the EU are also ramping up their programmes.

Although the US acceleration has been impressive, it’s still not enough to top the global cumulative leaderboard. Israelremains at the top of that table, having administered 117 doses per 100 people (i.e. they are on their second round for most people).

P.S. The 4 countries shown in the chart plus the EU accounts for 95%+ of our readership, but if we haven’t plotted your country here we recommend you check out the full data set from Our World In Data.

10. Deliberate Practice-Farnum Street

Summary

Deliberate practice isn’t everything, but if you want to keep improving at a skill or overcome a plateau, you’ll benefit from incorporating the principles mentioned in this article. To recap:

- Deliberate practice means practicing with a clear awareness of the specific components of a skill we’re aiming to improve and exactly how to improve them.

- The more we engage in deliberate practice, the greater our capabilities become.

- Our minds and bodies are far more malleable than we usually realize.

- Deliberate practice is structured and methodical.

- Deliberate practice is challenging because it involves constantly pushing yourself out of your comfort zone.

- Deliberate practice requires constant feedback and measurement of informative metrics—not vanity metrics.

- Deliberate practice works best with the help of a teacher or coach.

- Continuing deliberate practice requires a great deal of intrinsic motivation.

- Deliberate practice requires constant, intense focus.

- Deliberate practice leverages the spacing effect—meaning a consistent commitment over time is crucial.

- If you’re content with your current level of skill or just doing something for fun, you don’t necessarily need to engage in deliberate practice

- Deliberate practice is best suited to pursuits where you’re actively aiming for a high level of performance or to break beyond some kind of supposed limit.

***

Books about deliberate practice (further reading)

“A world in which deliberate practice is a normal part of life would be one in which people had more volition and satisfaction.” —Karl Anders Ericsson, Peak

If you’d like to learn more about the art and science of deliberate practice, check out any of these books:

- Talent Is Overrated, Geoff Colvin

- The Talent Code, Daniel Coyle

- The Little Book of Talent, Daniel Coyle

- Mastery, Robert Greene

- Outliers: The Story of Success, Malcolm Gladwell

- Bounce: Mozart, Federer, Picasso, Beckham, and the Science of Success, Matthew Syed

- The Art of Learning, Josh Waitzkin

- Mindset: The New Psychology of Success, Carol Dweck

- Teaching Genius: Dorothy Delay and the Making of a Musician, Barbara Lourie Sand

- Grit: The Power of Passion and Perseverance, Angela Duckworth

Great Full Read The Ultimate Deliberate Practice Guide: How to Be the Best

The Ultimate Deliberate Practice Guide: How to Be the Best (fs.blog)

ADD GBTC CHART BITW

Versus the stock market, Bitcoin had a correlation of just 0.11 from the start of 2018 through November 2020, according to data from Leuthold Group’s chief investment strategist, Jim Paulsen. That compares with bonds’ and stocks’ -0.24 correlation and gold’s and stocks’ 0.31. (1 is a perfectly positive correlation, -1 is a perfectly inverse relationship, and 0 means no correlation whatsoever.) Bitcoin also had a correlation with bonds of under -0.01 in that same period.

At the same time, investors’ mood has improved markedly with the coming of spring. The VIX—the Cboe Volatility Index —has retreated to its prepandemic levels, ending at 16.69 Friday. Qualitative assessments also indicate waning fear and increasing ebullience among investors. The Investors Intelligence polling of advisors found 60.8% bullish in the past week and only 16.7% bearish. Bullish readings over 60% and bull-bear spreads exceeding 40 percentage points tend to come around market peaks.

Investors’ Hopes Are in Bloom as a Season of Growth Arrives

By Evie Liu

April 9, 2021 8:20 pm ET https://www.barrons.com/articles/a-bitcoin-etf-is-still-in-the-works-here-are-your-options-in-the-meantime-51618014033?mod=past_editions

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.FacebookTwitter