1. Value and Growth History of 4 Cycles.

A Wealth of Common Sense Blog

https://twitter.com/awealthofcs

2. Q1 2021 Earnings Estimate Growth Year Over Year

Energy, Financials and Materials Lead Earnings Growth Estimates.

3. Factor Grid 2008 Thru Q1 2021

2008-2020 Growth Huge Leadership.

4. LQD Corporate Bond ETF Worse Month of Outflows in 20 Year History

Biggest Credit ETF Bleeds $3.6 Billion in Worst-Ever Month-by Katie Greifeld, 4/1/21

After a blowout 2020 for corporate debt, exchange-traded fund investors are quickly souring on those bonds.

The world’s largest credit ETF notched its worst month of outflows since it began trading about two decades ago. Traders pulled roughly $3.6 billion from the iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker LQD) in March, according to data compiled by Bloomberg. That exodus came as the $42 billion fund suffered its biggest quarterly rout in 12 years.

LQD -5% YTD bouncing off bottom

5. Best 1-month performers are funds involved with construction, manufacturing, or production – or the raw materials

| ETF | ONE-MONTH RETURN |

| Breakwave Dry Bulk Shipping ETF BDRY, -3.51% | 30.9% |

| VanEck Vectors Steel ETF SLX, -0.95% | 14.9% |

| Invesco S&P SmallCap Value with Momentum ETF XSVM, -0.77% | 13.9% |

| SPDR S&P Homebuilders ETF XHB, +0.87% | 13.5% |

| Pacer US Cash Cows 100 ETF COWZ, +0.02% | 13.2% |

| iShares US Home Construction ETF ITB, +0.68% | 12.9% |

| SPDR S&P Retail ETF XRT, +0.36% | 12.5% |

| Invesco S&P SmallCap 600 Revenue ETF RWJ, -0.22% | 12% |

| First Trust Utilities AlphaDEX Fund FXU, +0.30% | 11.8% |

| Invesco S&P 500 Equal Weight Utilities ETF RYU, +0.39% | 11.6% |

| Source: Refinitiv Lipper |

Safe haven plays still popular amid rotation into cyclical stocks, March fund flows show

6. XLF Financials ETF Chart

XLF-Financials ETF 50 week moving average about to cross 200 week moving average first time since 2012

Still, Maley said the longer-term setup looks incredibly strong for the financials.

“The 50-week moving average is getting very close to the 200-week moving average. In other words, it’s getting very close to a golden cross on a weekly basis. Golden crosses tend to be bullish on a daily basis on the charts, but when you get it on a weekly basis, it’s even more so. In fact we haven’t seen one of those crosses since 2012,” said Maley.

“That time, we’d also seen a big rally, and when the golden cross took place, it extended to a much further rally over the next several years,” Maley added.

A golden cross is formed when a 50-period moving average moves above the 200-period. It is a bullish formation that suggests an accelerating trend to the upside.

From June 2012 to a peak in August 2015, the XLF nearly doubled in price. Maley said he’d be looking to buy the group on weakness, while keeping an eye on whether a golden cross is seen in the charts.

Financial stocks set up for a bullish pattern not seen in nearly a decade, according to chart

7. Change in Migration Major Metro Area Gainers and Losers.

Tierra Partners, @tierrapartners

From CBRE migration patterns 2019 vs 2020 for major MSAs

https://twitter.com/tierrapartners

8. The Share of Home Purchase Applications for Second Homes hits 14%

Wolf Street

The share of purchase mortgage applications in February for second homes and investment properties has soared to 14.1% of total purchase mortgage applications, according to data by the Mortgage Bankers Association, cited and charted by the Wall Street Journal:

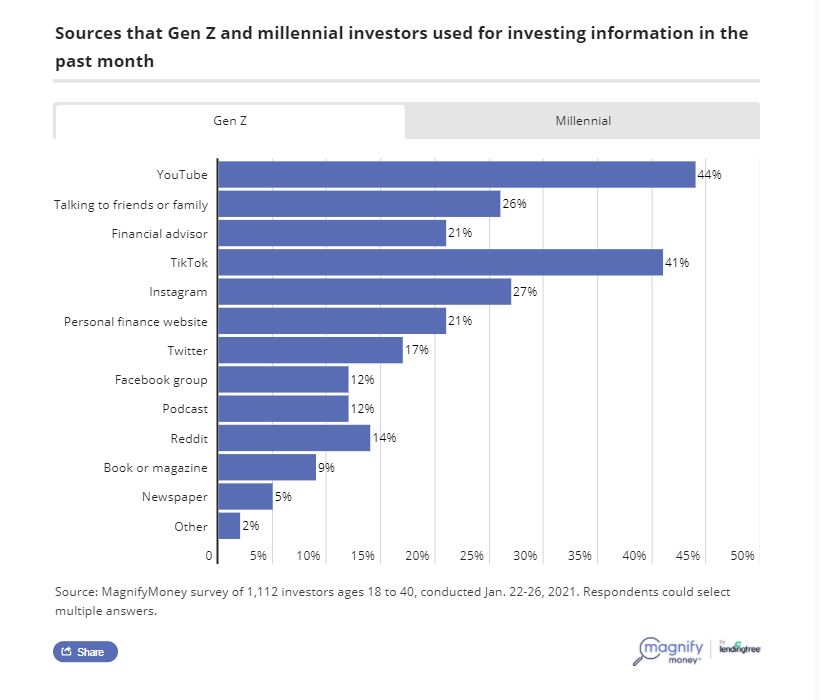

9. Millennials and Gen Z Sources of Investing Information

Magnify Money Blog

Survey: Nearly 60% of Young Investors Are Collaborating – MagnifyMoney

10. 7 Myths About Optimism and Pessimism

Defensive pessimism can help to manage anxiety and provide a sense of control.

SUMMARY

· Past research has demonstrated that optimism can benefit happiness, relationships, and health.

· But defensive pessimism—setting low expectations and considering worst-case scenarios—can help reduce anxiety.

· Defensive pessimism is most useful when negative outcomes are important to consider and when they can be prevented.

Optimism is among the most celebrated human qualities. Many studies have shown that optimists tend to fare better in life than their pessimistic friends—at least when it comes to physical and mental health, resilience, relationships, career, pain management, and even longevity. Being of good cheer and expecting the best, as science and cultural dogmas have us believe, will lead to the best.

But is it all that straightforward? Is optimism always adaptive, and is there really nothing good about being a pessimist?

Psychologist Julie Norem’s research suggests otherwise.

For almost four decades, Dr. Norem has been studying the phenomenon of defensive pessimism—the cognitive strategy of setting low expectations and considering worst-case scenarios of future events. It turns out, the habit of not getting your hopes high can help with managing anxiety and gaining a sense of control.

In her latest research, Dr. Norem found that the use of defensive pessimism was correlated with taking more precautions during the Covid-19 pandemic (e.g., hand-washing, mask-wearing, social distancing), and less risky behaviors (e.g., meeting inside with people you don’t live with). “Without a doubt, defensive pessimists are more anxious than their optimistic counterparts,” explains Dr. Norem, “but they also actively make more effort to manage their risk.”

One of the biggest surprises from Dr. Norem’s research is the public’s hesitation towards the mere idea of there being something positive about pessimism. Yet, perhaps ironically, when people discover that they are defensive pessimists, many report feeling relief and validation.

Here is Dr. Norem, in her own words, on 7 myths about optimism and pessimism, 2 examples when defensive pessimism is most effective, and 2 ways to foster optimism.

1. One is either an optimist or a pessimist.

False. People’s perspectives vary from domain to domain. For example, you can be optimistic about your social life and pessimistic about your work. Furthermore, we can consider optimism-pessimism as a tendency to expect good or bad things (trait level); or as how prone people are to experience positive-negative affect (temperamental level).

These are tendencies—they are not deterministic of specific expectations in specific situations. While these tendencies can be influenced by genetics, they merely point us in a certain direction. We still have freedom to move.

2. Optimists are born, not made.

This myth is too all-encompassing to be true. While we don’t have much evidence that we can get rid of our tendencies to experience negative affect, cognitive therapy studies suggest that people can learn to revise how they look at situations. It’s not easy, but it’s possible.

article continues after advertisement

3. Being an optimist is always better than being a pessimist.

False. Research from Japan finds that defensive pessimists do better than optimists in terms of affect and actual performance. Studies from the U.S. show that, on average, defensive pessimists do as well as optimists. Defensive pessimists have more negative affect, but not necessarily less positive affect.

In the U.S., the commonly held belief is that when it comes to positive affect, the more, the better. If you are feeling negative emotions, you are often motivated to get rid of them, because it makes you feel like you are failing at something. In other cultures, including Japan, the ideal affective life is more balanced. A well-adjusted person recognizes that there are negatives and positives in most things in life and allows herself to experience both.

4. Pessimists are more likely to get depressed than optimists.

True—in terms of general traits, pessimists are more at risk of depression. However, the overall picture is more complicated. Research shows that defensive pessimists are actually less likely to get depressed than other pessimists, and not significantly more likely than optimists. What increases the risk of depression is when pessimism is combined with hopelessness. That is, when pessimists don’t feel like they have any control over their circumstances.

Here, the distinction between defensive pessimism and fatalistic pessimism is important. Defensive pessimists are oriented towards making things better in their lives or getting things done. Fatalistic pessimists, on the other hand, might have the same underlying tendency to experience negative emotions, but instead of actively looking for what they could do in the world, they assume that they are fated to be the way they are and that there is no hope. That’s the pathway that tends to lead to depression.

5. Optimism is a key ingredient in human flourishing, while pessimism is a key impediment to well-being.

This myth is overly simplified and reductionistic. If you define flourishing primarily in terms of positive emotions, optimism indeed makes it much more likely for you to experience positive emotions. But since that is correlated with the temperamental tendency to experience positive emotions, it’s not clear what comes first. It’s also unclear that what relates positive emotions to optimism is relevant to people who aren’t optimistic—it’s not like people can just pretend to be optimistic and things will necessarily get better for them.

6. Pessimists can also be happy.

True. The value that people place on happiness as an outcome varies enormously. Defensive pessimists certainly have many moments of happiness and enjoy many things in their lives. But that’s not where their focus is. Instead, they want to not have regrets and work towards their goals. They want to feel as if they did their best in a given situation and they want to manage their anxiety so it doesn’t interfere with their goals.

Moreover, defensive pessimists are able to tolerate negative emotions. For many people, once they recognize that they are anxious, their primary goal becomes to get rid of anxiety and to feel happy. The strength of defensive pessimists lies in their ability to say, “I recognize that I feel anxious. I know what to do with this anxiety and I’m not going to let it get in my way.” It’s different than denying it or trying to suppress or avoid it.

https://www.psychologytoday.com/us/blog/between-cultures/202104/7-myths-about-optimism-and-pessimism

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.