1. Global Bonds Slump to a Discount for First Time Since 2008

Finbarr Flynn

(Bloomberg) — A gauge of global bonds dropped below a key fixed-income watermark after Federal Reserve Governor Lael Brainard signaled a quicker-than-expected rundown of the central bank’s debt holdings.

The Bloomberg Global Aggregate Index fell below a measure of so-called par value Tuesday, with its price falling to 99.9 — under the key 100 level at which bonds are often sold to investors. It’s the first time since 2008 that the gauge has traded at a discount to face value.

Global investors have fled the bond market this year, as skyrocketing inflation forced many central banks to accelerate plans for rate hikes to try and cap rising prices. The index — which contains government and corporate debt — has fallen 7.4% so far this year — a drop in market value of some $4.6 trillion, according to data compiled by Bloomberg.

Brainard called the task of reducing inflation pressures “paramount” and said the Fed will raise interest rates steadily while starting balance sheet reduction as soon as next month.

Stock, Credit Markets Too Calm Ahead of Fed QT, Funds Say

Treasuries extended a slump Wednesday, pushing the benchmark 10-year yield past 2.6% to the highest since 2019.

https://finance.yahoo.com/news/global-bonds-slump-discount-first-065315087.html

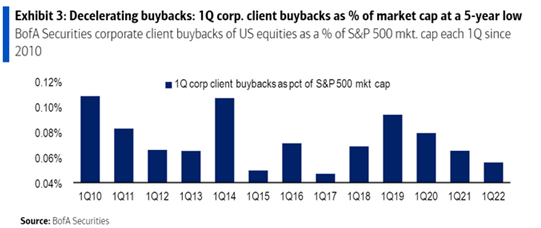

2. U.S. Stock Buybacks Drop to Lowest in 5 Years

From Dave Lutz at Jones Trading-U.S. stock buybacks dropped to the lowest in five years in the first quarter, providing evidence of a reversal in the multi-decade bullish trend for equities, according to BofA – While buybacks typically slow at the end of each quarter ahead of the earnings season, spending by S&P 500 firms on share repurchases as a percentage of market capitalization fell to its lowest since the first quarter of 2017

3. U.S. vs. Rest of World…Valuation Spread Historical Event

This is the U.S. divided by the rest of the world …2 std. deviation event…Double 1999 bubble.

Courtesy of Animal Spirits Podcast https://theirrelevantinvestor.

4. U.S. Households Net Worth Relative to Consumption Straight Up…Cushion for Recession Watch.

For now, strong household balance sheets are expected to be a tailwind for spending.

Source: Gavekal Research

The Daily Shot https://dailyshotbrief.com/

5. Crude Pulls Back Toward Major Support

6. Chinese Executives Sell at the Right Time, Avoiding Billions in Losses

WSJ–Consider a trade in Alibaba Group Holding Ltd. BABA -2.99% stock in 2020. In October of that year, Alibaba’s payments affiliate, Ant Group Co., was preparing for its initial public offering, a move that would have likely increased the value of Alibaba’s one-third stake.

Then Alibaba’s founder, Jack Ma, criticized Chinese regulators in a speech that infuriated government leaders, who scuttled the listing. Alibaba shares fell 8% on the New York Stock Exchange the day the announcement was made, Nov. 3, 2020.

Chinese tech stocks popular among U.S. investors have tumbled amid the country’s regulatory crackdown on technology firms. WSJ explains some of the new risks investors face when buying shares of companies like Didi or Tencent. Photo Composite: Michelle Inez Simon

The day before that announcement, an entity controlled by an Alibaba insider sold $150 million of Alibaba stock, according to filings. It isn’t known exactly who controls the entity, Sky Scraper Enterprises Ltd., but whoever it is was one of the company’s best-paid executives in recent years and had been granted huge swaths of stock as compensation, the Financial Times previously reported. The sale avoided hundreds of millions of dollars of losses when the stock dropped on news of the scuttled IPO.

The filing said the trade was made under a Rule 10b5-1 trading plan that was adopted two months earlier. Such plans are supposed to be adopted when an insider doesn’t have nonpublic information that might affect the stock price, and executives can’t direct stock sales after it is in place. A spokeswoman for Alibaba said the company’s plans require a period of up to 60 days before trading can begin.

How’s That October 2020 Insider Sale Look…Top tick $300

Chinese Executives Sell at the Right Time, Avoiding Billions in Losses – By Liz HoffmanFollowTom McGintyFollow

7. Volatility Index Non-Event Around Fed Speak

8. Carnival records busiest week in company history

Ihsaan Fanusie—Carnival Cruise Line (CCL) recorded its biggest booking week in company history last week as demand for luxury cruises continues to skyrocket.

The company announced that 22 of its 23 ships are back in operation now after many of the ships were out of operation following the pandemic. With covid hospitalizations decreasing and the 7-day moving average for new cases on the decline in the US, consumers feel more comfortable embarking on cruises.

“So where we are right now is in almost a transition period where it continues to come down,” Director of the National Institute of Allergy and Infectious Diseases Dr. Anthony Fauci told Yahoo Finance Live last week. “The CDC has pulled back on some of the recommendations for indoor masking. And yet, in the next week or two, we will see soon whether we are going to see an increase.”

The Centers for Disease Control (CDC) updated its guidelines for cruise travel on March 30, removing the “Cruise Ship Travel Health Notice” that it has uploaded on its website following a spread of COVID-19 variants across the world. Back in January, the CDC had given cruise ships a Level 4 warning, the highest level possible.

Carnival wasn’t the only cruise line to record significant bookings increases. Virgin Voyages, the cruise line operating under the parent conglomerate Virgin Group, also experienced higher demand after the CDC announcement.

“There’s incredible pent-up demand,” McAlpin, the president as well as chief executive of Richard Branson’s cruise line, told Yahoo Finance in an interview. “We are starting to see it. Bookings are up significantly, 125% over just January levels. Last week, we had a record booking week and we are gonna surpass that this week.”

Ihsaan Fanusie is a writer at Yahoo Finance. Follow him on Twitter @IFanusie.

https://finance.yahoo.com/

9. The Richest People in the World.

https://www/visualcapitalist.com/richest-people-in-the-world-2022/

10. To Be a More Decisive, Persuasive, and Effective Boss, Science Says First Take a Look at the Clock

Research shows sleep affects leadership decision making, engagement, and behavior. Here’s why you should get a good night’s rest — and what to do when you haven’t gotten enough.

BY JEFF HADEN, CONTRIBUTING EDITOR, INC.@JEFF_HADEN

Even though he was our boss, for the first two hours of each day we only glimpsed Rudy from a distance when he shuffled back and forth from his office to the break room coffee machine. If we called him — even if we paged him — he wouldn’t answer.

By around 10 a.m., he was a different person. Upbeat. Encouraging. Chatty. Eager to solve job scheduling or materials bottlenecks that could affect our productivity.

Then, by late afternoon, he became yet another person. Instead of chatting, he barked orders. Instead of solving actual problems, he yelled about nonexistent ones. Whether we needed his help or not, we did our best to avoid him.

Hold that thought.

It’s easy to assume that some people are good leaders and others are not. But the reality is more nuanced. Sometimes you’re a great leader. You’re empathetic. Insightful. Collaborative. Decisive.

Other times, you’re less effective.

Why? According to research, sleep plays a major role in your effectiveness. A 2015 study published in Academy of Management found that bosses who don’t get a good night’s sleep are less likely to make good decisions the next day. So, for example, less likely to foster engagement and collaboration with, and among, their teams the next day.

And they are also more likely to be abusive (which the researchers define as “hostile verbal and nonverbal behavior”) towards their employees the next day.

As the researchers write:

Emerging evidence suggests that leaders might be more (or less) abusive on some days than on others…abusive supervisory behavior varied more within supervisors than it did between supervisors.

Why does sleep deprivation have such an impact on leadership performance? For one thing, tired people tend to make poorer decisions.

But the researchers speculate the real culprit is ego depletion: Since self-control draws on a limited pool of mental resources that can be used up, when your energy is low, so is your self-control. Which means you’re less likely to have the inner “oomph” required to be the kind of leader you want to be.

Which makes you less patient. Less tolerant. Less collaborative. More likely to make snap decisions — and to snap at people, even if your version of “snapping” is only a nonverbal eye roll.

Rudy? He was chronically sleep-deprived. He needed four cups of coffee and a couple hours of quiet time to face the day, and us. But by the afternoon, no amount of coffee — or “I really want to be a good leader” willpower — could overcome his fatigue.

The solution, of course, is to always get a good night’s sleep.

But like most solutions, that isn’t always possible. So what should you do when you haven’t gotten a good night’s sleep? According to the researchers, don’t just try to power through.

Instead, adapt to the fact — and it is a fact — that lower levels of physical and mental energy can impact your leadership performance. If you can, put off major decisions. Force yourself to take a beat and think — instead of just reacting — before making smaller decisions. Recognize that fatigue naturally decreases your tolerance for frustration, and save potentially difficult or confrontational conversations with employees — if the issue or problem can be put off — for the next day.

And don’t answer emails that require deep thought, or nuance, or fine judgment late at night. Save them for the next morning when you’re fresh.

The key is to remember that no one is able, no matter how hard they may try, to always be the exceptional leader they aspire to be — especially when they’re tired.

So do your best to ensure you are at your best.

And when you’re not, to adjust accordingly.