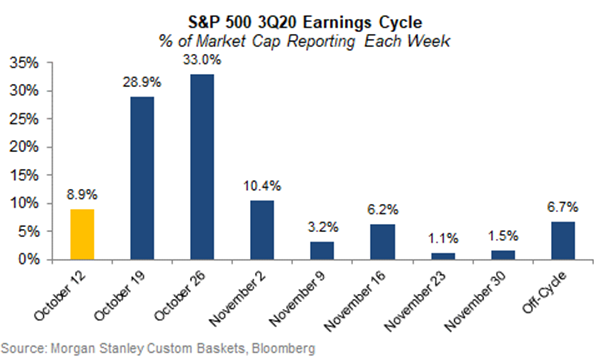

1. October Earnings Schedule…60% of S&P Reports in Next Two Weeks.

We get Earnings fromNetflix on Tuesday, Tesla and Verizon on Wednesday, and Intel Thursday. Apple, Amazon, Alphabet, Microsoft and Facebook report the following week.—Dave Lutz at Jones Trading

2. ‘Smart money’ just reversed bets against tech stocks in a huge way-Marketwatch

Last Updated: Oct. 19, 2020 at 10:42 a.m. ETFirst Published: Oct. 19, 2020 at 12:19 a.m. ET

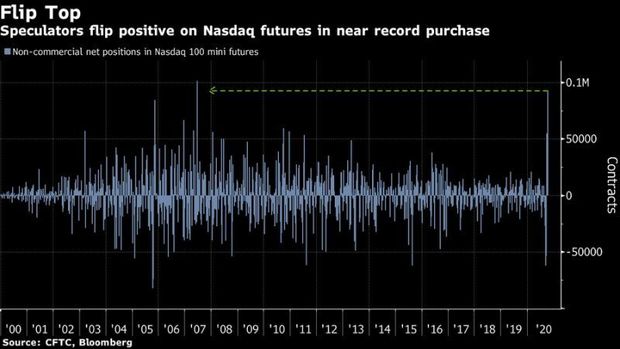

The 33rd anniversary of the “Black Monday” stock-market meltdown is upon us, and if hedge-fund managers are scared of history repeating itself, you certainly wouldn’t know it from the massive overhaul in their positions they’ve undertaken over the past week.

Read: This is the last chart investors need to see right now

After establishing one of their biggest short positions in U.S. tech stocks in more than a decade earlier this month, hedge-fund managers poured their money into Nasdaq futures at a near-record rate, according to Commodity Futures Trading Commission data cited by Bloomberg.

Here’s what that breakneck reversal looks like:

The reversal left speculators net long technology stocks for the first time since the beginning of September, when traders began loading up on short positions in a move that grew to the most bearish levels since before the financial crisis, Bloomberg reported.

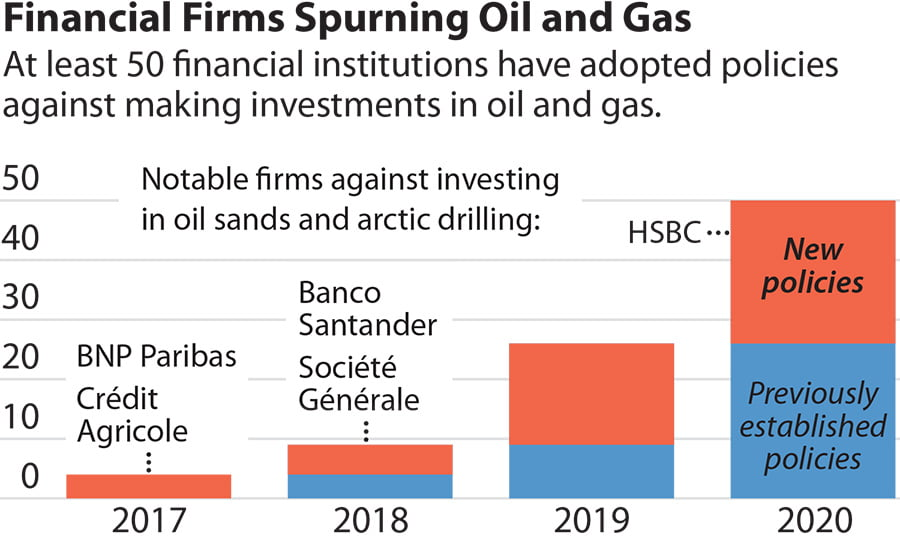

3. Financial Institutions Restrict Oil And Gas Drilling In The Arctic

Valuewalk

20 October 2020 (IEEFA): Fifty globally significant financial institutions have introduced policies restricting oil sands and/or oil and gas drilling in the Arctic including 23 to date this year, highlighting global capital continues to flee fossil fuels, according to a new tracker developed by the Institute for Energy Economics and Financial Analysis (IEEFA).

“Over 140 global financial institutions have already restricted thermal coal financing, insurance and/or investment and we are now seeing a similar accelerating shift of capital away from oil and gas exploration, starting with high risk oil sands development and drilling in the Arctic.

“This momentum in fossil fuel divestment globally means we expect a continuation of new announcements from other financial institutions seeking to better manage increasing climate risk.”

IEEFA has identified 50 significant global financial institutions to date with restrictions on financing oil sands and/or Arctic drilling projects, including HSBC, Banco Santander, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Citigroup, Wells Fargo and Morgan Stanley.

“Momentum is building against financing oil and gas projects,” says IEEFA’s Tim Buckley, director of energy finance studies and co-author of a new briefing note on global financial institutions divesting from oil and gas.

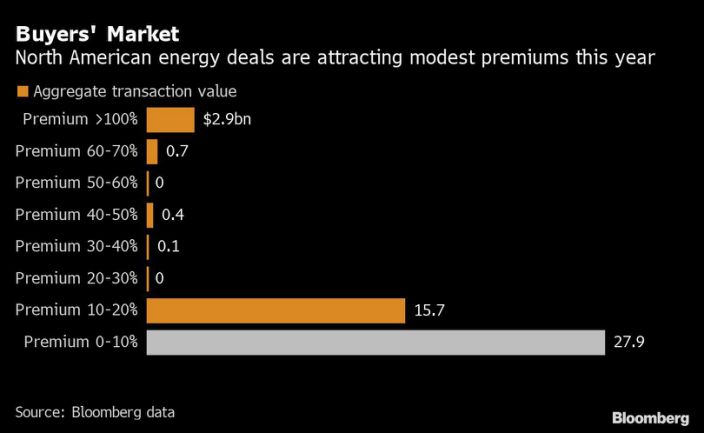

4. Energy Deals Happening at Less than 1/3 of Stocks Peak Value

Cut-Price Deals Show Shale’s Rapid Decline From Debt-Fueled Boom-Bloomberg

1 / 2

Cut-Price Deals Show Shale’s Rapid Decline From Debt-Fueled Boom

Kevin Crowley and David Wethe

Tue, October 20, 2020, 6:30 AM EDT

(Bloomberg) — There is no more dramatic sign of the U.S. shale industry’s fall from grace than one of the best in the business being sold off for less than a third of its peak value.

Concho Resources Inc., an early explorer of the Permian Basin’s once-coveted oil riches that was worth $32 billion just two years ago, is selling for $9.7 billion in stock. ConocoPhillips is paying a meager 15% premium over Concho’s closing price on Oct. 13, the last trading session before Bloomberg News first reported the companies were in talks.

Concho is not alone: More than half of the shale deals this year came with a premium of less than 10% over stock prices that had already plunged in the past couple of years, according to data compiled by Bloomberg.

https://finance.yahoo.com/news/cut-price-deals-show-shale-224427054.html

5. How We Spend Our Healthcare Dollars

Dollars to Doctors: How the Coronavirus Could Reshape Healthcare Spending

Are this year’s healthcare trends a short-term disruption, or will they continue to impact where our dollars go?

6. No Surprise 80% of Americans Plan on Following Election Results Closely This Nov.—Pew Research

Americans plan to pay even closer attention as results come in on election night. Roughly half of U.S. adults (48%) say they plan to follow results after polls close on Nov. 3 very closely, and another 32% plan to do so fairly closely. Just 6% plan to follow the results not at all closely.

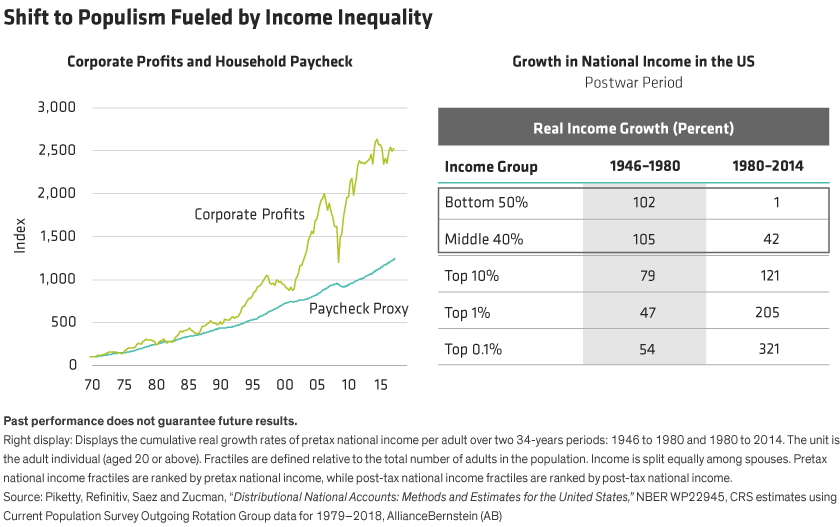

7. Why the Shift to Political Populism?

Do US Elections Matter for Equity Investors?

by Richard Brink, Walt Czaicki of AllianceBernstein, 10/19/20

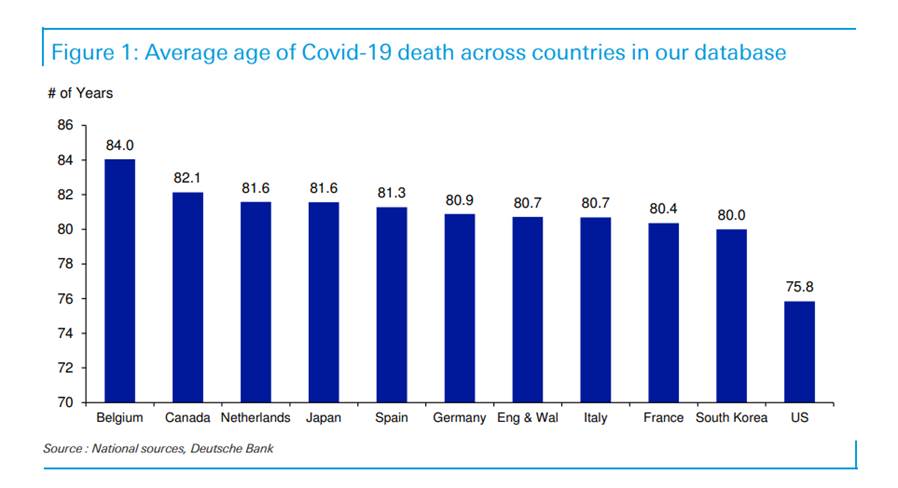

8. Average Age Covid Death

Jim Reid Deutsche Bank

We will be publishing the latest monthly chart book tomorrow. Ahead of that, we’ve updated a few of our Covid charts. One that stands out is the average age of fatalities from the virus for the countries we’ve collated data. For most countries, it is remarkably consistent around the 80-82 year old mark. As an aside, a study in the summer showed that those dying in their 80s in Italy lost on average 5 years of future life.

The country that stands out is the US where the average age of Covid fatalities is just under 76 years old.

A small part of this might be down to many of the other countries having an older population. For example, Italy’s median age is 45 (43 in Europe), whereas it is 38 for the US.

However, some of it is likely due to the higher prevalence of comorbidities in the US. For example, in global data from the CIA in 2016, the US has the highest obesity rate of any major country. It ranks 12th (36.2% of the population classified) out of 196 countries. The 11 higher were mostly South Pacific Islands such as Tonga, Samoa and the Cook Islands. The highest in Europe is Turkey in 17th (32.1%), followed by the UK in 36th (27.8%). For reference Germany is 79th (22.3%), France 87th (21.6%), Italy 107th (19.9%), China 169th (6.2%) and India 189th (3.9%).

9. What is Holding Up the Stimulus Package?

Republicans and Democrats are clashing over another stimulus package. Here are 7 areas of disagreementNegotiations between the White House and Democrats on another stimulus package are ongoing, but significant differences remain.

- The odds that Congress will enact a federal rescue package with $1,200 stimulus checks before the election appear very low.

- Here’s a breakdown of seven differences between both parties on a relief package, including childcare, federal unemployment benefits, overall spending, and testing.

Negotiations between the Trump administration and House Speaker Nancy Pelosi over another coronavirus relief package are crawling along, with few signs of a breakthrough.

While the White House and Democrats agree on another round of $1,200 stimulus checks for taxpayers, as well as assistance to small businesses and airlines, they’ve clashed on numerous other measures. Pelosi said on Sunday that any stimulus deal must be reached by Tuesday so Congress can pass it before the election on November 3.

The dynamics around a deal are complicated, with many Senate Republicans’ opposition to further relief spending as President Donald Trump calls for a large economic rescue package. Senate Majority Leader Mitch McConnell suggested on Thursday that he wouldn’t put a brokered deal up for a floor vote.

Here’s a breakdown of seven policy disagreements that are holding up another stimulus package.

Cost

Democrats have insisted on at least $2.2 trillion in additional spending to prop up people, businesses, and public-health agencies. The House earlier this month passed a slimmed-down version of the $3.4 trillion Heroes Act from May. The latest legislation includes more stimulus checks, among other provisions.

Meanwhile, the Trump administration made a $1.8 trillion offer to Democrats. In recent weeks, the White House has increased the amount it’s willing to spend. But it faces significant opposition from Senate Republicans who are reluctant to support a price tag of that size, reducing the odds that a bipartisan deal will become law.

Federal unemployment benefits

While both parties agree that the government should supplement state unemployment checks, they’re quarreling over the amount.

Democrats have not moved away from calling for the restoration of the $600 federal weekly unemployment benefit through January. They’ve argued that unemployment remains high in an economy displaying renewed signs of weakness, such as slowing job growth.

The Trump administration offered a $400 weekly federal supplement. Some Republicans are still critical, saying it would disincentivize work and set back the economic recovery.

Coronavirus testing

Pelosi and other Democrats have cited the lack of a national coronavirus testing and tracing strategy as a key reason they rejected the administration’s offer.

Treasury Secretary Steven Mnuchin has said that the differences between the sides are “overblown” and that the administration would accept the Democratic position with few changes.

But Democrats dismissed the new legislative language as insufficient and called for bigger changes.

Tax credits for low-income Americans

As part of their federal rescue package, Democrats are seeking to widen tax credits for people and families with lower incomes, such as the child tax credit and the earned income tax credit.

The expanded child tax credit would provide a modest monthly payment to people who have smaller incomes or don’t earn enough to file taxes.

The Trump administration’s newest plan doesn’t include funding to expand either credit, which Democrats have argued is necessary to help struggling families and unemployed people.

Aid to states

Democrats want to include at least $436 billion in aid to states weathering significant shortfalls in their budgets. Reduced tax revenue has caused 1.2 million public employees to lose their jobs.

Republicans have derided a “blue-state bailout,” saying it would provide funds for states to shore up pensions and use the money for measures unrelated to the pandemic.

But some Republican governors have also called for federal aid.

Childcare

Democrats’ latest economic aid package includes $57 billion to bolster childcare providers. Advocates have said many are grappling with the loss of revenue and increased operating expenses, forcing many providers to close.

The administration’s plan does include an unspecified amount of funding for childcare. But Pelosi told ABC News on Sunday it was insufficient and that Democrats would continue pressing for more.

Liability protections for businesses

Republicans are seeking a liability shield for businesses to protect them from coronavirus-related lawsuits from workers and customers through the Safe to Work Act. They say a wave of lawsuits could deter employers from reopening and could harm the economy.

Democrats lambasted this step as an unacceptable measure, with Sen. Chuck Schumer of New York last month calling it “a poison pill.” They’ve pressed to strengthen workplace protections and safety standards through the Occupational Safety and Health Administration, a federal regulatory agency.

10. 10 Self-Improvement Musts

The world’s shortest course in self-help.

Source: Jeff Turner, CC 2.0

Some people who want self-improvement prefer deep dives into a particular technique. Others prefer quick-and-dirty. This article is for the latter.

As I think back on my 5,500 career and personal coachingclients, I believe these 10 items are most central to self-improvement:

1. Put in the time. There’s no substitute for time-on-task. “Working smarter” takes you only so far and, chances are, if you’re reading an article on self-improvement, you’re probably already working as smart as you can yet still feel the need to significantly improve. Whether it’s building on a strength or remediating a weakness, your choice is to push harder or to be satisfied with modest growth. I don’t necessarily criticize the latter: It’s called “satisficing” and it can be a wise approach. Perhaps your time could be better spent getting better at something else, taking care of necessities, or simply having fun.

2. Avoid time-sucks. That is what enables people to put in the time without working too many hours. Accomplishers avoid such time-sucks as excessive TV watching, chatting, clothes shopping when you already have more than enough clothes, video-game playing, time-consuming sports like golf, and going to a second cousin twice-removed’s third wedding in Kalamazoo.

3. Focus on what you can control. Successful people spend little time jawboning about their illness, politics, or people they can’t stand. They focus on what’s in their sphere of influence.

4. Specialize. In our ever more complicated world, it’s more difficult to be good enough as a generalist. You need to be at least relatively expert in some niche. For example, the generic marriage-and-family therapist could well be beset by the imposter syndrome because there’s so much science and especially art to marriage-and-family counseling. Unless you’re unusually brilliant and hard-working, it’s wiser to specialize in something: for example, interracial couples, transgender couples, intellectually gifted children, physically abusive parents, men with stay-at-home wives, etc.

5. Take low-risk actions. Excessive rumination can lead to more fear and less accomplishment. So after a modest amount of reflection and perhaps research, follow that widely-agreed-on key to success: Ready, FIRE, Aim! That is, it’s far easier to revise your way to excellence than to think it up in the abstract. You need the feedback of empiricism to adjust what you’re doing. I like to invoke the metaphor of the person who’d like to sail from San Francisco to Hawaii. Yes, s/he should plan, but after just moderate planning, s/he’d be wise to set sail. On encountering the winds, the weather, s/he can adjust the plan. S/he’ll likely get to Hawaii far faster than would the excessive planner.

6. Spend time with people who bring out the best in you. Whether it’s a boss, romantic partner, platonic friend, or activity partner, some people bring out the best in us while others drag us down. Of course, you can’t always control who’s in your life but, when you have discretion, spend time with those who help you flower.

7. Take the time to find a fine mentor(s.) A generous person who is successful and ethical in what you’re trying to develop or who is an all-around winner, is a treasure, and usually having such a mentor is requisite to success for all but the most gifted people. How to find a fine mentor? Ask a question of one or more respected people. If s/he responds well, offer to be of help in any way you can. After a while, if you do your part and you’re lucky, your mentor will offer more help, become your cheerleader and champion, and be willing to open crucial doors for you.

8. Chart your progress. That can be as simple as, next to your desk, hanging a hand-drawn thermometer with milestones on the side, like nonprofits when they’re trying to raise money. Or give yourself a daily letter grade A to F. Keep that grade to yourself or share it with your social-media friends or real friends.

9. Look inward. My unsuccessful clients tend to blame their setbacks mostly on externalities: their boss, the economy, their race, their gender, etc. In contrast, my successful clients mainly look inward to see what, if anything, they need to do differently, for example, acquire a new skill, upgrade their attitude, slow or stop their substance abuse, revise their job target upward, downward, sideways, or to a new career that’s more aligned with their natural abilities.

10. Resolve to rebound. You’ve heard it before but it’s true: Even highly successful people fail. The difference between them and other people is that successful people tend to force themselves, yes force themselves, to rebound, not wallow. They see if there’s a lesson to be learned from the failure and then resolve to succeed at something at least as big. At the risk of being personal, when I was let go as a columnist in the San Francisco Chronicle, after an hour—yes just an hour—of feeling outraged, I channeled the anger. I said, “I’ll show them. I’ll go national! That very day, I sent clips to 10 national publications and since then, I’ve written a lot for such publications as TIME, The Atlantic, and yes, Psychology Today.

https://www.psychologytoday.com/us/blog/how-do-life/201906/10-self-improvement-musts

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only