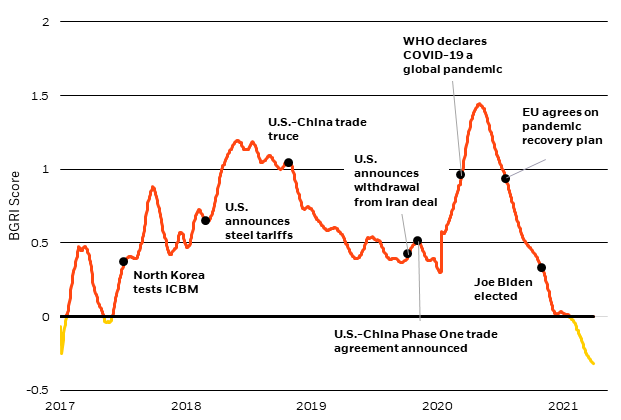

1. Market’s Attention to Geopolitical Risk Drops to Negative….Lowest in 5 Years.

Chart of the week-BlackRock Geopolitical Risk Indicator – global

Forward-looking estimates may not come to pass. Source: BlackRock Investment Institute, May 2021. Notes: The BlackRock Geopolitical Risk Indicator (BGRI) tracks the relative frequency of brokerage reports (via Refinitiv) and financial news stories (Dow Jones News) associated with specific geopolitical risks. We adjust for whether the sentiment in the text of articles is positive or negative, and then assign a score. This score reflects the level of market attention to each risk versus a 5-year history. We use a shorter historical window for our COVID risk due to its limited age. We assign a heavier weight to brokerage reports than other media sources since we want to measure the market’s attention to any particular risk, not the public’s.

Our dashboard gauges market attention to overall geopolitics and to each of our top-10 risks by tracking the relative frequency of brokerage reports and financial news stories associated with the risks through BlackRock Geopolitical Risk Indicators (BGRIs). The global BGRI score has been trending down in the past year because of fading attention to risks such as U.S.-China strategic competition, Covid-19 resurgence and Gulf tensions. It has hovered in negative territory this year, as the chart shows, meaning market attention to geopolitical risks is below the average of recent years. Overall, this indicates a significant reduction in concern about geopolitical risk since the change in U.S. administration. Our dashboard also provides BlackRock’s fundamental assessment of the likelihood of each risk materializing in the near term. We also introduce a new quantitative measure that seeks to gauge how similar the current market environment is to our estimate of market movement in the event the risk materialized.

We introduce four new risks in the dashboard: Covid-19 resurgence, Emerging market political crisis, Global technology decoupling and Climate policy gridlock. Market attention to Covid-19 resurgence appears low, but we assign medium likelihood to this risk; attention to Emerging market political crisis is relatively elevated, yet we see a low likelihood. We see a high likelihood that decoupling of the U.S. and Chinese tech sectors accelerates in scale and scope, despite the relatively low attention to the Global technology decoupling risk. The pace of global reshoring of technological supply chains has sped up, potentially increasing production costs. This supports our view that markets are underpricing medium-term inflation risks. The Biden administration is continuing its predecessor’s posture of intense rivalry with China, with a focus on critical technologies, and China has made tech self-reliance a top priority. We believe it’s key to invest in both these poles of global growth, as detailed in The role of Chinese assets. U.S.-China tensions over Taiwan have been rising. We do not see near-term risks of military showdown but believe there is a significant medium- and long-term threat.

Climate policy gridlock refers to the risk that developed economies fail to increase public investment and regulatory action to achieve their goals to reduce carbon emissions. Attention to this risk appears low, as reflected in our BGRI, in line with our assessment of a low likelihood. We believe avoiding climate-related damages will help drive growth and improve risk asset returns, and have included the effects of climate change – and a climate transition – in our long-term return assumptions.

In some cases our dashboard reveals a disconnect between market attention and our fundamental analysis. Two examples: First, attention to Major cyberattack(s) risk has receded from a 2020 peak yet we see a high likelihood of this risk occurring. The recent hacking of a U.S. oil pipeline – and its impact on energy markets – highlights the risk. Second, market attention to a potential North Korea conflict is well below the historical average, but we rate the likelihood of the risk as “medium” – and see tensions as likely to increase heading into 2022. North Korean provocations, including long-range missile tests and potential for a nuclear test, could trigger a possible escalation.

The bottom line: We see a relative decrease in market attention to geopolitical risks as justified, particularly in light of powerful key near-term market drivers such as the economic restart and inflation outlook. We remain pro-risk, but note t

2. Blockchain Related Stock Update.

RIOT-Well off highs but pre-covid it was a penny stock.

3. MARA—Similar story penny stock prior to Covid.

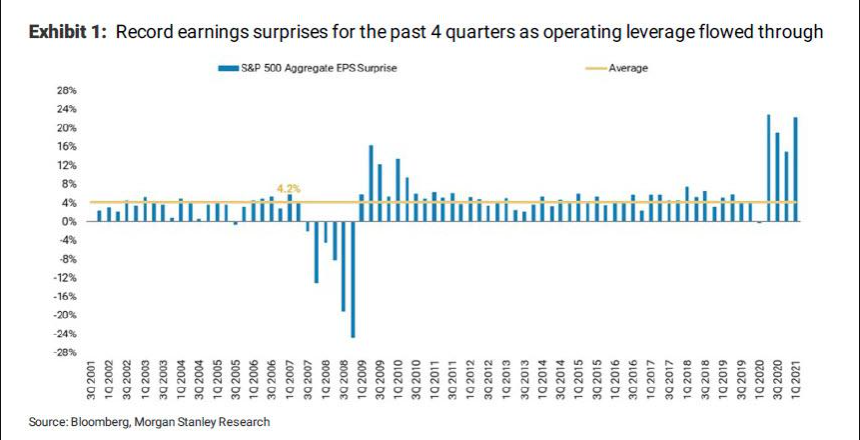

4. Record Earnings Surprises

Zerohedge

To be sure, there is some fundamental justification for this euphoria: in Wilson’s review of past earnings surprises, he has never witnessed such a large beat rate over a four-quarter period and/or revisions to out-year forecasts (something we predicted would happen ahead of earnings in “Q1 Earnings Will Be Stellar, But Are Fully Priced-In And Only Guidance Will Matter“). And while the results over the past year have been very much in line with Wilson’s call for superior operating leverage coming out of this recession, he is “now concerned that these results have been extrapolated in a way that is too optimistic.” First, over the past 4 quarters, earnings have beaten expectations by over 20%.

Not only is this unprecedented but it also didn’t follow a period of disappointment, which usually occurs during a recession, according to MS. As a reminder, when the economy collapsed due to the lockdown, earnings estimates were slashed overnight. And while Wilson back then argued they were reduced too far and that companies would likely experience record operating leverage during the recovery due to the unprecedented government subsidy for the unemployed – “fast forward to today and that’s what has happened” – the chief equity strategist is turning downright bearish.

One reason for that is Wall Street is basically extrapolating nirvana beyond the foreseeable future, with record earnings surprises resulting in record revisions. According to Wilson, “never before have we observed earnings revisions breadth this high (Exhibit 2), leaving it vulnerable to an inevitable decline.”

“A Reset Is Required”: Why Morgan Stanley Sees Pain In The Next 6 Months-BY TYLER DURDEN HTTPS://WWW.ZEROHEDGE.COM/MARKETS/RESET-REQUIRED-WHY-MORGAN-STANLEY-SEES-PAIN-NEXT-6-MONTHS

5. These are the 2021 CNBC Disruptor 50 companies

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

In the ninth annual Disruptor 50 list, CNBC highlights the private companies leading out of the pandemic with business models and growth rates aligned with a rapid pace of technological change.

Investors have taken notice that the companies on the 2021 Disruptor 50 list have become critical players in fundamental economic and consumer transformations. A majority of the CNBC Disruptor 50 are already billion-dollar businesses. Thirty-four disruptors are unicorns that have already reached or passed (in some cases far surpassed) the $1 billion valuation mark — 10 of the companies on this year’s list are worth at least $10 billion.

The 50 companies selected using the proprietary Disruptor 50 methodology have raised over $72 billion in venture capital, according to PitchBook, at an implied Disruptor 50 valuation of more than $388 billion. While technologies including AI, 5G, cloud computing and the Internet of Things are key to many companies making the 2021 Disruptor 50 list, the sectors they are upending are widespread, from financial services to health care, biotech, education, food, media, agriculture and transportation.

https://www.cnbc.com/2021/05/25/these-are-the-2021-cnbc-disruptor-50-companies.html

6. Yachts Hit Price and Sales Records…..Bezos New Yacht $500m +

Jeff Bezos’s New Superyacht Heralds Roaring Market for Big Boats-The triple-masted, 127-meter ship is likely to cost more than $500 million.

By Devon Pendletonand Brad Stone

Even in the ostentatious world of superyachts, project Y721 stands out.

When completed, it will be 127 meters (417 feet) long, span several decks and sport three enormous masts, according to the scant information available on the website of its manufacturer and various online bulletin boards of yachting enthusiasts. That will make it one of the largest sailing yachts ever built in the Netherlands, the unofficial capital of boat building for the extremely rich.

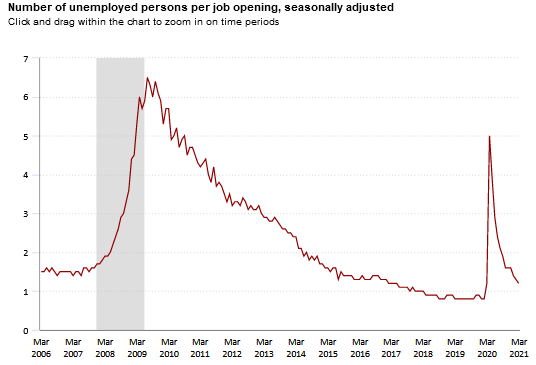

7. Number of Unemployed People Per Job Opening Back to Pre-Covid Levels.

From Dave Lutz at Jones Trading.

He added that he was “starting to advocate” for the Fed to look at other measures of job market tightness, particularly the unemployment to job opening ratio, which was at a low of 0.8 in February 2020, rose to 5 during the first lockdowns, and was back down to 1.2 in March 2021

8. China Dumping One Child Policy….Demographics are Destiny

Morningbrew

DEMOGRAPHICSChina Calls in the Storks GiphyOn Monday, China’s government said that couples will be able to have a third child, a decision meant to spark more babies in a country where population growth has hit a wall. The backstory: Family planning restrictions have existed in China since 1980, when the government instituted a one-child-per-household policy out of fear it wouldn’t have the resources to provide for a swelling population. China relaxed that cap to two children in 2015 but, following the pandemic’s baby bust, it’s realizing it needs to confront this problem more urgently. There were 12 million births in China in 2020, down 18% annually and the fourth straight year of declines. Demographers expect the country’s population, currently at 1.4 billion, to peak by 2025. Why it matters: Declining population growth has profound implications for a country’s economic success. Fewer babies = fewer future workers. And it could upend existing systems of support for the elderly, because younger workers’ taxes subsidize public services for retirees.This isn’t just a China problemA “demographic time bomb” alarm is being sounded in dozens of countries. South Korea’s rate of births per woman fell to 0.84 last year, the lowest in the world. For reference, the “replacement” rate that would keep a population stable is about 2.1. The US population grew at its slowest rate since the Great Depression from 2010–2020, and its birth rate declined for the sixth straight year last year.Germany doesn’t have enough people to fill its cities. It’s taken down 330,000 housing units since 2002. Zoom out: While many parts of the world face stagnant population growth, others are making up for it. Africa’s population is set to double by 2050, helping the world grow from 7.8 billion people today to 11 billion by 2100.Bottom line: As much as the Chinese government wants to grow the country’s share of the world population, it might be fighting a losing battle. The two-child policy didn’t lead to more babies, and critics say the three-child rule won’t move the needle, either. GiphyOn Monday, China’s government said that couples will be able to have a third child, a decision meant to spark more babies in a country where population growth has hit a wall. The backstory: Family planning restrictions have existed in China since 1980, when the government instituted a one-child-per-household policy out of fear it wouldn’t have the resources to provide for a swelling population. China relaxed that cap to two children in 2015 but, following the pandemic’s baby bust, it’s realizing it needs to confront this problem more urgently. There were 12 million births in China in 2020, down 18% annually and the fourth straight year of declines. Demographers expect the country’s population, currently at 1.4 billion, to peak by 2025. Why it matters: Declining population growth has profound implications for a country’s economic success. Fewer babies = fewer future workers. And it could upend existing systems of support for the elderly, because younger workers’ taxes subsidize public services for retirees.This isn’t just a China problemA “demographic time bomb” alarm is being sounded in dozens of countries. South Korea’s rate of births per woman fell to 0.84 last year, the lowest in the world. For reference, the “replacement” rate that would keep a population stable is about 2.1. The US population grew at its slowest rate since the Great Depression from 2010–2020, and its birth rate declined for the sixth straight year last year.Germany doesn’t have enough people to fill its cities. It’s taken down 330,000 housing units since 2002. Zoom out: While many parts of the world face stagnant population growth, others are making up for it. Africa’s population is set to double by 2050, helping the world grow from 7.8 billion people today to 11 billion by 2100.Bottom line: As much as the Chinese government wants to grow the country’s share of the world population, it might be fighting a losing battle. The two-child policy didn’t lead to more babies, and critics say the three-child rule won’t move the needle, either. |

https://www.morningbrew.com/daily

9. The Largest Flag Ever Displayed.

https://www.linkedin.com/in/chris-williamson-cr-22b964108/

10. What Are The Best Stoic Quotes?-The Daily Stoic

For more Stoic quotes, follow us on Instagram.

“We are often more frightened than hurt; and we suffer more from imagination than from reality.” — Seneca

“It’s silly to try to escape other people’s faults. They are inescapable. Just try to escape your own.” —Marcus Aurelius

“Our life is what our thoughts make it.” — Marcus Aurelius

“Don’t explain your philosophy. Embody it.” Epictetus

“If anyone tells you that a certain person speaks ill— of you, do not make excuses about what is said of you but answer, ‘He was ignorant of my other faults, else he would not have mentioned these alone.’” — Epictetus

“If it is not right, do not do it, if it is not true, do not say it.” — Marcus Aurelius

“You become what you give your attention to…If you yourself don’t choose what thoughts and images you expose yourself to, someone else will.” — Epictetus

“Be tolerant with others and strict with yourself.” — Marcus Aurelius

“You always own the option of having no opinion. There is never any need to get worked up or to trouble your soul about things you can’t control. These things are not asking to be judged by you. Leave them alone.” — Marcus Aurelius

“All you need are these: certainty of judgment in the present moment; action for the common good in the present moment; and an attitude of gratitude in the present moment for anything that comes your way.” — Marcus Aurelius

“No person has the power to have everything they want, but it is in their power not to want what they don’t have, and to cheerfully put to good use what they do have.” — Seneca

“If anyone can refute me—show me I’m making a mistake or looking at things from the wrong perspective—I’ll gladly change. It’s the truth I’m after, and the truth never harmed anyone.” — Marcus Aurelius

“Today I escaped anxiety. Or no, I discarded it, because it was within me, in my own perceptions not outside.” — Marcus Aurelius

“You have power over your mind – not outside events. Realise this, and you will find strength.” — Marcus Aurelius

“It isn’t events themselves that disturb people, but only their judgements about them.” — Epictetus

“To be like the rock that the waves keep crashing over. It stands unmoved and the raging of the sea falls still around it.” — Marcus Aurelius

“First say to yourself what you would be; and then do what you have to do.” — Epictetus

“Waste no more time arguing what a good man should be. Be One.” — Marcus Aurelius

“The primary indication of a well-ordered mind is a man’s ability to remain in one place and linger in his own company.” — Seneca

“Receive without pride, let go without attachment.” — Marcus Aurelius

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.