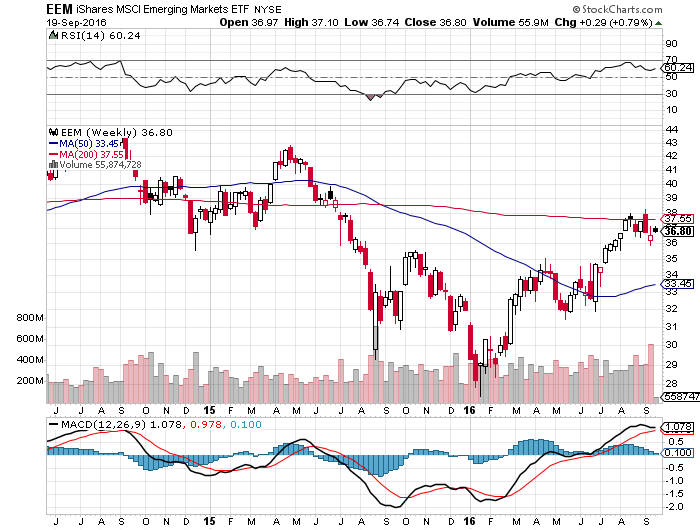

1.Emerging Markets ETF Rallies Right to 200day.

EEM Stopped at 200day …Red Line on Weekly Chart.

Emerging Markets Dependent on U.S. Dollar Direction…See Sideways action on dollar in chart.

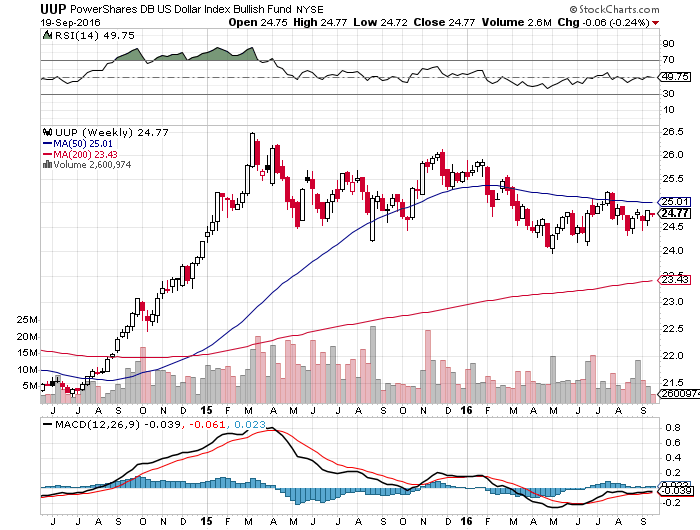

2. Strong Secular Prospects for Emerging Markets.

Very interesting chart showing growth in various countries — the chart makes it clear that the EM is where the growth is.

Fidelity expects that “over the next 20 years, EM countries will grow faster than developed markets (see chart, below), in large part due to faster labor force growth. In addition, several EMs with youthful demographics—such as the Philippines, India, and Indonesia—also have the benefit of considerable “catch-up potential” to grow productivity rates off a relatively low base.”

Noted . . .

EM countries are likely to grow faster than developed markets over the next 20 years.

Source: Fidelity

From Barry Ritholtz Blog

http://ritholtz.com/

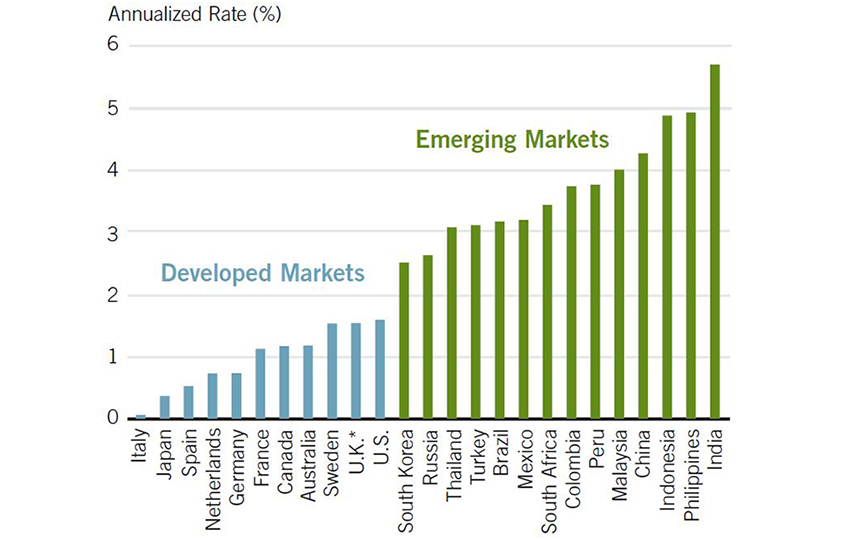

3.The Market Launches an 11th Sector…..Stand Alone Real Estate.

The ETF has seen massive inflows recently, with more than $2.8 billion pouring into it over the past week—by far the most of any exchange-traded fund, according to ETF.com data. The fund currently has $2.85 billion in assets under management.

The launch of the new sector has also meant outsize trading for the real estate ETF. More than 3.7 million shares changed hands Monday, many times the fund’s 30-day average of 436,000 shares. Overall action in the fund has spiked in September, with volume nearing or topping 1 million shares in several sessions. To compare, the most active day for the fund in August had about 200,000 shares traded.

XLRE SPDR Real Estate ETF.

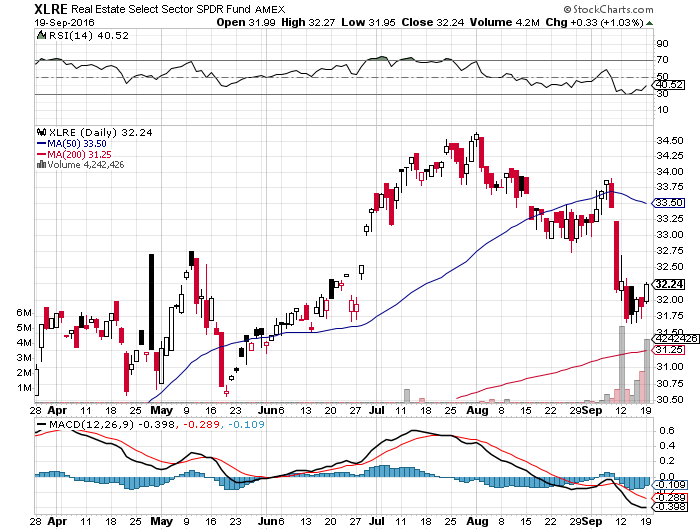

The addition of a new headline Real Estate Sector to GICS has a number of positive implications for real estate and REITs, including:

- Further affirms that real estate is a separate and distinct asset class and stock exchange-listed equity REITs are part of the real estate asset class

- Makes real estate a more visible asset class

- Will influence how listed real estate companies, including listed equity REITs are understood by investors and how they are positioned within investment products such as mutual funds and exchange-traded funds

- Could, over time, further enhance the diversification benefits provided by equity REITs

https://www.reit.com/investing/investor-resources/gics-classification-real-estate

HOLDINGS AND WEIGHTINGS as of 09/19/2016. Holdings and weightings are subject to change.

|

Symbol |

Company Name |

Index Weight |

Last |

Change |

%Change |

Volume |

52 Week Range |

|

Simon Property Group A |

11.62% |

209.59 |

+0.86 |

+0.41% |

960.08 K |

176.11 – 229.10 |

|

|

American Tower Corp A |

8.20% |

109.20 |

+1.20 |

+1.11% |

1.51 M |

83.07 – 118.26 |

|

|

Public Storage |

5.68% |

216.07 |

+1.11 |

+0.52% |

1.04 M |

204.63 – 277.60 |

|

|

Crown Castle Intl Corp |

5.47% |

91.80 |

+1.43 |

+1.58% |

2.51 M |

75.71 – 102.82 |

|

|

ProLogis Inc |

4.87% |

52.42 |

+0.95 |

+1.85% |

2.35 M |

35.25 – 54.87 |

|

|

Welltower Inc |

4.62% |

73.25 |

+0.06 |

+0.08% |

2.75 M |

52.80 – 80.19 |

|

|

Equinix Inc |

4.60% |

366.73 |

+8.52 |

+2.38% |

514.19 K |

255.45 – 391.07 |

|

|

AvalonBay Communities Inc |

4.25% |

175.41 |

+2.08 |

+1.20% |

439.24 K |

160.66 – 192.29 |

|

|

Ventas Inc |

4.25% |

68.63 |

+0.59 |

+0.87% |

1.72 M |

46.87 – 76.80 |

|

|

Equity Residential |

4.20% |

65.13 |

+0.71 |

+1.10% |

1.97 M |

62.39 – 82.39 |

http://www.sectorspdr.com/sectorspdr/sector/xlre/holdings

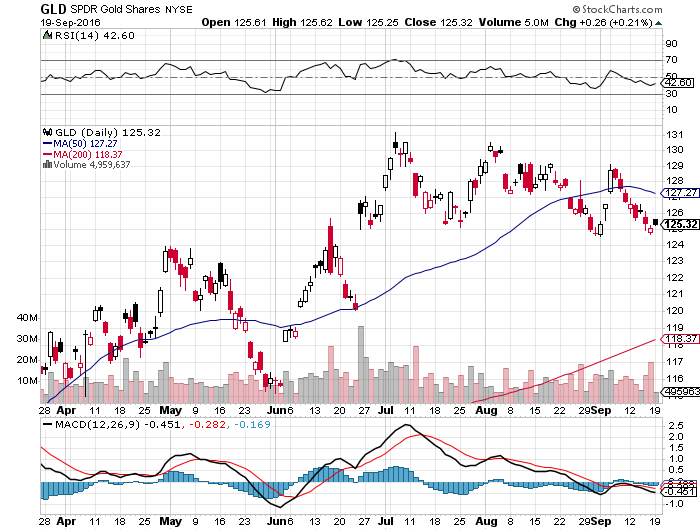

4. Central Banks have been Buying Gold Since 2008…. “total official holdings — at 32,805 tons as of mid-2016 — are still more than 5,500 tons below the 1965 peak of 38,350 tons.”

Not for nothing is the yellow metal still regarded in many ways as a bedrock of world money. Around 20% of all the gold ever mined is held by central bank and governments, with the biggest official holdings at the U.S. Treasury with 8,134 tons.

So it is significant that central banks are turning back to annual gold purchases in line with a century of practice between 1870 and 1970. This appears to be restoring gold as a central element of monetary management after four decades of attempted demonetization, according to reserve statistics compiled by the Official Monetary and Financial Institutions Forum, the financial research group.

Annual net gold purchases of 350 tons a year by world central banks over the past eight years have returned to the 100-year average up to 1970 — reflecting gold’s renewed attractiveness as a safe-haven asset in an environment of uncertainty and low or negative interest rates.

Even after the 2,800 tons of purchases over the past eight years of Period VII, total official holdings — at 32,805 tons as of mid-2016 — are still more than 5,500 tons below the 1965 peak of 38,350 tons.

After the rises and falls of the post-war period, total gold holdings are back to the levels of the early 1950s. But there has been a big shift over the past 70 years in the distribution of gold away from former near-monopoly holder the U.S. Treasury towards European countries and, latterly, developing nations – symbolizing the growth of a multipolar world economy.

http://www.marketwatch.com/story/central-banks-have-been-buying-gold-with-a-vengeance-2016-09-19

Gold Rally Yesterday….Series of lower tops since July…Sideways like U.S. Dollar

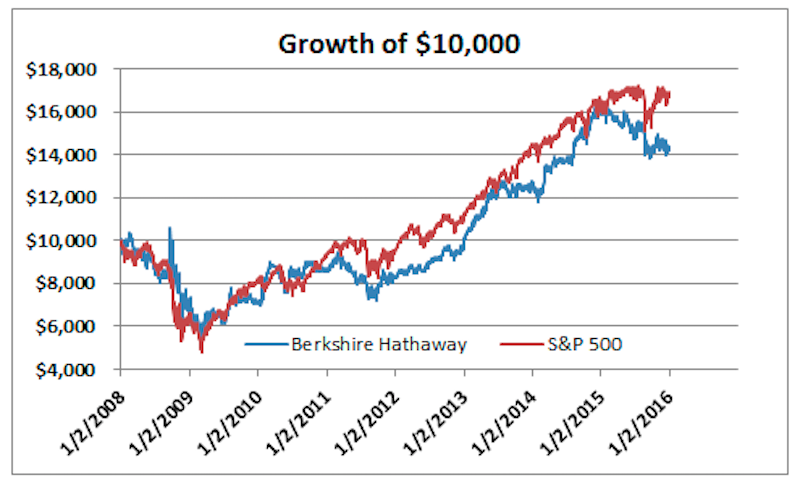

5. Warren Buffett has been getting smoked by the S&P 500 since 2008

Cullen Roche, Pragmatic Capitalism

Back in 2008 Warren Buffett made a famous bet with a big hedge fund.¹ Buffett bet that the S&P 500 would outperform a fund of hedge funds over the next 10 year period. His basic thinking was that most investors are better off owning a low cost index fund rather than owning high cost stock picking funds. And so far, Buffett is winning the bet by a mile with a total return of 65.67% for the S&P 500 vs 21.87% for the hedge funds.²

But there’s another inconvenient truth within this bet – Buffett isn’t really winning this bet. After all, his own company, Berkshire Hathaway, which is essentially an actively managed portfolio of public and private companies, is also losing out to the S&P 500. Since the beginning of 2008 Berkshire has underperformed the S&P 500 by 24.5% as of the start of 2016.³ This is better than the margin the hedge funds are losing by, but still doesn’t bode well for Berkshire.

Pragmatic Capitalism

Fortunately for Buffett the news has improved a bit since the start of the year. He’s now down just 18.06% vs the S&P 500. But will the momentum be enough to take him through next year? 18% is an awful lot to make up, but if anyone can do it we’d expect Buffett to be the guy….

¹ – The exact terms of the bet are:

“Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.”

² – These returns are as of 12/31/2015.

³ – Returns are measured with dividends reinvested in the S&P 500.

Read the original article on Pragmatic Capitalism. Copyright 2016.

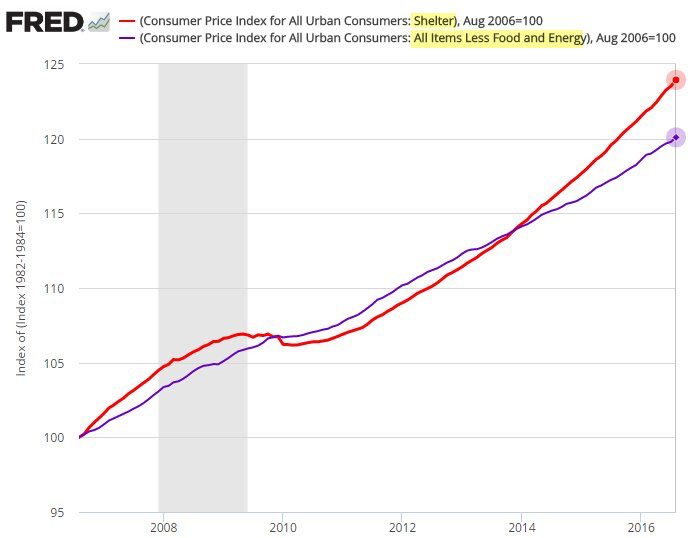

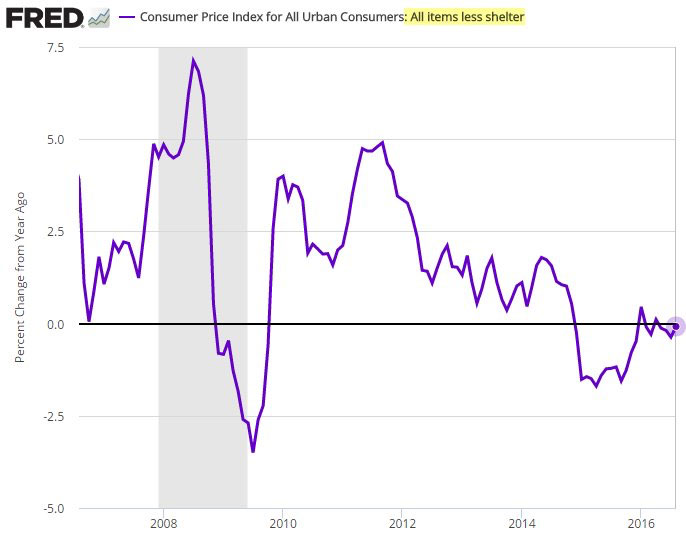

6. Follow up to Yesterday’s CPI Increase was all Healthcare Related……Rents have also Diverged from the Rest of CPI Components…..Ex-Rent and Healthcare, the U.S. is in Deflationary Environment.

The other component of inflation that remains robust is “shelter CPI.” The chart below shows how housing costs compare with the overall core CPI over the past ten years. Some suggest that a rate hike is required to cool housing costs. However, most of these increases come from rental expenses, and there is little evidence that higher rates reduce rents. In fact, higher financing costs could exacerbate the shortages of rental housing by lowering new construction activity.

The ex-shelter CPI is basically flat (chart below) and without the medical care price jump the US is in deflation.

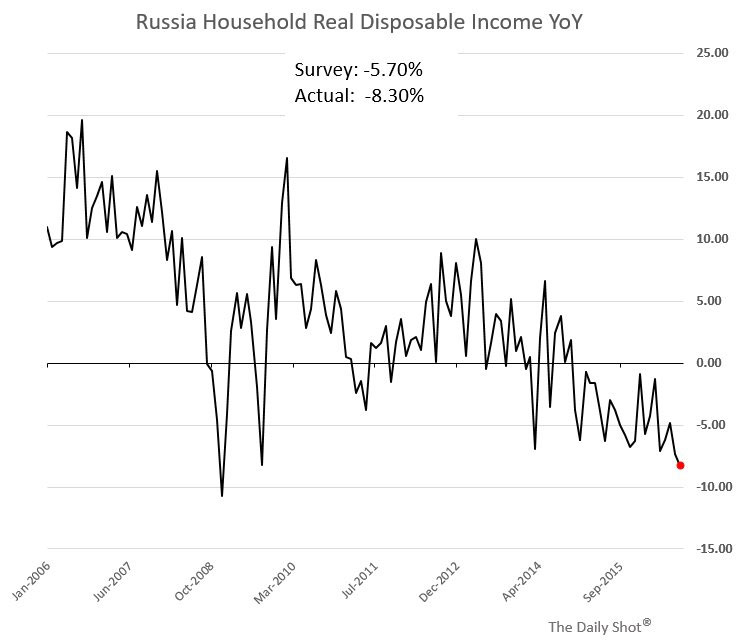

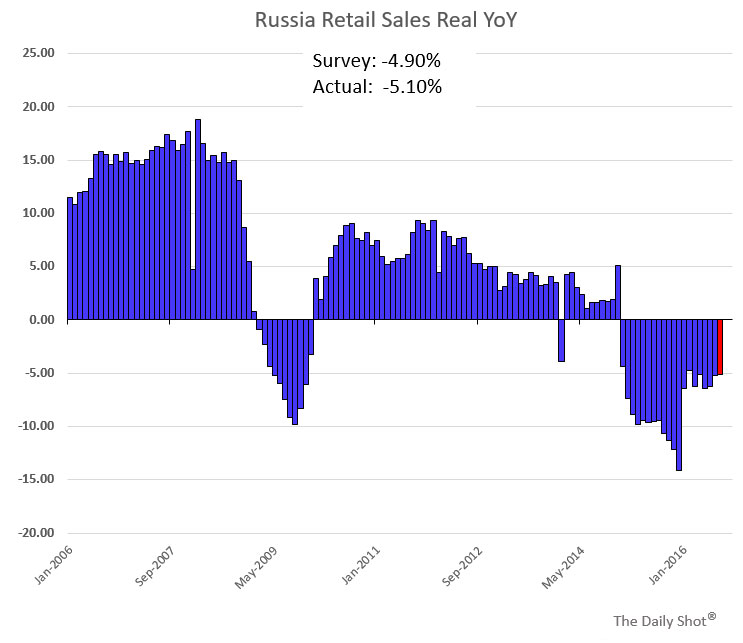

7.Russian Stock Market is 2016 Leader….Russian Citizens not so Good. Time to raid another country?

Russian real household disposable income is collapsing. With the consumer under pressure, retail sales continue to decline (second chart below).

Source: Tradingeconomics.com

http://dailyshotletter.com/

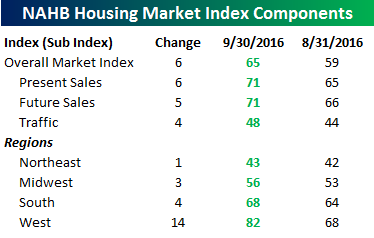

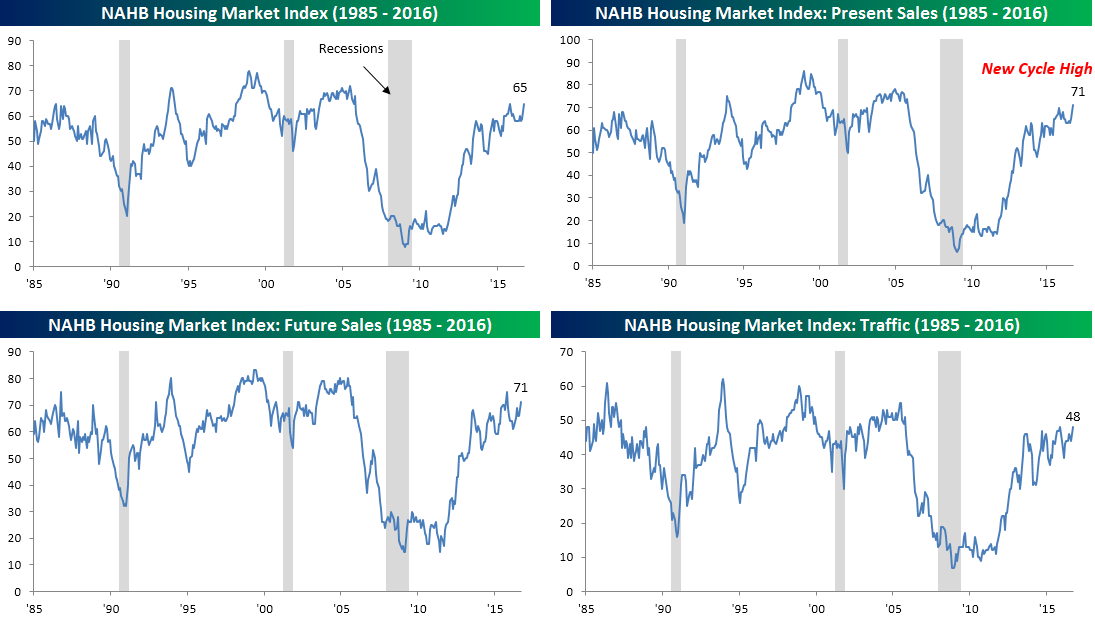

8.Homebuilder Sentiment Surges…65 Reading vs. 59 Estimate.

Sep 19, 2016

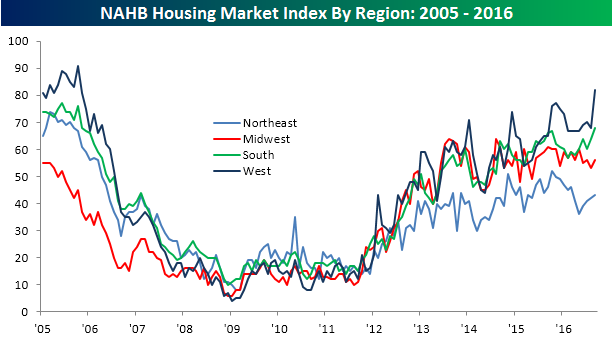

Homebuilder sentiment took a sharp turn for the better this month as the monthly sentiment index from the NAHB rose back to its highest levels of the current recovery. While economists were forecasting the NAHB’s monthly sentiment index to come in at a level of 59, the actual reading came in at 65, which was last seen back in October. Relative to expectations, the September report was the strongest since July 2013. The table to the right breaks down this month’s report by category and region and shows the current levels for each relative to last month. As shown, Present Sales saw the biggest monthly gain and hit a new cycle high. On a regional basis, sentiment in the West saw a huge jump, rising by 14 points to its highest level since October 2005.

Finally, the below shows the regional sentiment indices for the NAHB going back to 2005. While all four sentiment indices essentially tracked each other closely from 2005 through the early stages of the current expansion, in recent years there has been a bit of a divergence as sentiment in the Northeast has

https://www.bespokepremium.com/think-big-blog/

9. Read of the Day….Role Reversal: Bonds Are The New Stocks

September 19, 2016

[This article appears in our October 2016 issue of ETF Report.]

[See Part 1: “Role Reversal: Stocks Are The New Bonds“]

Safe. Steady. Dependable. Bonds, according to common investment wisdom, are like the best friend in a John Hughes teen film from the 1980s: Maybe not the sexiest of asset classes, but in good times and bad, they’ll never let you down.

“Bonds have one purpose: to be the shock absorber of a portfolio,” says Allan Roth, founder of Wealth Logic. “They should be boring.”

Lately, though, bonds have swerved hard from that boring standard. Prices have spiked; yields have plummeted. In fact, yields on some foreign bonds have even gone negative. Today’s bonds—far from being the safe and steady asset class—are starting to behave a lot more like their riskier counterparts: stocks.

However, bonds’ role reversal into something more akin to stocks haven’t scared off investors. As of the end of July, inflows into fixed-income ETFs had skyrocketed $60.5 billion year-to-date, bringing total assets under management for the class up to $435 billion.

So can the bond market’s change of heart last? Or are investors setting themselves up for teen-movie levels of angst if and when bonds start acting like bonds again?

Low Yields, High Prices

In developed markets around the world, bond yields continue to strike ever-lower thresholds. At home, the yield on the benchmark 10-year U.S. Treasury currently sits at 1.58%, which, while up from its July doldrums, is still nowhere near the 2.24% yield it started the year at. Meanwhile, the yield on the 30-year Treasury still lags at 2.27%.

Abroad, yield curves look even worse: The U.K 10-year bond, for example, offers a paltry 0.56% yield. France’s 10-year hovers at 0.16% yield, while the Netherlands’ 10-year yields just 0.16%.

In fact, in some developed markets, bond yields have actually fallen into negative territory. In both Germany and Japan, the two-, five- and 10-year bonds currently possess negative yields. In Switzerland, meanwhile, the entire stock of government bonds—including the 50-year bond—carries negative yields.

At the same time, prices on these low-yielding bonds have appreciated considerably. Bond prices normally rise when yields fall. The iShares 7-10 Year Treasury Bond ETF (IEF) has risen 6.97% year-to-date. That’s almost on par with the SPDR S&P 500 ETF (SPY), which has returned 7.84% over the same period. Meanwhile, the iShares 20+ Year Treasury ETF (TLT), which tracks Treasurys with a weighted average maturity of 26.29 years, has risen a whopping 16.87% year-to-date (Figure 1).

The picture looks similar in other developed markets. For example, the Barclays Global Aggregate Bond Index, which tracks investment-grade debt from 24 markets around the world, has risen 10.39% year-to-date.

Some of these bond ETF price appreciations are outperforming the broad stock indexes, which is where the role reversal between bonds and stocks really stands out. That conventional investment wisdom we talked about at the beginning says you don’t buy bonds for price appreciation, you buy stocks for that.

No wonder investors are starting to look at bonds as they might stocks. So what gives?

Read Full Story.

http://www.etf.com/publications/etfr/role-reversal-bonds-are-new-stocks

10. Why Is It Hard to Live for the Moment

How the multiple-selves paradigm can help us achieve it.

Posted Sep 19, 2016

Live for the moment and seize the day are probably the two most common cliché’s about dealing with distress. From new-age philosophers to Buddhist spiritualism to modern psychology we are told to put aside regrets about the past and worries about the future and to try to make the most out of the present. It sounds like a trivial task. Indeed, all non-human species do it all the time without even being aware of doing it. But it is precisely awareness, which distinguishes human beings from other species, that makes it so hard for us to live in the present.

Human psychology is evolutionarily hard-wired to live in the past and the future. Other species have instincts and reflexes to help with their survival, but human survival relies very much on learning and planning. You can’t learn without living in the past, and you can’t plan without living in the future. Regret, for example, which makes many of us miserable by reflecting on the past, is an indispensable mental mechanism for learning from one’s own mistakes to avoid repeating them. Fears about the future are likewise essential to motivate us to do something that is somewhat unpleasant today but has an enormous benefit for our well-being in the future. Without this fear we would not acquire an education or invest in our future; we wouldn’t be able to take responsibility for our health; we wouldn’t even store food. We would simply eat as much as we feel like and dispose of the rest.

Human psychology is evolutionarily hard-wired to live in the past and the future. Other species have instincts and reflexes to help with their survival, but human survival relies very much on learning and planning. You can’t learn without living in the past, and you can’t plan without living in the future. Regret, for example, which makes many of us miserable by reflecting on the past, is an indispensable mental mechanism for learning from one’s own mistakes to avoid repeating them. Fears about the future are likewise essential to motivate us to do something that is somewhat unpleasant today but has an enormous benefit for our well-being in the future. Without this fear we would not acquire an education or invest in our future; we wouldn’t be able to take responsibility for our health; we wouldn’t even store food. We would simply eat as much as we feel like and dispose of the rest.

The other reason why it’s so hard for us to live in the present is that our intelligent cognition simply denies its existence. Our mind views time as a continuous and linear process. Because it is continuous, any millisecond before the present moment is already past and any millisecond later is already a future.

But the “live for the moment” recommendation must have some truth in it if it’s universally recognized as a useful strategy for dealing with distress. Indeed, research evidence does show that people who are capable of discarding thoughts about the past and the future are generally happier.

Can our evolutionary disposition to overly focus on the past and the future be tricked into giving the present more space , making it endure? I believe it can. One useful strategy is to acknowledge the fact that “me” today is not exactly the same person as me yesterday or me tomorrow, that our lifespan is comprised of multiple selves on different shifts as we develop and change throughout our life. This is not an illusion but a reality. If “me” is the sum of my memories, desires, thoughts, and feelings , then clearly me today is a very different person from me twenty years ago, and who knows who this person might be twenty years from now. This reality becomes more apparent to us when we look at our photo album from the distant past, and people who have gone through a major crisis in their life would acknowledge this fact more readily than others.

While the multiple-selves paradigm might seem a bit scary to some people it is actually quite encouraging because it suggests that we should care less about past regrets and future fears. Our past and future selves are not total strangers to us. They are indeed our relatives but they aren’t us. And while we care about our relatives we care way more about ourselves. I may blame my past self for mistakes made in the past that affect my life today, but the more detrimental emotion of regret can be rendered null and void. I might feel concerned about how my future self might be coping in a few years’ time, but I can’t really know how he would feel about his new circumstances because again he is not me.

The multiple-selves paradigm encourages us to do something we are naturally pretty good at: to be really selfish, to care primarily for our true self, the one who lives now.

https://www.psychologytoday.com/blog/feeling-smart/201609/why-is-it-hard-live-the-moment