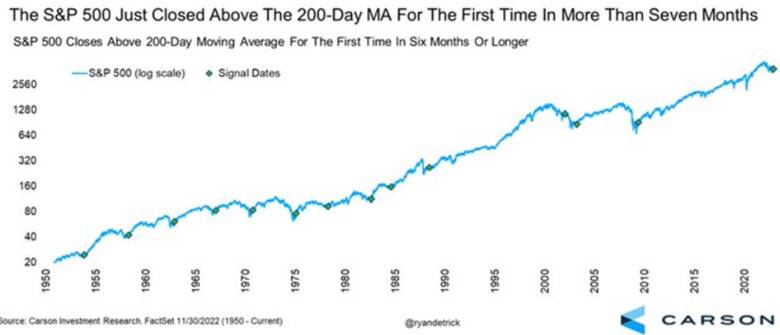

1. S&P Closes Above 200day Moving Average

2. History of S&P Below 200day for 6 Months

From Dave Lutz at Jones Trading Looking at the previous 13 times (since ’50) it was beneath the 200dma for 6 mos or more and closed above showed only once did it move back to new lows. Up avg 18.8% yr later and higher 12/13 times, Carson notes.

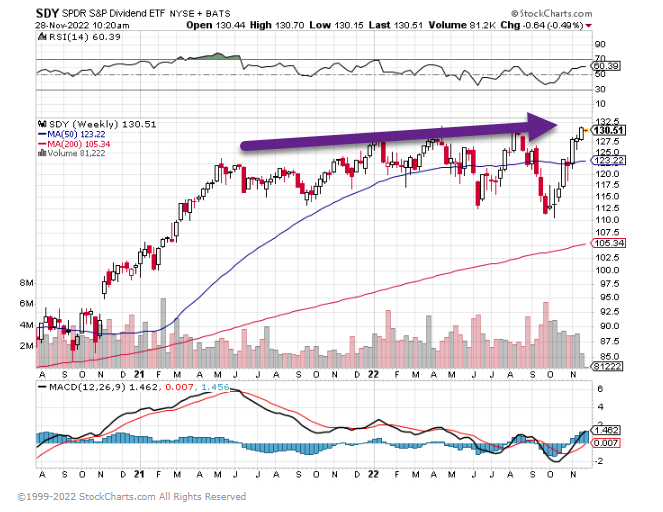

3. Another Large U.S. Arms Sale this Week $323M to Finland…Defense ETF New Highs

ITA-Aerospace and Defense ETF about to make new highs

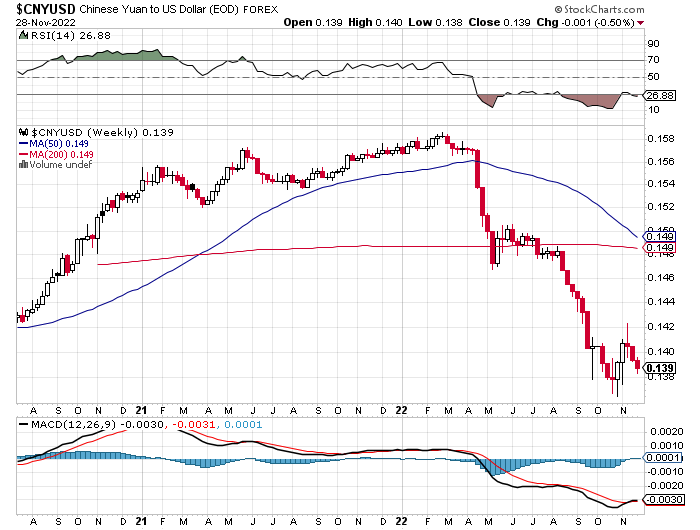

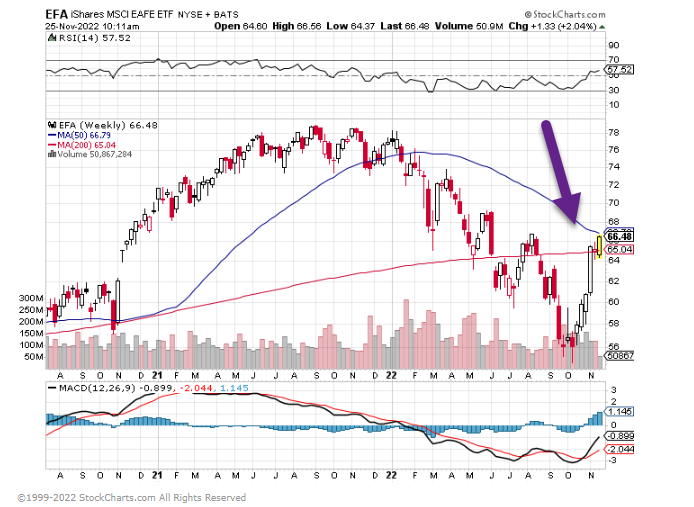

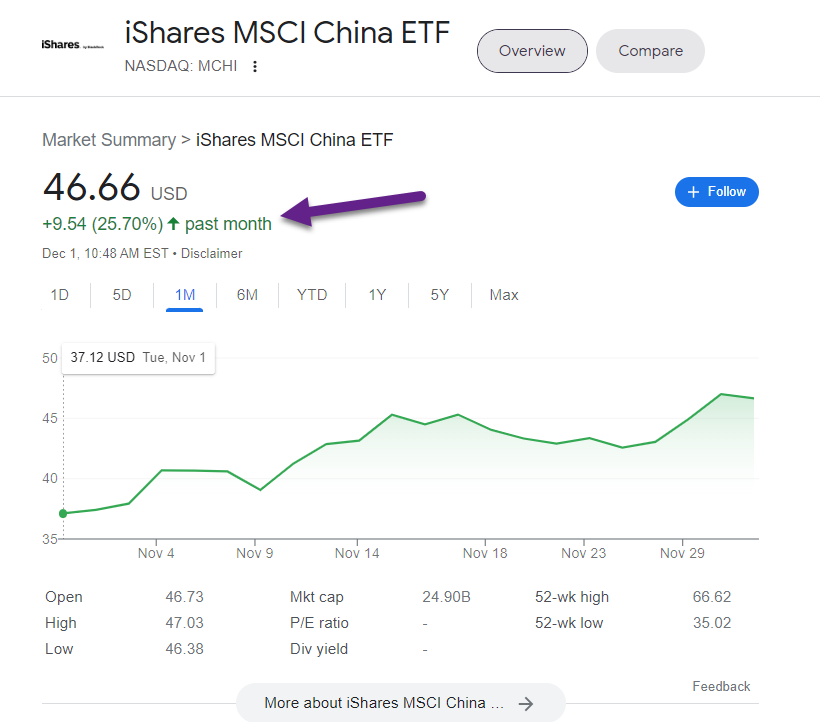

4. International Outperformance EFA Developed International +13.2% vs. S&P +5% November

5. MSCI China +25% November

https://www.google.com/finance/quote/MCHI:NASDAQ? sa=X&ved=2ahUKEwj6zZi74tj7AhWJpXIEHVFsAgQQ3ecFegQIHBAg

6. Tesla Traded Down to 200 Week Moving Average

Tesla after 3 lower tops..almost hits 200week on long-term chart

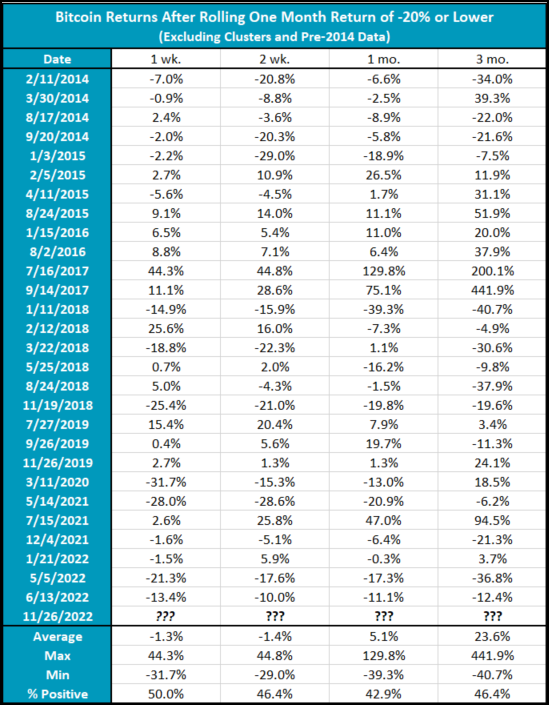

7. Bitcoin Returns After Rolling One Month -20%

Not sure if this matters but here is the history

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

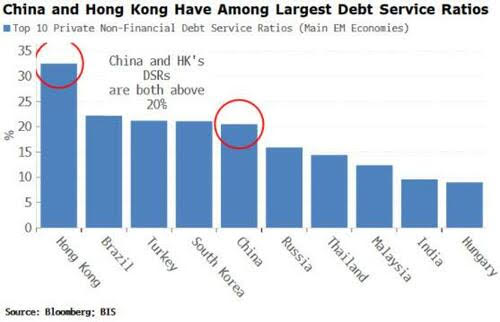

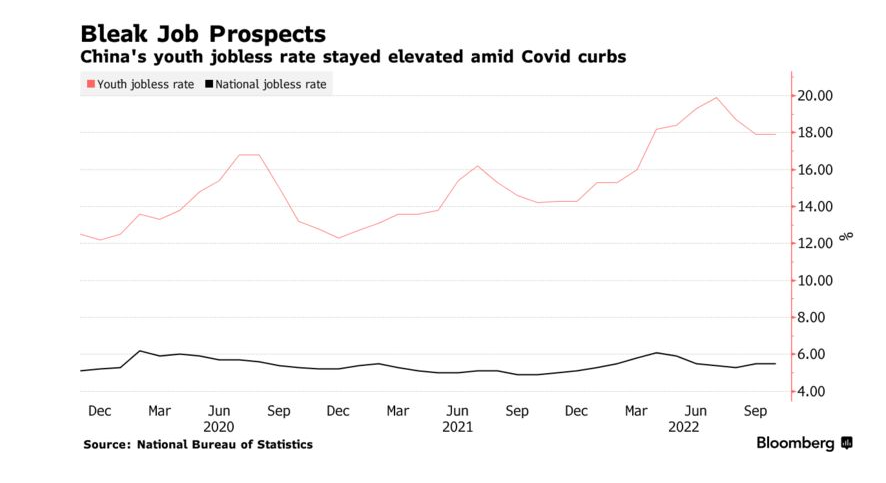

8. China Facing 11.58m College Grads this Year Looking for Jobs

My thought 18% Youth Unemployment Historically Equals Social Unrest

Bloomberg China’s Record Graduates to Pressure Youth Jobs Market in 2023

- A record 11.58 million students will graduate next year: Gov

- Youth unemployment rate hit all-time high this year on Covid

https://www.bloomberg.com/news/articles/2022-11-16/china-s-record-graduates-to-pressure-youth-jobs-market-in-2023?sref=GGda9y2L

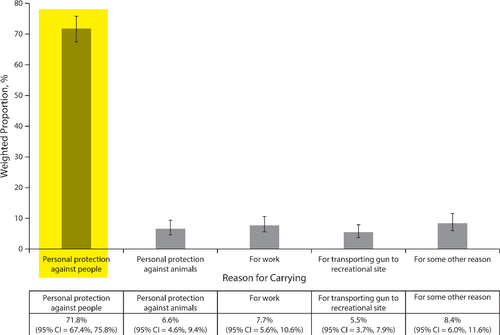

9. Number Of Handgun Owners Carrying Daily Nearly Doubles In US

ZEROHEDGE BLOG BY TYLER DURDEN A new study published in the American Journal of Public Health revealed the number of law-abiding Americans carrying a loaded handgun daily nearly doubled between 2015-19.

The study titled “Trend in Loaded Handgun Carrying Among Adult Handgun Owners in the United States, 2015‒2019” found the number of law-abiding US adults carrying handguns nearly doubled from 9 million in 2015 to 16 million in 2019.

“Proportionally fewer handgun owners carried handguns in states where issuing authorities had substantial discretion in granting permits,” the study’s authors said.

The authors claimed that very “little was known about the frequency and features of firearm carrying among adult handgun owners in the United States before this study. In fact, over the past 30 years, only a few peer-reviewed national surveys, conducted in 1994,1995, 1996, and 2015, have provided even the most basic information about firearm carrying frequency.”

Research firm Ipsos conducted the national survey between July 2019 and August 2019. Respondents were from firearm-owning households drawn from Ipsos’s Knowledge Panel, an online sampling pool of approximately 55,000 adults.

There was no explanation by the study’s authors for the rapid increase in daily handgun-carrying adults. But during the period, social unrest in Ferguson, Missouri, and Baltimore City, Maryland, as well as surging violent crime across certain metro areas, could be the reason behind the trend.

After all, an overwhelming number of respondents said they were carrying handguns for “personal protection.”

“And all of these increases happened before the Covid lockdowns and the “Summer of Love” where many US cities experienced massive rioting, violence and staggering increases in crime,” firearms blog Bearing Arms said. Much of this unleashed a tidal wave of law-abiding citizens panic buying guns, even to this day, for personal protection.

And then there’s this summer’s US Supreme Court’s NYSRPA v. Bruen ruling affirmed the right-to-carry applies outside the home, which forces states to stop arbitrarily denying carry permits to applicants who didn’t meet specific requirements. This ruling has allowed millions of gun owners to conceal carry if they take a two-day class and pass a background check.

Suppose the authors were to update the study for the pandemic years and the Bruen ruling. In that case, we believe the number of Americans packing heat has dramatically increased as the country is plagued with violent crime in progressively run cities.

https://www.zerohedge.com/

10. 10 things crypto people said at Thanksgiving this year

This article was written by Joe Weisenthal. It appeared first on the Bloomberg Terminal.

Well this is awkward for you. As Bloomberg’s Claire Ballentine notes, if you were preaching the gospel of crypto to your family at Thanksgiving last year, then this year you had a lot of explaining to do. Here are 10 things I’ve written that could have been said around the dinner table this year, that if nothing else, could salvage a few scraps of reputation and dignity.

1. “As bad as it seems right now, trust me, Mt. Gox was worse.” It doesn’t even matter that you weren’t around or even aware of crypto when that infamous exchange went down in early 2014. Nobody can really disprove the statement. And it gives you credibility about having a long-term perspective. You know the ups and downs.

2. “The collapse of FTX just validates… crypto.” This is really the key one that you have to keep arguing over and over again — that FTX and these other entities that went down this year were just traditional banks that had bastardized the vision of Satoshi Nakamoto. There was nothing “crypto” about them and it’s good that they’re gone. Next cycle, we need to move more and more activity on chain (just don’t bring up Luna!).

3. “Real crypto is working just fine.” Point to the various decentralized exchanges (like Uniswap) or lending platforms (like AAVE) that have continued to operate, without seizing user money. This is the future! And it works today. (Again, don’t bring up Luna.)

4. “Oh you want to mock crypto? I guess you’ve never had to make a payment in a developing market.” If the arguments about “real” crypto aren’t working, then you have to establish your moral superiority over your relatives. Talk about how privileged everyone else at the dinner table is for living in a country with a functioning banking and payment system. (Feel free to say this, even if you yourself have no personal experience with making payments in a developing market either.)

5. “Crypto already has numerous use cases, like stablecoins.” If anyone asks what crypto is, you know, used for (and someone will!) point out how there’s over $100 billion held in stablecoins on Ethereum alone, and how this is a better way of making payments than traditional apps. And if you want to appeal to the patriotic instincts of anyone at the table, argue that this crypto is covertly expanding global dollar supremacy by making USD holdable by anyone with a smartphone anywhere in the world.

There are some other things you can point to as “use cases” as well. Show how easy it is to post your Ethereum as collateral to get stablecoins. Ask them if they can do that with their Tesla shares on Robinhood. They can’t. Then sell some coins with a few clicks and ask them if they can do that on Robinhood. Oh wait, they can’t do that either because the market is closed on Thanksgiving. Checkmate!

6. “Of course crashes happen. But outside of just trading, crypto is changing culture and art.” This is where you bring in the influence of NFTs on art and music. Talk about how you’re all about supporting creators and how traditional models hurt artists and fans. Maybe say something about the Taylor Swift/Ticketmaster fiasco as evidence of the old business models being broken. How do NFTs solve the Taylor Swift problem? Unclear, but that’s for another conversation.

Of course, be careful. One piece of advice: Maybe acknowledge that the apes look dumb, just as a way to shore up your credibility on this point. If anyone does bring up the apes, point to some cool on-chain generative art or something like that.

7. “Crypto is going to change gaming.” This is the corollary to the art discussion. Point to the kids in the family that have left the dinner table to start playing video games. Gesture towards them and talk about how that generation is digital first, and will want to actually be able to own the items that they play with online. Owning their characters and so forth. Moving them from game to game. Acknowledge that the first generation of crypto games were not that fun, but that better gameplay is coming soon.

8. “Bubbles are a crucial part of the innovation process and often leave behind productive infrastructure in their wake.” This is tricky, but sophisticated. Point to the railroads that were left behind after the railway bubble in the 1800s. Point to the telecom infrastructure that was built amid the dotcom boom.

What’s the equivalent for crypto? Well there’s nothing physical you can point to that’s the equivalent of railroads or bandwidth. So your best shot is to talk about the accumulated knowledge gains that have been made in cryptography and computer science, as a result of all this speculation. Talk about zero-knowledge proofs, and how this privacy tech will have a profound, positive impact on how we use the Internet. Argue that any financial institutions, even TradFi ones, will benefit from having to cryptographically prove their solvency at all times.

You can even talk about Automated Market Makers, and how if you stipulate that right now they’re just being used for the trading of magic beans, that one day they can be used to trade equities or currencies without the need for a middleman. The code that’s been built up to support crypto trading is the infrastructure that will power a future golden age of financial markets.

9. “We needed a crash to weed out unhealthy speculators.” Maybe the line about bubbles being good and necessary is unconvincing. So instead talk about how crashes are good and necessary. Crypto is a long game, and it’s good for the ecosystem that the newbs and short-term pump and dumpers are out of the game. Now it’s time to build! And since you’re still here, arguing with family at Thanksgiving, then obviously you weren’t just in it for the quick buck. You’re one of the good ones, and in it for the long haul.

10. “It’s a mere 485 days until Bitcoin’s next halving!” It can’t possibly be priced in yet.