1. International Stocks: Possibly Off to a Good Start for the Year

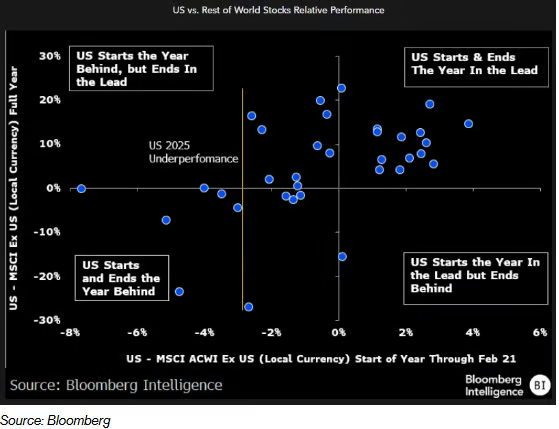

Equity markets around the world are trouncing US stocks in early 2025, an ominous historical signal for how the rest of the year could shape up for US investors.

While the S&P 500 Index eclipsed most foreign markets in 2024, that dynamic has gone into reverse so far this year, as tariff worries and nascent economic concerns weigh on US equities. The US stock benchmark is up just over 1% this year, compared to the MSCI All Country World Index excluding the US, which has gained nearly 7% since January.

If history’s a guide, that could mean further relative weakness for US stocks in the months ahead. The S&P 500 has never outperformed global peers on an annual basis when it has trailed the international benchmark by more than 2.8 percentage points by mid-February, as it did this year, according to a Bloomberg Intelligence analysis studying 35 years of data.

The underperformance is “a rare and historically significant red flag against a full-year recovery as the market’s fundamentals deteriorate,” according to BI strategists Gina Martin Adams and Gillian Wolff, who conducted the analysis.

2. Europe Facing Massive Increase in Defense Spending…Rheimmetall Chart +100% Year to Date

StockCharts

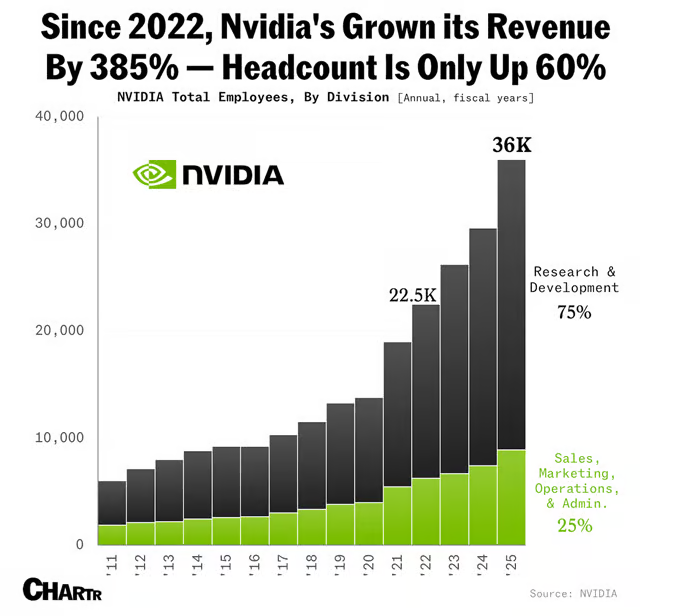

3. NVDA Revenue +385% vs. Headcount +60%

Chartr

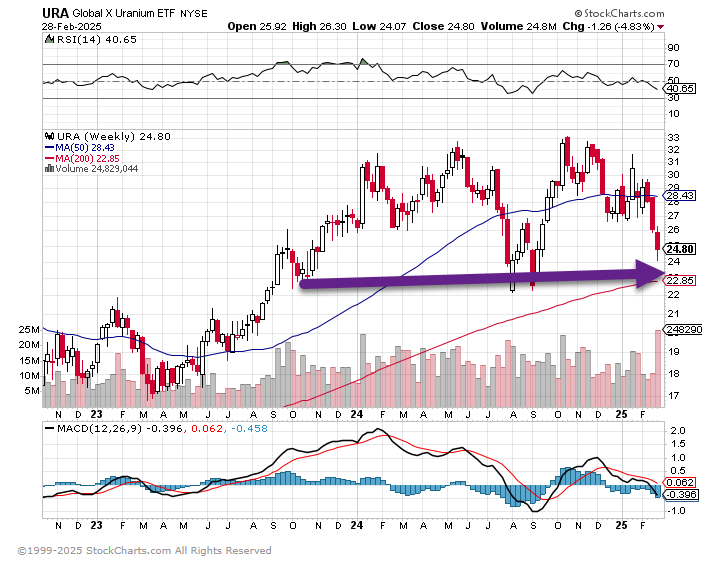

4. Uranium ETF 4th Pullback to these Levels in 18 Months

StockCharts

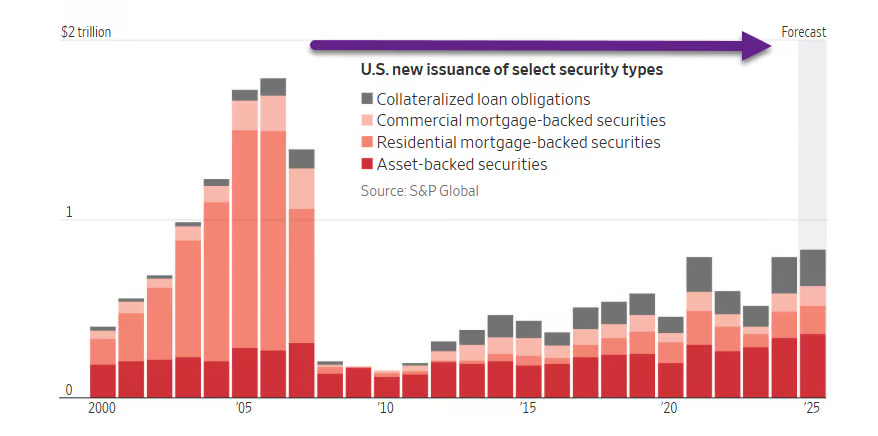

5. Collateralized Debt Obligations Forecast to Return to 2008 Levels

Wall Street expects to sell more than $335 billion in asset-backed debt this year. Remember that conference in ‘The Big Short’? It just drew a record 10,000.

WSJ

6. Private Equity Managers Apollo and Blackstone Pullback to 200-Days

StockCharts

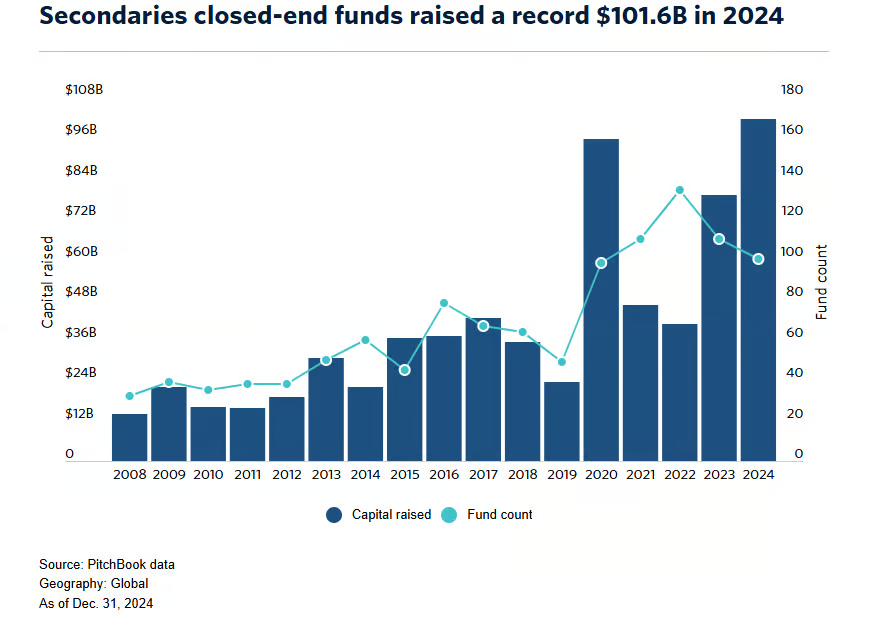

7. Private Equity Secondary Funds Raise $100B

PitchBook

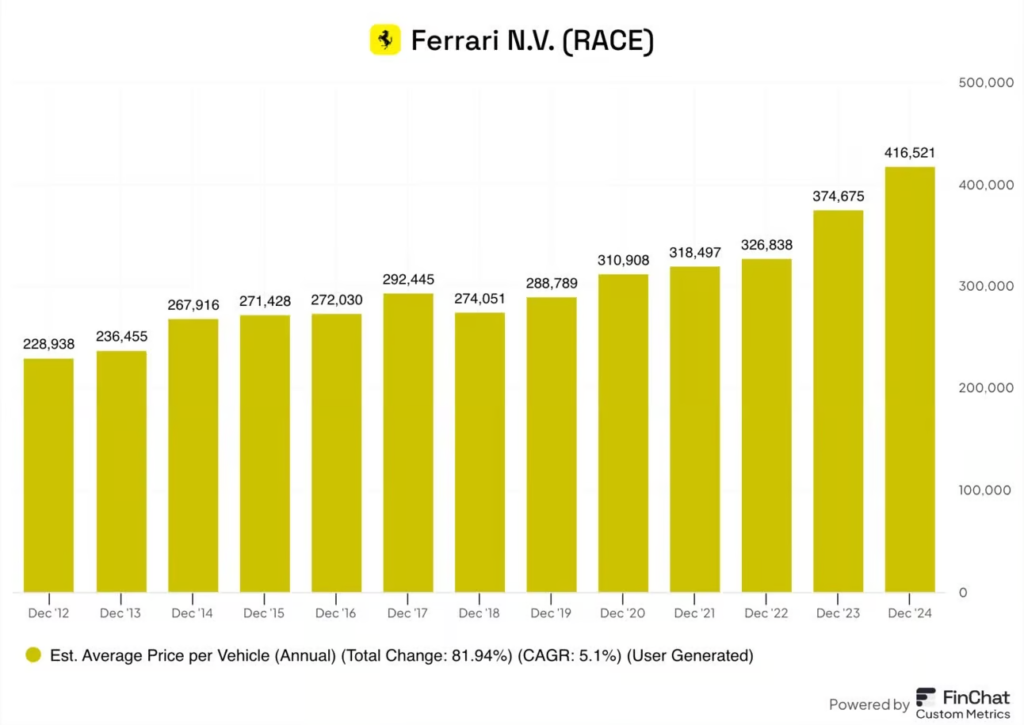

8. $416,000 for a Ferrari

In 2024, the estimated average cost of a Ferrari was more than $400,000. While that’s a pretty outrageous amount in isolation, it’s almost more impressive that Ferrari has been able to increase its prices by ~5% per year since 2012.

Formula: Cars & Spare Parts Revenue / Total Shipments

FinChat

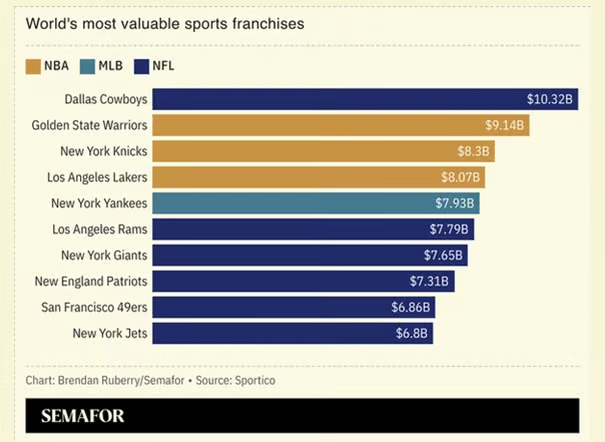

9. The World’s Most Valuable Sports Teams

Semafor

10. ‘The largest crypto theft of all time’: Historic $1.4 billion Bybit Hack Shocks World of Digital Assets

Quick Take:

- Bybit’s massive hack and loss of over $1.4 billion in crypto assets triggered various reactions.

- Elliptic’s Chief Scientist called it “the largest crypto theft of all time, by some margin.”

- Flashbots Strategy Lead Hasu said Bybit should be fine and expects the exchange “will make all customers whole.”

Via The Abnormal Returns blog: Bybit’s massive hack and loss of over $1.4 billion in crypto assets shook the world of digital assets on Friday, triggering multiple reactions.

“This makes it the largest crypto theft of all time, by some margin,” Elliptic co-founder and Chief Scientist Tom Robinson told The Block. “The next largest crypto theft would be the $611 million stolen from Poly Network in 2021. In fact it may even be the largest single theft of all time. We’ve labelled the thief’s addresses in our software, to help to prevent these funds from being cashed-out through other exchanges.”

On Friday, hackers appeared to steal more than $1.4 billion in ETH from Bybit’s cold wallet, the exchange confirmed. It seems the hacker tricked Bybit’s ETH cold wallet signers into approving a malicious transaction to gain control of the wallet surreptitiously.

The company’s CEO took to social media to reassure the public.

“Bybit is Solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover the loss,” Bybit CEO Ben Zhou posted to X.

Flashbots strategy lead Hasu also took to X to say that the hack would not lead to the demise of Bybit.

“If you want my serious take, Bybit has way more than 1.4 billion of revenue per year,” Hasu wrote. “They are good for the money and will make all customers whole. It doesn’t matter for ETH because Bybit will honor customers’s ETH liabilities and buy back the assets on open market.”

Nonetheless, the amount taken in the attack on Friday was astronomical, even by cryptocurrency standards.Start your day with the most influential events and analysis happening across the digital a

Also receive The Scoop, The Funding, and our weekly Data & Insights newsletters

Last May, the Japanese cryptocurrency exchange DMM Bitcoin suffered the largest crypto hack of 2024 when it lost over 4,500 BTC, valued at over $300 million at the time. FTX lost $477 million in 2022.

Binance founder and former CEO Changpeng Zhao, or CZ, offered assistance in reply to one of Bybit CEO’s many posts relaying information related to the hack. “Not an easy situation to deal with. Might suggest to halt all withdrawals for a bit as a standard security precaution. Will provide any assistance if needed.”

Meanwhile, Arkham Intelligence offered a bounty to track down whoever was responsible for the hack.

“We’ve created and funded a bounty to help identify the person or organization behind today’s [over] $1 billion Bybit hack,” the firm posted to X. “Submissions to this bounty will be shared with the Bybit team to support their investigation. Reward: 50,000 ARKM.”

“This Bybit hack really sucks,” trader Julius Stark posted to X. “As pro trader there isn’t a better trading platform with more accurate data and better UI. They are one of the good guys.”

Co-founder and CEO of Solana swap platform Titan told The Block: “The Bybit hack shows how important the human component of approving transactions is. If humans cannot easily inspect a proposed transaction in a multi-sig, people eventually approve anything that comes through.”

“Given the scale of the alleged exploit, this breach raises serious concerns regarding centralized exchange security and the evolving threat landscape in web3,” a CertiK spokesperson told The Block. CertiK is a digital assets auditing firm backed by Sequoia Capital, Tiger Global and Goldman Sachs.