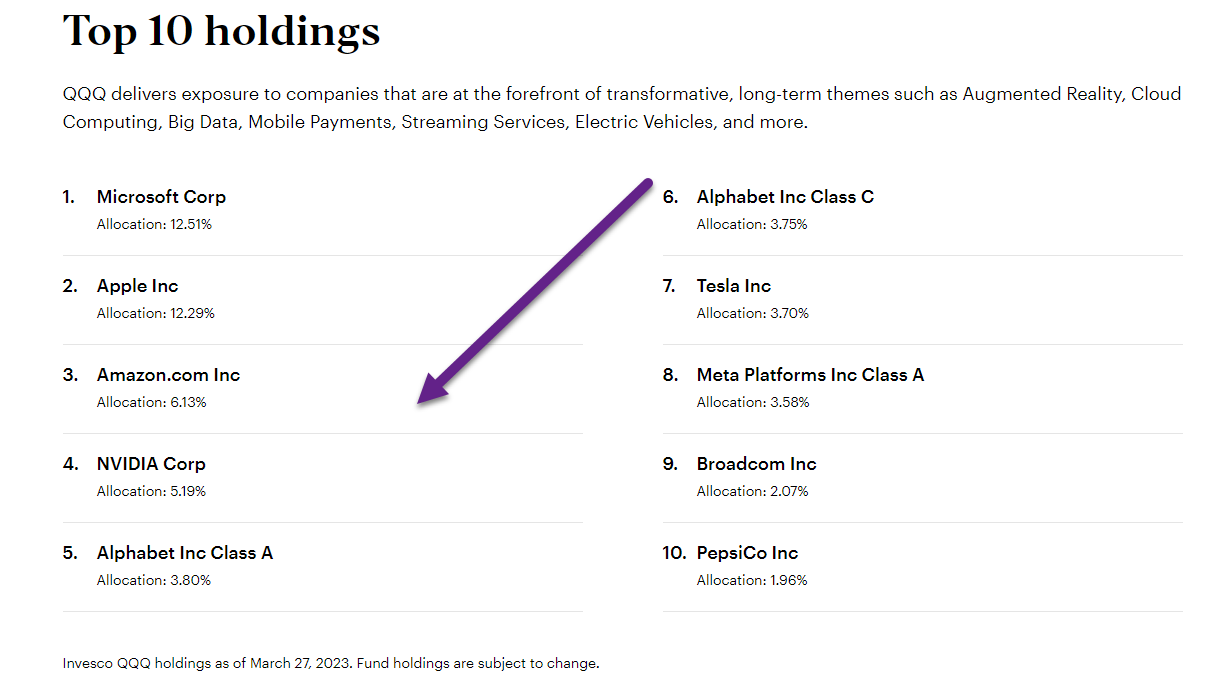

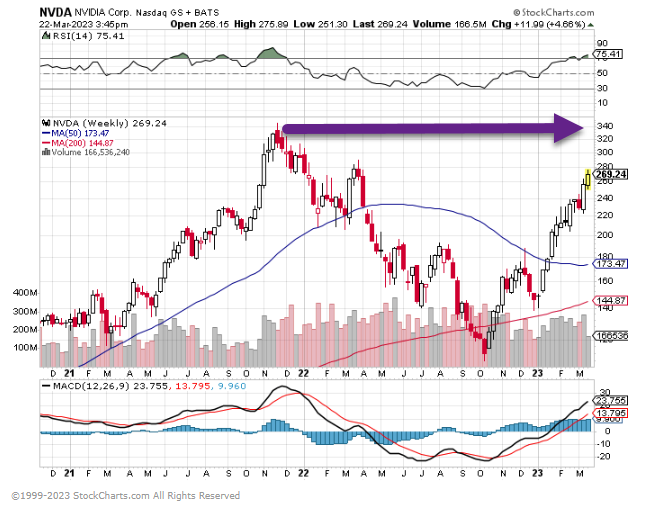

1. Q1 in One Chart….QQQ +17% vs. RPV S&P Value ETF -5.5%

2. Housing Affordability Worse than 2008….Big Difference-We Don’t Have the Leverage or Inventory of 2008

https://twitter.com/Barchart/statu/1640886723134603264

3. Homebuilders Holding Up Under Slowdown….Got Back to 2022 Highs

4. Most Americans The Largest Part of Net Worth is their Home

https://twitter.com/PeterMallouk

5. Office Space Vacancy 18.7% Highest in History

https://twitter.com/JoeConsorti

6. Alibaba Big Move this Week but Not Even Back to 2023 Highs

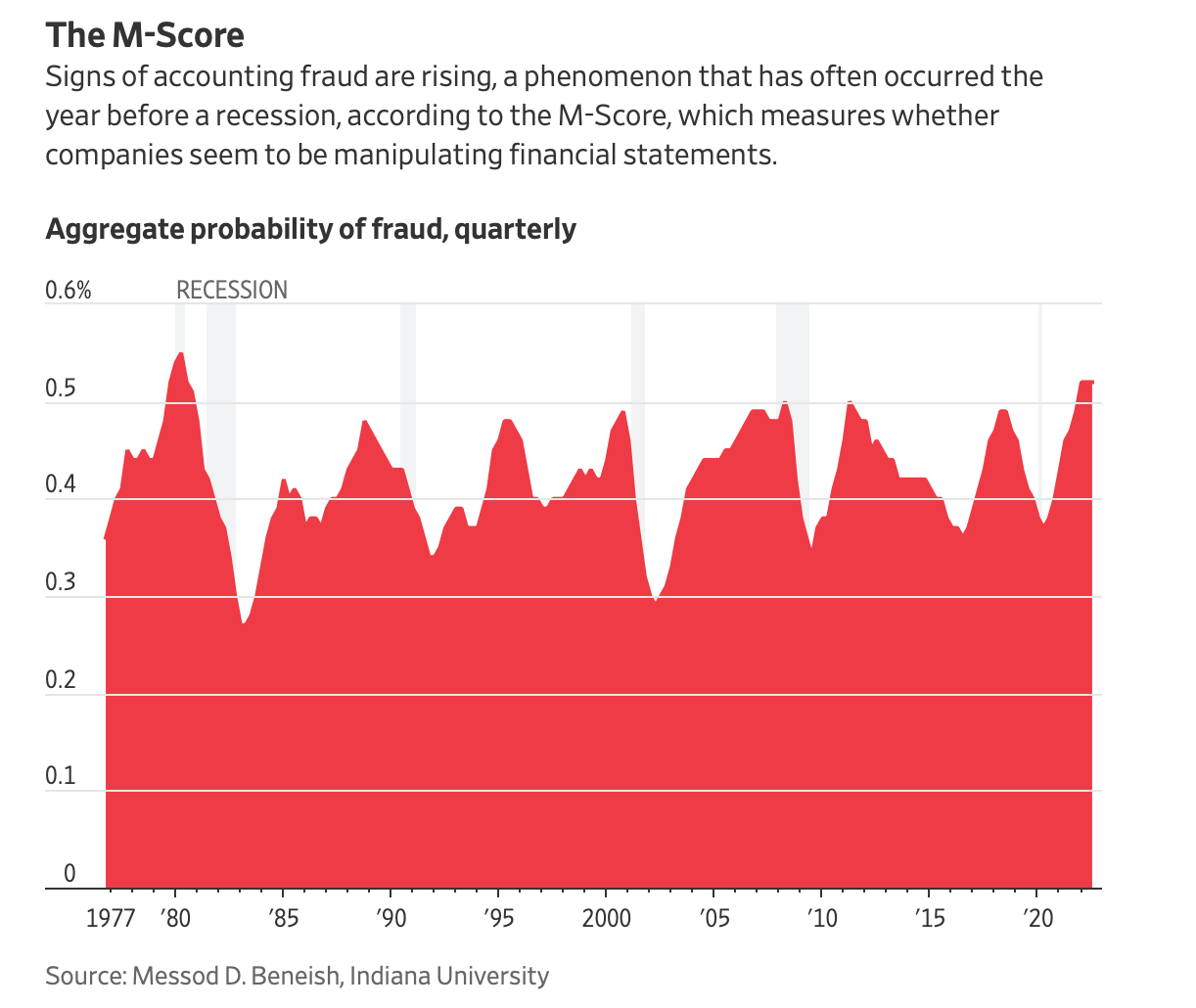

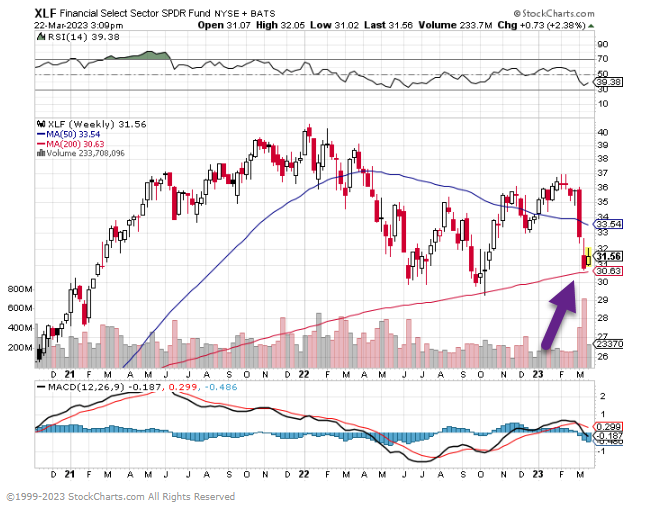

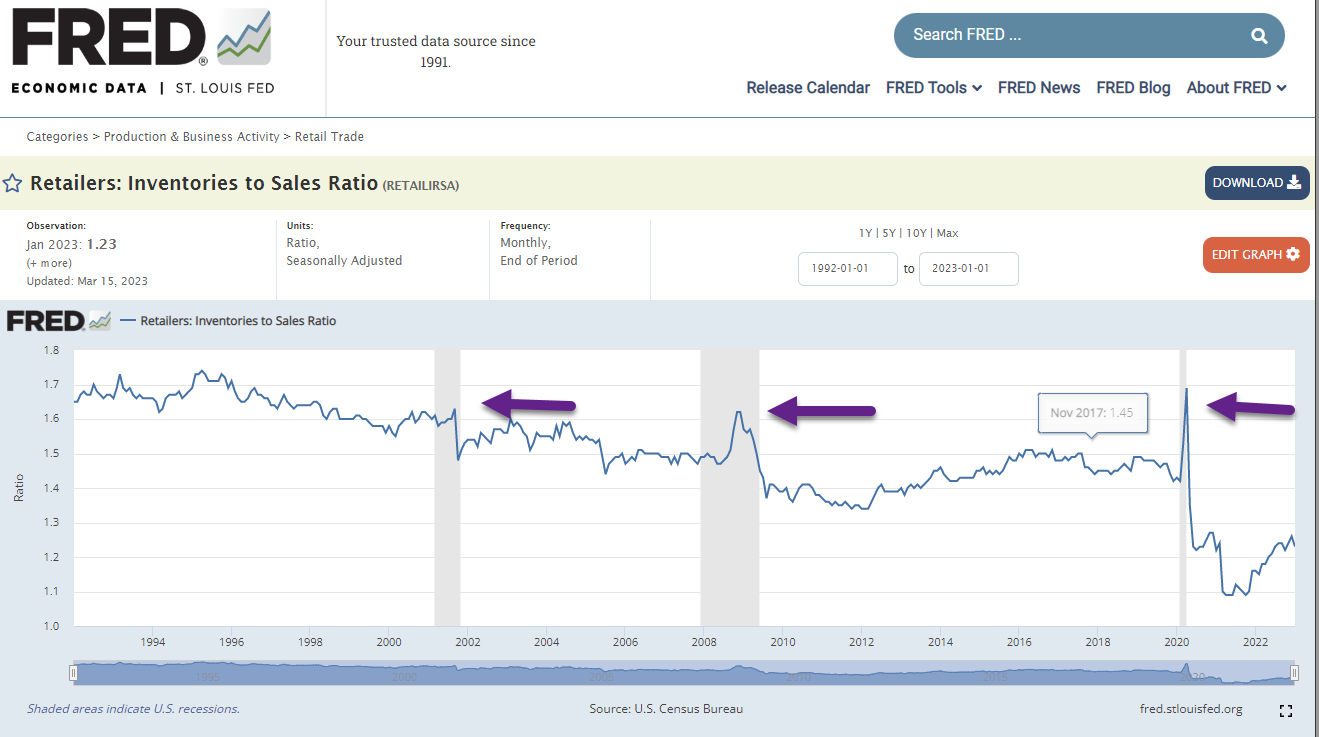

7. Net Percentage of Banks Tightening Standards Near Previous Recession Levels.

FRED Charts

https://fred.stlouisfed.org/series/DRTSCILM

8. Renewables Produce More Electricity than Coal

9. Here are 9 eye-popping allegations in the U.S. government’s lawsuit against Binance

The CFTC has accused Binance of doing everything it could to avoid having to follow U.S. regulations.

The Commodity Futures Trading Commission filed a lawsuit Monday against crypto exchange Binance and its charismatic CEO, Changpeng Zhao, alleging they went to great lengths to do business with U.S. customers while not following U.S. regulations.

The suit spells out a litany of alleged offenses that harkened back to wild west days of cryptocurrencies where no rules applied, despite Binance claiming it was playing by the rules.

The company says it is surprised by the CFTC’s as it had been working closely for years with the agency and had spent $80 million and hired 650 additional people to bolster its compliance efforts.

Here are nine of the most eye-popping allegations contained in the CFTC suit:

1) Where Chaopeng Zhao goes, Binance goes

The suit said the company was purposely vague about where it was based, with its founder, who is often called simply CZ, often saying that wherever he happened to be in the world, was the company’s headquarters that day.

2) Whatever you do, don’t let anyone know you’re American

Regulators allege Binance counseled its high-value U.S. customers to log in to their accounts using virtual private networks — or VPNs — to obscure their location. The company also didn’t typically ask these clients to provide any identifying documents as required by U.S. law.

3) What regulations?

The suit claims that Binance never registered with U.S. regulators and simply ignored U.S. laws despite the fact that its largest group of clients was in the U.S.

4) You might want to watch your back

Binance is accused of warning its VIP clients if they ever came under investigation by law enforcement. Account advisors were told to contact the clients immediately if their account had been frozen or unfrozen. If the account was unfrozen, they were instructed to “ not directly tell the user to run, just tell them their account has been unfrozen and it was investigated by XXX. If the user is a big trader, or a smart one, he/she will get the hint.”

5) Don’t mind the man behind the curtain

Regulators say Binance quietly operated some 300 house accounts that made trades on its own exchange, which could affect prices, without telling customers. It exempted the trading entities, including Merit Peak and Sigma Chain, from its own anti-fraud and insider-trading policies.

6) Who needs records?

The suit alleges that Binance executives frequently used disappearing chat programs like Wechat, Telegram and SIgnal to communicate internally and with customers.

7) A maze of companies

The suit charged that Binance used a “maze” of ownership structures to purposely obscure where each entity operated from, making jurisdiction challenging.

8) Everything comes from the top

Despite running a multi-billion business, regulators say CZ micromanged even the smallest decisions, once personally approving a $60 expense for office furniture in a month the company brought in $700 million in revenue.

9) There’s a whale in the room

Regulators identified one Chicago-based firm as controlling some 12% of all of Binance’s trading volume, and that CZ urged them to do business on the exchange using non-US IP addresses.

10. Change: Humankind’s Greatest Asset

By Jim Rohn | March 17, 2023 | 0 SUCCESS.COM

Our results are only limited by our imaginations. History has proven that time and again.

Once upon a time, it was a technological impossibility for humans to travel into outer space. In 1969, however, the first man stepped out onto the surface of the moon. The miraculous process of converting this dream into reality began when President John F. Kennedy challenged the scientific community to do whatever was necessary to see to it that America “commit itself to achieving the goal, before [the] decade [was] out, of landing a man on the moon and returning him safely to the earth.” That challenge awakened the spirit of a nation by planting the seed of possible future achievement into the fertile soil of imagination. With that one bold challenge, the impossible path became the course for reality.

I can tell you with absolute certainty that the same principles that put men on the moon have the power to take you a long, long way in your own life. The unique combination of desire, planning, effort and perseverance will always work its magic. The question is indeed not whether this formula for success will work for a person, but whether a person will work the formula. That is the unknown variable, the challenge that confronts us all. We can all go from wherever we are to wherever we want to be—provided we first have the courage to believe in that dream.

I know, because it happened in my own life. By the time I was 25, I was broke and embarrassed—I felt like I was a failure, and well on my way to failing more. But with mentorship, study and hard work, I changed my circumstances.

Of course, it didn’t happen overnight. The first thing I had to realize is what I was doing that brought me such poor results.

The status quo leads to failure

Failure is not a single cataclysmic event. Just as we don’t succeed overnight, we don’t fail overnight, either. The difference between failure and success is whether we choose to learn from and build upon our past mistakes or continue to make the same poor decisions. To put it more simply, failure is nothing more than a few errors in judgment repeated every day.

Now why would someone make an error in judgment and then be so foolish as to continuously repeat it? Perhaps the answer is because we do not think that it matters. On their own, our daily actions don’t seem that important. A minor oversight, a poor decision or a wasted hour don’t generally result in an instant and measurable impact. More often than not, we escape from any immediate consequences. If we have not bothered to read a single book in the past 90 days, this lack of discipline does not seem to have any immediate effect. And since nothing drastic happened to us after the first 90 days, we repeat this error in judgment for another 90 days, and on and on it goes. Why? Because it doesn’t seem to matter.

And herein lies the great danger. Far worse than not reading books is not even realizing that it matters to do so.

People who eat too many of the wrong foods are contributing to their future health problems, but the joy of the moment overshadows the consequences of the future. Those who drink or smoke too much go on making these poor choices year after year after year—again, because it doesn’t seem to matter.

But the pain and regret of these kinds of errors in judgment are only delayed until a later date.

Failure’s most dangerous attribute is its subtlety—that is, when we do not seem to be failing. In fact, sometimes these accumulated errors occur throughout periods of great joy and prosperity in our lives. Since nothing terrible happens to us—since there are no instant consequences to capture our attention—we simply drift from one day to the next, repeating the errors, thinking the wrong thoughts, listening to the wrong voices and making the wrong choices. The sky did not fall in on us yesterday; therefore, the act was probably harmless.

We should know better than that.

This is why it is imperative to refine our philosophy in order to be able to make better choices. With a powerful, personal philosophy guiding our every step, we become more aware of our actions and the ripple effects they’ll have. That’s the great news: Just like the formula for failure, the formula for success is easy to follow. It’s just a few simple disciplines practiced every day.

Making a change is the formula for success

How can we change the errors in the formula for failure into the disciplines required in the formula for success? The answer is by making the future an important part of our current philosophy.

What if you developed a new discipline to take just a few minutes every day to look a little further down the road? Perhaps you would then be able to foresee the impending consequences of your current conduct. Armed with that valuable information, you would be able to take the necessary action to change your errors into new success-oriented disciplines.

As you change daily errors into daily disciplines, you’ll begin to experience the positive results. When we change our diet, our health improves noticeably. We begin to feel a new vitality when we start exercising. When we take the time to study, we experience a growing awareness and a new level of self-confidence. Whatever new discipline we begin to practice daily will likely produce exciting results that will drive us to become even better at developing other disciplines in the future.

I know one surefire way to create change: start. If you start today, then this would be the first day of a new life leading to a better future. If today is the day you start to try harder, and in every way make a conscious and consistent effort to change subtle and deadly errors into constructive and rewarding disciplines, you may never again settle for a life of mere existence rather than one of substance.

More often than not, however, change isn’t as simple as flipping a switch. In my experience, it’s usually driven by one of three emotions.

Emotions are the most powerful forces inside of us. Under the power of emotions, human beings can perform heroic (and barbaric) acts. To a great degree, civilization itself can be defined as the intelligent channeling of human emotion. Emotions are fuel and the mind is the pilot, which together propel the ship of progress.

Which emotions cause people to act? There are three basic ones; each, or a combination of them, can trigger the most incredible progress. The day that you allow these emotions to fuel you is the day you’ll turn your life around.

Disgust

One does not usually equate the word “disgust” with positive action. And yet, properly channeled, disgust can change a person’s life. The person who feels disgusted has reached a point of no return. They are ready to throw down the gauntlet at life and say, “I’ve had it!” That’s what I said after many humiliating experiences at age 25. I said, “I don’t want to live like this anymore.”

Productive feelings of disgust come when a person says, “Enough is enough.” It is then that they are primed to become something new.

Desire

Almost anything can trigger desire. It’s a matter of timing as much as preparation. It might be a song that tugs at the heartstrings. It might be a memorable sermon. Maybe it’s a movie, a conversation with a friend or a bitter experience. Even a book or an article such as this one can trigger the inner mechanism that will make some people say, “I want it now!”

Therefore, while searching for your hot button of pure, raw desire, welcome each positive experience into your life. Don’t erect a wall to protect you from experiencing life. The same wall that keeps out the shadows of your disappointment also keeps out the sunlight of enriching experiences. So let life touch you. The next touch could be the one that turns your life around.

Resolve

Resolve says, “I will.” These two words are among the most potent in the English language.

The mountain climber says, “I will climb the mountain. They’ve told me it’s too high, it’s too far, it’s too steep, it’s too rocky, it’s too difficult. But it’s my mountain. I will climb it.” Who can argue with such resolve?

If you want to create change in your life, promise yourself you will never give up.

You have to choose to make a change

Any day you wish, you can discipline yourself to change it all, to open the book that will expose your mind to new knowledge, start a new activity and begin the process of changing your life. You can do it immediately, or next week, next month or next year.

Or, you can do nothing. You can pretend rather than perform. And if the idea of having to change makes you uncomfortable, you can remain as you are. Truth be told, this is the more comfortable setting right now. You probably haven’t experienced those consequences yet.

But are you thinking about the future? If you are, you know why you would choose labor over rest, education over entertainment, truth over delusion and confidence over doubt.

The emotions are ours to feel and the choices are ours to make. Don’t curse the effect while nourishing the cause. As Shakespeare uniquely observed in Julius Caesar, “The fault, dear Brutus, is not in our stars, / But in ourselves, that we are underlings.”

We create our circumstances by our choices. We have both the ability and the responsibility to make better choices, beginning today. Those who are in search of the good life do not need more answers or more time to think things over to reach better conclusions. They need the truth. They need the whole truth. And they need nothing but the truth.

We cannot allow our errors in judgment, repeated every day, to lead us down the wrong path. We must keep coming back to those basics that make the biggest difference in how our life works out. And then we must make the very choices that will bring life, happiness and joy into our daily lives.

Making a change starts with you

If I may be so bold to offer a final piece of advice for someone seeking and needing to make changes in their life: If you don’t like how things are, change it! You’re not a tree. You have the ability to totally transform every area of your life, and it all begins with your very own power of choice.

For more life-shaping advice from the icon of personal development and to download a free guide to setting powerful personal goals, visit JimRohn.com.

This article originally appeared in the Fall 2018 issue of SUCCESS magazine and has been updated. Photo by Inside Creative House/Shutterstock