1. Vanguard Growth Fund Nearing 2 ½ Year Up Trend Line

StockCharts

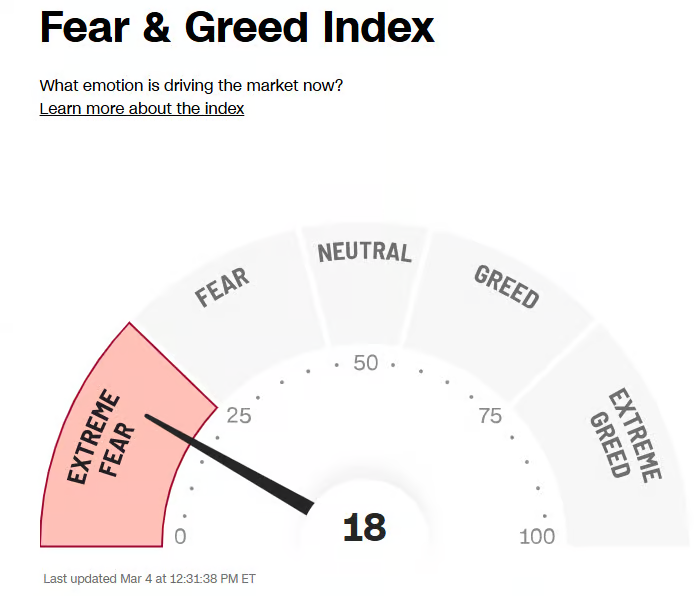

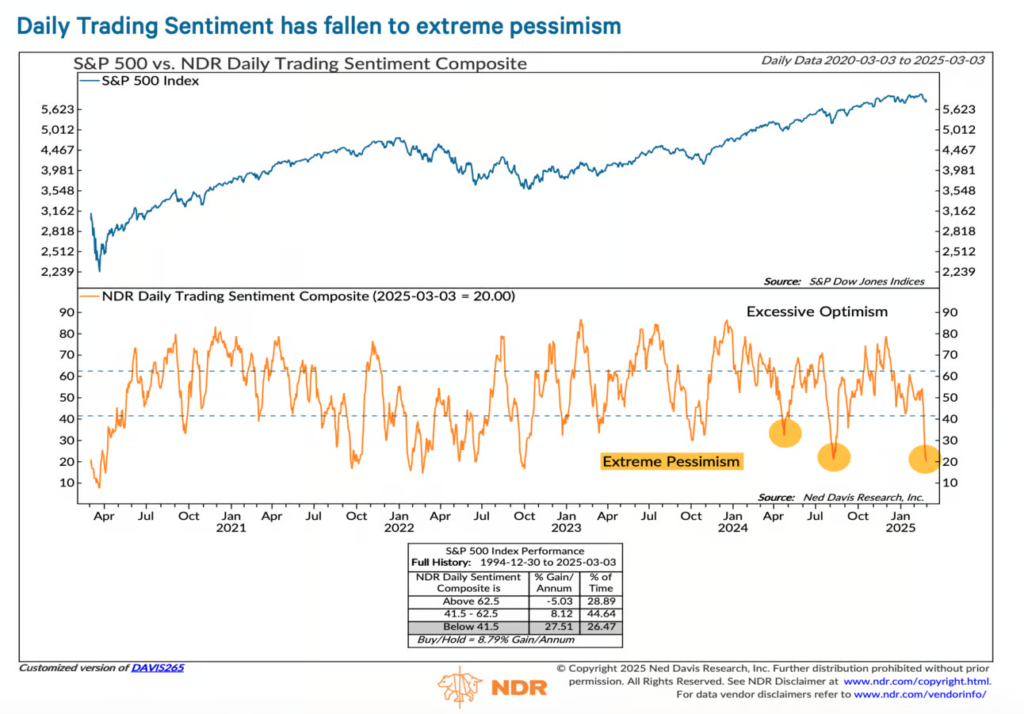

2. Another Extreme Pessimism Signal for Short-Term Bottom

NDR

3. U.S. Share of Global Stock Market Cap Exceeded Internet Bubble Levels

WSJ

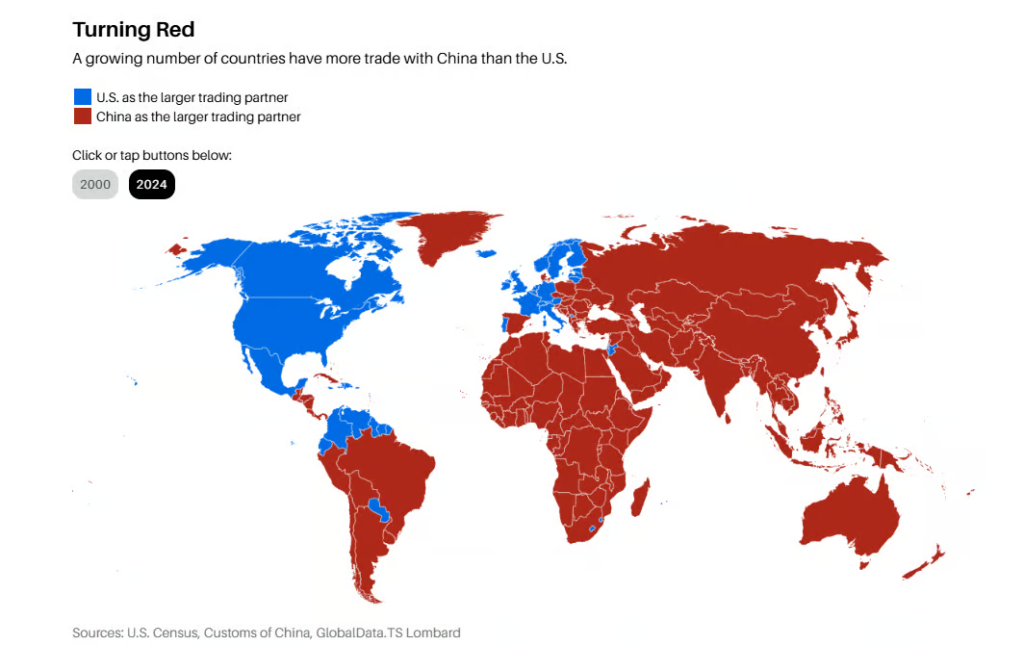

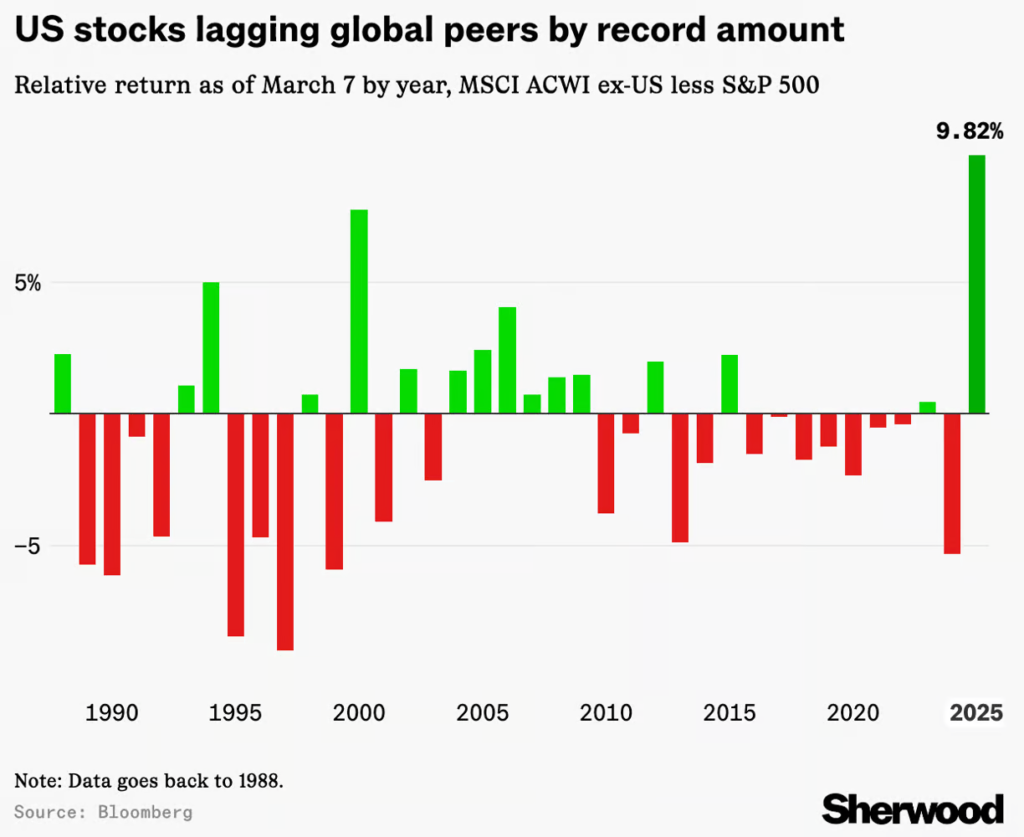

4. Rotation to International is Strongest Start to Year Since 1988

US vs. RoW. “As of March 7, this is the worst start to a year for the S&P 500 compared to the MSCI ACWI ex-US Index on record, going back to 1988.”

Sherwood

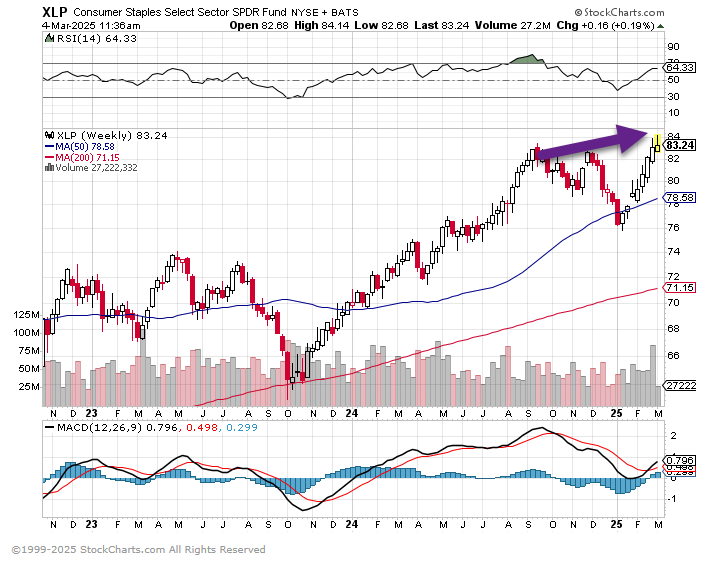

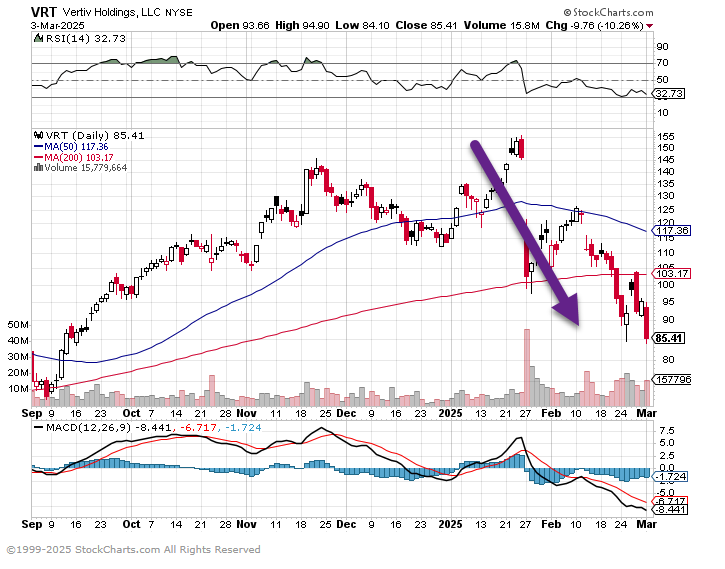

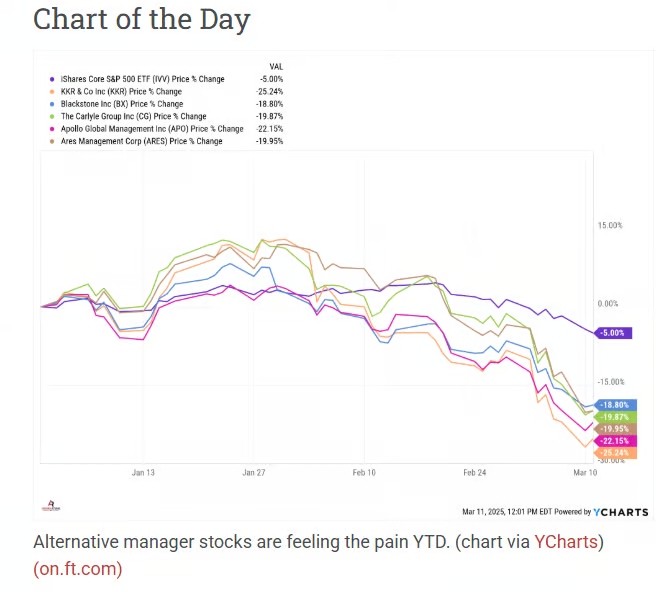

5. Alternative/Private Equity Stocks

StockCharts

6. Uranium ETF at Key Level..Right on 200-Week Moving Average

StockCharts

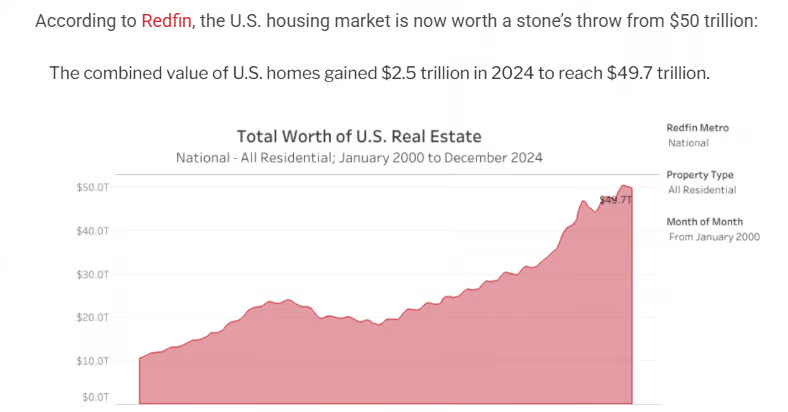

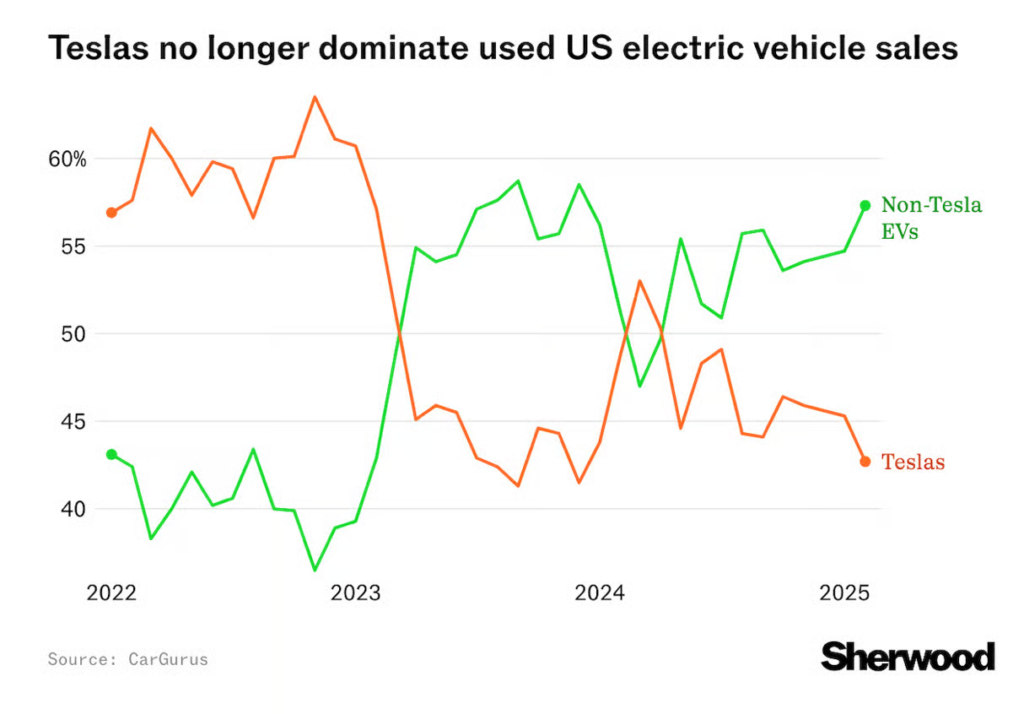

7. Tesla Market Share Dropping Well Before Political Turmoil

Sherwood

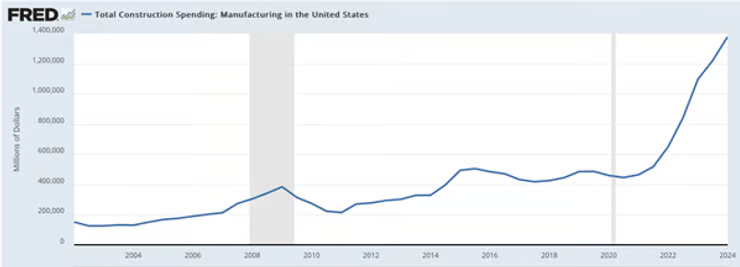

8. Will We See Weak Dollar Policy After $1.4 Trillion Spent on New Factories Last Year?

After 50 years of rust and decline, American manufacturing is roaring back to life. Spending on new factories hit $1.4 trillion last year… easily a record.

Rational Optimist Society

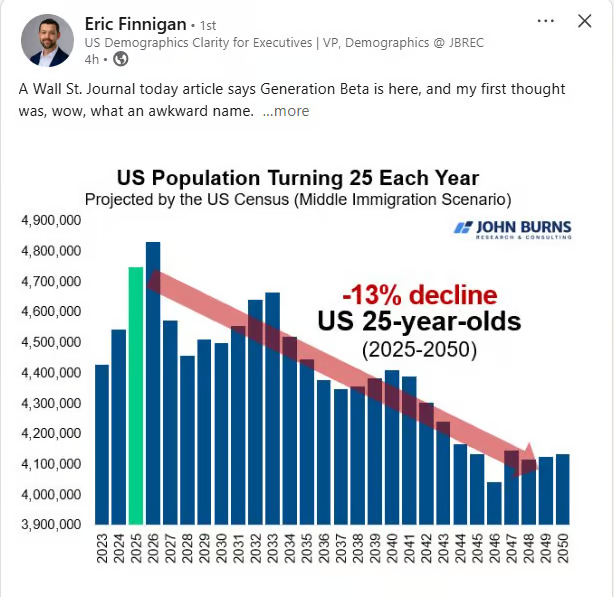

9. US Population Turning 25 Years Old Each Year Beginning a Downtrend

John Burns

10. The Reading Crisis in College

How critical thinking skills can help combat the decline in college reading skills.

Key points

- In the attention economy of the digital world, long-form content may be seen as a chore, not a pleasure.

- Teaching students to restate complex ideas in their own words is a powerful tool.

- Educators and parents need to model good reading habits and emphasize the irreplaceable value of deep reading.

Via Psychology Today: Many professors have witnessed a troubling trend in recent years: College students are struggling with reading more than ever. This isn’t just about preferring Netflix to novels; it’s a fundamental shift in how young adults engage with text, and it can have serious implications for their academic success and future careers.

The Decline of Reading Skills

Let’s face it: Reading isn’t what it used to be. In the attention economy of the digital world, long-form content is often seen as a chore rather than a pleasure. Recent trends indicate a concerning decline in reading skills among college students:

- Struggles with complex texts: Many students fixate on isolated details rather than grasping the full context.

- Diminished focus and endurance: Short attention spans make it difficult to engage with long passages.

- Preference for short-form content: Social Media consumption has rewired reading habits, making traditional texts feel overwhelming.

- Superficial engagement: Skimming has replaced deep reading, leading to a weaker grasp of complex ideas.

- Skepticism about reading’s value: Some students view reading as outdated, favoring video content and AI summaries instead.

- Pandemic’s lasting impact: Lowered academic standards and inflated grades have left many underprepared for college-level reading.

The Consequences

This decline in reading skills isn’t just an academic issue; it has real-world implications. Students who struggle with reading often:

- Have difficulty comprehending complex ideas in their chosen fields.

- Struggle to communicate effectively in writing.

- Miss out on the cognitive benefits of deep reading, such as improved empathy and critical thinking.

- Face challenges in careers that require analysis of detailed reports or contracts.

- The Critical Thinking Solution

The solution to this problem lies in harnessing the power of critical thinking to revitalize reading skills. Here’s how:

1. Active reading strategies: Encourage students to engage with texts actively. This means underlining key points, jotting down questions in the margins, and summarizing main ideas after each section. By treating reading as a dialogue with the author rather than a passive activity, students can improve both comprehension and retention.

2. The power of paraphrasing: Teaching students to restate complex ideas in their own words is a powerful tool. This process forces them to truly understand the material before they can explain it, deepening their engagement with the text.

3. Contextual analysis: Help students see the bigger picture by asking questions like:

- What’s the author’s background?

- When was this written, and how might that influence the content?

- How does this text relate to other things you’ve read or learned?

- This approach turns reading from a solitary activity into an investigative one, making it more engaging and relevant.

4. Debate and discussion: Organize group discussions or debates around the texts students are reading. This not only makes reading a social activity but also exposes students to different interpretations and viewpoints, enriching their understanding.

5. Real-world application: Encourage students to connect what they’re reading to current events or personal experiences. This makes abstract concepts more concrete and demonstrates the relevance of reading in understanding the world around them.

6. Digital literacy integration: Instead of fighting against digital trends, incorporate them into reading exercises. Use social media-style summaries as a starting point for deeper analysis or have students create video responses to readings, combining their digital skills with traditional comprehension.

7. Metacognitive reflection: Teach students to think about their thinking. After reading, have them reflect on questions like:

- What was challenging about this text?

- How did my understanding change as I read?

- What strategies helped me comprehend better?

- This self-awareness can help students develop personalized reading strategies.

8. Interdisciplinary connections: Encourage students to draw connections between texts from different courses or disciplines. This not only reinforces the idea that reading skills are universally applicable but also promotes a more holistic understanding of complex issues.

The Road Ahead

Improving reading skills among college students is not just about assigning more books or lamenting the influence of technology. It’s about reimagining how we approach reading in the digital age. By integrating critical thinking strategies, we can make reading more engaging, relevant, and rewarding for students.

Educators and parents need to model good reading habits and emphasize the irreplaceable value of deep reading. In a world increasingly dominated by soundbites and AI-generated content, the ability to critically engage with complex texts is more important than ever.

So, let’s turn the page on disengaged reading and write a new chapter where critical thinking and deep reading go hand in hand, to prepare students not just for academic success but also for a lifetime of learning and growth.