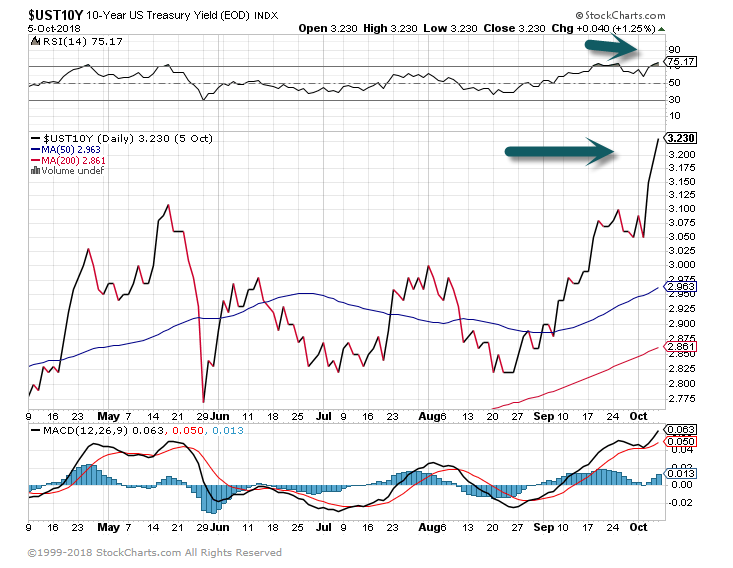

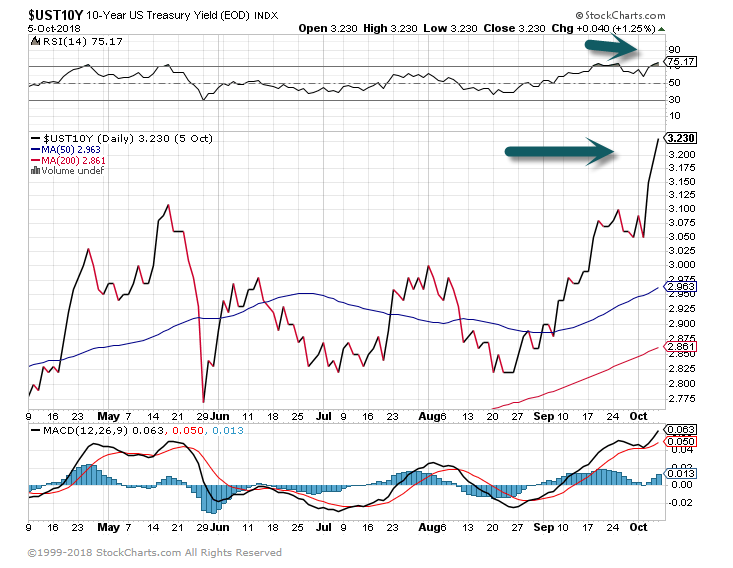

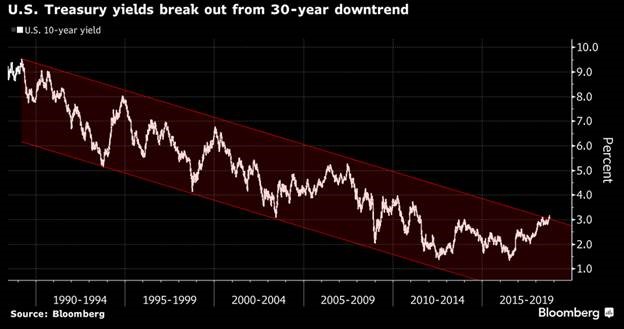

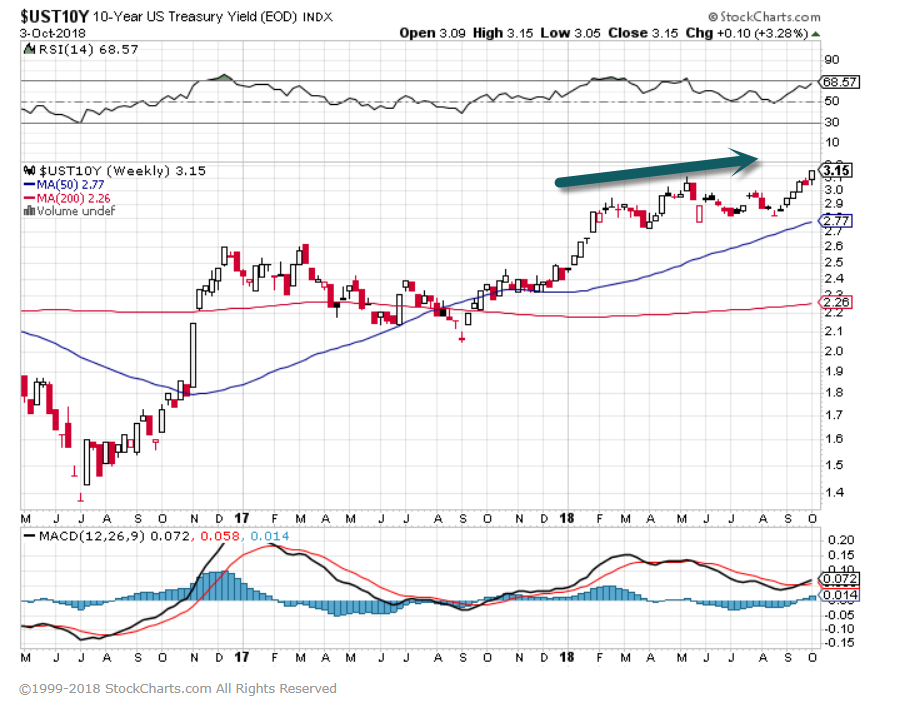

1.Rate Watch-10 Year Spike

Watching 10 Year to see if it settles down now…RSI 75 on chart

From Dave Lutz at Jones.

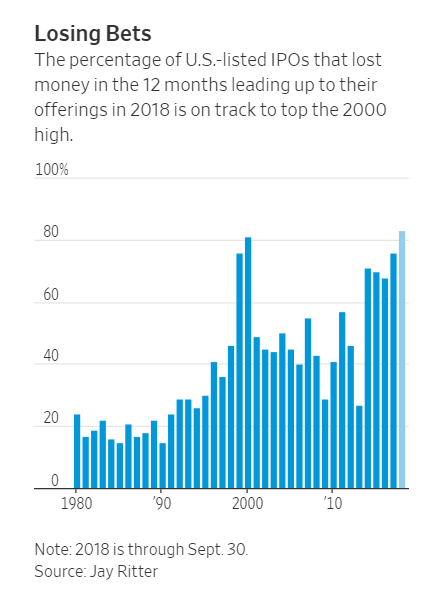

About 83% of U.S.-listed initial public offerings in 2018’s first three quarters involve companies that lost money in the 12 months leading up to their debut, according to data compiled by University of Florida finance professor Jay Ritter. That is the highest proportion on record, according to Mr. Ritter, an IPO expert whose data goes back to 1980.

IPO Market Has Never Been This Forgiving to Money-Losing Firms

Money-losing companies are going public at a record rate as investors hunger for new issues

https://www.wsj.com/articles/red-ink-floods-ipo-market-1538388000?tesla=y