1.All-Time Highs? Mostly Large Cap Growth Equities.

SPDR FUNDS

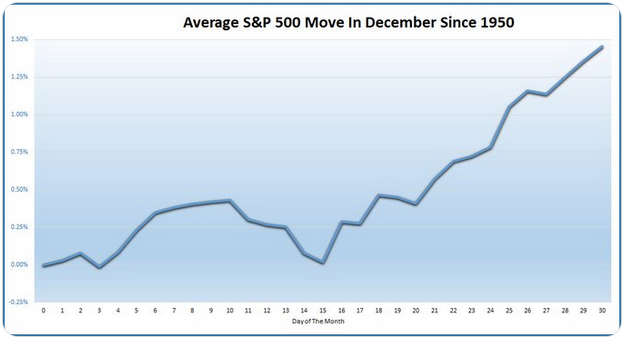

Twits remind us what your average December for the S&P 500 looks like – “Nearly all the gains happen late in the month.”

From Dave Lutz at Jones Trading.

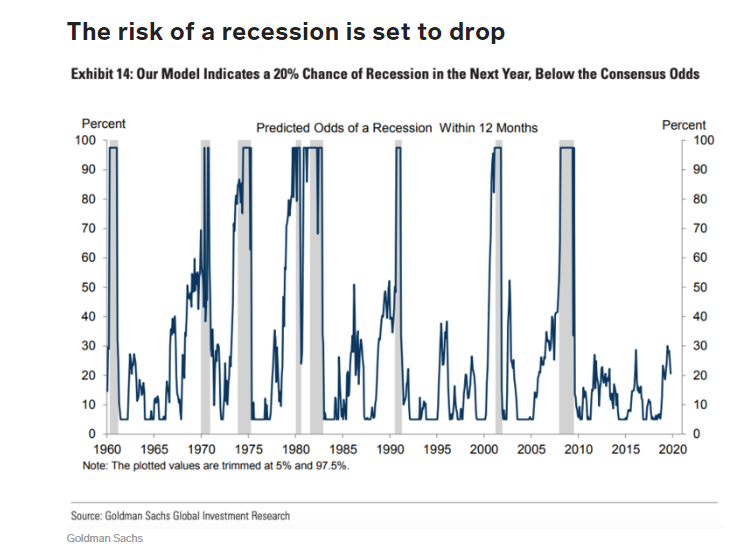

Continue readingAfter delivering three interest-rate cuts this year, the Federal Reserve seemed to indicate that it “would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” As a result of this, the bank expects fund rates to remain unchanged in 2020.

Earlier this year, the bank’s economists put the risk of a US recession within the next 12 months at one in three. Now it’s cut the chances to one in five.

“The current expansion is now the longest in US business cycle records dating to the 1850s, and some recession fears may simply reflect an instinctive sense that its time is nearly up,” the economists said.

“This has not been an unreasonable thought historically, as the two usual late-cycle risks-inflationary overheating and financial imbalances-often did grow over time. But so far both risks look limited,” they added.

Low recession risk, faster growth, and

unemployment at a 70-year low — here are Goldman Sachs’ predictions for the US

economy in 2020–Yusuf Khan

https://e-markets.nordea.com/#!/article/54825/week-ahead-where-did-all-the-vol-love-go

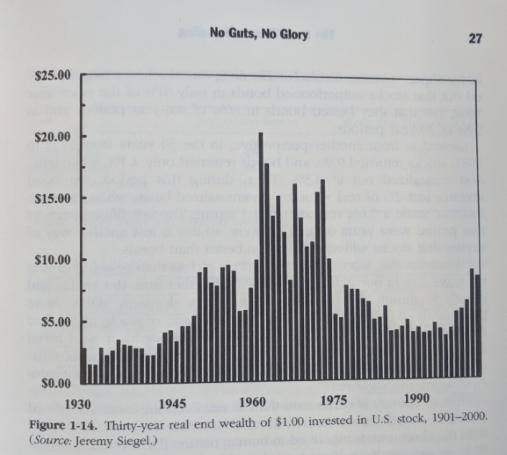

Continue readingWhen you’re born has a huge impact on lifetime investment returns. Genetics play a role in our health, and when we’re born has a big effect on our portfolio. An investor born in 1902 that invested 100% in U.S. stocks (VTI) from 1932 to 1962 earned 10.2% per year – turning $100,000 into an inflation-adjusted $1.8 million.

Shifting the investment window to 1965 to 1995 results in only earning $343,000. We can’t control when we’re born, so it’s important to focus on what we can control: saving more money, reducing fees, and increasing diversification.

Source: Page 27 of The Four Pillars of Investing

https://seekingalpha.com/article/4286243-book-summary-four-pillars-investing

Continue reading