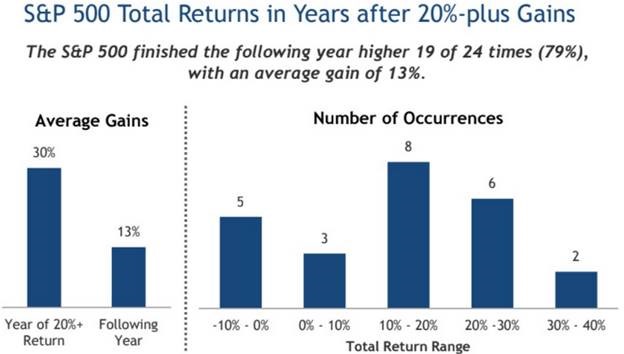

1.Gains Following a 20% + Year in S&P

PAIN TRADE? – Bloggers note Big gains for stocks in 2020!

From Dave Lutz at Jones Trading.

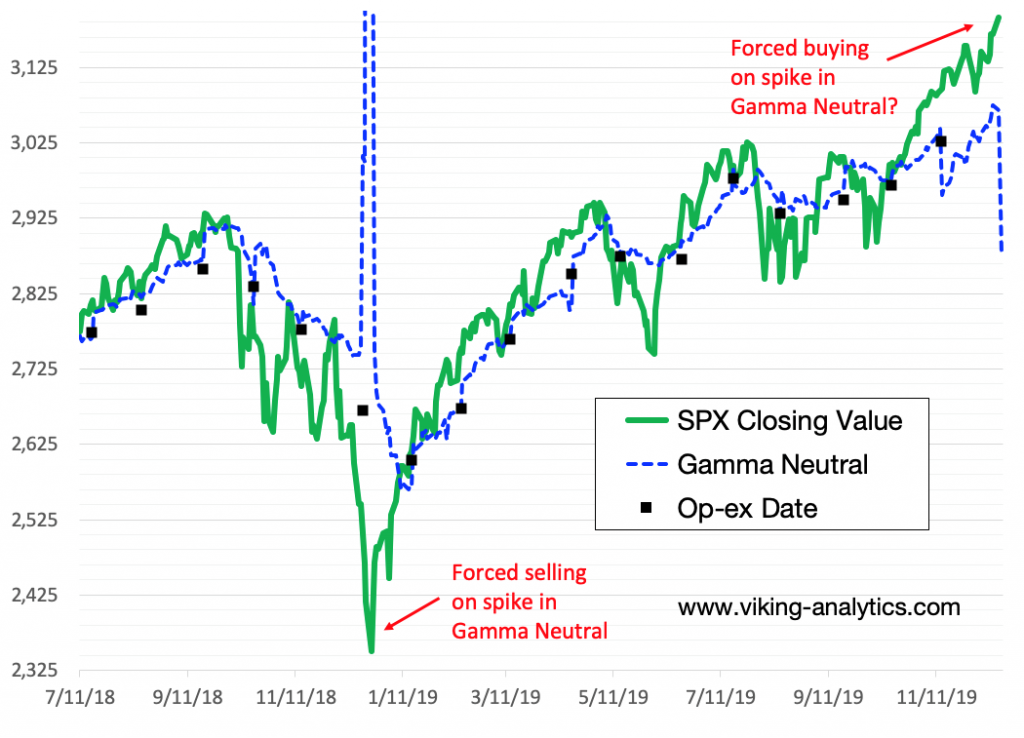

2.Options Expiring Friday Bullish?

I am not familiar with this indicator – for information purposes only.

The ‘ultimate smart money indicator’ is signaling a big move in the stock market by the end of the week

Things could get interesting… soon.

By SHAWNLANGLOIS

Look out, above!

S&P 500 index monthly options expire this Friday, and Erik Lytikainen, longtime trader and founder of Viking Analytics, says that, just like this time last year, investors could be in store for some real fireworks.

Just not necessarily the bearish kind we saw in 2018.

“Last December, in and around the final option expiration of the year, the S&P 500 fell by nearly 300 points,” he wrote Wednesday in a post on RealInvestmentAdvice.com. “This dramatic decline coincided with a spike in market gamma. It is my view that this decline was furthered by forced selling by the put sellers who needed to sell the S&P 500 index to cut their losses.”

Without getting too deep in the weeds, gamma measures how much the price of an option accelerates when the price of the security it is based on changes. Lytikainen describes the study of gamma as akin to the study of market risk.

When gamma is high, risks are high. When it’s low, risk is low.

“The study of market gamma can be viewed as the ultimate smart money indicator,” he said, adding that this particular measure of smart money, as this chart illustrates, suggests we could be seeing the inverse of the market declines last year:

Lytikainen forecast that instead of the put option sellers feeling the pinch in 2018, call sellers could dictate the market’s next big move.

“While I am not saying that stocks will melt up through the remainder of the year, the possibility of that scenario playing out is looking more likely,” he said, pointing out that if this were to happen, the S&P 500 would enjoy a 100-point rally in a matter of days.

“Of course, there are other market risks such as China trade and impeachment proceedings,” Lytikainen said. “I will either be watching from the sidelines, or perhaps buy a straddle to profit from a big move in either direction.”

Meanwhile, there’s a calm before this predicted storm, with the Dow DJIA, -0.10% , S&P 500 SPX, -0.04% and Nasdaq Composite COMP, +0.05% all mostly flat in Wednesday’s trading session.

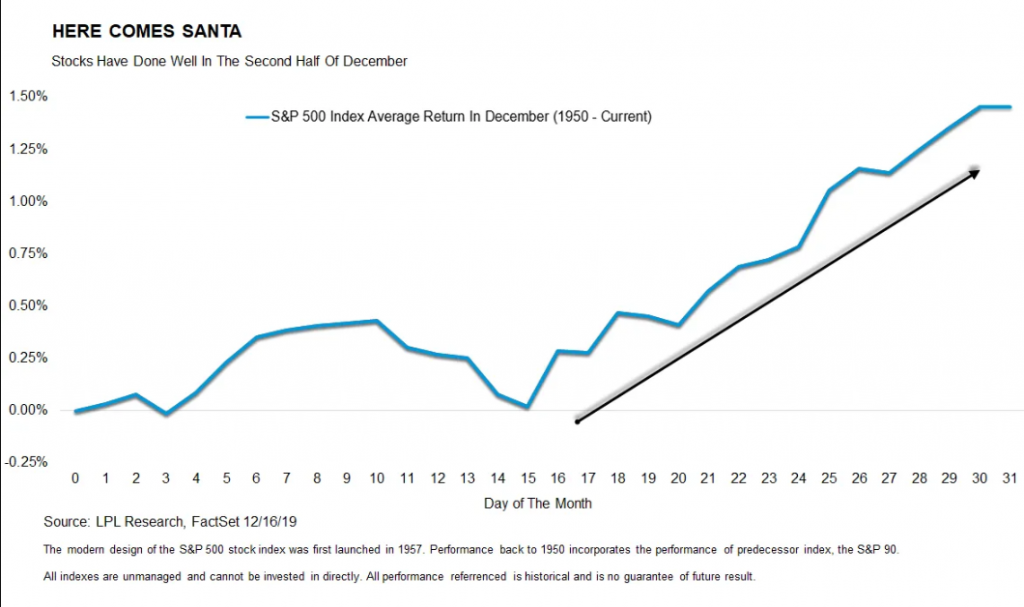

3.Is It Time For Santa?

Posted by lplresearch

Economic Blog

December 17, 2019

December has been widely viewed as a strong month for stocks, with this year following suit so far. What many probably don’t realize, however, is the majority of the gains have taken place late in the month.

“December has been a good month so far, but can it continue? Turns out, the majority of December’s gains have tended to happen in the second half of the month—so we still have time to believe in Santa,” explained LPL Senior Market Strategist Ryan Detrick.

As Ryan Detrick and Jeff Buchbinder discussed on the most recent episode of the LPL Market Signals podcast, with new clarity on U.S.-China trade and the recent United Kingdom elections, there may be a good chance stocks could deliver another stellar performance during this festive time of the year.

As our LPL Chart of the Day shows, December historically has been a strong month that has tended to deliver the majority of its gains late in the month.

https://i0.wp.com/lplresearch.com/wp-content/uploads/2019/12/Blog-12.17.19.png?ssl=1

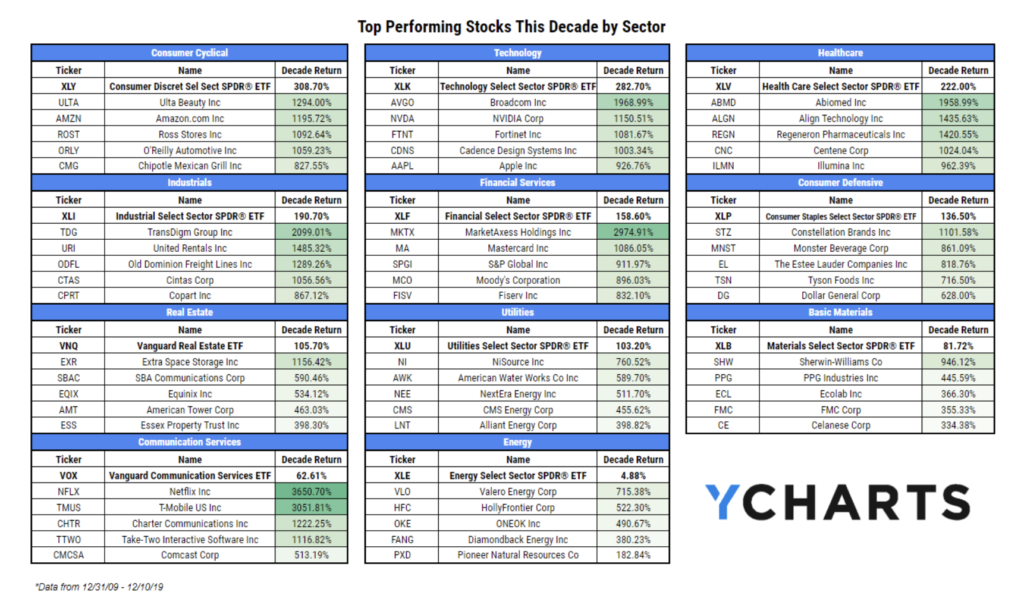

4.Top Performing Stocks This Decade by Sector-Y Charts.

https://ycharts.com/?gclid=EAIaIQobChMI6OTTk9fB5gIVEtvACh2x9AjsEAAYASAAEgKMAPD_BwE

JOSH BROWN BLOG

https://thereformedbroker.com/

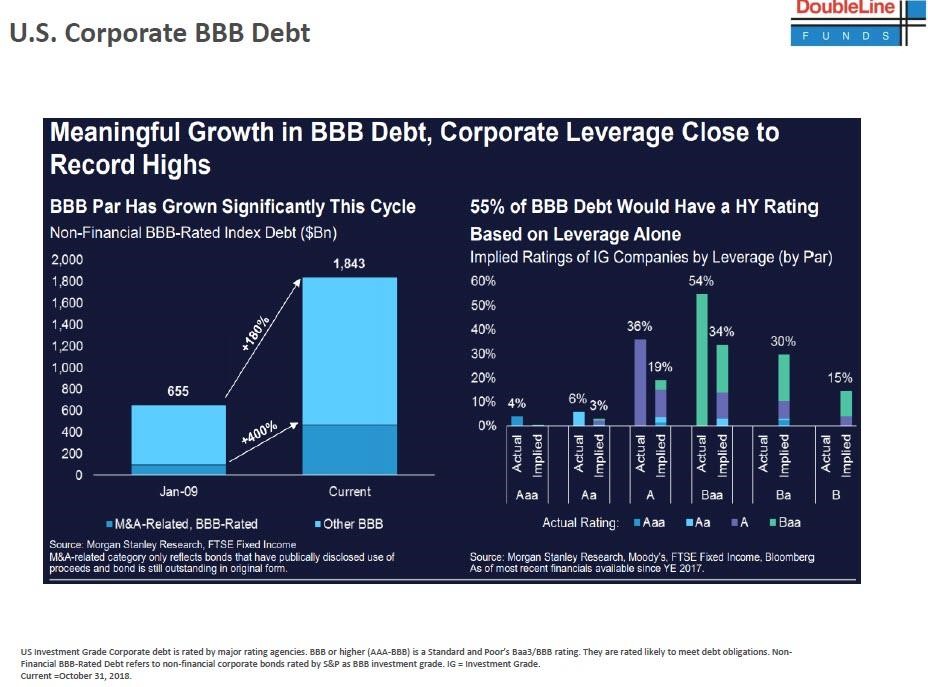

5.55% of BBB Debt Would Have a HY Rating Based on Leverage Alone

Zero Hedge

https://www.zerohedge.com/markets/even-goldman-bristles-junk-bond-rally-smashes-all-records

6.Twitter Flirting with Levels Going Back to 2017.

TWTR Chart

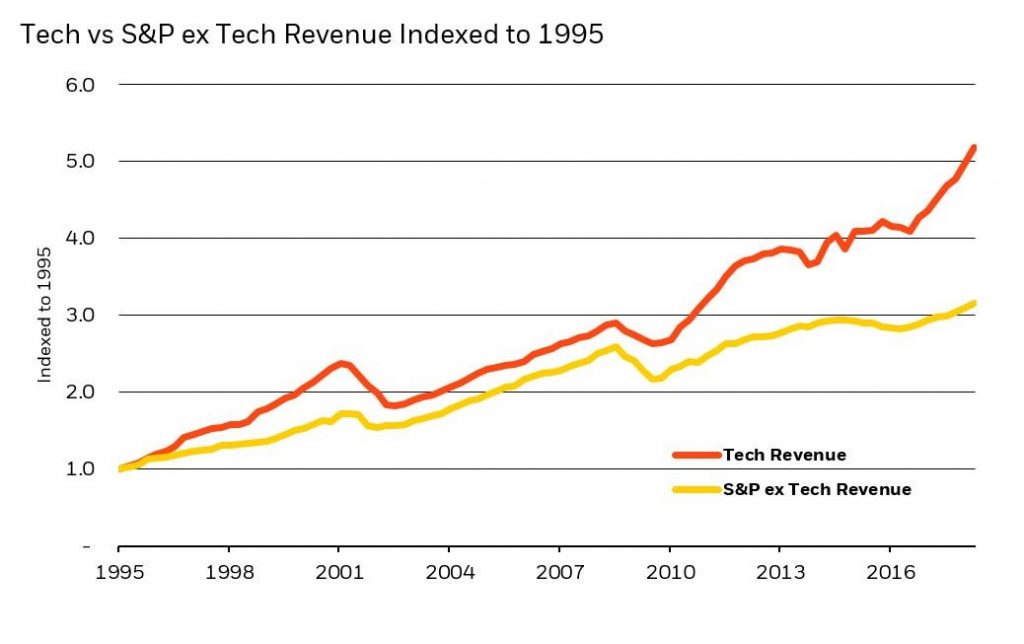

7.Tech vs. S&P Revenue

Blackrock

In 2020, the critical number to know is 1.8

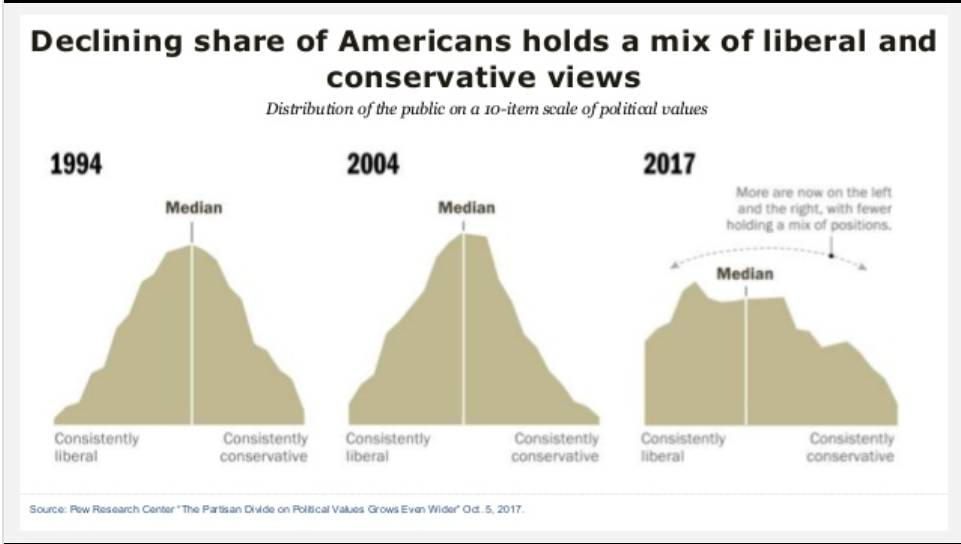

8.Pew Research on Slide Share

Pew Research on SlideShare

https://www.slideshare.net/PewInternet

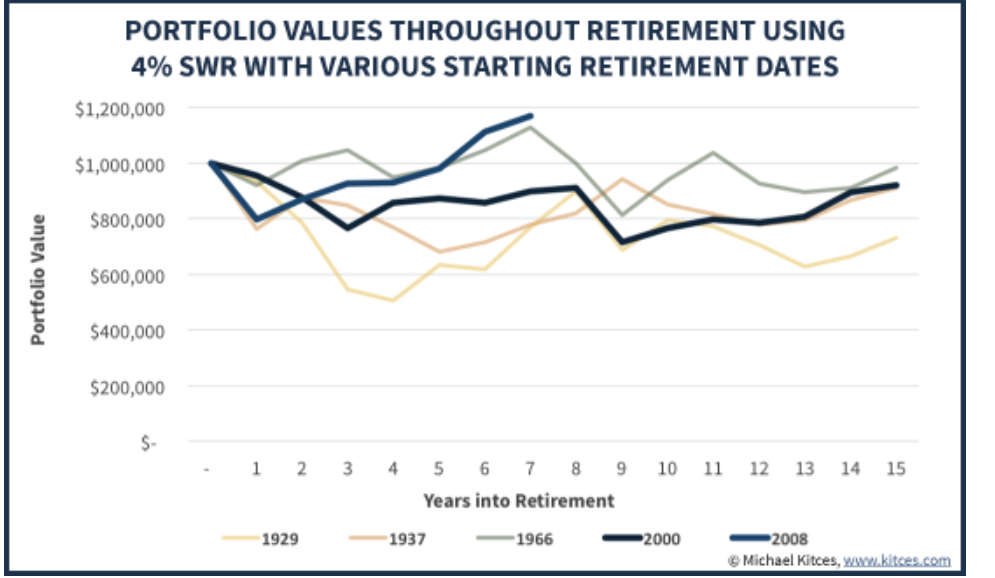

9.How The 4% Rule Is Faring For 2000 And 2008 Retirees

Michael Kitces

The fact that the 4% rule is based on a particular subset of especially bad historical scenarios gives us a unique opportunity to compare recent challenging times for retirees – like those who retired in 2000 or 2008 – and see how they compare. In other words, if we looked at how the portfolio of a retiree was doing in the first half of a retirement starting in 1929, 1937, or 1966, would a retiree who started in 2000 or 2008 be doing similar, better, or worse?

As the results reveal in the chart above, despite how shocking the tech crash and the 2008 financial crisis appeared to be in real time, the reality is that such retirees still have portfolios that are performing similar to or better than most of the historical 4% rule scenarios. The 2000 retiree is already half way through the 30-year time horizon with similar wealth to a 1929, 1937, or 1966 retiree had at this point, and the 2008 retiree is even further ahead than any of those historical scenarios (and even ahead of the 2000 retiree, too!).looked at how the portfolio of a retiree was doing in the first half of a retirement starting in 1929, 1937, or 1966, would a retiree who started in 2000 or 2008 be doing similar, better, or worse?

Full Read

10.Why We Need Heroes?

Co-Chief Investment Officer & Co-Chairman of Bridgewater Associates, L.P.

Today, shortly after Paul Volcker’s passing and his memorial service, and shortly after Mario Draghi passed the baton of the European Central Bank to Christine Lagarde, I can’t help but reflect on the heroism of these people and the heroism of Ben Bernanke and many other public servants who faced huge challenges and courageously and smartly (albeit imperfectly) dealt with them. They did so despite criticisms from ignorant people who advocated policies that would have been disastrous and despite the complaints of cynics who focused on the imperfections that were the unavoidable consequences of the big changes that saved us. Thinking about these public servants led me to reflect on why we now don’t have any recognized heroes.

I believe that we are living in an era in which there are no recognized heroes, even though we aren’t lacking real heroes, because the real heroes are vilified by cynics, the media, and politicians. Let me clarify.

By heroes I mean people with exceptional character and capabilities who put the well-being of others above their own well-being. Joseph Campbell described the typical “hero’s journey” as starting off with a person experiencing a call to adventure, then encountering the harsh realities of life, then having some successes but more importantly making painful mistakes that give them humility and sound principles for success. Then, in the process of pursuing their noble mission with others, they fall in love with the mission and with the others around them so much so that they put their mission and other people ahead of their own well-being. I know a number of such people.

The cynics are people who haven’t accomplished much themselves and stand on the sidelines while criticizing the heroes who are on their fields of battle. They arrogantly pontificate about how those on the field aren’t following the cynics’ untested and impractical approaches. Cynics also love to point to the mistakes the heroes make, ignoring the reality that all successful people make plenty of mistakes. In the process, they conjure up unrealistic images that heroes must be perfect rather than imperfect but great and much more successful than unsuccessful.

Too many people in the media are opinionated cynics with megaphones and too few are true journalists trying to report unfolding stories in a balanced way. They have strong preferences to be much more critical than complementary, especially of people who have different inclinations than theirs, often so much so that they will intentionally distort the facts to help create stories of evil people in positions of power. Because their audiences seem to revel in tearing down people in power, that approach also sells well which rewards them for such behavior.

Politicians are now more polarized than collaborative, more inclined to hurt each other than to be respectful, and more likely to vote along party lines than to vote based on principles about what’s right and wrong. As an extension of this, they tear each other down rather than hold good character in high regard. Based to the stats that I gathered to measure these things, this is now more true than at any time since around 1900.

Because there are many more cynics, cynical media with megaphones, and politicians trying to tear people down, and because there are no perfect heroes of the sort that the cynics paint pictures of, is it any wonder that there are no widely recognized heroes?

To me it’s a tragedy that we don’t have widely recognized heroes because they’re the ones we need to take us through the difficult times, they make good role models who help make us better just by watching them, and they deserve our appreciation rather than scorn.

Paul Volcker, Ben Bernanke, and Mario Draghi

I was very fortunate to be close to these people personally and to see the circumstances they faced and the choices they made up close, so I’d like to briefly share with you what I saw.

Paul Volcker, Ben Bernanke, and Mario Draghi were each central bankers who inherited brewing money and credit crises that boiled over on their watches. They each had to muster the courage to do the right things despite the great criticism of people who wanted them to do wrong things. As the leading central bankers, they had to fight huge economic wars in politically-charged and dysfunctional environments, and they won those wars. Their responsibilities and their powers were comparable to those of heads of state because they controlled the amount of money and credit that’s in the world and virtually nobody liked how they did it.

Paul Volcker stepped into an inflationary spiral created by others that threatened to destroy money and credit as we knew it and he broke the back of that inflation. He did it by raising interest rates to “the highest level since Jesus Christ” and causing a number of countries, companies, and people to go broke during the painful adjustment process. Needless to say, he was criticized and even hated by many people while he was doing it. In retrospect, most people could see that that Paul was a smart and principled man who did the right thing in an unbiased and apolitical way. Over his more than 60-year career, he was unwavering in operating that way as he handled many major crises.

Similarly, Ben Bernanke and Mario Draghi were each faced with existential debt crises that came to them because of what others before them did and that would have led to deflationary depressions and social and political disasters if they didn’t buck the cynics and politicians to make the controversial, unconventional moves that returned the world economy to non-inflationary growth. I watched their every move closely every day so I saw the decisions they made, the strains they were under, the fights they needed to have, and the personal attacks they had to endure in order to bring about stability.

While these moves averted past disasters, we are still faced with large debts and non-debt obligations (like pensions and health care) and growing deficits, so there are storms brewing. Now central bankers have less effective monetary tools and will have to coordinate with polarized politicians who have to agree on taxes, spending, and regulations. Most likely the challenges ahead will be harder rather than easier. If we keep treating the heroes the way we are treating them, we might not have any when we need them the most.

That’s my greatest worry as well as the greatest injustice.

https://www.linkedin.com/pulse/why-we-have-heroes-ray-dalio/?trackingId=V1iRBZCTSeyNnZYlnNMn2A%3D%3D