1.U.S. 10 Year Break Even Inflation Numbers Triple Off Covid Low .50 to 1.63%

US Inflation expectations (10-yr breakeven) rise to their highest level since February 20: 1.63%.

US Inflation expectations (10-yr breakeven) rise to their highest level since February 20: 1.63%.

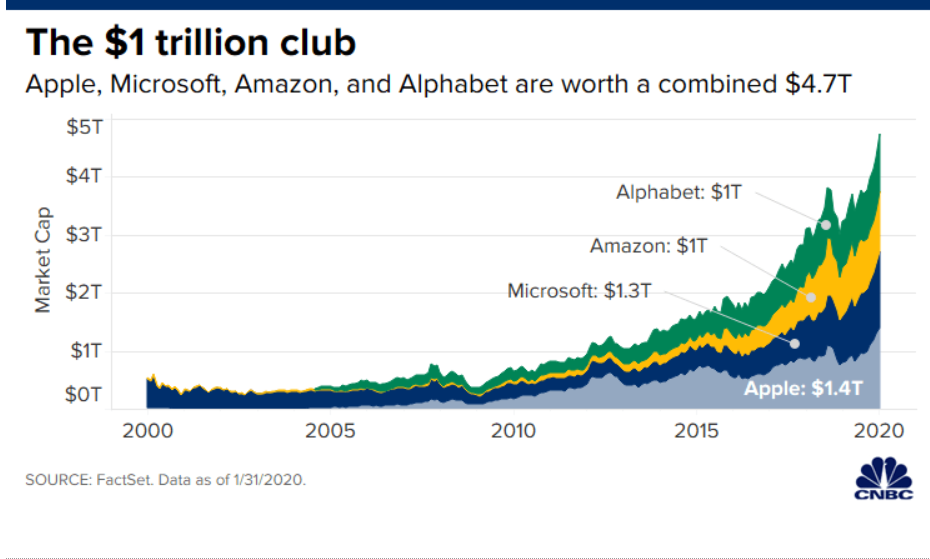

Tim Cook: The Apple CEO has built a cordial relationship with President Trump, despite a number of touchy issues, mostly involving Apple’s presence in China. Since Cook succeeded Steve Jobs as CEO in August 2011, Apple shares have rallied 750%. In other words, about 88% of Apple’s valuation has been generated with Cook in charge.

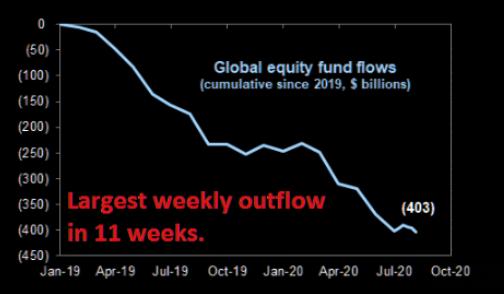

From Dave Lutz at Jones Trading

Goldman notes last week saw the biggest equity outflows YTD..

Continue readingFrom Nasdaq Dorsey Wright

The pie chart below shows the percent of stocks in the S&P 500 that have printed a new rally high since the market bottom on March 23, broken down by month.