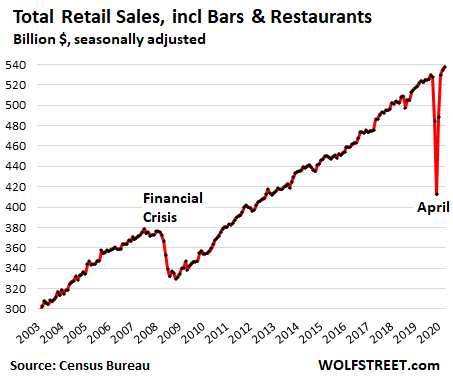

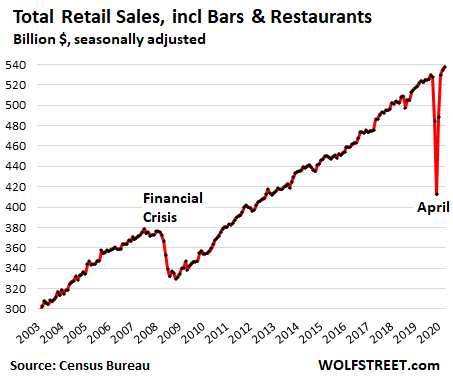

1. Total Retail Sales Thru Financial Crisis and Covid……..Versus Total Department Store Sales.

Wolf Street

Wolf Street

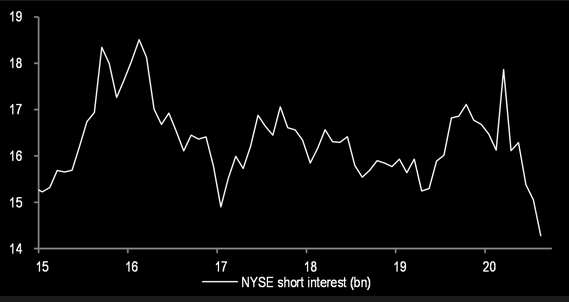

BloggersnoteShort interest in equities at multi-year lows

Continue readingBarrons

Inker’s thesis played out in markets just a few days later. On Sept. 4, as the tech-stock selloff got under way, the Nasdaq Composite sold off by as much as 5.1% to close with a 1.3% loss. And Treasury bond prices, which move opposite to yields, also sank. The 30-year Treasury yield rose 0.12 percentage point to 1.46%, in one of the largest single-day increases since the height of the pandemic panic. The 10-year yield jumped, as well, climbing 0.09 of a percentage point.

Treasuries Lose Some Haven Luster. Here Are Some Alternatives for Safety.-By Alexandra Scaggs

10 Year Treasury Yield….Will it go lower if stocks continue sell off?

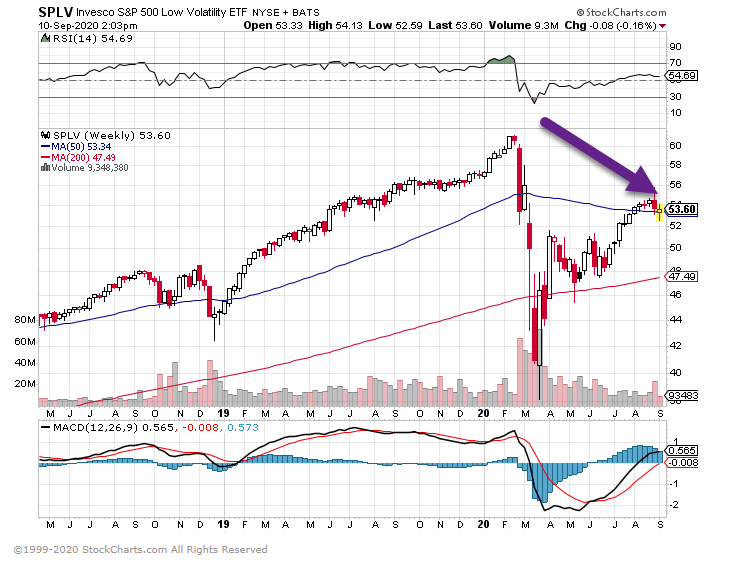

SPLV Well Below Highs….Did not protect against Covid volatility….Traded above 20x P/E