1. Mag 7 Call Options at FOMO Levels

ZeroHedge

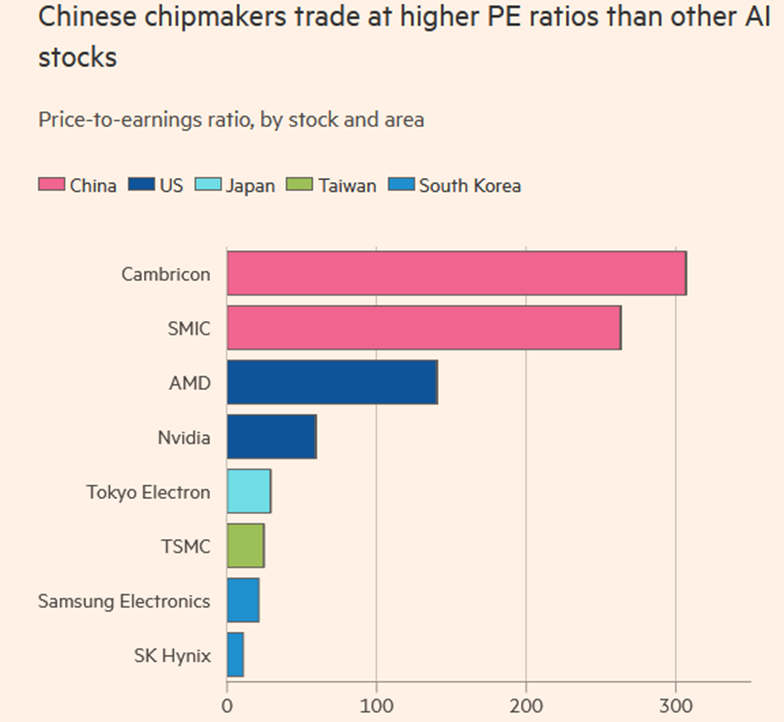

2. Chinese Chipmakers Higher P/E Ratios than U.S.

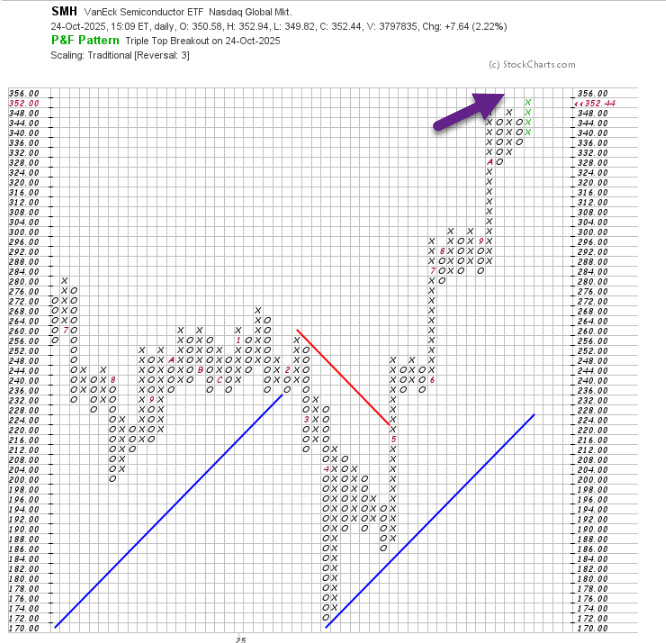

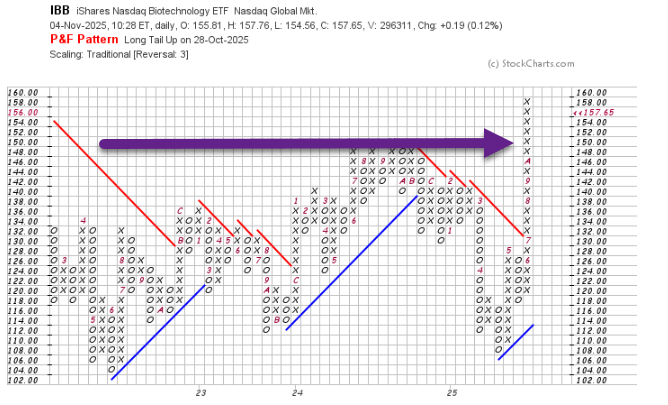

3. Biotech Long Bear Changing? +46% Off Liberation Day Lows…Breaks Above 3-Year Pattern

StockCharts

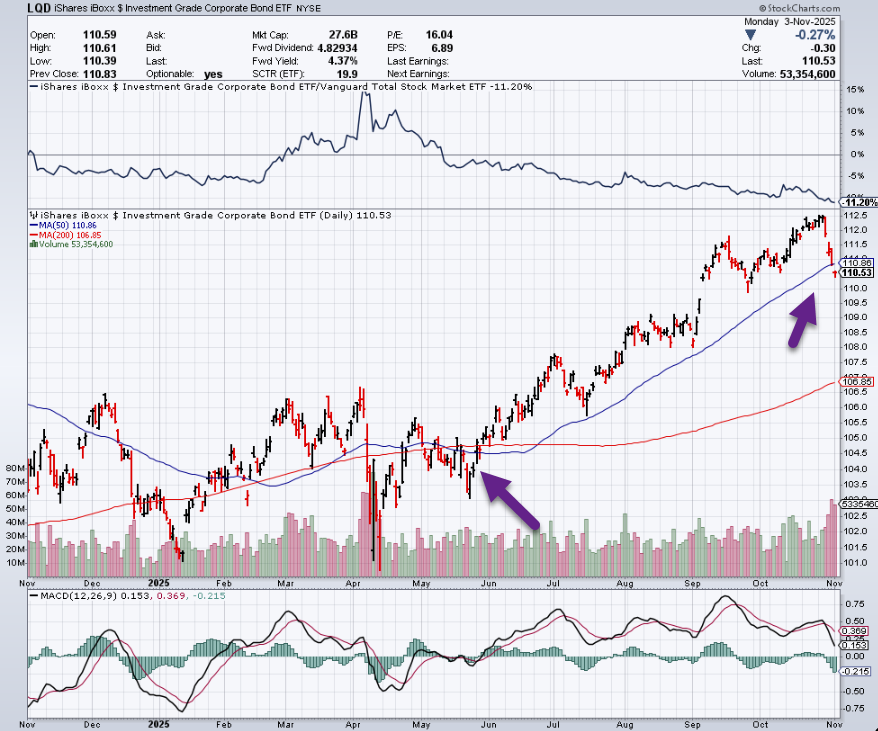

4. Investment Grade Credit ETF Closes Below 50-Day First Time Since May

StockCharts

5. Bitcoin IBIT -20% from Highs….Closes Below 200 Day First Time Since April

StockCharts

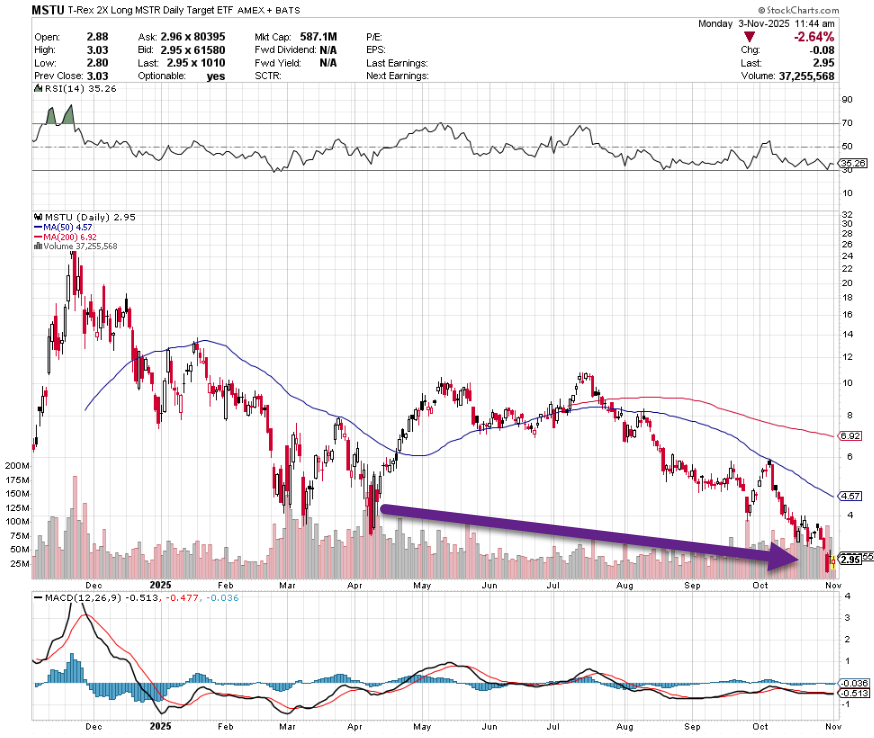

6. Microstrategy Pulls Back to March/April Lows. Down -45% from Highs

StockCharts

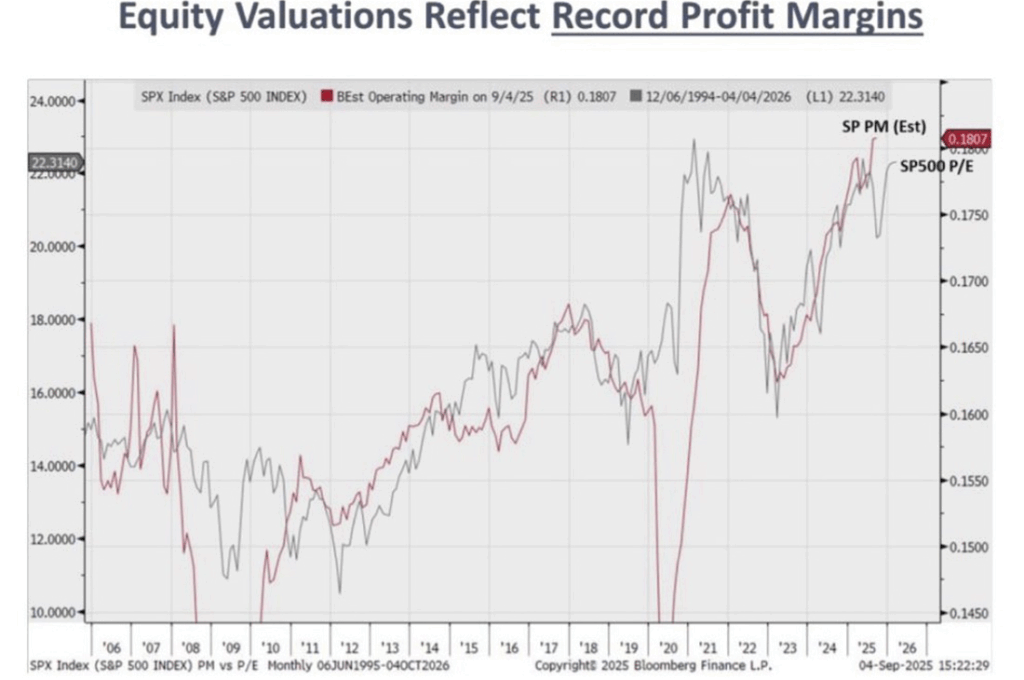

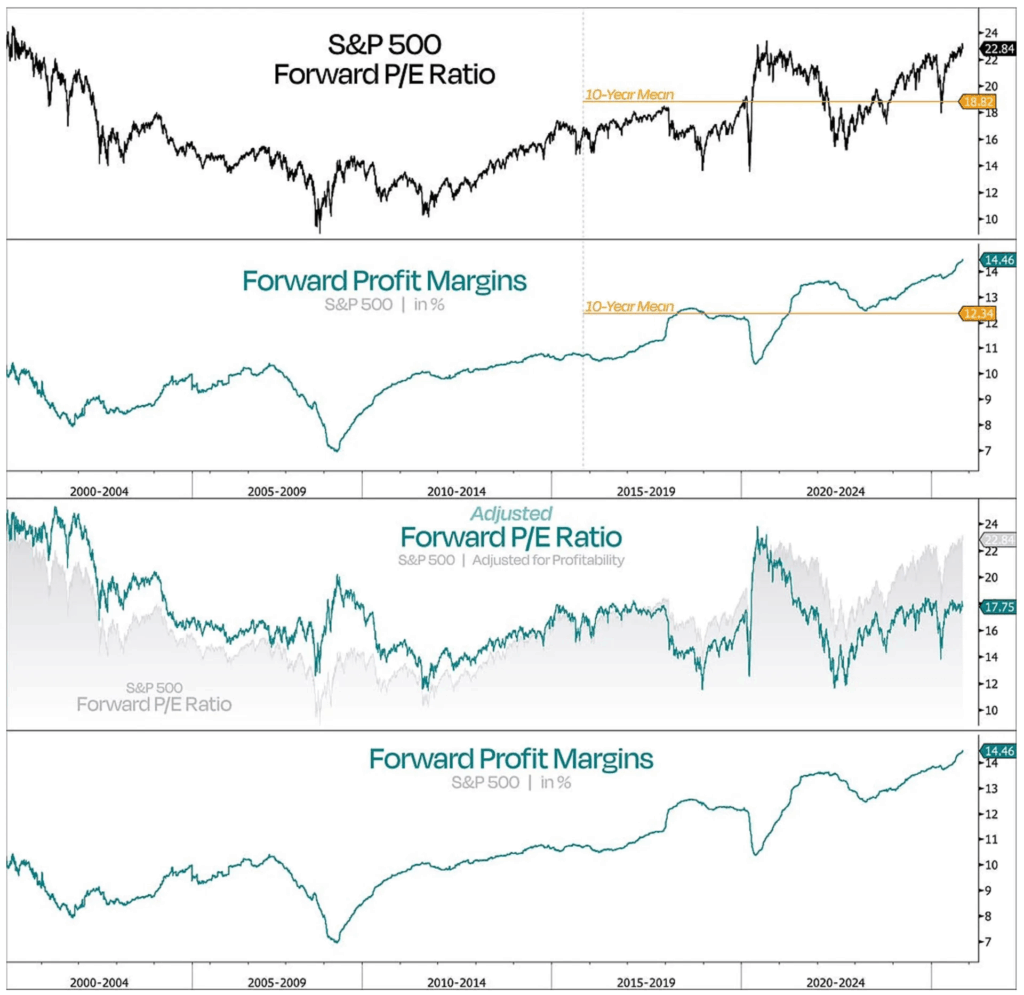

7. Good News P/E Ratios Adjusted for Profitability Are Much Lower than 1999-2000

Profitability-adjusted valuation. “Anyone comparing today’s valuations to the Dotcom era on a basic P/E basis is missing the point … higher profitability demands a higher valuation premium. Using our profitability-adjusted model, today’s P/E comes out to 17.75x — less than one standard deviation above its 20-year average of 16.2x.”

Duality Research

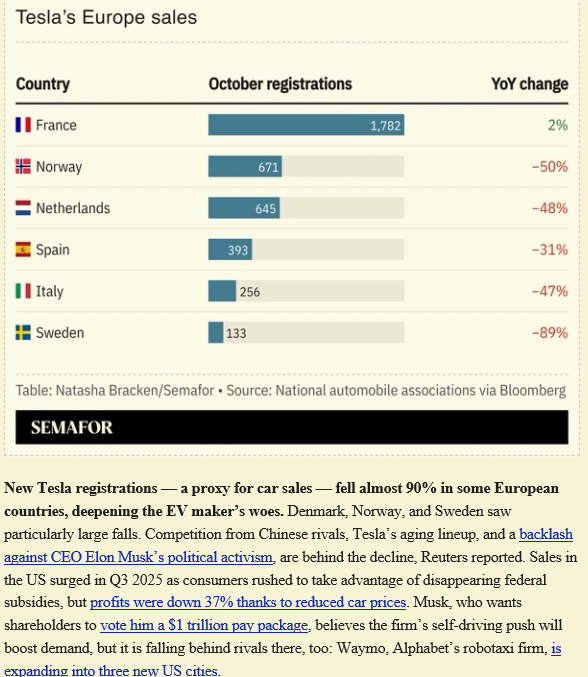

8. Tesla European Registrations Down -50-90%

Semafor

9. How to Eat 12 Servings of Vegetables a Day

Co-Founder & Chief Medical Officer of Function Health

12-a-Day: A Meal-by-Meal Guide

To get to 12+ daily veggie servings—or 6+ cups— think of vegetables as the foundation of each meal.

Try to include at least 1 to 2 cups of veggies for each of your main meals and another cup for a snack.

Do that and you’ll reach 6+ cups by day’s end.

Use the following meal-by-meal ideas for inspiration.

Breakfast

By sneaking greens and chopped veggies into smoothies and egg dishes, you can check off three or more veggie servings by the end of your morning meal.

- Veggie-loaded smoothie: Blend 1 cup packed greens, ½ a cucumber, and half a zucchini with 1 cup unsweetened almond or coconut milk, ½ an avocado, the juice of half a lemon, one tablespoon chia seeds, ¼ cup frozen berries, and one scoop protein powder.

- Veggie-loaded egg scramble: Chop a total of one cup of mushrooms, bell peppers, and onions. Sauté these with a cup of chopped greens. Once they’ve softened and reduced in size, mix in two pasture-raised eggs. Serve with lightly dressed greens on the side.

Lunch & Dinner

Turn lunch and dinner into a percentages game.

- Cover 75% of your plate with vegetables. For instance, I enjoy preparing three vegetable dishes for every meal. So, on a dinner plate, I might include a steamed artichoke, a tossed salad, and sautéed broccolini.

- Sneak more veggies into the remaining 25%. Look for ways to sneak finely chopped or pureed veggies into the meals you already make. Use spiralized zucchini as a substitute for pasta. Add veggies to stir-fried tofu, beef, or chicken. Wrap ground chicken in lettuce. Top chicken or fish with sauteed mushrooms, onions, and greens. Mix chopped veggies into meatballs, meatloaf, and burgers.

To follow the 75/25 rule, try the following:

- The Big Salad: Cover a dinner plate with a cup or more of your favorite greens. Mix a cup or more of your favorite chopped vegetables, along with a handful of sprouts. Include a sprinkle of sesame seeds for some crunch. Top with leftovers, roasted veggies, or cooked chicken, salmon, or another protein.

- The Veggie Bowl: Use a cup of greens as your base. Add a cup or more of roasted or steamed veggies of your choice. Great options include Brussels sprouts, zucchini, and cauliflower. Top with a half cup of crunchy veggies like shredded carrots or sliced radishes. Sprinkle on your favorite herbs. Then top it off with chicken, salmon, or beef.

- Soup, Stews, and Chili: Mix pureed greens, carrots, zucchini, or cauliflower into chicken or vegetable stock for your base. Then add chopped onions, garlic, peppers, celery, and other veggies. Greens disintegrate into soup. Experiment by adding handful after handful. Then fill out the soup with your favorite protein.

Snack

Net two+ servings by munching on a cup or more of pre-cut veggies — think bell peppers, cucumbers, and carrots—dipped in hummus. Here are some of favorite homemade versions:

10. “I’ve got your back”-Seth’s Blog

This is not a promise to be made lightly.

It’s not, “I’ve got your back until it becomes difficult or inconvenient for me.”

It puts us on the hook, without exception.

This is a powerful promise, a commitment that can change the life of both parties. Don’t do it lightly, but do it. It’s worth it.