1. Apple and Microsoft Close Below 50day Moving Averages

Short-term technical update post earnings AAPL and MSFT

2. European Financials Make New Highs Going Back to Great Financial Crisis

EUFN Euro Financials ETF

3. For Dow Theory Fans…Both Indices Close to Highs

Dow Jones and Dow Transports right at previous highs but no breakthrough.

https://www.investopedia.com/terms/d/dowtheory.asp

4. Russell 3000 Market Cap Just Short of New Highs

Bespoke Investment Group $10 Trillion Added in Market Cap; 2023’s Best and Worst Through July The US stock market (using the Russell 3,000 as a proxy) has now seen an increase in market cap of roughly $10 trillion from its bear market low last October through the end of July 2023. As shown below, the peak market cap for the US stock market was $51.5 trillion seen on the first day of 2022. From high to low, total US market cap fell $13.7 trillion during last year’s bear, but since then it has risen back up to $47.7 trillion. To get back to new all-time highs, total market cap would need to rise by roughly $3.8 trillion.

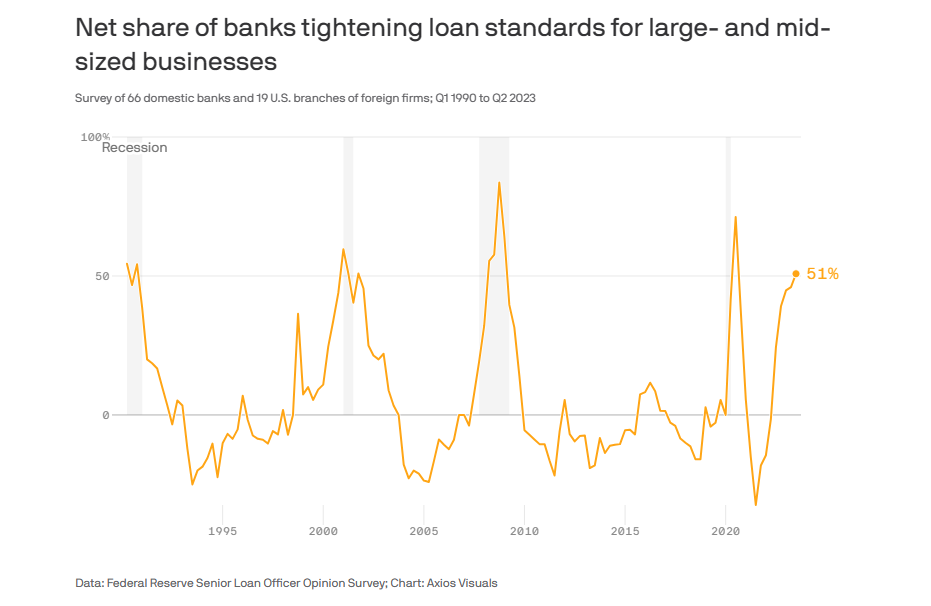

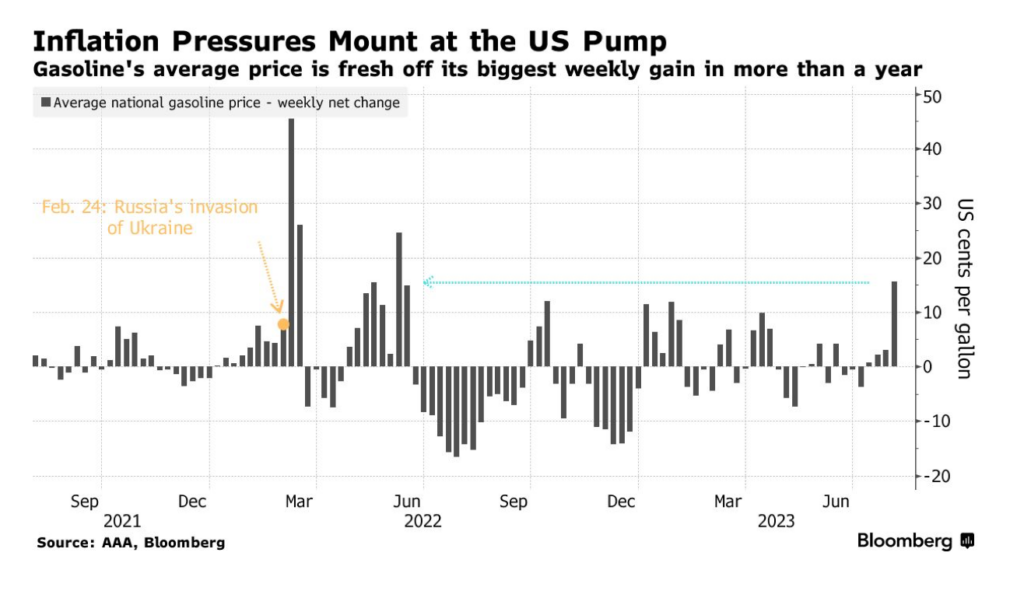

5. The Spread of Corporate Bond Yields vs. the Fed Funds Rate has Reached a Low Point

Callum Thomas Chart Storm https://www.chartstorm.info/ Things You Don’t See at the Bottom: The spread of corporate bond yields vs the Fed funds rate has reached a low point… similar to what it did at some of the previous major market peaks. The economic logic is that it reflects Fed tightening, yield curve recession signals, as well as (overly?) relaxed risk cushions on credit.

Source: @TaviCosta

6. Biotech Nowhere for 2 Years

7. Starbucks Made New Low for Year …Now Down 2023

SBUX chart 50day thru 200day to downside.

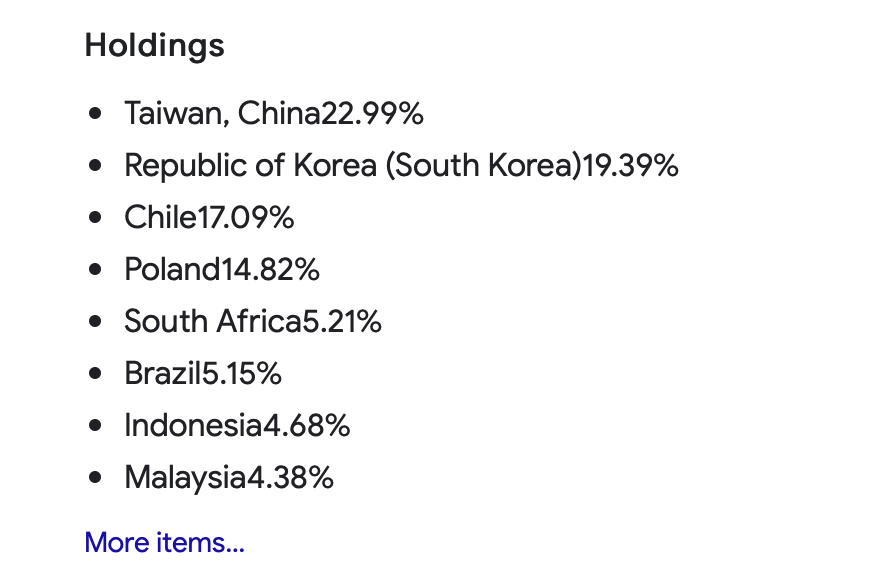

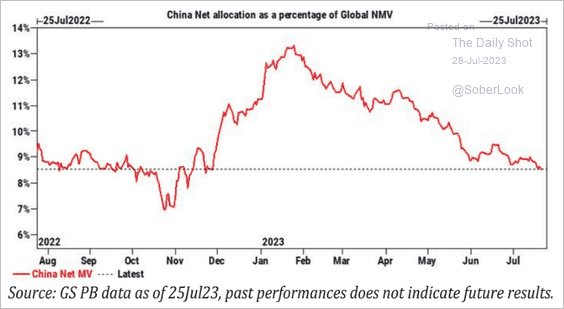

8. Chinese Citizens Investing Less …Parking in Money Market Funds

https://www.hellenicshippingnews.com/chinas-money-market-fund-market-continues-to-diversify/

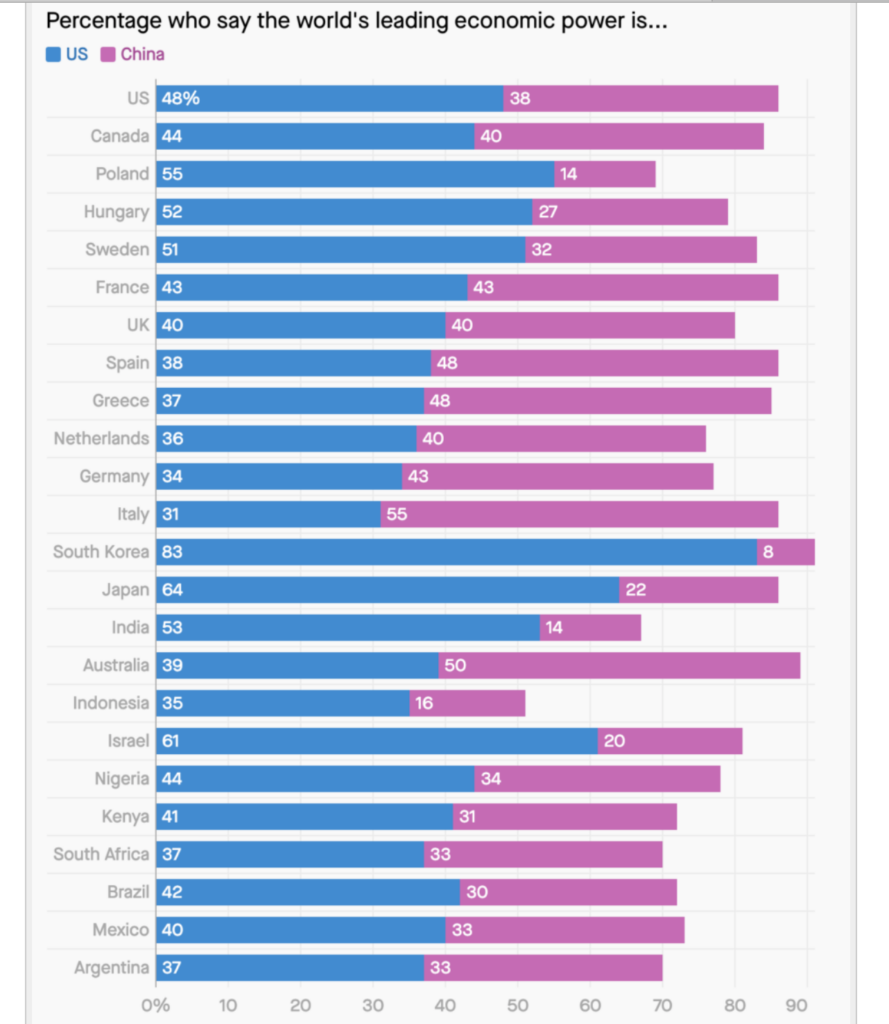

9. China Pew Research Poll

https://www.pewresearch.org/global/2023/07/27/views-of-china/

10. The 5 Secret Keys to Business Success

Ronald E. Riggio Ph.D. Psychological strategies for ensuring happy customers and profitable businesses.

KEY POINTS

- Good customer service is critical to success; interactions need to be positive, helpful, and informative.

- Selecting and training employees to provide great products and service is key to success.

- Realize that providing great products and service taxes staff, so they need to be encouraged and supported.

Secrets? Okay, they’re not so much “secrets,” but I had to get your attention. These are common strategies that business owners, managers, and dedicated employees should implement in order to have happy, repeat customers, profitability, and dedicated, healthy employees—all based on research in industrial-organizational psychology and management.

1. Constant Customer Service Orientation. We have all experienced it, bad customer service, surly employees, rude treatment, or simply being ignored when you need something. Quality of product is certainly important for pleasing customers, but so too is the quality of service. Read any online reviews, and you will see criticism, not about what was received, but concerning how the customer/client was treated.

What to Do? Create a culture of service. Make customer service a priority, by choosing staff members who are customer-focused and helpful, but also by constantly emphasizing the importance of quality service. This means having staff who go the extra mile, and, if service falls short, ensure that it is acknowledged and that the customer/client receives an apology, an explanation, and, if appropriate, compensation.

2. Clear and Constant Communication. I fly a lot, and there are inevitable delays. But the quality of my airline experience is affected by how the delay is managed. Foremost, is that there is clear and constant communication about the reasons for the delay, the expected timeline, and the outcome, along with a sincere apology. Communication is critical in any sort of customer-staff interaction.

What to Do? Keep the customer informed about the process and particularly about anything that is unusual or unexpected (e.g., “Our credit card processor is not working, so I will have to manually record your information and put it in the system later). Tell the client what you are doing and why you are doing it. If the process is complex, give a sort of running commentary of what is happening. Importantly, (and bridging with key no. 1), be pleasant and customer-focused.

3. Training Personnel and Aligning Values. Certainly, it is important to select employees who are competent, and who are customer service oriented, but regular training is also necessary. It is also critical for the organization to make its values clear (e.g., top-quality product/service, and great customer service) and to incorporate those values into the mission statement and regular practices and procedures.

What to Do? Have regular quality “refresher courses” that share best practices for performance. Encourage employees to participate in sharing innovative strategies for improvement, and reward them for it, particularly if the new idea benefits the bottom line. Leaders/managers should frequently mention the importance of the company’s values, and they should be exemplary role models for “living the values/mission.”

4. Measuring Progress and Outcomes. It is impossible to know the impact of efforts toward quality and good customer service unless there is some measurement of outcomes. Objective (meaning unbiased—begging customers to give an undeserved 5-star rating isn’t going to get you true results) assessments are critical. Ask customers for accurate feedback and make it easy for them to give it.

What to Do? Consider a formal customer feedback system that is easy to use, such as a brief, online survey, or written comment card. Managers can periodically check in with customers and ask if the product and service met, or exceeded their expectations, or whether there are any complaints/concerns. Pay attention to reviews on social media, learn from them, and respond (if appropriate) with an apology and a promise to do better.

5. Providing Feedback, Support, and Care for Employees. This could be an entire post (or book) on its own. Employees can’t know when their performance and quality of interactions with customers is good, or falls short, without management providing them with regular, and constructive, feedback.

What to Do? Provide regular feedback/performance reviews, not just the formal once-a-year type, but ongoing performance management. The focus should be on what’s right, what’s falling short, and how to do things better. It is also important for leaders/managers to realize that the customer isn’t right 100 percent of the time. Sometimes, the client/customer is out of line and they are being difficult or abusive to the staff. That’s when it is time to step in and support employees.

It is also important to note that providing great service is an emotionally (and sometimes physically) taxing endeavor. The psychological construct of “emotional labor” suggests that a can-do attitude, and service with a smile, is emotionally taxing and stressful.

Managers and leaders need to realize this and provide support and relief when needed.